|

市場調查報告書

商品編碼

1631625

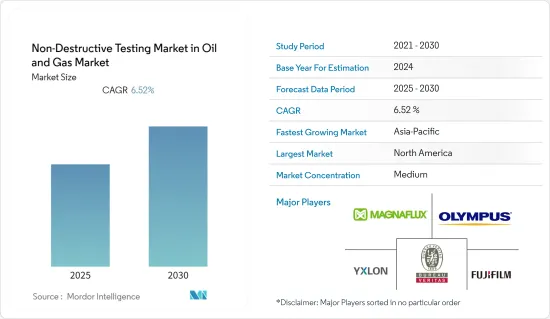

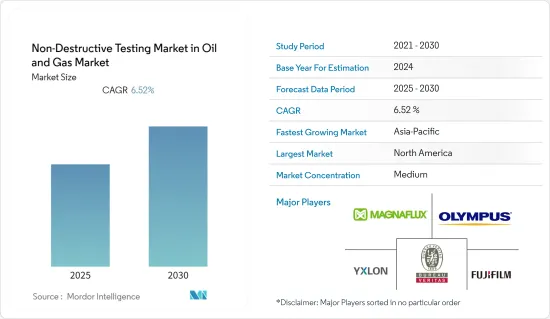

石油和天然氣無損檢測市場:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Non-Destructive Testing in Oil and Gas Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

石油和天然氣無損檢測市場預計在預測期內複合年成長率為6.52%。

主要亮點

- 據英國無損檢測協會稱,英國工廠和現場每天都會進行超過 25,000 次測試,以發現各種產品、工廠和結構中的缺陷和損壞。據信,全球有超過 12 萬名檢查員在工作。

- 無損檢測市場是由機械日益複雜、對產品精確使用規範的需求、嚴格執行政府法規以保護工人安全、需要更嚴格的品管等推動的。

- 由於過去發生的精油洩漏、管線爆炸和煉油廠爆炸事件,世界各國政府加強了有關無損檢測的安全法規,這推動了市場的成長。

- 超音波檢測預計將顯著成長。它使用低頻(20kHz 至 100kHz)廣播來檢測和識別材料屬性的變化,通常表示組件的機械完整性已受到損害。它經常用於檢測水下和埋地管道的腐蝕。

- COVID-19 大流行的爆發對全球幾乎所有行業(包括汽車、建築、航空和製造業)來說都是不利且意想不到的發展。作為預防措施,世界各地許多政府都採取了封鎖措施,以阻止冠狀病毒的傳播及其負面影響。

- 全球供應鏈中斷和工業生產力下降對全球經濟造成壓力。病毒的突然爆發也擾亂了企業的生產製造能力。

石油和天然氣無損檢測市場趨勢

無人機在市場上的使用越來越多

- 近年來,配備攝影機的無人機已成為無損檢測中收集視覺資料的另一種常用工具。由於技術限制,無人機只能在短時間內為檢查人員提供補充視覺資料。儘管如此,無人機並不能取代檢查人員親自收集視覺資料。然而,無人機技術的改進使得檢查人員可以使用無人機作為 RVI 工具,在某些情況下無需手動收集視覺資料。

- 無人機無需檢查員進入危險區域收集視覺資料,從而提高職場安全性。對於煉油廠、管道和石油儲備等資產的戶外檢查,無人機可以收集視覺資料,減少人們在塔和線路上花費的時間。

- 對於壓力容器和鍋爐等資產的室內檢查,使用 FlyAbility 的 Elios 2 等無人機收集視覺資料可以透過消除檢查員進入密閉空間的需要來顯著降低風險。

- 到目前為止,無人機在無損檢測中的主要用途是收集視覺資料。但近年來,無人機上的熱感測器使檢查人員能夠從每架無人機收集熱資料。隨著時間的推移,為無人機開發的新感測器可能會出現,支援更多無損檢測技術。

北美仍是最大市場

- 隨著美國、加拿大和墨西哥等國家石油和天然氣計劃的增加,該地區未來幾年可能會強勁成長。美國是最大的天然氣和原油生產國之一。

- 美國擁有世界上最大的技術可採頁岩氣蘊藏量和第二大緻密油蘊藏量。水力壓裂和損益平衡技術的新發展正在為陸上地區的上游石油和天然氣提供支援。這意味著無損檢測公司的需求量很大。

- 加拿大是世界領先的石油和天然氣生產國之一。石油和天然氣工業對國家經濟至關重要。油砂仍是碳氫化合物生產的重要來源,佔石油蘊藏量的90%以上。根據加拿大石油生產商協會(CAPP)預測,到2030年,該國石油產量預計將達到54億桶/日,其中油砂佔70.7%。

- 上述因素導致預測期內區域石油和天然氣市場無損檢測需求的增加。

石油和天然氣無損檢測概述

無損檢測市場競爭激烈。越來越多的法規要求各個組織強制執行壽命評估程序作為安全措施,再加上需要定期檢查以檢查設備的任何損壞並採取必要的措施,這塑造了無損檢測市場。因此,企業紛紛進入這個市場,將其視為一個巨大的機會。主要參與者包括 Magnaflux Corp.、Zetec Inc.、YXLON International Gmbh (COMET Group)、 FUJIFILM Corporation、 Olympus Corporation和 Bureau Veritas SA。近期趨勢如下:

2022 年 9 月,Waygate Technologies 與 RINA 合作。此次合作將無損檢測領域的數位專業知識和資料智慧相結合,為客戶創造卓越的利益和附加價值。此接頭解決方案有助於檢測焊接期間和焊接後的潛在缺陷,最佳化生產過程,降低返工和報廢風險,從而提高焊接接頭的品質。

2022 年 5 月,TWI 與 Tech Eurolab Ltd. 簽署了一份合作備忘錄,在各個行業和技術領域開展資助計劃和無損檢測計劃,以實現產品和流程的最高品質和安全標準。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業相關人員分析

- 市場促進因素

- 煉油廠資產運作營運的需求日益增加

- 上游產業預計將在主要市場獲得動力

- 市場挑戰

- 減產和技術純熟勞工短缺

- COVID-19 市場影響評估

- 無損檢測設備與服務業比較分析

- 市場機會

第5章市場區隔

- 按類型

- 裝置

- 服務

- 按類型

- 上游

- 中游

- 下游

- 依技術

- 超音波

- 射線照相術

- 目視檢查

- 液體液體滲透探傷劑

- 其他(磁粉探傷、渦流探傷)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 公司簡介

- Magnaflux Corp

- YXLON International Gmbh(COMET Group)

- Fujifilm Corporation

- Olympus Corporation

- Bureau Veritas SA

- GE Measurement and Control(Baker Hughes)

- Karl Storz Ndtec Gmbh

- Intertek Group PLC

- Applus Services SA

- Magnetic Analysis Corporation

- Zetec Inc

第7章 投資分析

第8章市場的未來

The Non-Destructive Testing Market in Oil and Gas Market is expected to register a CAGR of 6.52% during the forecast period.

Key Highlights

- According to the British Institute of Non-Destructive Testing, more than 25,000 inspections are done every day in factories and on-site in the UK to find flaws and damage in a wide range of products, plants, and structures. It is thought that more than 120,000 inspectors are working around the world.

- The NDT market is driven by the increasing complexity of machines, the need for accurate product usage specifications, the strict enforcement of government rules to keep workers safe, and the need for tighter quality control.

- As a result of refinery leaks, pipeline explosions, and refinery explosions in the past, governments around the world have tightened safety rules for NDT, which has helped the market grow.

- Significant growth is expected in ultrasonic testing. This is where the broadcast of low-frequency waves (20 kHz to 100 kHz) can detect and identify changes in material properties, often indicating that the mechanical integrity of the part is compromised. This is frequently used to detect corrosion in underwater or buried pipelines.

- The COVID-19 pandemic outbreak turned out to be unfavorable and unforeseen for almost all industries globally, including automotive, construction, airlines, and manufacturing. As a precaution, many governments around the world put lockdowns in place to stop the spread of the new coronavirus and its bad effects.

- The disrupted global supply chain and decreased industrial productivity strained the global economy. The companies' production and manufacturing capabilities were also disrupted due to the sudden outbreak of the virus.

Non-Destructive Testing in Oil and Gas Market Trends

The Rising Usage of Drones in the Market

- Over the last few years, camera-equipped drones have become another commonly used tool in NDTs for collecting visual data. Due to technical limitations, drones could only provide inspectors with supplementary visual data for a short time. Still, they were not a substitute for inspectors who physically collect the visual data themselves. However, as drone technology has improved, inspectors can now use the drone as an RVI tool, eliminating the need to collect visual data manually in some cases.

- Drones improve workplace safety by eliminating the need for inspectors to enter dangerous areas to collect visual data. For outdoor inspections of assets like refineries, pipelines, and oil reserves, drones can collect visual data to reduce the amount of time a person needs to be on a tower or line.

- For indoor inspection of assets such as pressure vessels and boilers, using a drone like the Elios 2 from FlyAbility to collect visual data eliminates the need for inspectors to enter confined spaces and significantly reduces the risk.

- To date, the primary use of drones in NDT has been collecting visual data. However, thermal sensors mounted on drones have allowed inspectors to collect thermal data on a drone-by-drone basis over the past few years. Over time, new sensors developed for drones may emerge to support more NDT technologies.

North America to Remain the Largest Market

- With the rise of oil and gas projects in countries such as the United States, Canada, and Mexico, the region can grow strongly over the next few years. The United States is one of the largest producers of natural gas and crude oil.

- The United States has one of the world's largest technically recoverable shale gas reserves and the second-largest tight oil reserves. New developments in hydraulic fracturing and break-even technology support upstream oil and gas in the onshore region. This means that NDT companies are in high demand.

- Canada is one of the world's largest producers of gas and oil. The oil and gas industry is vital to the country's economy. Oil sands remain a significant source of hydrocarbon production, accounting for more than 90% of total oil reserves. According to the Canadian Oil Producers Association (CAPP), the country's oil production is projected to reach 5.4 billion barrels per day in 2030, with oil sands accounting for 70.7% of the total output.

- The factors mentioned earlier contribute to the increasing demand for Non-Destructive Testing in the oil & gas market in the region during the forecast period.

Non-Destructive Testing in Oil and Gas Industry Overview

The NDT market is competitive. The increasing regulations, which make it mandatory for different organizations to undergo a life assessment procedure as a safety measure, coupled with the regular inspection required to check for any damage in the equipment and take necessary action, create a market for NDT. Thus, companies are entering this market, seeing a huge opportunity. Some key players are Magnaflux Corp., Zetec Inc., YXLON International Gmbh (COMET Group), Fujifilm Corporation, Olympus Corporation, and Bureau Veritas SA, among others. Some recent developments are:

In September 2022, Waygate Technologies teams up with RINA. This collaboration combines digital expertise and data intelligence in non-destructive inspection to create exceptional customer benefits and added value. The joint solution will help detect potential defects during and after welding, optimize production processes, reduce the risk of rework and scrap, and eventually improve the quality of welded joints.

In May 2022, TWI signed an MoU with Tech Eurolab Ltd. for delivering funded projects and non-destructive testing programs across a range of industries and technologies for attaining the highest standards of quality and safety for products and processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Stakehholder Analysis

- 4.3 Market Drivers

- 4.3.1 Rising need to run refinery assets at full cap

- 4.3.2 Upstream sector expected to gain momentum in key markets

- 4.4 Market Challenges

- 4.4.1 Production cuts and lack of skilled workforce

- 4.5 Assessment of the Impact of COVID-19 on the Market

- 4.6 Comparative Analysis of NDT Equipment VS Service Industry

- 4.7 Market Opportunities

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Equipment

- 5.1.2 Services

- 5.2 By Type

- 5.2.1 Upstream

- 5.2.2 Midstream

- 5.2.3 Downstream

- 5.3 By Technique

- 5.3.1 Ultrasonic

- 5.3.2 Radiography

- 5.3.3 Visual Inspection

- 5.3.4 Liquid Penetrant

- 5.3.5 Others (Magnetic Particle & Eddy Current)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Magnaflux Corp

- 6.1.2 YXLON International Gmbh (COMET Group)

- 6.1.3 Fujifilm Corporation

- 6.1.4 Olympus Corporation

- 6.1.5 Bureau Veritas SA

- 6.1.6 GE Measurement and Control (Baker Hughes)

- 6.1.7 Karl Storz Ndtec Gmbh

- 6.1.8 Intertek Group PLC

- 6.1.9 Applus Services SA

- 6.1.10 Magnetic Analysis Corporation

- 6.1.11 Zetec Inc