|

市場調查報告書

商品編碼

1631601

歐洲光電:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Optoelectronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

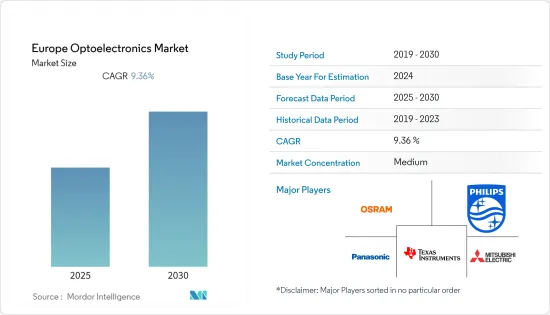

預計歐洲光電市場預測期內複合年成長率為9.36%

主要亮點

- 地方政府對啟動子發現計畫的更多參與增強了許多半導體導向產業,這些產業得到了高度技術互聯環境的支持。例如,德國政府承諾在2020年將研究公司數量增加到2萬家,創新企業數量增加到14萬家。

- 根據德國貿易投資署統計,德國電子電氣相關企業生產超過10萬種電子產品和系統,包括自動化系統、電子醫療設備、汽車電子和微電子元件等。

- 在汽車行業,OEM專注於開發下一代電動和自動駕駛汽車。英國正在鼓勵採用自動駕駛汽車。該計劃旨在創建一個先進的環境來測試自動駕駛和聯網汽車,包括緊急車輛警告(EVW)、道路作業警告(RWW)、緊急電子煞車燈(EEBL)、交通狀況警告(TCW)等技術。

- 此外,英國是歐盟(EU)外國直接投資的主要目的地,在高科技領域的佔有率不斷增加。設計和製造方面的豐富專業知識,加上策略性和商業友善環境,意味著英國照明產業透過聯合研究和直接投資為企業提供了重要的投資機會。

- COVID-19 的爆發影響了世界各地汽車產業的生產設施。 COVID-19在歐洲國家的疫情影響了該地區的汽車產業。西班牙、俄羅斯、英國、義大利、法國和德國是繼美國之後受影響最嚴重的國家,前所未有的國家封鎖給該地區境況不佳的汽車產業帶來了新的壓力。

歐洲光電市場趨勢

汽車產業推動市場成長

- 由於全球經濟狀況改善、生活方式改變、中階不斷壯大以及消費者可支配收入增加,全球對豪華和超豪華汽車的需求不斷增加。在汽車中,光電裝置可用於乘員檢測、駕駛員疲勞檢測、夜視、光學防盜系統和遠端無鑰匙進入。

- 光電技術擴大應用於汽車中,以實現照明和煞車等車輛功能的自動化。此外,光電技術擴大被納入車輛安全系統中,例如使用主動或被動紅外線系統的夜視系統,以提高駕駛人在前燈無法到達的區域或危險駕駛情況下的視野。

- 汽車購買者最關心的是乘客和車輛的安全。世界各地監管機構的目標是讓汽車更安全。隨著大眾對汽車安全意識的不斷增強以及政府對安全功能的要求,光電技術作為汽車的標準配備提供了各種安全功能。 BMW的主動式轉向頭燈、梅賽德斯的多光束 LED 頭燈是汽車行業中最好的頭燈之一,可改善道路上的顯示和能見度,使車輛更安全、乘客更舒適。

- 汽車光電市場預計將因 LED 的採用而受益匪淺。 LED 用於煞車燈、水坑燈、危險燈、警告燈等。全球汽車製造業的成長是推動全球汽車光電市場向前發展的原因之一。此外,巴西、中國和印度等新興市場對豪華車的需求不斷成長預計將推動市場擴張。

- 根據世界半導體貿易統計數據,2020年歐洲半導體銷售收益達375.2億美元,預計2021年將增加至454.5億美元。

LED產業帶動市場成長

- 歐洲是LED需求最有利的地區之一,預計在預測期內將維持其需求。這反映了德國、義大利和法國等國家嚴格的政府法規,例如能源績效合約(EPC)。

- 工業研究津貼是德國在各個領域生產如此多先進和尖端產品的主要原因之一。德國政府的巨額支出是推動德國研究文化的標誌之一。然而,在尋找新方法、產品和應用方面,德國私營部門是主要投資者。研究文化以及政府補助和資金也推動了對光電子研究的需求。巴伐利亞擁有超過 500 家光學技術領域的公司,因此成為德國第一大位置。

- 在德國,歐盟 (EU) 照明相關法規的變化正在推動住宅和商業應用對 LED 照明解決方案的需求。 2018年,歐盟(EU)宣布禁止使用低效率燈、鹵素燈和燈泡。

- 自2011年以來,德國光電產業每年持續成長。德國約有20家中型本土製造業生產光電元件和產品。這些公司服務於國內外各種行業,包括精密工具、光學檢測系統、雷射技術、測量和控制技術、航太和醫療技術。

- Ficosa 子公司 Adasens Automotive、Agfa-Gevaert HealthCare、Sill Optik、Osram Opto Semiconductors、Menlo Systems 和 Toptica Photonics 等主要企業的總部均位於德國。光學技術的重點地區是慕尼黑-奧格斯堡、埃爾蘭根-紐倫堡和雷根斯堡。

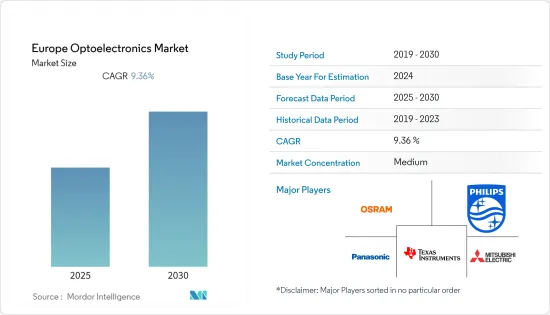

歐洲光電產業概況

隨著 Osram Licht AG、Koninklijke Philips NV、 夥伴關係 Corporation、Texas Instruments Inc. 和 Stanley Electric Co. 的出現,光電子市場上的競爭公司之間的競爭持續加劇。在發展並顯著提高市場佔有率。

- 2021 年 7 月 - Volpi 是美國和瑞士開展業務的主要企業之一,與荷蘭 TOPIC Embedded Systems 合作,擴大其光電測量解決方案組合,並進一步推動其數位化舉措。產品開發已經開始,Volpi 和 TOPIC 正在積極就客戶合約進行合作。

- 2021 年 2 月 - 東芝電子歐洲有限公司宣布其廣泛的光電產品組合中新增產品。 TLP241 Bisa 高電流光繼電器適用於可程式邏輯控制器 (PLC) 和 I/O 介面等工業設備,以及 HVAC(暖氣、通風和空調)等大樓自動化系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19市場評估

第5章市場動態

- 市場促進因素

- 對智慧家用電子電器和下一代技術的需求不斷成長

- 增加工業技術的使用

- 市場限制因素

- 製造加工成本高

第6章 市場細分

- 依零件類型

- LED

- 雷射二極體

- 影像感測器

- 光耦合器

- 太陽能電池

- 其他零件類型

- 按最終用戶產業

- 車

- 航太/國防

- 家用電子電器

- 資訊科技

- 醫療保健

- 住宅/商業

- 工業

- 其他

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 其他國家

第7章 競爭格局

- 公司簡介

- Osram Licht AG

- Koninklijke Philips NV

- Panasonic Corporation

- Texas Instruments Inc.

- Stanley Electric Co.

- Mitsubishi Electric

- Infineon Technologies AG

- On Semiconductor

- Maxim Integrated

- Analog Devices GmbH

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 72188

The Europe Optoelectronics Market is expected to register a CAGR of 9.36% during the forecast period.

Key Highlights

- The increasing involvement of regional government in promoter search programs has enhanced many semiconductors-oriented industries, and it is supported by high technology connectivity environment. For instance, the German Government is committed to increasing the number of research companies to 20,000 and innovative companies to 140,000 by the year 2020.

- According to Germany Trade & Invest, Germany's electronics, and electrical companies manufacture more than 100 thousand different electronic products and systems, ranging from automation systems, electronic medical equipment, automotive electronics, and microelectronic components.

- In the automotive industry, OEMs have been focusing on developing the next generation of electrified, autonomous vehicles. The United Kingdom is encouraging the adoption of autonomous cars. The UK government also funded GBP 100 million to the UK Connected Intelligence Transport Environment(UKCITE), a project that aims to create an advanced environment for testing autonomous and connected vehicles, which include technologies, such as emergency vehicle warning(EVW), road works warning(RWW), emergency electronic brake light(EEBL), and traffic condition warning(TCW).

- Furthermore, the United Kingdom is the leading destination for foreign direct investment into the European Union, with a growing proportion coming in high technology sectors. With the significant expertise in design and manufacturing, combined with policy and a business-friendly environment, the United Kingdom lighting industry offer significant investment opportunities to businesses through collaboration and direct investment.

- The outbreak of COVID-19 affected the production facilities of automotive industries across the globe. COVID-19 outbreak in European countries affected the automobile industry in the region. Spain, Russia,United Kingdom, Italy, France, and Germany is the worst-affected country after the UnitedStates, and the unprecedented lockdown of the country has heaped fresh pressure on thee region's ailing car sector.

Europe Optoelectronics Market Trends

Automobile Industry to Drive the Market Growth

- The improving global economic conditions, changing lifestyle, rising middle class, and increase in the disposable income of the consumers have increased the demands of sales of luxury and ultra-luxury cars across the globe. In a vehicle, optoelectronics devices can be used for occupant detection, drowsy driver detection, night vision, optical immobilizer, and remote keyless entry.

- Optoelectronics are increasingly being used in automobiles to automate vehicle functions such as lighting and brakes. Furthermore, optoelectronic is gradually being included in vehicle safety systems such as night vision systems, which use active or passive infrared systems to improve the distance a driver can see beyond the reach of headlights or in hazardous driving circumstances.

- Vehicle buyers' primary concern is the safety of the passengers and the vehicle. The goal of regulatory authorities all around the world is to increase automobile safety. Because of raising public awareness of vehicle safety and government demands for safety features, Optoelectronics is now offering a variety of safety features as standard equipment in automobiles. BMW Adaptive Headlights, Mercedes Multibeam LED headlights are one of the best headlights available in the automobile industry, this improves the display and visibility on road, thus making the vehicle more secure and safer for the passengers.

- The Automotive Optoelectronic market is expected to benefit considerably from the adoption of LEDs. They're utilised for things like brake lights, puddle lights, hazard lights, and warning lights, among other things. Growing automotive manufacturing around the world is one of the reasons driving the global Automotive Optoelectronic market forward. Furthermore, rising demand for luxury cars in developing nations such as Brazil, China, and India would propel market expansion.

- According to the world semiconductor Trade Statistics In 2020, revenue from the sale of semiconductors in Europe reached 37.52 billion U.S. dollars, with forecasts projecting it will rise to 45.45 billion U.S. dollars in 2021.

LED Industry to drive the Market Growth

- Europe is one of the most lucrative regions for the LED demand and is expected to maintain the demand over the forecast period. This is a reflection of stringent government regulations such as energy performance contracting(EPC) in countries such as Germany, Italy, and France, among others.

- Industrial Research funding is one of the major reasons why Germany has so many advanced and cutting edge products let it be any field. The massive spending by the German government is one of the prominent features that fuels up the research culture in Germany. However, the German private sector is the main investor when it comes to looking for new methods, products, and applications. The Research culture and subsidies and funds by the government fuel the Optoelectronics Research needs also. Therefore, with more than 500 companies in the field of optical technologies, Bavaria is the number one location in Germany.

- Germany has been experiencing growth in demand for LED lighting solutions both for residential and commercial applications due to change in European Union regulations related to lighting. In 2018, European Union banned the use of less efficient light, halogen light bulbs, as a part of the final stage of the European Union energy rules directive (EC244/2009) with the aim of improving energy efficiency and cutting the carbon footprint across the region.

- Since 2011, Germany's photonics industry has been growing every year. there are around 20 medium sized, local manufacturing company in Germany that are manufacturing Optoelectronics components and products. They cater a variety of industries such as precision tools, optical inspection systems, laser technology, measurement and control technology, aerospace, medical technology, etc. both locally and International.

- Key international players such as Ficosa subsidiary Adasens Automotive, Agfa-Gevaert HealthCare, Sill Optik, Osram Opto Semiconductors, Menlo Systems and Toptica Photonics all have sites in Germany. The regional focus areas for optical technologies are Munich-Augsburg, Erlangen-Nuremberg and Regensburg.

Europe Optoelectronics Industry Overview

The competitive rivalry in the optoelectronics market is high owing to the presence of major players like Osram Licht AG, Koninklijke Philips NV, Panasonic Corporation, Texas Instruments Inc., Stanley Electric Co., and many more. Strategic partnerships and mergers and acquisitions have allowed the companies to grow and gain a substantial amount of market share and maintaining a strong foothold in the market.

- July 2021- Volpi, one of the prominent players in optoelectronics with operations in the United States and Switzerland, has partnered with Netherlands-based TOPIC Embedded Systems to expand its portfolio of optoelectronic measurement solutions and further advance its digital initiatives. Product development is already underway and Volpi and TOPIC are actively collaborating on the client engagements.

- February 2021 - Toshiba Electronics Europe GmbH announced a new addition to its expansive optoelectronics portfolio. The TLP241 Bisahigh-current Photorelay, targeted at use in industrial equipment, such as programmable logic controllers(PLCs) and I/O interfaces, as well as building automation systems like HVAC(heating,ventilation,andairconditioning).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Smart Consumer Electronics and Next-generation Technologies

- 5.1.2 Increasing Industrial Applications of the Technology

- 5.2 Market Restraints

- 5.2.1 High Manufacturing and Fabricating Costs

6 MARKET SEGMENTATION

- 6.1 By Component type

- 6.1.1 LED

- 6.1.2 Laser Diode

- 6.1.3 Image Sensors

- 6.1.4 Optocouplers

- 6.1.5 Photovoltaic Cells

- 6.1.6 Other Component Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Consumer Electronics

- 6.2.4 Information Technology

- 6.2.5 Healthcare

- 6.2.6 Residential and Commercial

- 6.2.7 Industrial

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Osram Licht AG

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Panasonic Corporation

- 7.1.4 Texas Instruments Inc.

- 7.1.5 Stanley Electric Co.

- 7.1.6 Mitsubishi Electric

- 7.1.7 Infineon Technologies AG

- 7.1.8 On Semiconductor

- 7.1.9 Maxim Integrated

- 7.1.10 Analog Devices GmbH

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219