|

市場調查報告書

商品編碼

1630435

印度核能發電廠設備 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Nuclear Power Plant Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

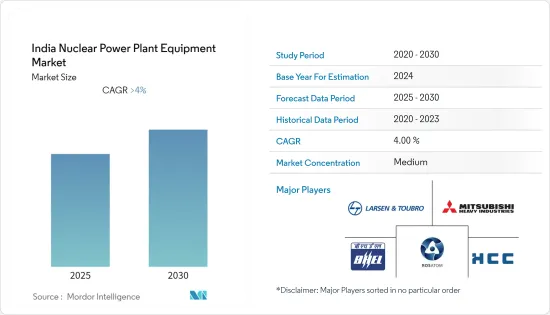

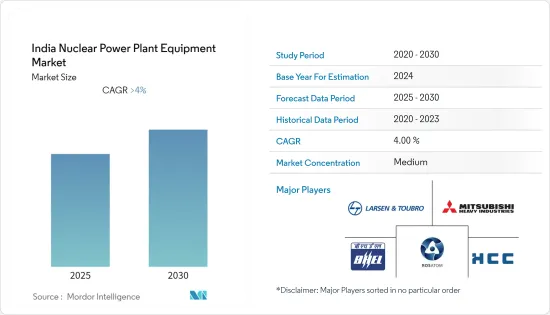

印度核能發電廠設備市場預計在預測期內複合年成長率將超過4%

COVID-19 對 2020 年市場產生了負面影響。市場現在可能達到大流行前的水平。

主要亮點

- 從中期來看,核能對減少溫室氣體排放的重大貢獻以及支持因人口成長和永續市場發展而增加的能源需求將推動該市場。

- 另一方面,增加對太陽能和風能等替代清潔能源來源的投資預計將在預測期內抑制市場成長。

- 快滋生式反應爐等新型核子反應爐設計的商業化研究和開發預計將成為預測期內及以後市場的重大機會。

印度核能發電廠設備市場趨勢

加壓重水反應器主導市場

- 壓水式反應爐通常使用未濃縮的天然氧化鈾作為燃料,因此需要更有效的重水作為冷卻劑。重水增加了中子經濟性,允許核子反應爐在沒有燃料濃縮設施的情況下運行,並允許核子反應爐使用替代燃料循環。

- 與壓水堆不同,壓水堆設計需要薄壁壓力管。這允許壓力邊界分佈在大量小直徑壓力管道上。因此,與壓水堆設計相比,這種設計不太可能意外破裂壓力邊界。因此,壓水堆被認為比壓水堆更安全。

- 截至2021年2月,印度正在營運18座PHWR,總發電量為5,080MW,其中包括15,220MW、2,540MWe和1,700MWe。

- 2021年1月,IPHWR-700核子反應爐-卡克拉帕爾勒3號機組首次併網發電。截至 2022 年 5 月,共有 5 座設計獨特的 700 MWe 重水堆處於不同建造階段。

- 此外,該國還計劃建造其他 10 座重水器核子反應爐。全球整體,有四座重水堆正在興建中。所有這些重水堆均由印度國家電力公司建造,其中兩個座位於卡克拉帕爾,兩個位於拉賈斯坦邦。這些核子反應爐的估計容量約為 2.8 GWe。

- 因此,預計該國的這些發展將在預測期內支持印度核能發電廠設備市場。

海島設備佔據市場主導地位

- 島設備類別中的主要設備是核能蒸氣供應系統(NSSS)和安全系統。核能蒸氣供應系統包括反應器堆芯、控制系統、核子反應爐冷卻劑泵(RCP)、一次管道和用於控制一次冷卻劑壓力的穩壓器(僅在壓水器中使用)。還有蒸汽產生器用於一、二次迴路之間的熱交換。

- 根據中央電力局統計,到2022年印度核能發電裝置容量將達到約6,780兆瓦。核能是印度電力結構中的重要能源來源之一。

- 截至2021年,印度核能發電約680萬千瓦,截至2022年12月,在建裝置容量約870萬千瓦,規劃或提案裝置容量超過8,000萬千瓦。儘管核能僅佔該國裝置容量的一小部分,但隨著清潔能源需求的增加,預計政府將大力投資開發新的核能發電廠設施。隨著未來更多計劃的規劃,對島嶼設施的需求預計將大幅成長。

- 已在建的核能發電廠計劃預計將在未來 10 年內運作,儘管會有所延遲。政府計劃到 2050 年,該國 25% 的電力來自核能,根據這一目標,將加強計劃儲備,以在預測期內顯著推動市場發展。

- 2022 年 3 月,印度政府宣布計畫從 2023 年開始以船隊模式建造重水堆。 Kaiga 5 號和 6 號機組將於 2023 年澆築第一批混凝土,Gorakhpur Haryana Anu Vidyut Praiyonjan 3 號和4 號機組將於2024 年澆築,Mahi Banswara Rajasthan Atomic Power Projects 1-4 號機組將於2025 年澆築,Chutka Madhya Pradesh 1 號和2 號機組將於2025 年澆築。

- 2021 年 9 月,BHEL訂單了6 個核能壓水式反應爐(PHWR) 渦輪機島的訂單,其中 4 個位於戈勒克布爾,2 個位於凱加,價值 1080 億印度盧比。

- 此外,2021 年 7 月,Bharat Heavy Electricals Ltd (BHEL)訂單了一份價值 140 億印度盧比的契約,供應 12700,000 MWe 印度設計的 PHWR蒸汽產生器,將在戈勒克布爾和凱加等四個地點建造。印度對重水器核子反應爐的如此大規模投資預計將在預測期內增加對重水器電廠設備的需求。

- 因此,考慮到以上幾點,海島設備很可能在預測期內佔據市場主導地位。

印度核能發電廠產業概況

印度核能發電廠設備市場適度整合。市場的主要企業包括(排名不分先後)Larsen &Toubro Ltd、Rosatom State Atomic Energy Corporation、Hindustan Construction Company、Bharat Heavy Electricals Limited 和 Mitsubishi Heavy Industries。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 核子反應爐類型

- 壓水式反應爐

- 加壓重水反應器

- 其他核子反應爐類型

- 載體類型

- 島嶼設備

- 輔助設備

- 研究反應器

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Westinghouse Electric Company LLC

- Doosan Corporation

- Hindustan Construction Company

- Larsen & Toubro Ltd

- Dongfang Electric Corp. Limited

- Bharat Heavy Electricals Limited

- Mitsubishi Heavy Industries Ltd

- Rosatom State Atomic Energy Corporation

第7章 市場機會及未來趨勢

The India Nuclear Power Plant Equipment Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, the significant contribution of nuclear energy in reducing GHG emissions while fulfilling the increasing energy demands of a growing population and supporting sustainable development is driving the market.

- On the other hand, rising investments in alternative clean energy sources such as solar and wind are expected to restrain the market's growth during the forecast period.

- Nevertheless, the research and development into commercializing new nuclear reactor designs, such as Fast Breeder Reactor, is expected to be a significant opportunity for the market beyond the forecast period.

India Nuclear Power Plant Equipment Market Trends

Pressurized Heavy Water Reactors to Dominate the Market

- PHWRs generally use unenriched natural uranium oxide as fuel and, therefore, need more efficient heavy water as the coolant. The heavy water enhances the neutron economy and allows the reactor to operate without fuel enrichment facilities, enabling the reactor to use alternate fuel cycles.

- The PHWR design requires thin-walled pressure tubes, unlike PWR nuclear plants. This allows the distribution of pressure boundaries in many small-diameter pressure tubes. As a result, this design has a lesser chance of accidental rupture of a pressure boundary compared to PWR designs. Therefore, PHWR is considered safer than PWR plants.

- India is the second-largest market for PHWR technology globally, trailing behind only Canada, and as of February 2021, India operates 18 PHWR units with a total capacity of 5080 MW, of which consists of 15 of 220 MW, two units of 540 MWe, and 1 unit of 700 MWe.

- In January 2021, Kakrapar-3, the first indigenously developed IPHWR-700 reactor model, was synchronized with the grid for the first time. As of May 2022, 5 indigenously-designed PHWR units, each of 700 MWe, are in various stages of construction.

- Additionally, ten other PHWR reactors are planned in the country. Globally, there are four under-construction PHWRs. All these PHWRs are being constructed by the National Power Corporation of India, with 2 in Kakrapar and 2 in Rajasthan. The estimated capacity of these reactors will be around 2.8 GWe.

- Thus, such developments in the country are expected to support the India nuclear power plant equipment market during the forecast period.

Island Equipment to Dominate the Market

- The major equipment under the island equipment category is the nuclear steam supply system (NSSS) and safety system. The nuclear steam supply system includes reactors that contain the reactor core, control system, reactor coolant pumps (RCP), primary piping, pressurizer for controlling the pressure of primary coolant (only used in PWR). It also consists of steam generators for heat exchange between the primary circuit and the secondary circuit.

- As per Central Electricity Authority statistcs, by Mrch 2022, India's nuclear energy installed capacity accounts for about 6,780 MW. Nuclear energy is one of the significant energy sources in India's electricty mix.

- India had nearly 6.8 GW of installed nuclear capacity as of 2021, and as of December 2022, around 8.7 GW net capacity under construction and over 80 GW planned or proposed. Depsite the fact that nuclear energy makes up a small share of the country's installed capacity mix, with rising demand for clean energy, the government is expected to invest significantly in the development of new nuclear power plant facilities. With upcoming projects, the demand for island equipment is likely to grow significantly.

- Those nuclear projects already under construction are expected to come online over the next ten years, albeit delayed. The government plans to source 25% of the country's electricity from nuclear energy by 2050, up from the current level of 2.5% - and the project pipeline strengthened in line with these targets, driving the market considerably in the forecast period.

- In March 2022, the Indian government announced that it planned to start the construction of PHWRs in fleet mode from 2023. The first concrete for Kaiga units 5 and 6 is expected in 2023, followed by Gorakhpur Haryana Anu Vidyut Praiyonjan units 3 and 4 and Mahi Banswara Rajasthan Atomic Power Projects units 1-4 in 2024 and Chutka Madhya Pradesh units 1 and 2 in 2025

- In September 2021, BHEL received orders worth INR 108 billion for turbine islands for six nuclear power pressurized heavy water reactor (PHWR) units, 4 at Gorakhpur and 2 at Kaiga, which is the largest order in BHEL's history.

- Additionally, in July 2021, Bharat Heavy Electricals Ltd (BHEL) received an INR 14 billion contract to supply twelve 700MWe Indian-designed PHWR steam generators to be built at four sites including Gorakhpur and Kaiga. Such large investments in PHWR reactors by India is expected to push the demand for PHWR power plant equipment during the forecast period.

- Therefore considering the above-mentioned points, island equipment is likely to dominate the market during the forecast period.

India Nuclear Power Plant Equipment Industry Overview

The India nuclear power plant equipment market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Larsen & Toubro Ltd, Rosatom State Atomic Energy Corporation, Hindustan Construction Company, Bharat Heavy Electricals Limited, and Mitsubishi Heavy Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Other Reactor Types

- 5.2 Carrier Type

- 5.2.1 Island Equipment

- 5.2.2 Auxiliary Equipment

- 5.2.3 Research Reactor

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Westinghouse Electric Company LLC

- 6.3.2 Doosan Corporation

- 6.3.3 Hindustan Construction Company

- 6.3.4 Larsen & Toubro Ltd

- 6.3.5 Dongfang Electric Corp. Limited

- 6.3.6 Bharat Heavy Electricals Limited

- 6.3.7 Mitsubishi Heavy Industries Ltd

- 6.3.8 Rosatom State Atomic Energy Corporation