|

市場調查報告書

商品編碼

1630442

南美洲船用燃料:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

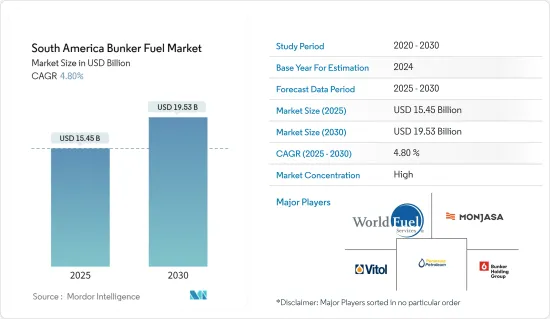

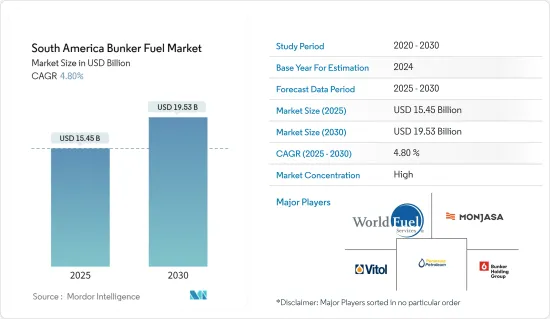

南美洲船用燃料市場規模預計到2025年為154.5億美元,預計2030年將達到195.3億美元,預測期內(2025-2030年)複合年成長率為4.8%。

主要亮點

- 從中期來看,關鍵貨物海上運輸的增加以及更嚴格的環境法規的實施推動了對清潔船用燃料的需求等因素將推動南美船用燃料市場的成長。

- 另一方面,石油市場的波動預計將對船用燃料市場產生重大影響,因為它可能會影響船用燃料供應商的盈利,並使規劃和投資變得困難。

- 也就是說,擴大使用更清潔的船用燃料為南美船用燃料市場創造了巨大的機會。

- 由於原油產量大幅增加以及該國出口穩定成長等因素,預計巴西將主導該地區船用燃料油市場。

南美洲船用燃料油市場趨勢

極低硫燃料油(VLSFO)大幅成長

- 近年來,由於國際海事組織 (IMO) 要求減少船舶硫排放,南非船用燃料油市場對淺硫燃料油 (VLSFO) 的需求大幅增加。

- 截至2023年4月,南非船用燃料油市場使用的VLSFO大部分都是進口的,使得國內船用燃料油市場的VLSFO供應尤為緊張。德班港、伊莉莎白港、開普敦港和阿爾戈亞灣(伊麗莎白港和恩古庫拉附近)的海上燃料庫可提供低硫燃油。

- 2022年12月至2023年4月的價格變動約為5%。相比之下,VLSFO 的價格波動更大,這進一步增加了對該燃料的需求。

- 2022 年 10 月,專門從事船用燃料行業的商品公司FUEL &MARINE OIL CORP (FAMOIL) 在秘魯的業務中增加了一艘燃油輸送船。該公司已將 Ecomar II 號油輪添加到其船隊中。該船將在塔拉拉、派塔、巴伊巴魯、薩拉伯里、欽博特皮斯科港、聖尼古拉斯、馬塔拉尼和洛供應極低硫燃油(VLSFO)和高硫燃油。

- 此外,南美市場對VLSFO的需求也受到該地區營運船舶數量不斷增加的推動。關於這些燃料對海洋生物的環境影響的嚴格監管也推動了對 VLSFO 的需求。

- 總體而言,由於國際海事組織限硫令實施後需求增加等因素,預計市場在預測期內將顯著成長。

巴西主導市場

- 巴西是該地區最大的經濟體,預計將成為預測期內成長最快的經濟體。由於人口成長、工業化和都市化,該國是世界上成長最快的國家之一。

- 巴西石油出口的增加預計將在推動南美船用燃料市場方面發揮關鍵作用。巴西是主要石油生產國,正在擴大石油產量,出口增加為該地區的船用燃料市場創造了重大機會。

- 隨著國際航線經過南美水域,船舶使用的船用燃料的需求預計將激增。巴西作為主要石油出口國的戰略地位使其成為影響南美洲船用燃料供應和價格趨勢的關鍵參與者。

- 例如,2022年11月,挪威Kanfer Shipping AS與Nimofast Brasil SA簽署夥伴關係協議,從2025年起在巴西建立中小型液化天然氣運輸船和液化天然氣燃料庫解決方案。液化天然氣運輸船和液化天然氣加註船將透過 FSU 進行裝載,該 FSU 將永久位於巴拉那州的 Nemofast 液化天然氣進口和發行終端。

- 此外,巴西石油出口的增加與該地區海上貿易活動活性化的更廣泛趨勢是一致的。隨著船舶運輸量的增加,作為船舶主要能源來源的船用燃料的需求預計也會相應增加。

- 船用燃料需求的激增不僅反映了南美洲在全球貿易中日益重要的地位,而且還反映了巴西等石油出口國對船用燃料等相關行業趨勢產生重大影響的潛力,這凸顯了能源市場的相互關係聯性。

- 巴西擁有全球最大的可採超深層石油蘊藏量,巴西96.7%的石油產量來自海上。 2022 年石油產量為 1.631 億噸,高於 2021 年的 1.569 億噸。

- 因此,隨著石油和天然氣產量預計增加,巴西與世界其他地區之間的貿易活動預計將進一步增加。由於主要的國際貿易是透過海上航線進行的,預計巴西將在不久的將來成為船用燃料的新興市場。

- 所有上述因素預計將有助於該國在預測期內在船用燃料方面佔據該地區的主導地位。

南美船用燃料油產業概況

南美船用燃料市場已減少一半。主要企業(排名不分先後)包括 Bunker Holding A/S、Monjasa Holding A/S、AP Moeller Maersk A/S、World Fuel Services Corp 和 Peninsula Petroleum Ltd。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 南美洲必需品海運的增加

- 清潔船用燃料支持政策

- 抑制因素

- 石油市場不穩定

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按燃料類型

- 高硫燃料油(HSFO)

- 極低硫燃油(VLSFO)

- 船用輕柴油 (MGO)

- 液化天然氣(LNG)

- 其他燃料(甲醇、液化石油氣、生質柴油)

- 按船舶類型

- 容器

- 油船

- 普貨

- 散裝貨櫃

- 其他船舶類型

- 按地區

- 巴西

- 智利

- 阿根廷

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Fuel Suppliers

- Vitol Holding BV

- Monjasa Holding A/S

- Bunker Holding A/S

- World Fuel Services Corp

- Peninsula Petroleum Ltd

- TotalEnergies SA

- Chevron Corporation

- Ship Owners

- AP Moeller Maersk A/S

- Mediterranean Shipping Company SA

- China COSCO Holdings Company Limited

- CMA CGM Group

- Hapag-Lloyd AG

- Ocean Network Express

- Fuel Suppliers

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 使用無污染燃料

簡介目錄

Product Code: 71505

The South America Bunker Fuel Market size is estimated at USD 15.45 billion in 2025, and is expected to reach USD 19.53 billion by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the ever-rising marine transportation of essential commodities and implementation of stricter environmental regulations driving the demand for cleaner bunker fuels drive the growth in the South American bunker fuel market.

- On the other hand, the oil market's volatility is significantly expected to affect the bunker fuel market as it can impact the profitability of bunker fuel suppliers and make planning and investing difficult.

- Nevertheless, the increase in the use of clean bunker fuels creates a significant opportunity for the South American bunker fuel market.

- Brazil is expected to dominate the bunker fuel market in the region owing to factors like substantial crude oil production and a steady rise in exports from the country.

South America Bunker Fuel Market Trends

Very Low Sulfur Fuel Oil (VLSFO) to Witness Significant Growth

- The demand for shallow sulfur fuel oil (VLSFO) in the South African Bunker fuel market has seen a significant rise in recent years, following the International Maritime Organization's (IMO) mandate on reducing sulfur emissions from ships.

- As of April 2023, VLSFO availability is particularly strained in the domestic bunker fuel market, as most of the VLSFO used in the South Africa bunker fuel market is imported. Low-sulfur fuel oil is available in the ports of Durban, Port Elizabeth, and Cape Town, as well as at offshore bunkering in AlgoaBay (off Port Elizabeth and Ngqura).

- Moreover, the price fluctuations for VLSFO in the region are lesser compared to their counterparts, as between December 2022 and April 2023, the changes in prices were recorded at around 5%. In contrast, the counterparts have registered more variance, which further adds to the demand for this fuel.

- In October 2022, FUEL & MARINE OIL CORP (FAMOIL), a commodity trading house specializing in the marine fuel industry, added a bunker delivery vessel to its operation in Peru. The company added the tanker Ecomar II to its fleet. The vessel supplies Very Low Sulfur Fuel Oil (VLSFO) and High Sulfur Fuel Oil at Talara, Paita, Bayovar, Salaverry, Chimbote ports Pisco, San Nicolas, Matarani, and Llo.

- Moreover, the demand for VLSFO in the South American market is also driven by the growing number of vessels operating in the region. The stricter regulations on the environmental impact of these fuels on marine life have consequently driven the demand for VLSFO.

- Overall, the market is expected to witness significant growth during the forecast period owing to factors like increasing demand, which spurred up after the implementation of the IMO sulfur cap.

Brazil to Dominate the Market

- Brazil is the largest economy in the region and is expected to be the fastest-growing economy in the forecast period. The country is one of the fastest-growing countries worldwide because of the increasing population, industrialization, and urbanization.

- The increasing exports of oil from Brazil are anticipated to play a pivotal role in driving the market for bunker fuel in South America. Brazil, as a major oil-producing nation, has been expanding its oil output, and the growing exports present a significant opportunity for the bunker fuel market in the region.

- As international shipping routes pass through South American waters, the demand for bunker fuel used by marine vessels is expected to surge. Brazil's strategic location as a prominent exporter of oil makes it a crucial player in influencing the availability and pricing dynamics of bunker fuel in South America.

- For instance, In November 2022, Norwegian company Kanfer Shipping AS signed a partnership deal with Nimofast Brasil S.A. to establish small and medium-scale LNG shipping and LNG bunkering solutions in Brazil from 2025 onwards. The LNG vessels and LNG bunker ships will be loaded via the permanently based FSU at the Nimofast LNG import- and distribution terminal in the state of Parana.

- Moreover, the rise in oil exports from Brazil aligns with the broader trend of increased maritime trade activities in the region. As shipping traffic intensifies, the demand for bunker fuel as the primary energy source for marine vessels is expected to witness a corresponding uptick.

- This surge in demand for bunker fuel not only reflects the growing importance of South America in global trade but also underscores the interconnected nature of energy markets, where oil-exporting countries like Brazil can significantly impact the dynamics of related sectors such as marine fuels.

- Brazil owns the largest recoverable ultra-deep oil reserves in the world, with 96.7% of Brazil's oil production produced offshore. In 2022, the oil production was 163.1 million tonnes, increased from 156.9 million tonnes in 2021.

- Hence, with the expected increase in oil and gas production, trading activities between Brazil and the rest of the world are expected to increase further. With major international trading activities carried out through the marine route, Brazil is expected to become the emerging market for bunker fuel in the near future.

- All of the above factors are expected to help the country dominate the region in terms of bunker fuel during the forecast period.

South America Bunker Fuel Industry Overview

The South American bunker fuel market is semi-fragmented. Some of the major companies (in no particular order) are Bunker Holding A/S, Monjasa Holding A/S, AP Moeller Maersk A/S, World Fuel Services Corp, and Peninsula Petroleum Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Marine Transportation of Essential Commodities in South America

- 4.5.1.2 Supportive Policies for Cleaner Bunker Fuel

- 4.5.2 Restraints

- 4.5.2.1 Volatile Nature of Oil Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Liquefied Natural Gas (LNG)

- 5.1.5 Other Fuel Types (Methanol, LPG, and Biodiesel)

- 5.2 Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Container

- 5.2.5 Other Vessel Types

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Chile

- 5.3.3 Argentina

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fuel Suppliers

- 6.3.1.1 Vitol Holding BV

- 6.3.1.2 Monjasa Holding A/S

- 6.3.1.3 Bunker Holding A/S

- 6.3.1.4 World Fuel Services Corp

- 6.3.1.5 Peninsula Petroleum Ltd

- 6.3.1.6 TotalEnergies SA

- 6.3.1.7 Chevron Corporation

- 6.3.2 Ship Owners

- 6.3.2.1 AP Moeller Maersk A/S

- 6.3.2.2 Mediterranean Shipping Company SA

- 6.3.2.3 China COSCO Holdings Company Limited

- 6.3.2.4 CMA CGM Group

- 6.3.2.5 Hapag-Lloyd AG

- 6.3.2.6 Ocean Network Express

- 6.3.1 Fuel Suppliers

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Utilization of Clean Bunker Fuels

02-2729-4219

+886-2-2729-4219