|

市場調查報告書

商品編碼

1632035

世界專業論文 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Specialty Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

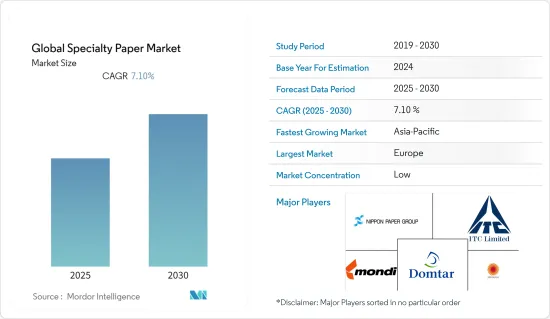

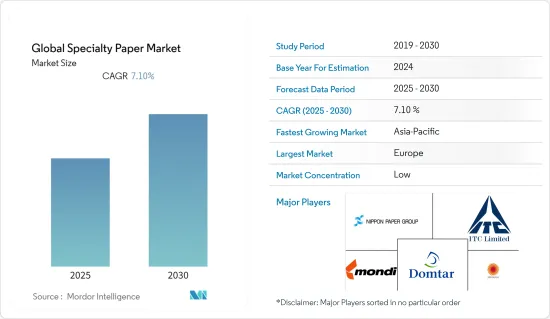

預計全球特種紙市場在預測期間的複合年成長率為 7.1%。

在餐飲業,特種紙擴大用於手提盒、手提袋、紙管、紙盤和紙杯。特種紙具有優異的阻隔性能、高濕強度、優異的柔韌性、適印性、延長的產品保存期限,並且還能夠實現無縫運輸加工。

主要亮點

- 特種紙具有非反應性、高品質、防水性、耐熱性和重量輕等吸引人的特性,使其在包裝行業中需求量很大。全球室內設計趨勢增加了包裝和電子商務行業的特殊紙銷售。

- 牛皮紙廣泛用於自黏屋頂和地板材料,離型紙用於材料安裝和運輸。紙張必須足夠耐用以容納重型建築材料,並且在安裝過程中必須易於拆卸。這些可以透過使用牛皮紙等特殊紙張來實現。隨著建設計劃的不斷增加,特種紙市場似乎佔據了該行業的主要部分。

- 特種紙的分子結構使其能夠有效地開發根據用戶需求量身定做的新產品,包括生物分解性的選項。此外,特種紙中含有的奈米材料適用於多種不同的產品。特種紙的所有這些特性使其成為許多最終用戶的首選之一。

- 使用環保產品的成長趨勢和特種紙成本的上漲似乎正在影響市場。例如,原生紙最常見的替代品是使用消費後廢棄物。這種類型的紙張含有很高比例的消費後廢棄物(最終進入回收箱的紙張)。它使紙張不再進入垃圾掩埋場,使用更少的樹木,並節省能源。

- 特種紙市場受到SARS-CoV-2感染的影響。在新冠疫情期間的前半段,市場受到行動限制、嚴格的挨家挨戶規範和勞動力減少的負面影響。然而,疫情下半年,電商產業的崛起和包裝食品消費的增加導致全球特種紙銷售增加。

特種紙市場趨勢

包裝和標籤佔據很大佔有率

- 醫療行業的特種紙必須無污染且重量輕。製藥業使用特種紙的最新趨勢導致了更複雜的包裝要求,特種紙為無污染包裝和更具吸引力和清晰的標籤等挑戰提供了解決方案。

- 使用特種紙是指在任何設備的零件上塗上一定的保護油,然後用紙包裹起來。使用牛皮紙可以保護包裝內的零件並防止油沾滿盒子。

- 例如,BIOCARBON LAMINATES 提供英國第一個碳中性層壓板。生物碳層壓板產品系列已通過環境產品聲明 (EPD) 和生命週期分析 (LCA) 環境性能認證。

- 它還可以安全地用於注重衛生的區域,例如酒店、醫療、更衣室、洗手間、休閒設施、商業設施、教育設施和零售商店。

- CEPI成員國的紙和紙板產量比與前一年同期比較成長約5.0%,2021年達5.8%。 2021 年總產量達 9,020 萬噸,幾乎所有紙和紙板等級都出現成長。

歐洲佔主要市場佔有率

- 根據歐洲造紙工業聯合會(CEPI)發布的報告,2021年包裝級產量較2020年成長約7.1%,達到歐洲有史以來的最高水準。包裝等級中,主要用於運輸包裝的箱體材料和紙板,由於電商行業的成長趨勢,成長了7.8%。

- 受益於歐盟支持逐步淘汰塑膠包裝的替代效應,紙袋生產中使用的包裝等級增加了11.7%。

- 主要用於零售包裝的紙板產量增加了4.1%。 2021年,包裝級佔紙和紙板產量的58.7%,圖文級佔27.8%。其他紙和紙板產量增加9.6%,佔紙和紙板總產量的4.8%(來源:CEPI)。

- 根據初步研究,2021年Sepi地區紙和紙板進口成長約1.5%,其中主要來自歐洲其他國家的進口成長21.8%。來自歐洲其他國家的進口占歐洲進口總額的50.0%。

- 2021 會計年度紙漿產量(總量 + 市場)成長了 2.2%。與上年相比,總產量約為3,700萬噸(資料來源:CEPI)。

特種紙業概況

全球特種紙市場競爭激烈。特種紙市場的參與企業關注永續性和可回收性。透過增強產品差異化來維持品質是特種紙市場主要企業的關注焦點。

- 2021 年 12 月 - Stora Enso Oyj 投資 2,300 萬歐元在芬蘭 Varkaussite 生產紙板。該投資預計將於2022年終完成,旨在提高客戶可用產品系列的靈活性,並將該工廠的總產能提高約10%。

- 2021 年 3 月 - Pixelle 從 Veritiv Corporation 收購特種紙業務 RollSource。 4 月 5 日,Pixelle 從 Appvion Operations Inc. 收購了無碳捲筒和安全紙業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 改變消費者對採用永續裝飾層壓板的偏好

- 增加廣告看板支出並取消 COVID-19 限制

- 市場限制因素

- 關於特種紙製造中化學品使用的嚴格政府法規

第6章 市場細分

- 按用途

- 包裝和標籤

- 食品服務管理

- 印刷/出版(海報紙)

- 建築/施工(壁紙)

- 商務溝通

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Stora Enso Oyj

- Nippon Paper Industries Co. Ltd

- Mondi Group PLC

- ITC Limited

- Domtar Corporation

- Nordic Paper AS

- Twin Rivers Paper Company

- LINTEC Corporation

- Sappi Limited

- BillerudKorsns AB

- Glatfelter Corporation

- Fedrigoni SPA

- Munksjo Group

- KAMMERER Spezialpapiere GmbH

- Mosaico SpA

第8章投資分析

第9章 市場的未來

The Global Specialty Paper Market is expected to register a CAGR of 7.1% during the forecast period.

In the Foodservice industry, specialty papers are increasingly being used for carryout boxes, carryout bags, paper tubes, paper plates, and cups. They provide good barrier performance, high wet strength, excellent flexibility, print-ability, increase the shelf life of a product, and also enable seamless transportation handling.

Key Highlights

- Specialty papers attractive features like non-reactance, high-quality, waterproof, temperature resistance, and lightweight have increased their demand in packaging industries. The surging trend of interior designing across the globe increased the sales of specialty papers in the packaging and e-commerce Industry.

- Kraft papers are used extensively for self-adhesive roofing and flooring, and release liners are used to install and transport materials. The paper needs to be durable enough to hold heavy construction materials and must be easily removed during installation. These can be achieved using specialty papers like Kraft paper. With growing trends in construction projects, the specialty paper market seems to be a major part of the industry.

- The molecular structure of specialty paper is effective in developing new product variants customized to the requirement of users, including biodegradable options. Also, nanomaterials in specialty papers make it suitable for several by-products. All these properties of specialty papers make it one of the favorite options for several end users.

- The rising trends of using eco-friendly products and the increased cost of specialty papers seem to impact the market. For example, the use of Post-Consumer Waste is the most common alternative to virgin paper. This type of paper is made from a high percentage of post-consumer waste - those paper items that are put into the recycling bin. It keeps paper out of landfills, reduces the number of trees used, and it also saves energy.

- The specialty paper market has been moderately affected by SARS-CoV-2 infections. In the first half of the COVID period, the market was negatively affected by movement restrictions, stringent lockdown norms, and a reduced workforce. However, the rising e-commerce industry and increased packaged food consumption during the 2nd half of the outbreak increased the sales of specialty papers worldwide.

Specialty Paper Market Trends

Packaging and Labeling holds the major market share

- Specialty papers for the medical industry need to be contamination-free and lightweight. With the recent trends of more sophisticated packaging requirements in the pharmaceutical industry's use of specialty, papers will provide solutions to challenges like contamination-free packaging and more attractive and visible labeling.

- The use of specialty papers while packaging parts of any equipment they are covered in a specific, protecting oil and then wrapped in paper. Kraft paper can be used to protect the parts in the packaging and keep the oil from getting all over the box.

- For Instance, BIOCARBON LAMINATES supply the UK's First Carbon Neutral Laminate. The BioCarbon Laminates range has received recognition of Environmental Product Declaration (EPD and environmental performance through a Life Cycle Analysis (LCA).

- The decorative laminate also provides the security of Anti-Microbial protection for hygiene-sensitive areas in industries such as hospitality, healthcare, locker rooms, washrooms, Leisure facilities, commercial interiors, and educational and retail.

- CEPI member countries' paper and board production increased by around 5.0% to 5.8% in 2021 compared to the previous year. Total production in 2021 reached 90.2 million ton, with an increase reported in almost all paper and board grades.

Europe Accounted to Hold the Major Market Share

- As per the report published by the Confederation of European Paper Industries (CEPI), the production of packaging grades increased by approximately 7.1% in FY 2021 compared to FY2020 reaching the highest level ever in Europe. Within packaging grades, case materials - mainly used for transport packaging and corrugated boxes, increased by upward trends in the e-commerce industry, recording an increase of 7.8%.

- The wrapping grades used for paper bag production - increased by 11.7% and benefited from substitution effects resulting from the EU-backed phase-out of plastic packaging.

- The output of carton boards, mainly used for retail packaging, increased by 4.1%. The share of packaging grades accounted for 58.7% in FY 2021 of the total paper and board production, with graphic grades 27.8%. The output of all other paper and board rates - mainly for particular and industrial purposes- was up by 9.6%, with a share of 4.8% of total paper and board production (source: CEPI).

- Preliminary indications show that imports of paper and board into the Cepi area increased by around 1.5% in FY 2021, primarily increasing volumes from other European countries by 21.8%. Other European countries account for 50.0% of all European imports.

- The production of pulp (integrated + market) was up by 2.2% in 2021. Compared to its previous year, with a total output of approximately 37.0 million ton (source: CEPI).

Specialty Paper Industry Overview

The global specialty papers market is highly competitive. The players in the specialty papers market are focusing on sustainability and recyclability. Maintaining quality with Product differentiation enhancement is a key focus area of key players in the specialty papers market.

- December 2021 - The company Stora Enso Oyj invested EUR 23 million into board production at a Varkaussite in Finland. The investment will be completed at the end of 2022 with an aim to increase the flexibility of the product range available for customers and to grow the site's total capacity by approximately 10%.

- March 2021 - Pixelle acquired the specialty paper business Rollsource from Veritiv Corporation. On April 5th, Pixelle acquired the carbonless rolls and security papers business from Appvion Operations Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Changing consumer preference to adopt sustainable decorative lamination

- 5.1.2 Increased spending on signages and lifting of COVID-19 regulations

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations Pertaining to the Usage of Chemicals While Manufacturing of Specialty Papers

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Packaging & Labelling

- 6.1.2 Food Service Management

- 6.1.3 Printing & Publication (Poster Paper|

- 6.1.4 Building & Construction (Wallpaper

- 6.1.5 Business and Communication

- 6.1.6 Others End User

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stora Enso Oyj

- 7.1.2 Nippon Paper Industries Co. Ltd

- 7.1.3 Mondi Group PLC

- 7.1.4 ITC Limited

- 7.1.5 Domtar Corporation

- 7.1.6 Nordic Paper AS

- 7.1.7 Twin Rivers Paper Company

- 7.1.8 LINTEC Corporation

- 7.1.9 Sappi Limited

- 7.1.10 BillerudKorsns AB

- 7.1.11 Glatfelter Corporation

- 7.1.12 Fedrigoni SPA

- 7.1.13 Munksjo Group

- 7.1.14 KAMMERER Spezialpapiere GmbH

- 7.1.15 Mosaico SpA