|

市場調查報告書

商品編碼

1683803

亞洲內部貨運:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Intra-Asia Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

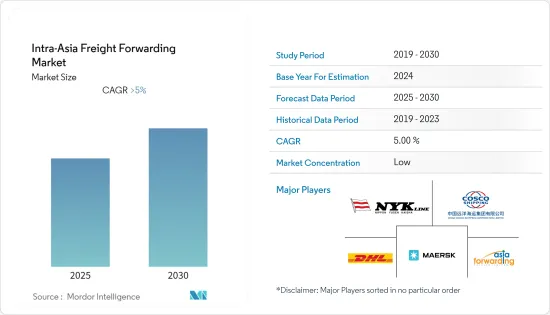

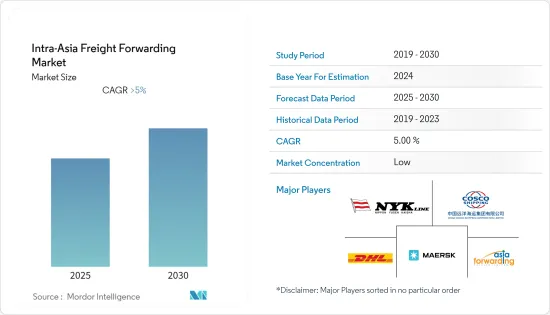

預測期內,亞洲內部貨運市場預計將以超過 5% 的複合年成長率成長

主要亮點

- COVID-19 疫情導致全球封鎖,商業活動停止,對經濟造成挑戰,並對營運、供應鏈、法規和勞動力要求造成巨大變化,擾亂了貨運市場。 2020 年空運和海運量均大幅下降,2020 年前幾個月中國港口處理的海運貨櫃總量下降了 10.1%。隨後,隨著限制措施的放寬,全部區域的貨物運輸量大幅增加。

- 各國也正在進行聯合計劃以促進跨境貿易。例如,2023年1月,印度公路運輸和公路部與日本代表團舉行會議,共同研究智慧交通系統和綠色交通領域的數位轉型計劃。該委員會還計劃在印度和日本之間建造一條公路,以方便人員和貨物的流通。

- 同時,瑞士國際空港航空公司將於 2022 年 10 月在中部國際機場開設一個新的航空貨運中心,以滿足日益成長的貨運需求。

- 同時,亞洲正成為世界的物流中心,預計到2030年亞洲將佔全球貿易成長的一半左右。此外,2021 年第一季,更多的新興企業和併購為亞洲帶來了超過 250 億美元的收入。因此,該地區的貨運商可以期待從不斷增加的計劃和貿易活動中獲得大量業務。

亞洲內部貨運市場的趨勢

電子商務產業蓬勃發展推動市場

2022 年,亞太地區的電子商務經歷了顯著成長,主要得益於快速的都市化、中階的不斷壯大、數位付款的日益普及以及電子商務生態系統的不斷擴大。此外,疫情的爆發也促進了該地區網路零售的發展。電商生態系統的擴張需要貨運和物流的支持,以確保貨物的順暢流通。

此外,電子商務的成長正在推動零售業走向全通路,到2021年,該地區仍將是零售電子商務的最大市場,數位銷售額將超過2.9兆美元,是北美的三倍,西歐的近五倍。此外,到 2022 年,預計中國將大幅成為最大的電子商務市場。

同時,到2022年,快速消費品(FMCG)電子商務將成為繼傳統貿易之後的第二大零售通路,佔該地區銷售額的19%以上。然而,業內專家估計,在韓國(34%)和中國(31%),電子商務佔快速消費品銷售額的近30%。此外,到 2022 年,中國將在該地區的線上消費領域領先,其次是印尼和印度。因此,電子商務銷售額的成長將促進系統化的供應鏈和物流服務,提供順暢的端到端貨物運輸,進一步擴大貨運市場。

日本市場正在經歷顯著的成長。

日本的貨運業務正在快速成長。 2022年12月,日本出口年增超過17%,進口則成長近41%。此外,日本2021年出口總額超過7,500億美元,與前一年同期比較增加18%。

此外,2021年日本的主要出口目的地是中國(1,600億美元),出口佔有率接近21%;韓國(520億美元),出口佔有率接近6.9%;香港和泰國的出口佔有率分別為4.6%和4.3%。中國也是最大的進口國之一,佔有率超過24%(1.875兆美元)。澳洲和其他亞洲國家也是主要進口國。

此外,該國的航空貨運量正在大幅成長。這主要是由於貿易擴大、卡車駕駛人短缺和港口交通惡化。 2021年,日本最大的航空貨運機場成田機場的航空貨運量將超過260萬噸,與前一年同期比較增加32%。此外,2021年日本機場的航空貨物處理量將超過499萬噸,與前一年同期比較增加18%。因此,該國對貨運代理的需求可能會受到貨運量成長的推動。

亞洲貨運業概況

亞洲內部貨運代理市場是一個分散的市場,由全球、區域和本地參與者組成。當地小型企業透過小型車隊和儲存空間服務市場。貨運市場正在穩步成長,充滿商機,迫使參與者擁抱技術,推動數位化,並擴大營運規模和效率。對於任何企業來說,擁有一個遍布全球的強大網路都很重要。市場上其他主要企業包括 Asia Forwarding Private Limited、DHL、UPS 和日本郵船。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 價值鏈/供應鏈分析

- 洞察投資場景

- 深入了解政府法規和舉措

- 線上貨運和數位平台技術發展概述

- 貨運市場的數位化

- 電子商務物流與貨運概述

- COVID-19 市場影響

第5章 市場動態

- 驅動程式

- 限制因素

- 機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場細分

- 按運輸方式

- 海運

- 空運

- 公路貨物運輸

- 鐵路貨物運輸

- 依客戶類型

- 企業對企業 (B2B)

- 企業對客戶 (B2C)

- 按應用

- 工業/製造業

- 零售

- 衛生保健

- 石油和天然氣

- 食品和飲料

- 其他用途

- 按地區

- 中國

- 日本

- 韓國

- 印度

- 亞洲其他地區

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- Maersk

- DB Schenker

- DHL

- FedEx

- CHINA COSCO SHIPPING

- NYK Line

- Yamato Transport Co., Ltd.

- Hitachi Transport System, Ltd.

- CEVA Logistics

- Kuehne+Nagel

- Asia Forwarding Private Limited.

- XPO, Inc.

- UPS*

第8章:貨運市場的未來

第 9 章 附錄

The Intra-Asia Freight Forwarding Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 pandemic led to global lockdowns, and commercial activities were halted, challenging the economy and disrupting the freight forwarding market with massive changes in operations, supply chains, regulations, and workforce requirements. Air and ocean freight volumes fell significantly in 2020; total ocean freight container volumes handled at Chinese ports dropped by 10.1% in the first few months of 2020. Later, as restrictions eased, cargo movement increased significantly across the region.

- Countries are also working on joint projects to boost cross-border trade. For example, in January 2023, the Indian Ministry of Road Transportation and Highways and the Japanese Delegation met to work on projects for digital transformation in the areas of intelligent transportation systems and eco-friendly mobility.The committee also planned to build roads between India and Japan so that people and goods could move more easily.

- In the meantime, Swissport, an aviation company, opened a new air cargo center at Central Japan International Airport in October 2022 to meet the growing demand for freight transport.

- Asia, on the other hand, is becoming a global logistics hub right now, and it is expected that the region will be responsible for about half of the world's trade growth by 2030. Also, more start-ups, mergers, and acquisitions brought more than USD 25 billion to Asia in the first quarter of 2021. So, the region's freight forwarders can expect a lot of business from the growing number of projects and trade activities.

Intra-Asia Freight Forwarding Market Trends

Booming E-commerce Sector is Driving the Market

In 2022, e-commerce in the Asia Pacific region witnessed significant growth, primarily driven by rapid urbanization, the growing middle class, the increasing penetration of digital payments, and the expansion of the e-commerce ecosystem. In addition, the pandemic outbreak also acted as a catalyst for accelerating online retail sales in the region. The growing e-commerce ecosystem requires freight and logistics support for the smooth movement of shipments.

Moreover, e-commerce growth is driving the retail industry toward omnichannel, and in 2021, the region remained the largest market for retail e-commerce, with digital sales amounting to more than USD 2.9 trillion, whereas these sales were three times greater than those in North America and nearly five times greater than those in Western Europe. In addition, in 2022, China will have outperformed the e-commerce market by a large margin.

Meanwhile, in 2022, fast-moving consumer goods (FMCG) e-commerce emerged as the second-biggest retail channel next to traditional trade, which accounted for more than 19% of sales in the region. However, as per industry experts' estimates, e-commerce accounts for nearly 30% of FMCG sales in South Korea (34%), and China (31%). Moreover, in 2022, China topped online spending in the region, followed by Indonesia and India. Thus, the growing e-commerce sales boost the systematic supply chain and logistics services to provide smooth end-to-end transfers of goods, further resulting in the expansion of the freight forwarding market.

Japan is Experiencing Significant Growth in the Market

Japan's freight forwarding business is growing quickly. This is mostly due to more trade activities like importing and exporting.In December 2022, exports from the country reached a growth rate of more than 17%, and imports reached nearly 41% when compared to the same period in the previous year. Also, Japan's total exports of goods were worth more than USD 750 billion in 2021, which was an increase of 18% from the year before.

Moreover, in 2021, the major export destinations of Japan will be China with an export share of nearly 21% (USD 160 billion), Korea with an export share of nearly 6.9% (USD 52 billion), and Hong Kong and Thailand with an export share of 4.6% and 4.3%, respectively. Also, China is one of the biggest importers, with a share of more than 24% (1875 billion USD). Australia and other Asian countries are also big importers.

Also, air cargo transportation is growing a lot in the country. This is mostly because trade is growing, there aren't enough truck drivers, port traffic is getting worse, etc. In 2021, Japan's Narita Airport, the country's largest airport for air freight, will handle more than 2.6 million tons of air cargo, an increase of 32% when compared to the previous year. In addition, in 2021, the volume of air freight handled at Japanese airports amounted to more than 4.99 million tons, which was up by 18% when compared to the previous year. So, the demand for freight forwarders in the country is likely to be driven by the growth of freight forwarding.

Intra-Asia Freight Forwarding Industry Overview

The intra-Asia freight forwarding market's landscape is fragmented by nature, with a mix of global, regional, and local players. Small- and medium-sized local players still serve the market with small fleets and storage spaces. As the freight forwarding market is growing steadily and there is abundant opportunity, the players need to embrace technologies, become more digitized, and increase the scale and efficiency of their operations. Having a strong network spanning the globe is important for companies. In addition, some of the major players in the market include Asia Forwarding Private Limited, DHL, UPS, NYK Line, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Digitalisation of Freight Forwarding Market

- 4.7 Overview on E-commerce Logistics and Freight Forwarding

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean Freight Forwarding

- 6.1.2 Air Freight Forwarding

- 6.1.3 Road Freight Forwarding

- 6.1.4 Rail Freight Forwarding

- 6.2 By Customer Type

- 6.2.1 Business to Business (B2B)

- 6.2.2 Business to Customer (B2C)

- 6.3 By Application

- 6.3.1 Industrial and Manufacturing

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Oil And Gas

- 6.3.5 Food And Beverages

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 South Korea

- 6.4.4 India

- 6.4.5 Rest of Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Maersk

- 7.2.2 DB Schenker

- 7.2.3 DHL

- 7.2.4 FedEx

- 7.2.5 CHINA COSCO SHIPPING

- 7.2.6 NYK Line

- 7.2.7 Yamato Transport Co., Ltd.

- 7.2.8 Hitachi Transport System, Ltd.

- 7.2.9 CEVA Logistics

- 7.2.10 Kuehne+Nagel

- 7.2.11 Asia Forwarding Private Limited.

- 7.2.12 XPO, Inc.

- 7.2.13 UPS*