|

市場調查報告書

商品編碼

1644338

歐洲襯管吊架系統 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Liner Hanger System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

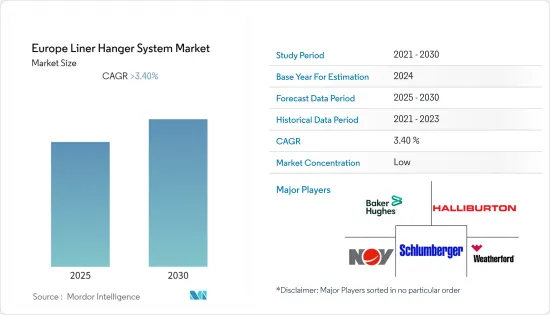

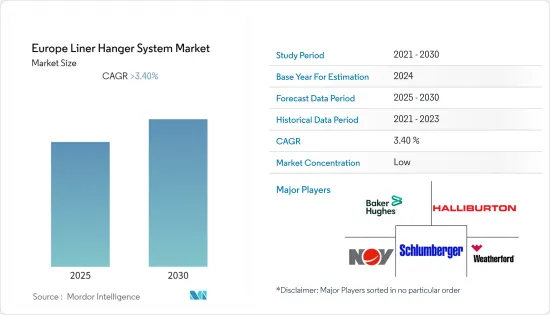

預測期內,歐洲襯管吊架系統市場預計將以超過 3.4% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,俄羅斯和挪威上游活動的激增預計將推動該地區對襯管吊架系統 (LHS) 的需求。

- 同時,2020年及2021年全球原油價格下跌,導致各類油氣計劃停頓延後。此外,預計挪威、丹麥和義大利的產量下降將抑制預測期內的預期成長。

- 預計未來幾年,英格蘭北部的 Bowland 頁岩、蘇格蘭的米德蘭谷和英格蘭南部的威爾德盆地將產生鑽井和完井機會,從而推動襯管吊架系統市場的發展。

- 俄羅斯是該地區襯管吊架系統的主要市場之一,預計在預測期內將繼續佔據主導地位。

歐洲襯管吊架市場趨勢

海上市場可望實現最高成長

- 襯管吊架系統由襯管吊架器組件、釋放工具、固井頭、封隔器等組成。襯管吊架系統是完井的一部分,可以是機械的或液壓的、高級的或標準的、旋轉的或非旋轉的、常規的或擴大的、袋式卡瓦或更多的。

- 2021 年,隨著最大的Start-Ups之一——位於北海中部的高壓高溫卡爾贊天然氣田的運作,襯管吊架系統呈現成長態勢。頁岩氣蘊藏量估算為2.8兆至39.9兆立方公尺(TCM)。然而,水力壓裂帶來的環境風險引發的公眾反對仍然是英國頁岩氣開發的最大障礙之一。這最終限制了襯管吊架系統的成長潛力。

- 由於歐盟 (EU) 原油產量在 2021 年下降至每天 342 萬桶,與全球其他地區相比,襯管吊架系統的成長率較低。

- 雖然北海地區大部分蘊藏量處於下降階段,但由於俄羅斯大規模的探勘活動,海上領域的襯管吊架市場預計將大幅成長。

- 2022年2月,北海六個新的油氣天然氣田即將獲得英國政府核准。財政部已敦促上級部門加快頒發這六個能源區塊的建設許可證。這將促進全部區域的襯管吊架系統的成長。

- 此外,2022 年 1 月,挪威石油和能源部在 2021 年預定區域獎勵 (APA) 中向 28 家公司提供了挪威水域 53 個海上石油和天然氣生產許可證的所有權。一旦油藏開發開始,預計這將推動油田服務市場的新成長。

- 考慮到以上所有因素,預計預測期內海上板塊將佔據市場主導地位。

俄羅斯佔據市場主導地位

- 俄羅斯頁岩油資源豐富,頁岩氣蘊藏量潛力最大。巴熱諾夫頁岩被譽為世界最大頁岩蘊藏量。由於擁有大量廉價土地,巴熱諾夫的頁岩氣開發預計將於 2024 年開始。 2021年,俄羅斯佔全球鑽井活動的最大佔有率,其次是美國。因此,俄羅斯在襯管吊架系統市場上也處於歐洲領先地位。

- 截至2021年,俄羅斯是僅次於美國的世界第二大天然氣生產國。它還擁有世界上最大的天然氣蘊藏量,並且是世界上最大的天然氣出口國。 2021年,該國生產了7,620億立方米天然氣,並透過管道出口了約2,100億立方公尺天然氣。

- 水平鑽井在該國正以驚人的速度發展。 2021年,俄羅斯礦產探勘公司鑽探面積約83.9萬公尺。 2019年,年鑽井量達到高峰110多萬米,自此後一直在下降。

- 俄羅斯天然氣工業股份公司繼續探勘巴熱諾夫油田,目標到 2023 年實現頁岩油日產量 4 萬桶。預計在預測期內對襯管吊架的需求將非常巨大。

- 隨著鑽機數量的大幅增加以及用於水平鑽井的鑽機比例的增加,俄羅斯對襯管吊架系統的需求預計將隨著鑽井量的增加而繼續成長。

歐洲襯管吊架產業概況

歐洲襯管吊架系統市場是細分的。主要企業(不分先後順序)包括 National-Oilwell Varco, Inc.、Halliburton Company、Weatherford International plc、Baker Hughes 和 Schlumberger Limited Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 市場類型

- 傳統的

- 加大型

- 部署位置

- 海上

- 陸上

- 地理

- 英國

- 挪威

- 俄羅斯

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Halliburton Company

- Weatherford International plc

- National Oilwell Varco Inc.

- Baker Hughes Company

- National-Oilwell Varco, Inc

- Well Innovation AS

- NCS Multistage LLC

- Schlumberger Limited

- Drill-Quip Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71169

The Europe Liner Hanger System Market is expected to register a CAGR of greater than 3.4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the surge in upstream activities in Russia and Norway is likely to boost the region's demand for Liner Hanger Systems (LHS).

- On the other hand, the global crude oil price decline in 2020 & 2021 has led to a halt or delay in various oil and gas projects. Also, declining production in Norway, Denmark, and Italy is expected to restrain the expected growth in the forecast period.

- The Bowland Shale in Northern England and the Midland Valley of Scotland, and the Weald Basin in Southern England are expected to create drilling and completion opportunities in the future, driving the market of the Liner Hanger System.

- Russia is one of the leading markets for Liner Hanger Systems in the region and is expected to continue its dominance in the forecast period.

Europe Liner Hanger Market Trends

Offshore Market is Expected to Witness the highest growth

- A Liner Hanger System consists of a liner hanger assembly, releasing tool, cementing head, packer, etc. The liner hanger system is a part of well completion and can be mechanical or hydraulic, premium or standard, rotating or non-rotating, conventional or expandable, and pocket slip.

- Liner Hanger System witnessed growth in 2021 as the high-pressure, high-temperature Culzean gas field in the central North Sea, one of the biggest start-ups comes on stream. Estimates suggest that the amount of shale gas lies between 2.8 and 39.9 trillion cubic meters (TCM). However, public opposition due to the environmental risk associated with fracking has become one of the biggest hurdles in shale gas development in the United Kingdom. This eventually restrains the possible growth of the liner hanger system.

- Due to the declining crude oil production to 3,420 thousand barrels per day in 2021 in European Union, the growth of the liner hanger system is less in comparison to other global regions.

- Although most of the reserves in the North Sea area are in the declining phase, with large-scale exploration activities in Russia, the market of liner hanger in the offshore segment is expected to grow significantly.

- In February 2022, six new oil and gas fields in the North Sea almost confirmed approval from the UK government. The finance department pushed the senior authorities to fast-track the licenses for constructing the six energy areas. This, in turn, culminates in the growth of the liner hanger system across the region.

- Moreover, In January 2022, the Norwegian Ministry of Petroleum and Energy offered 28 companies ownership interests in 53 offshore oil and gas production licenses on the Norwegian Shelf in the Awards in Predefined Areas(APA) 2021. This will usher in new growth in the oilfield services markets when the reservoir development starts.

- Owing to the above points, the offshore segment is expected to dominate the market during the forecast period.

Russia to Dominate the Market

- Russia has significant shale oil and the biggest potential in shale gas reserves. Bazhenov Shale is known to be the biggest shale reserve in the world. As cheaper sites are abundant, shale gas development in Bazhenov is expected to start in 2024. In 2021, Russia held a major share of global drilling activities, followed by the United States. With this, Russia is also leading in the European region in terms of the liner hanger system market.

- As of 2021, Russia is the world's second-largest producer of natural gas, behind the United States. It also has the world's largest gas reserves and is the world's largest gas exporter. In 2021, the country produced 762 bcm of natural gas and exported approximately 210 bcm via pipeline.

- Horizontal drilling is growing at a significant pace in the country. Nearly 839 thousand meters were drilled by mineral exploration companies in Russia in 2021. The number of meters drilled per year has decreased since 2019 when it peaked at over 1.1 million meters.

- Gazprom Neft continues to conduct studies on its Bazhenov acreage and is targeting 40,000 b/d of production from shale by 2023. With this significant demand for the liner, hangers can be expected in the forecast period.

- Demand for the liner hanger system in Russia is expected to continue to increase, in line with the drilling volume, driven by the considerable increase in the number of rigs and a higher proportion of rigs being used for horizontal drilling.

Europe Liner Hanger Industry Overview

The Europe Liner Hanger System Market is fragmented. The major companies (not in a particular order) include National-Oilwell Varco, Inc., Halliburton Company, Weatherford International plc, Baker Hughes, and Schlumberger Limited Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Expandable

- 5.2 Location of Deployment

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Geogrpahy

- 5.3.1 The United Kingdom

- 5.3.2 Norway

- 5.3.3 Russia

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International plc

- 6.3.3 National Oilwell Varco Inc.

- 6.3.4 Baker Hughes Company

- 6.3.5 National-Oilwell Varco, Inc

- 6.3.6 Well Innovation AS

- 6.3.7 NCS Multistage LLC

- 6.3.8 Schlumberger Limited

- 6.3.9 Drill-Quip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219