|

市場調查報告書

商品編碼

1632072

東南亞工業幫浦:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Southeast Asia Industrial Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

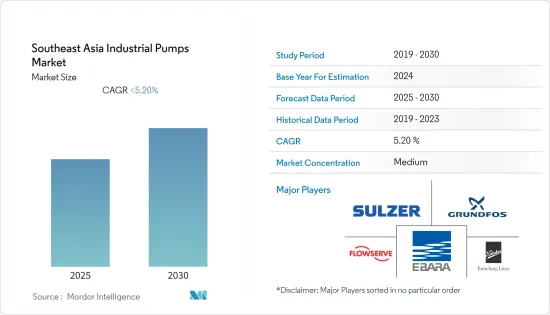

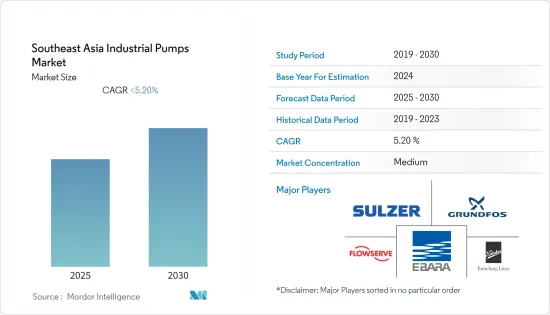

預計東南亞工業泵市場在預測期內的複合年成長率將略低於 5.2%。

主要亮點

- 在東南亞,對工業泵的需求是由於供水和衛生系統的不斷擴大以及對建築和水基礎設施投資的增加而推動的。因此,泵浦擴大應用於各種最終用途行業,包括化學和污水處理廠以及採礦、紙漿和造紙、食品和飲料以及發電等一般行業。

- 例如,2021年9月,世界銀行核准了3.8億美元貸款,用於開發印尼首座抽水蓄能電站。此舉旨在提高尖峰時段發電能力,同時支持該國的能源轉型和脫碳目標。

- 此外,3D列印技術與電腦建模相結合的製造技術進步也是推動市場成長的關鍵因素之一。隨著物聯網、資料分析和網路連接等數位解決方案的日益普及,工業泵市場正在數位化,以實現更好的水資源管理、故障識別和借助遠端監控選項捕獲即時資料。

- 東南亞COVID-19患者數量不斷增加以及由此產生的各種活動限制正在嚴重影響工業泵浦市場。泵浦消耗的減少和建設活動的有限阻礙了市場的成長。然而,隨著監管的放鬆,市場預計將在未來幾年內復甦。

- 近年來,鋼材、銅、鋁等原物料價格上漲,推高了該地區工業幫浦的價格。然而,客戶對低價產品的偏好可能是限制市場成長的因素。

東南亞工業泵市場趨勢

用水和污水產業佔據主要市場佔有率

- 在東南亞,用水和污水處理行業的高速成長預計將增加工業泵的整體收益。水務產業的成長是由對更好的水資源管理的需求所推動的,包括水循環利用、雨水收集、儲水和改進灌溉過程。

- 例如,越南前江省將於 2022 年 2 月開始建造一座鋼壩,耗資超過 107 億越南盾(約 47.2 萬美元),建成後預計將有助於防止海水入侵並儲存淡水 。

- 此外,東南亞地區許多國家都面臨嚴重的水資源短缺問題。對清潔水的需求不斷增加、水污染日益嚴重、政府對水處理的嚴格規定以及向水體排放工業廢棄物的增加是這些國家需要採取舉措擴大污水處理設施的主要原因。

- 例如,印尼東部的第一個污水處理設施計劃於 2024 年在望加錫開始運作。該先導計畫7,500 萬美元,旨在使該地區約 7 萬名居民受益,以應對水污染惡化的擔憂。

- 工業泵浦在污水處理廠中發揮重要作用。它幫助收集工廠各個部分的污水並將其運送到處理設施。一旦水被淨化,幫浦就會幫助將處理過的水輸送到所需的位置或儲存槽。

離心式長大

- 離心式幫浦是一種液壓操作的機器,其主要目的是增加壓力和輸送流體。離心式幫浦目前用於許多家庭和工業製程。需要不同類型的離心式幫浦來有效滿足從住宅供水到食品、飲料和化學製造等工業應用的泵送要求。

- 典型的離心式幫浦裝置由一個或多個連接到旋轉泵浦軸的葉輪組成。這種佈置提供了引導流體通過泵浦系統和相關管道所需的能量。根據其設置中葉輪的數量,離心式幫浦可進一步分為單級和多級。

- 此外,潛水泵是一種離心式幫浦,連接到馬達並在浸沒在水中時運行。密封馬達旋轉一系列葉輪。泵浦的容量由葉輪葉片的寬度決定,壓力由葉輪的數量決定。

- 離心式幫浦可用於處理大量液體並提供非常高的流量,液體流量可在較寬的範圍內調節。這些泵浦通常適用於柴油和水等低黏度(稀)液體。

- 東南亞地區在全球離心式幫浦市場中佔有很大佔有率。由於這些國家實施了許多有利於商業的政策,該地區的工業基礎設施正在不斷成長。此外,快速都市化導致建築業投資增加可能會進一步加速對這些泵浦的需求。

東南亞工業泵產業概況

東南亞工業泵市場競爭適度,由有影響力的參與者組成。這些公司利用策略集體行動來增加市場佔有率並提高盈利。

- 2021 年 10 月 - 格蘭富宣布推出 LC232 控制器,這是一款新型地下水泵控制器,有助於推動印尼和泰國等亞太地區四個市場的智慧農業。該控制器預計將在控制用於灌溉、取水以及農業供水和輸送的潛水鑽孔泵方面提供可靠性和靈活性。

- 2021 年 6 月 - 威樂集團在馬來西亞吉隆坡開設了一家新組裝廠,作為向全部區域供應威樂泵的平台。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 爆發對產業的影響

第5章市場動態

- 市場促進因素

- 房屋建築投資增加

- 製造技術的進步

- 市場挑戰

- 原料成本上漲

第6章 市場細分

- 按類型

- 正排量泵

- 旋轉泵

- 往復運動

- 蠕動的

- 離心式幫浦

- 單級

- 多級

- 水下

- 其他

- 正排量泵

- 按最終用戶產業

- 石油和天然氣

- 用水和污水

- 化學/石化

- 發電

- 製藥/生命科學

- 飲食

- 其他最終用戶產業

- 按國家/地區

- 印尼

- 泰國

- 馬來西亞

- 新加坡

- 其他東南亞國家

第7章 競爭格局

- 公司簡介

- Kirloskar Brothers Limited

- Grundfos Holding A/S

- Flowserve Corporation

- Sulzer Ltd.

- Ebara Corporation

- Pumpco International Pte. Ltd

- Dancomech Holdings Berhad

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91174

The Southeast Asia Industrial Pumps Market is expected to register a CAGR of less than 5.2% during the forecast period.

Key Highlights

- In Southeast Asia, the demand for industrial pumps is driven by increasing investments towards building and construction along with water infrastructure, with consistent expansion in access to water supply and sanitation systems. This has led to an increase in the utilization of pumps across various end-use industries like chemical and wastewater treatment plants and general industries like mining, pulp, paper manufacturing, food and beverages, and power generation.

- For instance, in September 2021, the World Bank approved a USD 380 million loans to develop Indonesia's first pumped storage hydropower plant, aiming to improve power generation capacity during peak demand while supporting the country's energy transition and decarbonization goals.

- Further, the technological advancements in manufacturing with the combination of 3D printing technology with computer modeling is another primary factor driving the market growth. With the increased adoption of digital solutions such as IoT, data analysis, and network connectivity, the industrial pump market is resorting to digitalization for better water management, identifying faults, and capturing live data with the help of a remote monitoring option.

- The increase in COVID-19 cases in Southeast Asia and the consequent restrictions on various activities have severely impacted the industrial pumps market. A decline in pump consumption and the restriction on construction activities hampered the market growth. However, with restrictions easing up, the market is expected to recover in the coming years.

- Over the past couple of years, the rising costs of raw materials such as steel, copper, and aluminum, have pushed up the prices of industrial pumps in the region. However, customers' inclination toward low-cost products might act as a restraint for the market growth.

Southeast Asia Industrial Pumps Market Trends

Water and Wastewater Industry to Hold a Major Market Share

- In Southeast Asia, high growth in the water and wastewater treatment industry is expected to increase the overall revenues for industrial pumps. Growth in the water industry is driven by the need for better management of water resources, including water recycling, rainwater harvesting, storage, and improved irrigation processes.

- For instance, in February 2022, the construction of a steel dam worth over VND 10.7 billion (USD 472,000) started in the Tien Giang Province of Vietnam, which is expected to help prevent saltwater intrusion and store fresh water upon completion.

- Further, many countries in the Southeast Asian region face severe water shortages. The increasing demand for clean water, growing water contamination, stringent government regulations on water treatment and increasing industrial waste discharge in waterbodies are the major factors that have necessitated initiatives to expand wastewater treatment facilities in these countries.

- For instance, the first wastewater treatment plant of eastern Indonesia is expected to commence operation in Makassar in 2024. The USD 75 million pilot project is aimed at benefiting the region's roughly 70,000 residents amid concerns over worsening water pollution.

- In any wastewater treatment plant, industrial pumps play a critical role. They help in collecting the wastewater from different parts of the plant and transfer it to the treatment plant. Once the water is purified, pumps then assist in moving the treated water to places where it is required or to a storage tank.

Centrifugal Type to Grow Significantly

- Centrifugal pumps are hydraulically operated machines whose primary purpose is to transfer fluids through increased pressure. Centrifugal pumps are currently used across many domestic and industrial processes. Different types of centrifugal pumps are required to effectively meet pumping requirements, from supplying the water used in residential buildings to industrial applications like food, beverage, and chemical manufacturing.

- A typical centrifugal pump setup comprises one or more impellers attached to a rotary pump shaft. This arrangement provides the energy required to conduct fluid through the pump system and the associated piping. Centrifugal pumps can be further classified into single-stage or multi-stage, depending on the number of impellers present within their setup.

- Further, a submersible pump is another variant of a centrifugal pump, which is attached to an electric motor and operates while submerged in water. The sealed electric motor spins a series of impellers. The pump's capacity is determined by the width of the impeller vanes and its pressure by the number of impellers.

- Centrifugal pumps can be used for handling huge amounts of liquids to provide extremely high flow rates, and they can regulate the flow rate of the liquid over a wide range. These pumps are usually preferred for lower viscosity (thin) liquids like light oil or water.

- The Southeast Asia region holds a significant share of the centrifugal pumps market globally. The region's industrial infrastructure is witnessing growth because of many business-friendly policies implemented in these countries. Additionally, the increasing investments in the construction industry, attributed to rapid urbanization, will further accelerate the demand for these pumps.

Southeast Asia Industrial Pumps Industry Overview

The Southeast Asia Industrial Pumps market is moderately competitive and consists of some influential players. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

- October 2021 - Grundfos introduced its LC232 Controller, a new groundwater pump controller that will help advance smart agriculture in four markets in the Asia Pacific region - including Indonesia and Thailand. The controller is expected to provide reliability and flexibility to control submersible borehole pumps for irrigation, extraction, and agricultural water supply and transfer.

- June 2021 - Wilo Group opened a new assembly plant in Kuala Lumpur, Malaysia, which will serve as a platform and supply the entire SEA region with Wilo pumps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Building and Construction

- 5.1.2 Technological Advancements in Manufacturing

- 5.2 Market Challenges

- 5.2.1 Rising Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Positive Displacement

- 6.1.1.1 Rotary Pump

- 6.1.1.2 Reciprocating

- 6.1.1.3 Peristaltic

- 6.1.2 Centrifugal

- 6.1.2.1 Single-stage

- 6.1.2.2 Multi-stage

- 6.1.2.3 Submersible

- 6.1.2.4 Others

- 6.1.1 Positive Displacement

- 6.2 By End-User Industry

- 6.2.1 Oil and Gas

- 6.2.2 Water and Wastewater

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Power Generation

- 6.2.5 Pharmaceutical/Life Sciences

- 6.2.6 Food and Beverage

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Indonesia

- 6.3.2 Thailand

- 6.3.3 Malaysia

- 6.3.4 Singapore

- 6.3.5 Rest of Southeast Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kirloskar Brothers Limited

- 7.1.2 Grundfos Holding A/S

- 7.1.3 Flowserve Corporation

- 7.1.4 Sulzer Ltd.

- 7.1.5 Ebara Corporation

- 7.1.6 Pumpco International Pte. Ltd

- 7.1.7 Dancomech Holdings Berhad

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219