|

市場調查報告書

商品編碼

1641877

空氣清淨機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

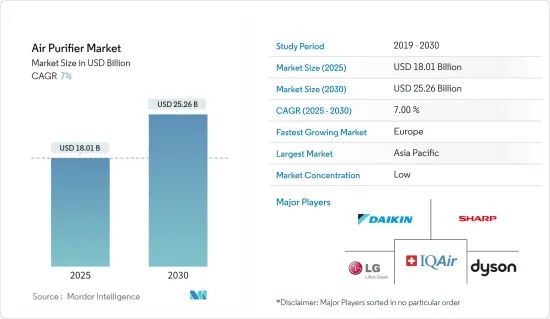

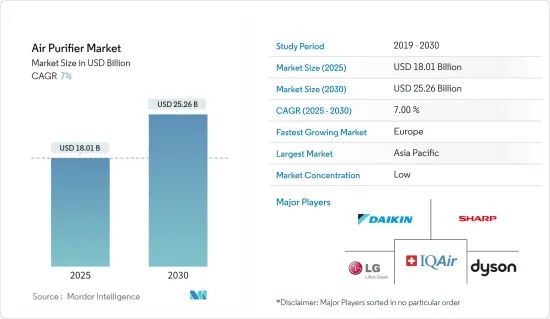

空氣清淨機市場規模預計在 2025 年為 180.1 億美元,預計到 2030 年將達到 252.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7%。

關鍵亮點

- 空氣傳播疾病的增加、工業活動排放的增加以及消費者健康意識的增強等因素正在推動市場的發展。

- 儘管技術取得了各種進展,但空氣清淨機由於其高昂的安裝和維護成本,尤其是在商業和住宅領域,無論是在低度開發經濟體還是新興經濟體,仍然是一種奢侈品。公認的。反過來,這預計會阻礙市場成長。

- 空氣污染是人口稠密的亞太地區面臨的嚴峻挑戰,損害了環境、公眾健康和農業產量。不過這些問題很可能會為未來的空氣清淨機市場創造一些機會。

- 預計預測期內亞太地區將佔據市場主導地位,大部分需求預計來自孟加拉、印度和越南等國家。

空氣清淨機市場趨勢

高效微粒空氣 (HEPA) 市場可望佔據主導地位

- 機械空氣過濾器(例如 HEPA 過濾器)透過將顆粒捕獲在過濾材料中來去除顆粒。它可以捕獲較大的空氣傳播顆粒,如灰塵、花粉、黴菌孢子、動物皮屑以及含有塵蟎和蟑螂過敏原的顆粒。

- HEPA 過濾器是一種擴展表面過濾器,具有較大的表面積,能夠有效去除各種尺寸的空氣傳播顆粒。此外,這種空氣過濾器比褶折疊式濾網能更有效地去除可吸入顆粒。 HEPA 空氣清淨機所需的兩個最常見標準包括其去除 0.3微米或更大顆粒的能力:99.95%(歐洲標準)或 99.97%(ASME 標準)。

- 在過去的十年中,HEPA 過濾器已被證明可以減少各種醫療設施和生命科學應用中空氣中的顆粒物和病毒、細菌等生物體的傳播。許多專業工程協會建議醫院、感染控制診所和其他醫療機構使用 HEPA 過濾器來去除微生物和其他危險顆粒。

- 此外,近年來世界各地的污染水平急劇上升。因此,從事該行業的公司正專注於開發和推出創新產品。

- 例如,2023 年 10 月,空氣清淨機製造商 ISO-Aire 推出了一款名為 RSF500 的新型 HEPA 清淨機。此型號每分鐘可輸送 500 立方英尺,適用於中小型辦公室。它還列出了三級空氣過濾保護,以去除有害污染物和空氣中的細菌。類似這樣的 HEPA 空氣清淨機的變體將來可能會變得更加普遍。

- 根據世界空氣品質報告,2023 年孟加拉的顆粒物 (PM) 2.5 濃度最高,為每立方公尺 79.9 微克 (μg/m3),其次是巴基斯坦,分別為 73.7μg/m3、54.4μg/m3 和 66.7 μg/ m3。

- 因此,預計這些因素將導致高效微粒空氣(HEPA)技術在預測期內佔據市場主導地位。

亞太地區可望主導市場

- 亞太地區正在推動空氣清淨機市場的需求。印度、孟加拉、塔吉克、印尼、越南和中國等開發中國家由於工業化活動的活性化和人口的成長,正經歷工業成長的高峰。預計這將在預測期內推動需求。

- 根據世界空氣品質報告,PM2.5平均濃度最高的國家是印度,為92.7μg/m3,其次是孟加拉(80.2μg/m3)、塔吉克(46μg/m3)、中國(34.1μg/m3)和印尼(43.8)。

- 另一方面,在印度,空氣清淨機市場主要局限於大城市。不過,預計在預測期內將會成長。 2023年11月,Nirvana推出了印度首款以微靜電除塵設備(MESP)技術為基礎的空氣消毒清淨機。據信,MESP 技術在印度大氣條件下表現最佳,可防 PM2.5、灰塵、煙霧、病毒、細菌和花粉。

- 越南的空氣清淨機市場正在迅速擴張,主要原因是隨著消費者對細塵的關注度不斷提高,需求激增。 2024年2月,空氣清淨機製造商Revowa推出了一款名為Revowa Core 200S的新產品,適用於住宅和商務用。 Revowat Core 200S 配備三層過濾器,由基本尼龍芯、H13 True HEPA 芯和內部活性碳芯組成。去除99.97% 小於 0.3 微米的空氣懸浮顆粒。這些產品可能會保護人們免受越南有害廢氣排放的影響。

- 因此,預計這些因素將導致亞太地區在預測期內佔據空氣清淨機市場的主導地位。

空氣清淨機產業概況

空氣清淨機市場是細分的。該市場的主要企業(不分先後順序)包括大金工業株式會社、夏普株式會社、IQAir、LG 電子公司和戴森有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 過濾技術

- 高效微粒空氣 (HEPA)

- 其他過濾技術(靜電除塵設備(ESP)、離子產生器、臭氧產生器等)

- 類型

- 獨立的

- 導入

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Daikin Industries Ltd

- Sharp Corporation

- Resideo Technologies Inc.

- LG Electronics Inc.

- Unilever PLC

- Dyson Ltd

- Whirlpool Corporation

- AllerAir Industries Inc.

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co. Ltd

- Winix Inc.

- Xiaomi Corp.

- 市場排名分析

第7章 市場潛力及未來趨勢

簡介目錄

Product Code: 61329

The Air Purifier Market size is estimated at USD 18.01 billion in 2025, and is expected to reach USD 25.26 billion by 2030, at a CAGR of 7% during the forecast period (2025-2030).

Key Highlights

- Factors such as increasing airborne diseases, rising emissions due to industrial activities, and growing consumer health consciousness are driving the market.

- On the other hand, despite the various technological developments, air purifiers have been perceived as a luxury item in both underdeveloped and emerging economies, particularly in the commercial and residential segments, owing to the high installation and maintenance costs. This, in turn, is expected to hinder the market's growth.

- Growing air pollution in the densely populated Asia-Pacific region has emerged as a significant challenge, damaging the environment, public health, and agricultural crop yields. However, such problems will likely create several future opportunities for the air purifier market.

- Asia-Pacific is expected to dominate the market during the forecast period, with most of the demand coming from countries like Bangladesh, India, and Vietnam.

Air Purifier Market Trends

The High-efficiency Particulate Air (HEPA) Segment is Expected to Dominate the Market

- Mechanical air filters, such as HEPA filters, remove particles by capturing them on filter materials. They capture large airborne particles, such as dust, pollen, mold spores, animal dander, and particles containing dust mite and cockroach allergens.

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these air filters remove respirable particles more efficiently than pleated filters. The two most common standards required for HEPA air purifiers include the capability to remove particles, i.e., 99.95% (European Standard) or 99.97% (ASME Standard), which have a size greater than or equal to 0.3 micrometers.

- For the last decade, HEPA filters have been proven to control the spread of airborne particles and organisms, such as viruses and bacteria, across various healthcare facilities and life sciences applications. Many professional engineering organizations recommend HEPA filters in hospitals, infection control clinics, and other healthcare facilities to eliminate microbes and other dangerous particles.

- Further, pollution levels around the globe have increased dramatically in recent years. Hence, companies operating in the industry have focused on developing and introducing innovative products.

- For instance, in October 2023, the air purifier manufacturing company ISO-Aire launched its new HEPA purifier variant called RSF500. The model delivers 500 cubic feet per minute and is feasible for small to medium-sized offices. It also offers three levels of air filtration protection to eliminate harmful pollutants and airborne germs. Such HEPA air purifier variants are likely to get traction in the future.

- As per the World Air Quality Report, the highest concentration of particulate matter (PM) 2.5 in 2023 was noted in Bangladesh at 79.9 micrograms per cubic meter (µg/m3), followed by Pakistan at 73.7 µg/m3, 54.4 at µg/m3, Tajikistan at 49 µg/m3 and Burkina Faso at 46.6 µg/m3.

- Therefore, owing to such factors, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has been a catalyst for demand in the air purifier market. In developing nations such as India, Bangladesh, Tajikistan, Indonesia, Vietnam, and China, industrial growth is at its peak owing to increased industrialization activities and population growth. This is expected to drive demand during the forecast period.

- As per the World Air Quality Report, the highest average PM 2.5 concentration in India stood at 92.7 µg/m3, Bangladesh at 80.2 µg/m3, Tajikistan at 46 at µg/m3, China at 34.1 µg/m3, and Indonesia at 43.8 µg/m3.

- On the other hand, in India, the market for air purifiers is mainly confined to metropolises. However, it is expected to grow during the forecast period. In November 2023, Nirvana rolled out India's first-ever Micro-electrostatic precipitator (MESP) technology-based air sterilizing purifier. The MESP technology is deemed to perform best in Indian atmospheric conditions and protect against PM 2.5, dust, smoke, viruses, bacteria, and pollen.

- The air purifier market in Vietnam is expanding rapidly, mainly due to surging demand as consumers become more concerned about fine dust. In February 2024, the air purifier company Levoit launched a new one called Levoit Core 200S for residential and commercial use. Levoit Core 200S has a 3-layer filter with an essential Nylon core, an H13 True HEPA core, and an inner activated carbon core. It filters up to 99.97% of airborne particles with a size of 0.3 microns. Such products are likely to protect people from harmful emission levels in Vietnam.

- Therefore, such factors are expected to make Asia-Pacific the dominant air purifier market during the forecast period.

Air Purifier Industry Overview

The air purifier market is fragmented. Some key players in this market (not in a particular order) include Daikin Industries Ltd, Sharp Corporation, IQAir, LG Electronics Inc., and Dyson Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Filtration Technologies (Electrostatic Precipitators (ESPs), Ionizers and Ozone Generators, etc.)

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 NORDIC

- 5.4.2.5 Russia

- 5.4.2.6 Turkey

- 5.4.2.7 Italy

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Malaysia

- 5.4.3.5 Thailand

- 5.4.3.6 Indonesia

- 5.4.3.7 Vietnam

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Qatar

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries Ltd

- 6.3.2 Sharp Corporation

- 6.3.3 Resideo Technologies Inc.

- 6.3.4 LG Electronics Inc.

- 6.3.5 Unilever PLC

- 6.3.6 Dyson Ltd

- 6.3.7 Whirlpool Corporation

- 6.3.8 AllerAir Industries Inc.

- 6.3.9 Panasonic Corporation

- 6.3.10 Koninklijke Philips NV

- 6.3.11 IQAir

- 6.3.12 Samsung Electronics Co. Ltd

- 6.3.13 Winix Inc.

- 6.3.14 Xiaomi Corp.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES and FUTURE TRENDS

02-2729-4219

+886-2-2729-4219