|

市場調查報告書

商品編碼

1630412

襯管吊架系統:中東和非洲市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Middle-East and Africa Liner Hanger System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

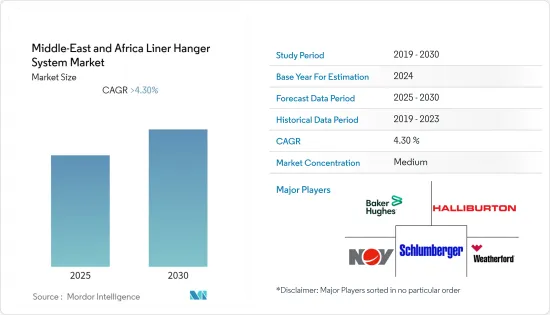

中東和非洲襯管吊架系統市場預計在預測期內複合年成長率將超過 4.3%。

2020 年,COVID-19 對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從長遠來看,該地區擁有世界上最大的石油蘊藏量,預計在預測期內上游油氣業務將強勁成長。此外,中東天然氣產量的增加也推動了對襯管吊架系統的需求。

- 同時,2020年及2021年全球油價下跌導致各類油氣計劃暫停或延後。此外,2021 年中東原油總產量有所下降。如果這種下降趨勢持續下去,預計將對市場的進一步成長產生負面影響。

- 中東和非洲擁有最大的天然氣和原油探明蘊藏量,探勘和完井活動潛力巨大,預計在不久的將來將為襯管吊架系統市場提供重大商機。

中東和非洲襯管吊架系統市場趨勢

土地市場預計將主導市場

- 襯管吊架系統由襯管吊架組件、釋放工具、固井頭、封隔器等組成。襯管吊架系統包括機械式、液壓式、高級式、標準式、旋轉式、非旋轉式、傳統式、擴展式和袋式卡瓦式。

- 由於波斯灣探勘和鑽探活動活性化,襯管吊架系統在 2021 年出現成長。 2021年12月,伊朗石油天然氣公司帕爾斯油氣公司(POGC)宣布開始在波斯灣南帕爾斯天然氣田進行鑽探作業,作為其油田開發策略的一部分。

- 2022年8月,阿布達比國家石油公司簽署了五項總價值18.3億美元的框架協議,以增加該酋長國油田的鑽探活動。

- 此外,美國對伊朗的持續制裁可能會導致道達爾等大公司撤回投資,這可能會對 LHS 市場產生負面影響。此外,2021年中東原油產量將增加至2,815萬桶/日,導致預測期內襯管吊架系統顯著成長。

- 陸上油田預計將顯著推動市場發展,因為幾個陸上油田的石油和天然氣產量最高,而且還擁有大量石油和天然氣蘊藏量。

沙烏地阿拉伯主導市場

- 據貝克休斯稱,沙烏地阿拉伯的頁岩氣蘊藏量估計位居世界第五。因此,它具有複製北美傳統型蘊藏量開發成長的巨大潛力。該國擁有豐富的頁岩蘊藏量,傳統型蘊藏量的持續開發預計將增加對襯管吊架系統的長期需求。

- 沙烏地阿美公司不斷探勘和開發,以補充其他地區日益萎縮的油田。這為襯管吊架系統開闢了一個新市場。 2021年12月,沙烏地阿美公司簽署了價值1,000億美元的Jafra計劃協議,目標是到2030年成為第三大天然氣生產商。此外,該計劃的開發預計將提高沙烏地阿拉伯對天然氣作為發電來源的重視,並幫助其實現 2060 年淨零目標。

- 2021年沙烏地阿拉伯石油產量達1,095萬桶/日。到2022年,沙烏地阿拉伯預計將有超過100個陸上鑽機投入運作。這些鑽機的部署預計將增加鑽井活動並進一步增加對襯管吊架系統的需求。

- 沙烏地阿美還希望在 2028 年每天生產 0.65 bcm 的天然氣。為此,它計劃瞄準北阿拉伯、南加瓦爾和加瓦爾以東的賈夫拉盆地的傳統天然氣蘊藏量。

- 由於陸上油田生產大量原油和天然氣,液壓和機械襯管吊架系統在日本仍廣泛使用。然而,隨著越來越多的人尋找海上石油和天然氣蘊藏量,對可擴展 LHS 的需求可能會增加。

中東和非洲襯管吊架系統產業概況

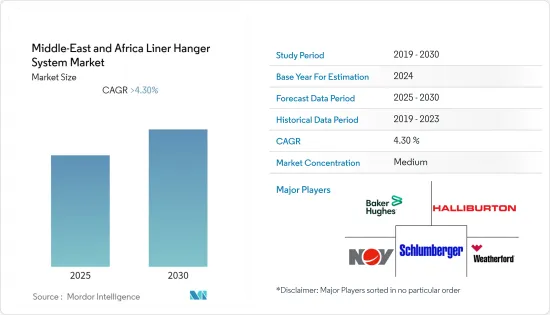

中東和非洲襯管吊架系統市場適度整合。主要企業(排名不分先後)包括 National-Oilwell Varco, Inc.、Halliburton Company、Weatherford International Plc、Baker Hughes 和 Schlumberger Limited Ltd。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 市場類型

- 傳統的

- 擴充型

- 部署地點

- 離岸

- 土地

- 地理

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Halliburton Company

- Weatherford International plc

- National Oilwell Varco Inc.

- Baker Hughes Ltd

- National-Oilwell Varco, Inc

- Well Innovation AS

- NCS Multistage LLC

- Schlumberger Limited

- Drill-Quip Inc.

第7章 市場機會及未來趨勢

The Middle-East and Africa Liner Hanger System Market is expected to register a CAGR of greater than 4.3% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market.Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, with the world's largest oil reserves, the region is expected to witness significant growth in upstream oil and gas activities in the forecast period. Moreover, the increasing gas production in the Middle East is driving the demand for the liner hanger system.

- On the other hand, the global crude oil price decline in 2020 and 2021 has led to a halt or delay in various oil and gas projects. Also, total crude oil production in the Middle East declined in 2021. If this declining trend continues, it is expected to have a negative impact on further market growth.

- With the largest proven reserves of natural gas and crude oil, the Middle East and Africa have significant potential for exploration and completion activities, which will create substantial opportunities for the liner hanger system market in the near future.

Middle-East And Africa Liner Hanger System Market Trends

Onshore Segment is Expected to Dominate the Market

- A liner hanger system consists of a liner hanger assembly, a releasing tool, a cementing head, a packer, etc. Liner hanger systems can be mechanical or hydraulic, premium or standard, rotating or non-rotating, conventional or expandable, and pocket slip.

- The Liner Hanger System witnessed growth in 2021 as the exploration and drilling activities in the Persian Gulf ramped up. In December 2021, Iranian oil and gas firm Pars Oil and Gas Company (POGC) announced the start of drilling operations at the South Pars gas field in the Persian Gulf as part of its field development strategy.

- In August 2022, the Abu Dhabi National Oil Company gave out five framework agreements worth a total of USD 1.83 billion to increase drilling in the oilfields of the emirate.The growing drilling activities in the onshore region will, in turn, culminate in the growth of the linger hanger systems across the region.

- Moreover, due to ongoing sanctions on Iran by the United States, major companies like Total are withdrawing their investment, which can negatively impact the LHS market. Furthermore, rising crude oil production in the Middle East to 28.15 million barrels per day in 2021 will result in significant growth of the liner hanger system during the forecast period.

- Since several onshore fields produce the most oil and gas and have the most oil and gas reserves, the onshore segment is expected to drive the market a lot.

Saudi Arabia to Dominate the Market

- According to Baker Hughes, Saudi Arabia is estimated to have the world's fifth-largest estimated shale gas reserve. Thus, it has great potential to replicate North America's unconventional reserves' development growth. The country has vast shale reserves, and the increasing exploitation of its unconventional reserves is expected to drive the demand for liner hanger systems in the long run.

- Saudi Aramco is always doing exploration and development to make up for fields that are getting smaller in other places. This opens up new markets for liner-hanger systems. In December 2021, Saudi Aramco awarded USD 100 billion in contracts on the Jafurah project to position itself as the third-largest natural gas producer by 2030. Further, the project's development is expected to help the country incline more towards natural gas as a source of electricity generation, thus supporting the pursuit of its 2060 net-zero target.

- Saudi Arabia's oil production amounted to 10.95 million barrels per day in 2021. By 2022, the country was expected to have more than 100 active onshore rigs. The deployment of these rigs is expected to increase drilling activities, which is further likely to increase the demand for liner hanger systems.

- Aramco also wants to produce 0.65 bcm of natural gas per day by 2028. It plans to do this by going after unconventional gas reserves in North Arabia, South Ghawar, and the Jafurah Basin, which is east of Ghawar.

- Because the onshore fields produced more crude oil and natural gas, more hydraulic and mechanical liner hanger systems were still used in the country. But as more people look for oil and gas reserves offshore, the demand for expandable LHS is likely to rise.

Middle-East And Africa Liner Hanger System Industry Overview

The market for liner hanger systems in the Middle East and Africa is moderately consolidated. Some of the major companies (in no particular order) include National-Oilwell Varco, Inc., Halliburton Company, Weatherford International Plc, Baker Hughes, and Schlumberger Limited Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Expandable

- 5.2 Location of Deployment

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Geogrpahy

- 5.3.1 The United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Nigeria

- 5.3.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International plc

- 6.3.3 National Oilwell Varco Inc.

- 6.3.4 Baker Hughes Ltd

- 6.3.5 National-Oilwell Varco, Inc

- 6.3.6 Well Innovation AS

- 6.3.7 NCS Multistage LLC

- 6.3.8 Schlumberger Limited

- 6.3.9 Drill-Quip Inc.