|

市場調查報告書

商品編碼

1643202

特種紙:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Specialty Papers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

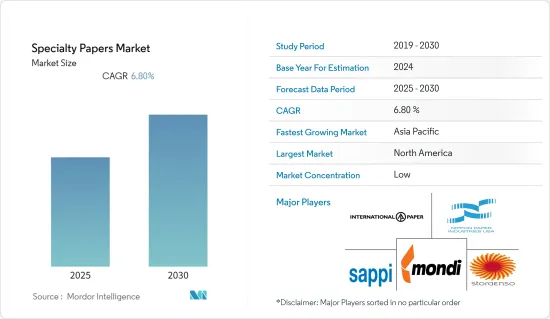

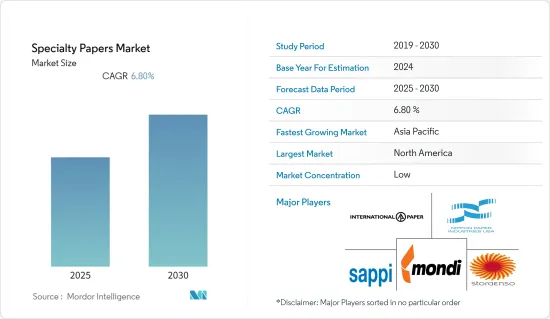

預計預測期內特種紙市場複合年成長率為 6.8%。

主要亮點

- 生活方式的改變導致快餐消費的增加,推動了即食食品的成長。此外,線上訂餐和送貨上門的趨勢日益成長,預計也將有助於推動市場成長。自新冠疫情以來,這種趨勢急劇上升。外帶餐廳會使用特殊的紙張來包裝產品,以防止顧客打擾餐飲的進行。預計網上配送的成長將支持市場成長。例如,根據《經濟時報》報道,受新冠疫情和商品暫時限流影響,網路外送配送規模出現下滑。儘管如此,預計到 2025 年市場將重新獲得 35% 的吸引力並達到 128 億美元。

- 由於不斷進行研究和開發以增強特種紙的性能,水性阻隔塗層、輕質特殊性能塗層等特種紙的永續改進正在增加。同樣,高性能複合材料、生物分解性和奈米材料很可能在可預見的未來繼續創造新的市場並推動全球市場成長。

- 由於其在包裝、倉儲和運輸等電子商務活動中的應用日益廣泛,市場正在獲得發展動力。除了豪華包裝外,特種紙的其他基本用途還包括印刷和裝飾邀請函。此外,家居裝飾中現代設計、色彩和材料的使用越來越多,也推動了新型和先進裝飾紙的發展。牛皮紙由於使用方便、強度高、對環境的影響小,擴大被用於製作用於處理貨物的包裝、袋子和小袋。

- 此外,根據最終用戶偏好提供具有特定屬性的可客製化特種紙產品也是推動全球特種紙市場發展的一大優勢。然而,造紙過程中產生的二氧化碳排放和森林砍伐是特種紙的重大缺陷,預計將阻礙市場成長。

- 由於最近COVID-19疫情的爆發,世界各地的特種紙製造商都面臨供應鏈中斷和現場生產減少的問題。不過,世界各國政府都認為食品相關業務至關重要,因此預計在此期間對特種紙包裝的需求將保持強勁。此外,俄烏戰爭正在影響整個包裝生態系統。

特種紙市場趨勢

餐飲業預計將佔很大佔有率

- 由於城市居民生活節奏加快、可支配收入不斷增加,包裝食品的需求大幅增加。餐飲業經常使用特種紙來包裝外帶食品,因此隨著包裝食品銷售的飆升,對特種紙的需求也在增加。例如,英國的 Just Eat PLC 表示,2021 年家庭外帶食品上的支出將達到 112 億英鎊(132.5 億美元)。

- 在餐飲業,特種紙外帶用於外帶盒、外帶袋、紙管、紙盤、紙杯等,因為它們具有良好的阻隔性、高濕強度、優異的柔韌性、適印性、延長產品保存期限,並能實現無縫的運輸流程。

- 此外,包裝和標籤已成為該行業潛在客戶的差異化因素。這就是為什麼製造商和負責人不斷創新和改進包裝和標籤解決方案以吸引潛在買家。預計這將促進食品服務業特種紙市場的成長。

- 當新冠肺炎疫情剛開始蔓延時,對基本包裝食品、食品和飲料產品的需求激增。公司難以適應快速變化的市場並面臨供應鏈中斷。此外,蓬勃發展的電子商務正在推動並促進食品、飲料、網路藥局和藥局銷售對特種紙包裝的需求成長。例如,根據美國人口普查局的數據,2021年美國餐飲場所的銷售額達到約8,763.3億美元。

預計北美將佔最大佔有率

- 預計在預測期內推動該地區採用特種紙的關鍵因素之一是外出就餐的趨勢日益成長以及該地區餐飲服務業的擴張。例如,Home Chef 估計美國人一生將在外賣和外帶上花費 7 萬美元。

- 市場參與者也將策略性收購視為擴大其在區域市場影響力的有利機會。此外,某些參與者正致力於擴大其產品組合。例如,JK Paper打算在2022年4月擴大其產品組合,並計劃推出液體包裝、捲菸紙板、抗真菌和水性紙板。該公司推出了牛皮箱板紙、彩色牛皮紙、JK Pack Fresh、JK Sublime 紙(卷)和液體包裝紙板。此外,該公司正在研發處於不同開發階段的多種新產品,重點是性能等級、特殊紙和紙板以及永續包裝,以推動特種包裝的成長。在 21 會計年度,該公司銷售了 3,40,976 公噸未塗佈 W&P 和特殊紙張(包括出口)。

- 該地區的快餐店(QSR)產量也在增加。預計這將在預測期內推動市場成長。例如,根據國際專利權協會的統計數據,美國快餐店(QSR)專利權行業的產值達到2555.3億美元。

- 由於特種紙產業的蓬勃發展,美國在北美地區佔據主導地位。此外,製藥業作為宣傳單對特種紙的消耗量正在增加,從而推動了特種紙市場的需求。這些案例表明該地區的市場將在預測期內成長。

特種紙業概況

特種紙市場競爭激烈。特種紙市場的參與者正專注於可回收性和永續性,以擴大其消費者群體。產品差異化和品質改進是主要企業關注的重點領域,其中包括:日本製紙工業公司、Stora Enso Oyj、Sappi Limited、Mondi Group Plc 和其他特殊紙市場公司。

- 2022 年 8 月:印度班加羅爾 Arttek Solutions 正在與 BillerudKorsnas 合作,在印度更換塑膠吸管。 Arttek Solutions 與 BillerudKorsnas 密切合作推動創新,並選擇 BillerudKorsnas 的 ConFlex Glaze 作為首選吸管材料。高品質 MG 特種紙,100% 可回收且永續,來自 FSC 認證的斯堪地那維亞的納維亞森林。

- 2022 年 7 月:私人投資公司 Millrock Capital 的私人公司Millrock Packaging Partners 收購了美國專業包裝和印刷公司 Impressions。

- 2022 年 7 月:Neenah Paper 和 Schweitzer Maudui International 完成合併,目前以 Machiave Holdings 的名義運作。這兩家特種紙製造商今年 3 月宣布計劃組建一家年銷售額達 30 億美元的公司。新公司在醫療保健和保健、保護和黏合解決方案、工業解決方案、包裝和特殊紙張等新興類別擁有強大的市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 網路訂餐日益流行

- 消費者偏好轉變,採用永續裝飾層壓板

- 市場挑戰

- 政府對特種紙生產過程中化學品使用的嚴格規定

- 由於嚴格的森林砍伐環境法規導致原料短缺

第6章 市場細分

- 按類型

- 牛皮紙

- 箱板紙/紙板

- 標籤紙

- 矽油紙

- 其他

- 按最終用戶產業

- 包裝和標籤

- 食品服務

- 印刷出版

- 建築和施工

- 其他最終用戶產業(層壓板、零售袋等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Mondi Group PLC

- ITC Limited

- Domtar Corporation

- Nordic Paper AS

- Twin Rivers Paper Company

- LINTEC Corporation

- Sappi Limited

- BillerudKorsns AB

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 70227

The Specialty Papers Market is expected to register a CAGR of 6.8% during the forecast period.

Key Highlights

- The changing lifestyle has increased fast food consumption, and eat-on-the-go food has propelled growth. Also, the increasing trend of online food ordering and delivering it to the doorstep is expected to support market growth. This trend has surged since covid. The food delivery restaurants use speciality paper to pack products to prevent the development from becoming dishevelled by the customer. The growth in online delivery will support market growth. For instance, according to The Economic Times, the size of online food delivery experienced a decline owing to COVID-19 and restrictions on the moment for goods. Still, the market is projected to regain traction by 35 % and reach USD 12.8 billion by 2025.

- Sustainable improvement in the specialty paper, such as water-based barrier coating and lightweight and special performance coating, is rising due to constant research and development in enhancing specialty paper. Likewise, high-performance composites, biodegradability, and nano-materials are poised to give rise to new markets in the foreseeable future and will continue to boost the global market growth.

- The market is gaining traction owing to its rising applications in the e-commerce activities such as packaging, storing, and transportation. Other basic applications of specialty papers other than high-end packaging include printing invitations and decoration. Additionally, the growing usage of the latest design, colors, and materials in home decor drives new and advanced decor papers. Owing to its convenience, strength, and less environmental impact, kraft paper is witnessing growing demand for wrapping, sacks, and pouches to handle goods.

- Moreover, the availability of customizable specialty paper products with specific properties according to end-user preference is an advantage driving the global specialty paper market. However, carbon emissions from the paper manufacturing processes and deforestation are projected to be a substantial disadvantage of specialty papers, hindering their market growth.

- With the recent outbreak of COVID-19, the specialty papers manufacturer is facing supply chain disruption and decreasing manufacturing at the site in many parts of the world. However, Governments across the globe have deemed food-related businesses essential, owing to which the demand for packaging from specialty papers is expected to be steady during the period. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem

Specialty Paper Market Trends

Food Service Industry is Expected to hold Significant Share

- The demand for packaged food items has risen considerably due to the urban population's busy lives and increasing disposable income. The need for specialty paper is growing as packaged food sales soar because specialty paper is often utilized in the food service industry to package takeaway items. For instance, Just Eat PLC in the UK stated that household spending on takeout food reached GBP 11.2 billion (USD 13.25 billion ) in 2021.

- In the food service industry, speciality papers are increasingly being used for carryout boxes, carryout bags, paper tubes, paper plates, cups, and more as they provide good barrier performance, high wet strength, excellent flexibility, print-ability, and increased shelf life of a product and also enables seamless transportation handling.

- Also, packaging and labelling have become differentiating factors for potential customers in the industry. Therefore, manufacturers and marketers constantly innovate and improve their packaging and labelling solutions to attract potential buyers. This is expected to boost the speciality papers market growth in the food service industry.

- The demand for essential packed food and beverage products surged during the initial spread of COVID-19. Companies struggled to meet the rapidly changing market and faced supply chain disruptions. In addition, the rapidly growing e-commerce has contributed to the growth by driving the demand for specialty paper packaging in the sale of food, beverages, online pharmacies, and drug stores. For instance, according to US Census Bureau, the United States food service and drinking place sales amounted to about USD 876.33 billion in 2021.

North America is Expected to hold the Largest Share

- One of the key elements anticipated to drive the adoption of speciality papers in the region over the forecast period is the growing tendency for on-the-go eating, along with the expansion of the food service industry in the area. For instance, Home Chef estimates that Americans spend an astounding USD 70,000 on delivery and takeout over their lives.

- The market players are also witnessing strategic acquisitions as a lucrative opportunity to expand their regional market presence. Also, certain players are focusing on widening their product mix. For instance, in April 2022, JK Paper intends to expand its product mix and is planning to introduce liquid packaging, cigarette board, anti-fungal, and aqueous boards. The company launched kraft liner paper, colour kraft paper, JK Pac fresh, JK sublime paper (rolls) & Liquid packaging board. Further, the company is working on numerous new products under various stages of development, focusing on functional grades, speciality paper & board, and sustainable packaging, which will promote the growth of speciality packaging. In the financial Year 2021, the Company sold 3,40,976 MT of uncoated W&P and specialty paper (including exports).

- The region also is witnessing an increased output from the quick-service restaurant (QSR). This is expected to fuel market growth over the forecast period. For instance, according to the International Franchise Association, the Output of the quick-service restaurant (QSR) franchise industry in the United States reached USD 255.53 billion.

- The U.S. dominates in the North American region as the specialty paper sector proliferates. Also, the increasing consumption of specialty paper as a leaflet in the pharmaceutical industry boosts the demand for specialty paper in the market. Such instances indicate that the market in the region is poised to grow over the forecast period.

Specialty Paper Industry Overview

The specialty papers market is highly competitive. The players in the specialty papers market are focusing on recyclability and sustainability to widen their consumer base. Product differentiation and quality enhancement are key focus areas of key players such as Nippon Paper Industries Co., Ltd., Stora Enso Oyj, Sappi Limited, Mondi Group Plc, and others in the specialty papers market. Some key developments of the market are:

- August 2022: Arttek Solutions in Bengaluru, India, collaborates with BillerudKorsnas to replace plastic straws in India. Arttek Solutions has collaborated with BillerudKorsnas to drive innovation, selecting BillerudKorsnas ConFlex Glaze as its straw material. A 100% recyclable and sustainable high-quality MG specialty paper made from FSC-certified Scandinavian forests.

- July 2022: Mill Rock Packaging Partners, a portfolio company of private investment firm Mill Rock Capital, has acquired US-based specialty packaging and printing company Impressions.

- July 2022: Neenah Paper Inc. and Schweitzer-Mauduit International, Inc. completed their merger and are now operating under the name Mativ Holdings Inc. The two specialty paper manufacturers announced a plan to form a company with USD 3 billion in annual sales in March. This newly formed company touted its strong market share in emerging categories such as health care and wellness, protective and adhesive solutions, industrial solutions, packaging paper, and specialty paper.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Trend of Online Food Ordering

- 5.1.2 Changing Consumer Preference to Adopt Sustainable Decorative Lamination

- 5.2 Market Challenges

- 5.2.1 Stringent Government Regulations Pertaining to the Usage of Chemicals While Manufacturing of Specialty Papers

- 5.2.2 Shortage of Raw Materials caused due to Stringent Environmental Regulations for deforestation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Kraft Paper

- 6.1.2 Container Board/Paper Board

- 6.1.3 Label Paper

- 6.1.4 Silicon-based Paper

- 6.1.5 Others

- 6.2 By End-user Industry

- 6.2.1 Packaging & Labelling

- 6.2.2 Food Service

- 6.2.3 Printing & Publication

- 6.2.4 Building & Construction

- 6.2.5 Other End-user Industries (lamination, retail bags etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stora Enso Oyj

- 7.1.2 Nippon Paper Industries Co., Ltd.

- 7.1.3 Mondi Group PLC

- 7.1.4 ITC Limited

- 7.1.5 Domtar Corporation

- 7.1.6 Nordic Paper AS

- 7.1.7 Twin Rivers Paper Company

- 7.1.8 LINTEC Corporation

- 7.1.9 Sappi Limited

- 7.1.10 BillerudKorsns AB

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219