|

市場調查報告書

商品編碼

1630453

照護現場資料管理軟體 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Point-of-Care Data Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

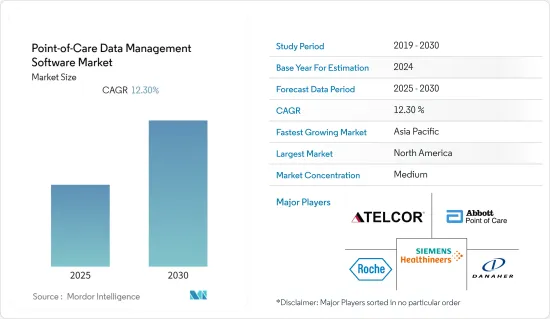

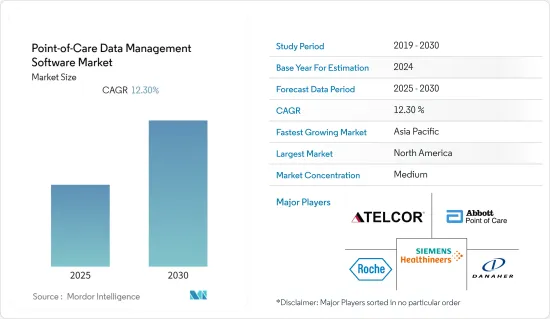

預測期內,照護現場資料管理軟體市場預計將以 12.3% 的複合年成長率成長

主要亮點

- 由於醫療保健領域價值觀的變化和技術的發展,對就地檢驗的需求正在增加。有幾個因素推動了 POCT 的需求。其中包括感染疾病的增加、心臟疾病和糖尿病等與文明病的增加、想要使用家用 POC 設備的患者的增加以及使設備更快、更容易使用的技術進步。

- 全球估計有 5.11 億成年人患有糖尿病。到 2040 年,這一數字預計將增加到 5.7 億以上。隨著糖尿病在世界各地持續增加,還需要努力提高人們的意識。預計 37% 的成人糖尿病患者居住在亞太地區。另外,根據國際糖尿病聯盟的數據,2021年全球糖尿病患者人數為5.37億人。 2021 年至 2045 年間,全球糖尿病照護支出預計將從 9.66 億美元成長到 10.53 億美元。根據美國疾病管制與預防中心 (CDC) 最近的一份報告,超過 50% 的被診斷患有 COVID-19 的糖尿病患者正在住院治療。

- 透過就地檢驗(POCT) 快速診斷臨床症狀可以改善患者的治療結果。 POCT 發展背後的關鍵理念是,它可以透過使測試更接近患者並快速輕鬆地向醫療保健專業人員提供結果來加快診斷和治療速度。現今的 POCT 設備正在發生變化,但取得記錄合規性所需的資料仍然非常耗時。強大的 POCT 管理系統和連接解決方案可減少手動輸入結果所需的時間,消除手動輸入中固有的錯誤,並促進即時存取結果,幫助醫療保健專業人員做出及時的決策。

- 此外,隨著醫療資料分析越來越普遍地用於支援以患者為中心的護理和人口健康管理,POCT 結果可以以電子方式整合,結果追蹤指標和關鍵績效指標也必須包含在內。 2015年至2019年,美國電子健康記錄(EHR)支出將以5.4%的複合年成長率成長,2019年總計達到145億美元。此外,根據日本護理協會的調查,2019年9月至10月,日本約63%的醫院引進了EMR系統。該國政府自 2000 年代初以來一直在推廣該系統的使用。

- COVID-19 的爆發給世界各地的衛生系統帶來了巨大的壓力,這些系統難以應對大量需要挽救生命的治療的患者。一些國家正在目睹或準備應對關鍵醫療設備的短缺,例如外科口罩、面罩、救生人工呼吸器或患者的實體空間和床位。在日益高科技的醫療設備世界中,這些看似基本的必需品被優先考慮。

照護現場(POC)資料管理軟體市場趨勢

醫院/重症患者監護室細分市場預計將佔據主要市場佔有率

- 醫院擴大使用就地檢驗(POCT) 和電子健康記錄系統,從而提高了即時電子結果報告的重要性。 POCT資料管理系統隨著市場需求的變化而不斷發展以支援此類模型。在各個醫院中,從一個校園到另一個校園,或從一個州到另一個州,基於網路的互聯資料管理平台極大地釋放了就地檢驗專案管理的效率。

- 照護現場(POC) 技術最重要的方面是其床邊存在。 POC 技術促進並改善患者與護理師、醫生和外科醫生之間的互動,從而改善醫療保健結果。床邊血糖檢測是最廣泛、容量最大的 POC 市場。這些是第一批開發的設備,涉及數百台設備和數千名操作員。

- 此外,透過在每個房間/治療區域安裝壁掛式 POC 終端或輪式工作站,任何醫院都可以節省大量縮短時間和成本。各種研究得出的結論是,護士花 25% 到 50% 的輪班時間來完成記錄,而傳統上是使用鉛筆和紙來填寫病歷。這意味著護理人員經常參與準確搜尋、創建、修改和儲存關鍵患者資料。

- 此外,加護病房(ICU)/重症患者監護病房的臨床醫生經常在有限的空間內治療重症患者,此時他們必須快速做出決定。因此,POCT 擴大被用作重症監護病房患者管理的常規組成部分,特別是血氣分析。雖然血液氣體分析儀 (BGA) 的主要目的是提供血液氣體水平(例如 pH、pO2、pCO2)的精確測量,但現代分析儀目前不測量血紅蛋白或電解質濃度(例如鈉)。包括鉀、氯和離子鈣。

- 西班牙一家醫院與 NTT 資料(NTT DATAzGroup) 合作開發了 SmartICU,讓醫生和技術人員與 NTT 資料的資料科學家組成團隊,以取得更好的臨床結果。在與醫院合作開發 SmartICU 解決方案的為期一年的旅程開始時,團隊發現資料管理和彙報是一個關鍵障礙。

- 鑑於護理師每小時手動測量的非結構化性質,關鍵病房資料來源遠遠超出了高級儀器測量的範圍。團隊花了一些時間來發現、整合、設計和客製化資料儀表板。在此基礎上,醫院和 NTT 資料團隊專注於最具附加價值的分析場景。

預計北美將佔據較大市場佔有率

- 數十年來,北美地區一直使用就地檢驗(POCT) 來診斷和監測急性和慢性疾病。用於診斷愛滋病毒、結核病和瘧疾等感染疾病的快速檢測正在變得可用,這主要是由於醫生和患者能夠透過智慧型手機可視化結果並做出適當的臨床決策。變化。照護現場診斷市場也受到診斷行業最新創新的推動,這些創新為支持治療方法的快速臨床決策提供快速診斷。

- 根據美國疾病管制與預防中心的數據,慢性呼吸道疾病,包括慢性阻塞性肺病和氣喘,是美國第四大死因。每年有超過 16 萬人死亡。在美國,五分之一的慢性阻塞性肺病患者預計將在 30 天內再次入院。

- POC 招聘受到政府的青睞。 POC 檢測減輕了醫院資源的負擔,減少了急診室的等待時間和就診次數。生產中的大多數 POC 測試都是為檢測感染疾病而設計的。例如,美國國家生物醫學影像和生物工程研究所建立的Point of Care技術研究網路正在加速POC診斷和檢測產品的開發。有利的法規,例如臨床實驗室改進法案 (CLIA) 指南,比其他形式更促進 POC 測試。

- 目前,美國的POC檢測包括化學/電解質、懷孕、血紅蛋白、心臟生物標記、血液學、糞便潛血、濫用藥物、肝功能、血氣和有限的感染疾病。由於現有的心臟生物標記POC 測試存在缺陷,MEDITECH 的Expanse Point of Care 軟體為護理師和治療師提供了一種基於網路的現代化解決方案,以便與患者互動並提供最佳、最高效的護理。 感染疾病's Daughters 引入了行動技術。根據地理位置和潛在的感染疾病,可以針對流行病、複雜的緊急情況或災難量身定做 POC 資源。

- 隨著醫療界迫切需要準確及時的虛擬策略來改善患者照護,特別是在感染疾病爆發的情況下,Evoke360 不僅可以提高護理品質和患者治療效果,還可以影響品質和風險調整評分,提高利潤率以及供應商組織的競爭日益激烈。 2020 年 6 月, 資料 Software (DataLink) 指出了 Evoke360 及其提供者關係管理 (PRM) 模組的主要優勢,可協助提供者從按服務付費轉向基於價值的護理。 Evoke360 充當照護現場(POC) 解決方案,聚合來自不同來源的資料,以加速對患者的先發製人護理,並縮小護理差距,超越診斷和治療。

照護現場(POC)資料管理軟體產業概述

由於多家公司參與,照護現場(POC)資料管理軟體市場競爭非常激烈。市場似乎適度分散,主要企業採取產品創新、併購和收購等策略來擴大市場滲透率並保持競爭力。該市場的主要企業包括西門子 Healthineers AG、雅培 Point of Care Inc. 和丹納赫公司 (Danaher Corporation)。

- 2022 年 1 月,Glytec 與羅氏在胰島素管理領域展開合作。這項數位健康合作關係將羅氏的醫療設備和 IT 解決方案專業知識與 Glytec 經 FDA 批准的胰島素劑量決策支援軟體 Glucommander 相結合,以解決醫院床邊住院患者血糖管理的挑戰,旨在透過實現即時資料照護現場。

- 2022 年 2 月,Butterfly Network, Inc.(一家透過手持式全身超音波改變醫療保健的數位健康公司)和 Ambra Health(一家 Intelerad 公司和領先的雲端基礎的醫療影像管理套件的製造商)宣布,他們將共享床邊服務互通性。此次合作增強了 Butterfly Blueprint 企業平台的可擴展性,改善了醫院和衛生系統之間有價值的超音波資訊的存取和共用。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 靈活連接和軟體介面解決方案的創新

- 增加醫療基礎設施預算

- 政府努力普及POC測試

- 市場問題

- 高實施成本和營運挑戰

- 市場機會

- 快速偵測並分散醫療服務

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 當前監管狀態(臨床實驗室改進法案 CLIA 指南和連接標準 (POCT1-A2))

- 就地檢驗的新應用(敗血症生物標記、內分泌測試、中風標記等)

第5章 COVID-19 對市場的影響

第6章 市場細分

- 按最終用戶

- 醫院/重症患者加護病房

- 診斷中心

- 診所/門診病人

- 按用途

- 感染疾病裝置

- 血糖監測

- 凝血監測

- 尿液檢查

- 心臟代謝監測

- 癌症標記物

- 血液學

- 其他 POC 應用

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 日本

- 中國

- 新加坡

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Siemens Healthineers AG+(Conworx)

- Abbott Point of Care Inc.+(Alere)

- Danaher Company(HemoCue and Radiometer Medical ApS)

- Roche Diagnostics Corporation

- TELCOR Inc.

- Orchard Software Corporation

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc.

第8章投資分析

第9章市場的未來

The Point-of-Care Data Management Software Market is expected to register a CAGR of 12.3% during the forecast period.

Key Highlights

- The demand for point-of-care testing is growing in response to the value shift in healthcare and technological developments. Several factors are driving the need for POCT. Some of them include an increase in infectious diseases, a rise in lifestyle-related diseases, such as cardiac diseases and diabetes, a growing patient desire to use home-based POC devices, and technological advancements creating faster and easier-to-use devices.

- Around the globe, an estimated 511 million adults have diabetes. By 2040, this number is expected to rise to over 5,70 million. As diabetes worldwide continues to increase, so must the effort to raise awareness. 37% of all diabetic adults are expected to live in the Asia-Pacific region. Additionally, according to the International Diabetes Federation, the number of diabetic patients worldwide in 2021 was 537 million. Between 2021 - 2045, the global expenditures for diabetes treatment are anticipated to grow from USD 966 million to USD 1,053 million. According to a recent report by the Centers for Disease Control and Prevention (CDC), more than 50% of people with diabetes who have been diagnosed with COVID-19 are hospitalized.

- Rapid diagnosis of clinical conditions through point-of-care testing (POCT) can improve patient outcomes. The primary concept behind POCT growth is that bringing testing closer to the patient and results quickly and conveniently to the provider can speed up the diagnosis and treatment. Today's POCT devices are changing, but capturing the data required to document compliance is still time-consuming. A robust POCT management system and connectivity solution reduces the time spent manually typing in results, eliminates errors inherent to manually entered results, and facilitates real-time access to results so that providers can make timely decisions.

- Additionally, as healthcare data analytics are more commonly used to support patient-centered care and population health management, it is essential to have POCT results electronically integrated to include results tracking metrics and key performance indicators. Electronic medical records (EHR) expenditures in the United States grew at an annual average of 5.4% from 2015 to 2019, totaling USD 14.5 billion in 2019. Additionally, according to the Japanese Nursing Association survey, from September to October 2019, around 63% of the hospitals in Japan implemented the system of EMR. The government in the country has been promoting the system's use since the beginning of the 2000s.

- The COVID-19 outbreak placed a significant burden on healthcare systems worldwide that are straining to handle the volume of ill patients requiring life-saving treatment. Several countries have witnessed or are preparing for shortages of critical medical equipment such as surgical masks, face shields, life-saving ventilators, or even the physical space and beds for patients. These seemingly fundamental necessities become the priority in a world of increasingly high-tech healthcare equipment.

Point-of-Care (POC) Data Management Software Market Trends

Hospitals/Critical Care Units Segment is Expected to Hold a Significant market Share

- The point-of-care testing (POCT) and electronic medical records system usage are rising in hospitals, where the importance of real-time electronic reporting of results is increasing. POCT data management systems are evolving to meet the marketplace's changing needs in supporting such a model. Across the hospitals, either from campus to campus or from one state/province to another, the web-based connectivity data management platform unlocks primary efficiency in point-of-care testing program management.

- The most critical aspect of POC (point-of-care) technology is its presence at the bedside. POC technologies facilitate and improve interactions between patients and their nurses, doctors, and surgeons, leading to better healthcare outcomes. Bedside glucose testing is the most widespread and occupies the most massive volume in the POC market. These were the first devices developed and involved hundreds of devices and thousands of operators.

- Further, a wall-mounted POC terminal in every room/treatment area or workstation on wheels has the potential to create significant time and cost savings in any hospital. Various studies concluded that nurses spend 25-50% of their shifts on documentation done in the traditional manner, which is on a physical chart with a pencil and paper. This means that nurses are regularly involved in accurate retrieval, production, modification, and critical patient data storage.

- Further, clinicians in intensive care units (ICU)/critical care units often work with critically ill patients in limited space and must make quick decisions at that point of care. Thus, critical care units have increasingly used POCT as a routine element of patient management, notably for blood gas analysis. The primary objective of the blood gas analyzer (BGA) is to deliver accurate measures of the blood gas levels (such as pH, pO2, and pCO2); however, modern analyzers can currently measure additional parameters in the same blood sample, such as the hemoglobin or electrolyte concentrations (includes sodium, potassium, chloride, and ionized calcium).

- The development of SmartICU at a hospital in Spain, in partnership with NTT DATA (an NTT DATAzGroup), is teaming its doctors and technologists with NTT DATA's data scientists to get better clinical results. At the outset of a one-year journey of developing the SmartICU solution with the hospital, the team identified data management and reporting as the primary obstacle.

- Data sources at the critical units go far beyond high-level device readings when one considers them unstructured, such as the nurse's hourly measurements manually. The teams spent a certain amount of time on data discovery, integration, reporting dashboard designing, and customizing. With this foundation, the hospital and NTT DATA teams have focused on the most value-adding analytic scenarios to layer on top.

North America is Expected to Hold a Significant Market Share

- Point-of-care testing (POCT) has been used in the North American region for several decades to diagnose and monitor acute and chronic medical conditions. The growing availability of rapid tests for diagnosing infectious diseases, such as HIV, TB, or malaria, that primarily enable physicians and patients to visualize the results from a smartphone and make appropriate clinical decisions may transform the market over the next few years. The point-of-care diagnostics market is also driven by the latest innovations in the diagnostics industry to provide an expedited diagnosis for quick clinical decision-making to support treatment regimens.

- According to the Centers for Disease Control and Prevention, chronic lower respiratory diseases, including COPD and asthma, are the fourth-leading causes of mortality in the United States. They are responsible for more than 160,000 deaths a year. It is expected that 1 in 5 COPD patients will be readmitted within 30 days in the United States.

- There is a preference for POC adoption by governments. POC testing reduces the strain on hospital resources, as well as ER wait times and visits. The majority of POC tests produced are designed for detecting infectious diseases. For instance, the Point of Care Technologies Research Network established by the United States National Institute of Biomedical Imaging and Bioengineering accelerates POC diagnostics or testing product development. Favorable regulations, such as the Clinical Laboratory Improvement Amendments (CLIA) guidelines, promote POC testing over other forms.

- Presently, US POC testing caches comprise chemistry/electrolytes, pregnancy, hemoglobin, cardiac biomarkers, hematology, fecal occult blood, drugs of abuse, liver function, blood gases, and limited infectious diseases. Owing to the deficiencies with existing POC tests for cardiac biomarkers, MEDITECH's Expanse Point of Care software, the company's latest web-based mobile technology for nurses and therapists to provide the best and most efficient patient-facing care, has been implemented at King's Daughters Medical Center, aiming to eliminate infectious diseases. Depending on geographic location and potential infectious diseases, POC resources can be customized for pandemics, complex emergencies, or disasters.

- As the healthcare community scrambles for accurate, timely, and virtual strategies to improve patient care, especially amid the COVID -19 pandemic, Evoke360 not only enhances the quality of care and patient outcomes but also impacts quality and risk adjustment scores that increase profit margins and give provider organizations a competitive edge. In June 2020, DataLink Software (DataLink) pointed to the key advantages of Evoke360 and its Provider Relations Management (PRM) module, enabling providers to transition from fee-for-service to value-based care. Evoke360 serves as a point-of-care solution, aggregating data from disparate sources to accelerate preemptive patient care, closing gaps in care to treat more than the diagnosis results.

Point-of-Care (POC) Data Management Software Industry Overview

The Point-of-Care Data Management Software Market is highly competitive, owing to the presence of multiple players in the market. The market appears to be moderately fragmented, with the key players adopting strategies such as product innovation, mergers, and acquisitions, to expand their reach and stay competitive in the market. Some of the market's major players are Siemens Healthineers AG, Abbott Point of Care Inc., and Danaher Corporation, among others.

- In January 2022, Glytec and Roche struck a partnership on insulin management. This digital health collaboration combines Roche's expertise in medical devices and IT solutions with Glytec's FDA-cleared insulin dosing decision support software, Glucommander, to address the challenges with inpatient blood sugar management at the hospital bedside, designed to improve patient safety and care by empowering point-of-care clinicians to collect and take immediate action on glycaemic management data.

- In February 2022, Butterfly Network, Inc., a digital health company transforming care with handheld, whole-body ultrasound, and Ambra Health, an Intelerad Company and maker of a leading cloud-based medical image management suite, announced a partnership to accelerate and simplify interoperability for bedside imaging data. This partnership strengthens Butterfly Blueprint's enterprise platform's scalability and will enhance access and shareability of valuable ultrasound information across hospitals and health systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovation in Flexible Connectivity and Software Interface Solutions

- 4.2.2 Rise in Healthcare Infrastructure Budgets

- 4.2.3 Government Initiatives for Promoting the Deployment of POC Testing

- 4.3 Market Challenges

- 4.3.1 High Deployment Costs and Operational Challenges

- 4.4 Market Opportunities

- 4.4.1 Rapid Testing and Decentralized Healthcare

- 4.5 Porters Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Current Regulatory Landscape (Guidelines of Clinical Laboratory Improvement Amendments CLIA) and Connectivity Standards (POCT1-A2))

- 4.7 Emerging Applications in Point-of-Care Testing (Sepsis Biomarkers, Endocrine Testing, Stroke Markers, etc.)

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Hospitals/Critical Care Units

- 6.1.2 Diagnostic Centers

- 6.1.3 Clinics/Outpatient

- 6.2 By Application

- 6.2.1 Infectious Disease Devices

- 6.2.2 Glucose Monitoring

- 6.2.3 Coagulation Monitoring

- 6.2.4 Urinalysis

- 6.2.5 Cardiometabolic Monitoring

- 6.2.6 Cancer Markers

- 6.2.7 Hematology

- 6.2.8 Other POC Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 Japan

- 6.3.3.3 China

- 6.3.3.4 Singapore

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens Healthineers AG + (Conworx)

- 7.1.2 Abbott Point of Care Inc. + (Alere)

- 7.1.3 Danaher Company (HemoCue and Radiometer Medical ApS)

- 7.1.4 Roche Diagnostics Corporation

- 7.1.5 TELCOR Inc.

- 7.1.6 Orchard Software Corporation

- 7.1.7 Randox Laboratories Ltd

- 7.1.8 Thermo Fisher Scientific Inc.