|

市場調查報告書

商品編碼

1630443

保險分析 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Insurance Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

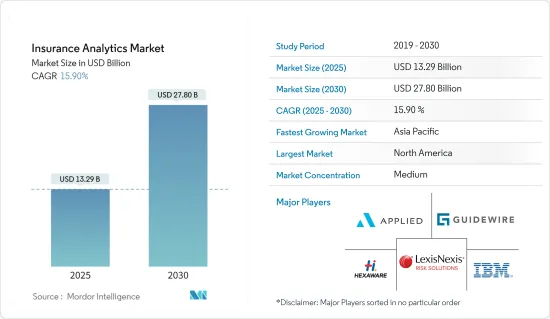

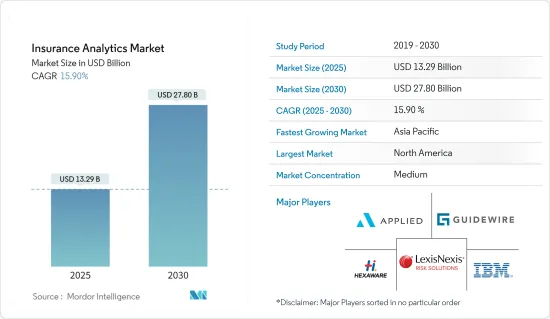

保險分析市場規模預計到 2025 年為 132.9 億美元,預計到 2030 年將達到 278 億美元,預測期內(2025-2030 年)複合年成長率為 15.9%。

公司可以使用預測分析來識別可疑的索賠、詐欺和行為模式,並提交以進行進一步調查。這提高了索賠、保單和銷售流程的效率,並支持合理的業務決策。例如,客戶終身價值 (CLV/CLTV) 工具提供有價值的客戶見解,可以預測客戶行為、態度以及保留或取消保單的可能性。

主要亮點

- 透過人工智慧和機器學習的整合,這些解決方案變得更加有價值。根據埃森哲的報告,到 2035 年,在金融領域利用人工智慧可以將收益提高 31%。此外,人工智慧也將能夠為客戶提供量身訂製的金融服務,改善客戶體驗。因此,基於人工智慧的保險分析解決方案可以幫助金融機構節省數十億美元的成本,增加數十億美元的收益,並減少詐欺。 Advanced Analytics (AA) 將歐洲、中東和非洲四大公司的營業利潤提高了 10-25%。我們預計這種影響將在未來兩年內擴大。

- COVID-19危機後,經濟活動的動盪、不確定性和低迷帶來的結構性變化對保險業產生了根本性影響。這些變化迫使保險公司重新思考其開展業務以及與客戶互動的方式。此外,對增強數位互動以及個人和健康風險管理的需求也推動了對數位和分析解決方案的投資。因此,在整個研究期間預測市場成長。

- 由於連接性和遠端存取的增加,資料可靠性和安全性變得越來越重要。人們非常擔心惡意第三方存取個人資料。從歷史上看,保險公司並沒有在基礎設施上投入巨資,因此購買和維護昂貴的安全軟體預計會阻礙保險分析市場的成長。

- 隨著保險業競爭的加劇,對分析解決方案的需求日益成長,以維持全球市場的激烈競爭。企業正在採用可擴展且高效的解決方案來管理不斷成長的風險、應對災難並滿足監管監控需求,這些是保險分析的關鍵促進因素。

- 此外,隨著消費者擴大24/7在線尋求公司報價和客製化保險解決方案,工業公司之間的競爭正在興起。因此,日益激烈的市場競爭正在加速市場主要企業對保險分析的採用。

保險分析市場趨勢

不斷上升的風險和詐欺正在推動保險分析的採用。

- 在保險領域,定期識別和管理人為和自然災害的風險。這些不確定的風險推動了對綜合風險管理的需求,該管理將知識、控制和公司日常營運的最佳化結合起來。保險分析解決方案提供了重要的理解,以加強各層面的風險管理。

- 86% 的保險公司正在建立保險資料分析系統,以根據巨量資料報告提供最準確的預測。資料分析可以在所有產品類別和公司職能中實現前所未有的創造力。例如,汽車保險公司現在不再依賴損失記錄等內部資料來源,而是轉向行為模式的分析,並將信用局的信用評級納入其研究中。

- 虛假保險申請每年造成保險公司數十億美元的損失。保險公司認為10%到20%的保險申請是詐欺的,只有不到20%的詐欺申請被偵測到。使用預測分析可以偵測詐欺、可疑索賠和行為模式,其中預測分析結合了統計模型以進行有效的詐欺偵測。

- 用於索賠詐騙偵測的人工智慧非常有用,因為它可以立即註意到模式並即時識別異常和可疑請求。該公司正在利用人工智慧來加快整個申請流程並提供更先進的詐欺檢測,而無需增加員工或增加成本。

- 保險申請付款對於保險公司的營運效率至關重要。許多與申請相關的業務都可以快速處理,並且透過利用資料分析處理和分析龐大資料集的卓越能力,整個申請付款得以簡化。

亞太地區將經歷最高的成長

- 由於對客戶分析、行為分析、機器學習和演算法開發的需求不斷成長,數位基礎設施的日益普及推動了亞太地區保險分析市場的發展。例如,在印度,Max Life Insurance 推出了即時分析解決方案,可識別虛假醫療報告並提供客戶的相對健康評分。

- 此外,亞太地區的人口日益都市化,導致了與久坐生活方式相關的所有健康危害。這種情況將鼓勵客戶投資健康保險計劃。因此,保險公司接觸都市區新人口存在巨大的機會。資料分析可以幫助您在購買保險之前研究該客戶群。

- 該地區的保險公司正在投資自動化流程,在後端直通式處理,在前端進行通路數位化。例如,Prudential 與 Google Cloud 合作開發資料分析解決方案。此次合作將使亞洲的保障、醫療保健和儲蓄解決方案更容易理解和使用。

- 近年來,大多數亞太市場放鬆了對外資所有權的限制。亞太地區七個新興市場中有六個允許外國投資者控制並擁有國內保險公司的多數股權。

- 亞太地區保險公司的法規不斷發展。這些監管改進的重點是保單持有人保護、資本保全和保險科技的推廣,但不同地區的發展程度有所不同。

保險分析產業概述

保險公司可以使用資料分析來更了解客戶行為,並提供客製化解決方案來滿足用戶的需求。這些分析提供者與多家公司簽訂契約,提供資訊科技軟體和服務。隨著企業向數位技術轉型,擴張的範圍正在擴大。保險分析市場需要變得更有凝聚力。為了因應保險業不斷變化的需求,公司正在投資於產品創新。

- 2023 年8 月- IBM 和FGH Parent, LP(連同其子公司「Fortitude Re」)將使用人工智慧技術和其他技術為保單持有人和保險公司提供一流的客戶體驗,並宣布達成一項價值4.5億定序的協議。

- 2023 年 2 月 - LexisNexis Risk Solutions 幫助美國住宅保險承保人縮小需要根據風險進行額外評估的財產範圍,並為具有完整內部、外部和空中結構的財產提供消費者自助研究工具,推出新的綜合財產LexisNexis Total Property Understanding資訊解決方案,可擷取資料並提供人工智慧支援的見解,以加快決策速度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 更多採用先進技術

- 保險業競爭加劇

- 市場限制因素

- 嚴格的政府法規

- 隱私和安全問題

第5章市場區隔

- 按成分

- 工具

- 按服務

- 按業務用途(定性分析)

- 理賠管理

- 風險管理

- 流程最佳化

- 客戶管理和個人化

- 依實施類型

- 本地

- 雲

- 按最終用戶

- 保險公司

- 政府機構

- 第三方管理人員、仲介和顧問公司

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭狀況

- 公司簡介

- IBM Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies Limited

- Guidewire Software Inc.

- Applied Systems Inc.

- Microsoft Corporation

- MicroStrategy Incorporated

- OpenText Corporation

- Oracle Corporation

- Sapiens International Corporation

第7章 供應商市場佔有率

第8章 市場機會及未來趨勢

The Insurance Analytics Market size is estimated at USD 13.29 billion in 2025, and is expected to reach USD 27.80 billion by 2030, at a CAGR of 15.9% during the forecast period (2025-2030).

Companies can identify dubious claims, fraudulent activities, and behavioral patterns using predictive analytics submitted for further research. This will improve the efficiency of claims, policy, and sales processes helping in sound business decisions. For instance customer lifetime value (CLV/CLTV) tool provides the client's informative insights that enable forecasting the possibility of customer behavior and attitude, policy maintenance, or a policy surrender.

Key Highlights

- These solutions are becoming more valuable with AI and machine learning integration. Using AI in the financial sector might boost profitability rates by 31% by 2035, according to a report by Accenture. Additionally, AI will likely make it possible to give tailored financial services to clients, improving the customer experience. As a result, AI-based insurance analytics solutions can help financial organizations cut costs by billions, increase revenues by billions, and decrease fraud. Advanced Analytics (AA) increased the operating profit of the top four performers by 10 to 25 percent in EMEA. They anticipate this impact to grow over the following two years.

- With the onset of the COVID-19 crisis, structural changes brought on by turbulence, uncertainty, and weak economic activity had essential ramifications for the insurance sector. These changes compelled insurance companies to rethink how they conducted business and interacted with customers. Also, the need for digital interactions and enhanced risk management for personal and health boosted investments in digital and analytics solutions. As a result, market growth was predicted throughout the study period.

- Data reliability and security are significant due to increased connection and distant accessibility. Concerns about nefarious parties getting access to personal data are very high. Historically, insurance companies have yet to be known to make significant expenditures in infrastructure, so purchasing and maintaining pricey security software will hinder the growth of the Insurance Analytics Market.

- With the rise in competition in the insurance sector, the need for analytics solutions tends to rise to sustain stiff competition across the global market. Companies are adopting scalable & efficient solutions for managing amplified risk, dealing with catastrophes, and meeting demands of regulatory scrutiny, which are some of the significant factors that propel the adoption of insurance analytics.

- Furthermore, as consumers are inclined toward getting online quotes & customized insurance solutions 24/7 from different companies, it creates competition among industry firms. Therefore, an increase in competition is accelerating the adoption of insurance analytics among key players in the market.

Insurance Analytics Market Trends

Increasing Risks And Fraudulent Activities Are Boosting the Adoption Of Insurance Analytics.

- Risks from man-made and natural disasters are regularly identified and managed in the insurance sector. The need for integrated risk management, which combines knowledge, control, and optimization of routine company operations, is high due to this uncertain risk. Insurance analytics solutions provide the crucial understanding to enhance risk management at all levels.

- 86% of insurance companies are creating insurance data analytics systems to provide the most accurate predictions of big data reports. Data analytics enable unprecedented creativity across all product categories and corporate functions. For instance, instead of depending on internal data sources like loss records, auto insurance started working on behavior-based analytics and incorporating credit ratings from credit bureaus into their study.

- Due to false claims, insurance firms suffer enormous losses every year. Insurers believe that between 10% to 20% of claims are fraudulent and that less than 20% of fraudulent claims are discovered. It is possible to detect fraudulent activities, suspicious claims, and behavioral patterns using predictive analytics incorporating statistical models for efficient fraud detection.

- AI for claims fraud detection is quite beneficial since it can immediately notice patterns, allowing them to identify anomalies and suspicious requests in real-time. Businesses are using AI to speed up the entire insurance claims process and gain access to more advanced fraud detection without adding more staff or spending more money.

- The speed at which claims are settled is crucial to determining how effectively an insurance company runs. Many claim-related tasks are processed quickly, and the entire claim-settlement process is streamlined post-adoption of data analytics' excellent abilities to process and analyze huge datasets.

Asia-Pacific to Witness Highest Growth

- APAC region's insurance analytics markets are primarily driven by the increased adoption of digital infrastructure due to the growing need for customer and behavioral analytics, machine learning, and algorithm development. For instance, In India, Max Life Insurance launched a real-time analytics solution to identify false medical reports and provide relative health scores for a customer.

- Furthermore, populations in the Asia-Pacific region are becoming more urbanized, which brings all the health hazards related to a more sedentary lifestyle. This scenario will urge customers to invest in health insurance plans. Thus there is a vast opportunity for insurers to capture this newly added urban crowd, and data analytics can help study this customer base before issuing them any insurance.

- Insurance companies in the region are investing in automating processes with straight-through processing at the back end and digitally enabling distribution channels on the front end. For instance, Prudential collaborated with Google Cloud for its data analytics solution. Through this partnership, protection, health, and savings solutions will be more straightforward and accessible across Asia.

- In recent years, most Asia-Pacific markets relaxed their limitations on foreign ownership. Six of seven emerging Asia Pacific markets have permitted foreign investors to control and own a majority interest in domestic insurers.

- The laws and regulations for insurers in Asia-Pacific are constantly evolving. These regulatory improvements have focused on policyholder protection, capital preservation, and InsurTech promotion despite the varying degrees of development across various regional nations.

Insurance Analytics Industry Overview

Insurance Companies can use data analytics to learn more about client behavior and deliver customized solutions per user needs. These Analytics providers sign contracts with various companies to help them with Information Technology Software and services. As businesses shift to digital technologies, they have a wider scope of expansion. The insurance analytics market needs to be more cohesive. Players tend to invest in innovating their product offerings to cater to the insurance industry's changing demands.

- August 2023 - IBM and FGH Parent, L.P. (with its subsidiaries, "Fortitude Re") announced business has entered into a USD 450 million deal to change Fortitude Re's life insurance policy servicing operations with the implementation of AI technology and other automation tools developed to deliver a best-in-class customer experience for policyholders and insurers.

- February 2023 - LexisNexis Risk Solutions has launched LexisNexis Total Property Understanding, a new comprehensive property intelligence solution to help enable U.S. home insurance underwriters to narrow in on properties needing additional evaluation based on risk, capture complete interior, exterior, and aerial data from those properties through a consumer self-guided survey tool, and access AI-enabled insights to fast-track decision making.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Market Drivers

- 4.4.1 Increased Adoption of Advanced Technologies

- 4.4.2 Rise in Competition among the Insurance Sector

- 4.5 Market Restraints

- 4.5.1 Stringent Government Regulations

- 4.5.2 Privacy and Security Concern

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Tool

- 5.1.2 Services

- 5.2 By Business Application (Qualitative Analysis)

- 5.2.1 Claims Management

- 5.2.2 Risk Management

- 5.2.3 Process Optimization

- 5.2.4 Customer Management and Personalization

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.4 By End-User

- 5.4.1 Insurance Companies

- 5.4.2 Government Agencies

- 5.4.3 Third-party Administrators, Brokers, and Consultancies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 LexisNexis Risk Solutions

- 6.1.3 Hexaware Technologies Limited

- 6.1.4 Guidewire Software Inc.

- 6.1.5 Applied Systems Inc.

- 6.1.6 Microsoft Corporation

- 6.1.7 MicroStrategy Incorporated

- 6.1.8 OpenText Corporation

- 6.1.9 Oracle Corporation

- 6.1.10 Sapiens International Corporation