|

市場調查報告書

商品編碼

1631616

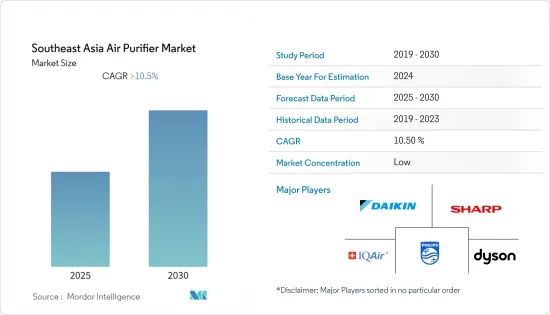

東南亞空氣清淨機市場:佔有率分析、產業趨勢/統計、成長預測(2025-2030)Southeast Asia Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計東南亞空氣清淨機市場在預測期內將維持超過10.5%的複合年成長率。

COVID-19 的爆發對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 空氣傳播疾病的增加和消費者健康意識的增強等因素正在推動市場的發展。工業造成的空氣污染不斷出現,不僅對環境而且對個人健康構成重大威脅。近年來,由於空氣品質惡化和對健康問題的日益擔憂,對空氣清淨機的需求不斷增加。

- 儘管技術不斷發展,但由於安裝和維護成本高昂,空氣清淨機在低度開發經濟體和新興經濟體中仍被視為奢侈品,特別是在商業和住宅領域。預計這將阻礙預測期內的市場成長。

- 空氣清淨機系統發展的技術進步和升級預計將在未來幾年為東南亞空氣清淨機市場帶來巨大機會。

- 由於人們擴大採用空氣淨化器,空氣清淨機的銷量成長了數倍,預計印尼將在預測期內主導市場。

東南亞空氣清淨機市場趨勢

高效顆粒空氣(HEPA)預計主導市場

- 機械空氣過濾器(例如 HEPA 過濾器)透過將顆粒捕獲在過濾材料中來去除顆粒。捕捉空氣中的大顆粒,例如灰塵、花粉、黴菌孢子、動物皮屑以及含有塵蟎和蟑螂過敏原的顆粒。

- HEPA 過濾器是一種膨脹表面過濾器,具有較大的表面積,能夠有效去除空氣中的顆粒,無論其大小如何。此外,這種類型的空氣過濾器比折疊式濾網更有效地去除可吸入顆粒。

- HEPA 空氣清淨機所需的兩個最常見的標準包括去除大於 0.3微米顆粒的能力,即 99.95%(歐洲標準)或 99.97%(ASME 標準)。

- 此外,HEPA過濾器在工業和商業空間的應用導致東南亞國家對相同產品的高需求。具有先進整合技術、設計和新概念的新型 HEPA 過濾器的推出可能會增加對相同產品的需求。空氣污染的加劇和氣候條件的惡化可能會刺激工作需求,並在未來幾年推動 HEPA 濾網市場的發展。

- 在過去的十年中,HEPA 過濾器已被證明可以在各種醫療設施和生命科學應用中減少空氣中的顆粒和生物體(例如病毒和細菌)的傳播。此外,許多專業工程協會建議在醫院、感染控制診所和其他醫療機構中使用 HEPA 過濾器,以去除微生物和其他危險顆粒。

- 因此,基於上述因素,高效顆粒空氣(HEPA)技術預計將在預測期內主導市場。

預計印尼將主導市場

- 截至2021年,印尼在全球污染最嚴重的國家中排名第17位,人口加權平均PM2.5濃度為34.3微克/立方公尺。根據《世界空氣品質報告》,印尼是 2021 年東南亞污染最嚴重的國家。

- 此外,截至2021年,泗水、萬隆和雅加達是該國污染最嚴重的三個城市,其中雅加達的年平均PM2.5濃度最高(PM2.5濃度39.2μg/m3)。

- 季節性農業刀耕火種、季節性森林火災、快速城市發展、生活垃圾露天焚燒以及對煤炭能源的依賴是印尼顆粒物污染的主要原因。

- 儘管 COVID-19 大流行改善了全球空氣質量,但印度尼西亞雅加達等城市的 PM2.5 水平仍然居高不下,而我所在城市附近運作的燃煤發電廠更是加劇了這種情況。此外,印尼計劃在雅加達建造更多燃煤發電廠,這可能會導致進一步的空氣污染和空氣清淨機的廣泛使用。

- 因此,由於上述因素,印尼預計將在預測期內主導東南亞地區的空氣清淨機市場。

東南亞空氣清淨機產業概況

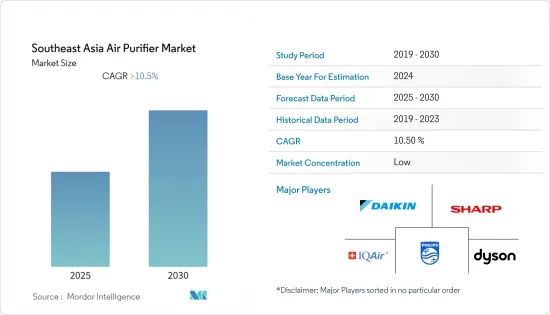

東南亞空氣清淨機市場區隔。主要參與企業包括(排名不分先後)Daikin Industries, Ltd.、Sharp Corporation、Koninklijke Philips NV、IQAir 和 Dyson Ltd.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 過濾技術

- 高效能顆粒空氣 (HEPA)

- 其他過濾技術(靜電除塵設備(ESP)、離子產生器、臭氧產生器等)

- 類型

- 獨立的

- 感應

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 新加坡

- 其他東南亞地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Daikin Industries, Ltd.

- Sharp Corporation

- LG Electronics Inc.

- Unilever PLC

- Dyson Ltd

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co., Ltd.

- WINIX Inc.

- Xiaomi Corp.

- Amway(Malaysia)Holdings Berhad

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 72357

The Southeast Asia Air Purifier Market is expected to register a CAGR of greater than 10.5% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing airborne diseases and growing health consciousness among consumers are driving the market. Air pollution from industries is constantly emerging as a big threat to the health of individuals as well as the environment. Due to deteriorating air quality and rising concerns about health issues, the demand for air purifiers has increased in recent years.

- Despite the various technological developments, air purifiers have been perceived as a luxury item in both underdeveloped and emerging economies, particularly in the commercial and residential segments, owing to the high installation and maintenance costs. This, in turn, is expected to hinder the growth of the market studied during the forecast period.

- Technological advancements and upgrades in developing air purifier systems are expected to create immense opportunities for the Southeast Asian air purifier market in the coming years.

- With sales of air purifiers increasing by several folds due to the public's increasing adoption of air purifiers, Indonesia is expected to dominate the market during the forecast period.

Southeast Asia Air Purifier Market Trends

High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market

- Mechanical air filters, such as HEPA filters, remove particles by capturing them on filter materials. It captures large airborne particles, such as dust, pollen, mold spores, animal dander, and particles containing dust mite and cockroach allergens.

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these types of air filters remove respirable particles more efficiently than pleated filters.

- The two most common standards required for HEPA air purifiers include the capability to remove particles, i.e., 99.95% (European Standard) or 99.97% (ASME Standard), which have a size greater than or equal to 0.3 micrometers.

- Furthermore, HEPA filter applications in industrial and commercial spaces have led to high demand for the product across Southeast Asian countries. The advent of newer HEPA filters with advanced integrated technologies, designs, and new concepts is likely to increase demand for the product. The rising air pollution and worsening climatic conditions fuel the need for the work, which may boost the HEPA filter market in the coming years.

- For the last 10 years, HEPA filters have been proven across a wide range of healthcare facilities and life science applications to control the spread of airborne particles and organisms, such as viruses and bacteria. Moreover, many professional engineering organizations recommend HEPA filters in hospitals, infection control clinics, and other healthcare facilities to eliminate microbes and other dangerous particles.

- Therefore, based on the above-mentioned factors, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Indonesia Expected to Dominate the Market

- As of 2021, Indonesia stood in the seventeenth position in terms of the most polluted country globally, with an average of 34.3 µg/m3 PM2.5 concentration weighted by population. According to the World Air Quality Report, in 2021, Indonesia was the most polluted country in Southeast Asia.

- Moreover, as of 2021, Surabaya, Bandung, and Jakarta were the three most polluted cities in the country, with the highest annual average of PM2.5 concentrations coming from Jakarta (39.2 µg/m3 PM2.5 concentration).

- Seasonal agricultural burning practices, seasonal forest fires, rapid urban development, open burning of household waste, and reliance on coal-based energy are the primary sources of particulate pollution in Indonesia.

- Although the COVID-19 pandemic led to an improvement in global air quality, cities such as Jakarta, Indonesia, consistently recorded high PM2.5 levels, which were exacerbated by coal-fired plants working in the vicinity of the city. Moreover, Indonesia is set to build more coal-fired power plants in Jakarta, which may lead to more air pollution and increase the adoption of air purifiers.

- Therefore, based on the above-mentioned factors, Indonesia is expected to dominate the air purifier market in the Southeast Asian region during the forecast period.

Southeast Asia Air Purifier Industry Overview

The Southeast Asia air purifier market is fragmented. Some of the major players include (in no particular order) Daikin Industries, Ltd., Sharp Corporation, Koninklijke Philips N.V., IQAir, and Dyson Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Filtration Technologies (Electrostatic Precipitators (ESPs), Ionizers and Ozone Generators, etc.)

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Thailand

- 5.4.4 Vietnam

- 5.4.5 Philippines

- 5.4.6 Singapore

- 5.4.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries, Ltd.

- 6.3.2 Sharp Corporation

- 6.3.3 LG Electronics Inc.

- 6.3.4 Unilever PLC

- 6.3.5 Dyson Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Koninklijke Philips N.V.

- 6.3.8 IQAir

- 6.3.9 Samsung Electronics Co., Ltd.

- 6.3.10 WINIX Inc.

- 6.3.11 Xiaomi Corp.

- 6.3.12 Amway (Malaysia) Holdings Berhad

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219