|

市場調查報告書

商品編碼

1644643

亞太工業幫浦:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia-Pacific Industrial Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

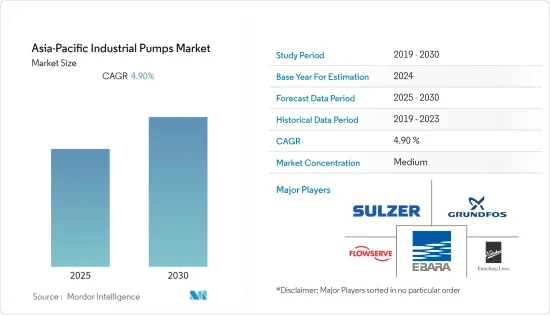

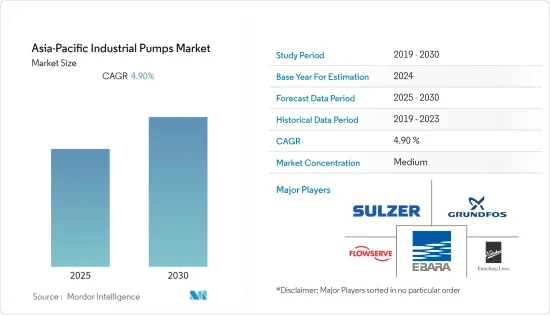

預測期內亞太工業幫浦市場預估複合年成長率為 4.9%

關鍵亮點

- 在亞太地區,供水和衛生系統的持續擴大,以及建築和水利基礎設施投資的增加,推動了對工業泵浦的需求。這導致泵浦在各種終端行業中的使用不斷增加,其中包括化工廠、污水處理廠、採礦、紙漿和造紙、食品和飲料、發電和其他一般行業。

- 根據自由亞洲電台(RFA)最近報道,湄公河主流預計將建造一個新的發電工程。這個投資 24 億美元的計劃由泰國正大能源與水務亞洲公司(CEWA)開發,如果核准,將由兩家韓國建設公司——韓國西部電力(KOWEPO)和斗山重工業負責建設。如果核准,該項目預計將於 2029 年完工。預計這些發展將推動工業泵的需求。

- 此外,製造業的技術進步以及3D列印技術與電腦建模的結合也是推動市場成長的主要因素。隨著物聯網、資料分析和網路連接等數位解決方案的日益普及,工業泵浦市場正在轉向數位化,以便更好地水資源管理、識別故障並藉助遠端監控選項獲取即時資料。

- 亞太地區 COVID-19案例的增加以及由此對各種活動實施的限制嚴重影響了工業泵浦市場。泵浦消耗量下降和建設活動受限阻礙了市場成長。然而,隨著管制的放鬆,市場預計將在未來幾年內復甦。

- 近年來,鋼鐵、銅、鋁等原料成本上漲,帶動該地區工業泵浦價格上漲。然而,消費者對低價產品的偏好可能會限制市場的成長。

亞太工業泵浦市場趨勢

離心式幫浦市場佔有主要市場佔有率

- 離心式幫浦是一種液壓驅動的機器,其主要目的是輸送加壓流體。離心式幫浦目前用於許多家庭和工業製程。需要不同類型的離心式幫浦來有效滿足從住宅供水到食品、飲料和化學製造等工業應用的泵送要求。

- 典型的離心式幫浦裝置由一個或多個安裝在旋轉泵軸上的葉輪組成。這種佈置描述了透過泵浦系統和相關管道輸送流體所需的能量。根據離心泵的設定中葉輪的數量,離心式幫浦可進一步分為單級或多級。

- 亞太地區採礦活動的增加是推動離心式幫浦需求的關鍵因素。採礦活動需要大量的水,例如在礦漿或懸浮液中運輸礦石和廢棄物、透過化學過程分離礦物、透過發電機周圍的冷卻系統控制溫度、抑制礦物加工過程中的粉塵以及礦井脫水。離心式幫浦在這些應用中發揮著至關重要的作用。

- 此外,隨著工業化和都市化的推進以及能源需求的不斷成長,未來對礦物的需求預計將大幅增加,這可能會刺激亞太地區對離心式幫浦的採用。

- 2021年12月,格蘭富宣佈在印度推出新一代大型CR泵,即立式多段離心直列泵系列。這款新型更大的 CR 系列的最大水流量已提升至 320m3/h,適用於各種供水和處理應用。

快速成長的中國市場

- 中國工業泵市場因相關加工工業基礎設施的開發和眾多大型建設計劃的推出而大幅的成長。中國對基礎設施的大力投資預計將有助於提高工業產出並推動工業泵的成長。

- 例如,2021年6月,中國在西南部運作兩座大型水力發電廠,預計將成為全球最大的水力發電發電工程。該計劃正在建設中,耗資約340億美元。

- 此外,由於中國人口不斷成長,食品和飲料行業的成長也加速了對工業泵的需求。例如,根據工信部統計,2021年主要飲料生產企業產量超過1.83億噸,與前一年同期比較增加12%。

- 工業泵廣泛應用於整個食品和飲料行業,在加工和生產應用中運輸、混合和計量流體和半流體物質。這些泵浦由食品級材料製造,表面光滑,可防止食物污染和細菌積聚。

- 此外,2021年7月,合肥荏原精機(HEPM)投資9,480萬元人民幣,在中國合肥正式開設新的真空幫浦大修工廠。

亞太工業泵產業概況

亞太地區工業泵浦市場競爭適中,並擁有眾多重要參與企業。這些公司利用策略合作行動來提高市場佔有率並增強盈利。

- 2022 年 1 月-蘇爾壽推出 SES 和 SKS 系列,擴大了其清潔水泵產品組合。這些新型 EN733 級泵浦適用於市政、水處理廠、商業和灌溉應用。它們具有堅固的鑄鐵外殼和鑄鐵、不銹鋼或青銅葉輪,並作為包括馬達在內的完整套件提供。

- 2021年11月-荏原製作所與日本大學室蘭工業大學(MuroranIT)和日本新型太空公司星際技術公司(IST)合作,開始開發用於將超小型衛星發射到太空的火箭的渦輪泵。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 新冠肺炎疫情對各行業的影響

第5章 市場動態

- 市場促進因素

- 建築業投資增加

- 製造技術的進步

- 市場問題

- 原料成本上漲

第6章 市場細分

- 按類型

- 正排量泵

- 旋轉

- 往復式

- 蠕動

- 離心式幫浦

- 單級

- 多級

- 水下

- 其他

- 正排量泵

- 按最終用戶產業

- 石油和天然氣

- 用水和污水

- 化工和石化

- 發電

- 製藥和生命科學

- 飲食

- 其他

- 按國家

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Grundfos Holding A/S

- Flowserve Corporation

- Sulzer Ltd.

- Ebara Corporation

- Kirloskar Brothers Limited

- KSB SE & Co. KGaA

- Schlumberger Limited

- Atlas Copco

- ITT Inc.

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 91008

The Asia-Pacific Industrial Pumps Market is expected to register a CAGR of 4.9% during the forecast period.

Key Highlights

- In the Asia Pacific, the demand for industrial pumps is driven by increasing investments towards building and construction along with water infrastructure, with consistent expansion in access to water supply and sanitation systems. This has led to an increase in the utilization of pumps across various end-use industries like chemical and wastewater treatment plants and general industries like mining, pulp, paper manufacturing, food and beverages, and power generation.

- As per a recent Radio Free Asia (RFA) report, a new hydropower project is expected to be undertaken on the mainstream of the Mekong River. The USD 2.4 billion projects are being developed by Thailand's Charoen Energy and Water Asia (CEWA) and, if approved, will be built by two South Korean construction companies, Korea Western Power (KOWEPO) and Doosan Heavy Industries & Construction. If approved, the project is scheduled to be completed in 2029. Such developments will propel the demand for industrial pumps.

- Further, the technological advancements in manufacturing and the combination of 3D printing technology with computer modeling is another primary factor driving the market's growth. With the increased adoption of digital solutions such as IoT, data analysis, and network connectivity, the industrial pump market is resorting to digitalization for better water management, identifying faults, and capturing live data with the help of a remote monitoring option.

- The increase in COVID-19 cases in the Asia Pacific region and the consequent restrictions imposed on various activities have severely impacted the industrial pumps market. A decline in pump consumption and the restriction on construction activities hampered the market growth. However, with restrictions easing up, the market is expected to recover in the coming years.

- Over the past couple of years, the rising costs of raw materials such as steel, copper, and aluminum, have pushed up the prices of industrial pumps in the region. However, customers' inclination toward low-cost products might act as a restraint for the market growth.

Asia-Pacific Industrial Pumps Market Trends

Centrifugal Segment to Hold Significant Market Share

- Centrifugal pumps are hydraulically operated machines, and their primary purpose is to transfer fluids through increased pressure. Centrifugal pumps are currently used across many domestic and industrial processes. Different types of centrifugal pumps are required to effectively meet pumping requirements, from supplying the water used in residential buildings to industrial applications like food, beverage, and chemical manufacturing.

- A typical centrifugal pump setup comprises one or more impellers attached to a rotary pump shaft. This arrangement provides the energy required to conduct fluid through the pump system and the associated piping. Centrifugal pumps can be further classified into Single-stage or multistage, depending on the number of impellers present within their setup.

- Increasing mining activities in the Asia Pacific region is a crucial factor driving the demand for centrifugal pumps. Mining activities like transportation of ore and waste in slurries and suspension, separation of minerals using chemical processes, controlling temperature via cooling systems around power generators, suppression of dust during mineral processing, and dewatering of mines require enormous volumes of water. Centrifugal pumps play an integral role in these applications.

- Moreover, with the increasing rate of industrialization and urbanization, coupled with the growing need for energy, the demand for minerals is expected to rise significantly in the years ahead, which would fuel the adoption of centrifugal pumps in the Asia Pacific region.

- In December 2021, Grundfos announced the launch of its new generation of large CR pumps, a range of vertical multistage centrifugal inline pumps, in India. This new large range of CRs brings an increased maximum water flow of up to 320 m3/h and is suitable for various water supply and water treatment applications.

China Market to Grow Significantly

- The Chinese industrial pumps market is witnessing a significant growth driven by infrastructure development in related processing industries and many large construction project launches. The robust investments into infrastructure in China are expected to aid the increase of industrial output, driving the growth of industrial pumps.

- For instance, in June 2021, China launched two units of a massive hydropower station in the country's southwest, which is also assumed to be the world's largest hydropower project. The project is under construction and costs about USD 34 billion.

- Further, the growth of the food and beverage industry due to the increasing population in China is also accelerating the demand for industrial pumps. For instance, in 2021, major beverage producers saw their output rise by 12% year-on-year to over 183 million metric tons, according to the Ministry of Industry and Information Technology.

- Industrial pumps are used across the food and beverage industries to transfer, mix and dose fluid and semi-fluid substances in processing and production applications. These pumps are manufactured from food-grade materials and have smooth surfaces to prevent contamination from food and bacteria buildup.

- Further, in July 2021, Hefei Ebara Precision Machinery Co. Ltd. (HEPM) officially opened its new vacuum pump overhaul facility in Hefei, China, after an investment of CNY 94.8 million.

Asia-Pacific Industrial Pumps Industry Overview

The Asia-Pacific Industrial Pumps market is moderately competitive and consists of some influential players. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

- January 2022 - Sulzer extended its portfolio of clean water pumps with the launch of the SES and SKS ranges. These new EN733 standard pumps are suitable for use in municipalities, water treatment facilities, and commercial and irrigation applications. With a robust cast iron casing and a choice of cast iron, stainless steel, or bronze impellers, the new units are supplied as a complete package, including the motor.

- November 2021 - Ebara Corporation, along with a Japanese university, the Muroran Institute of Technology (MuroranIT), and Interstellar Technologies Inc. (IST), a Japanese NewSpace company, started the development of a turbo pump for a rocket that will launch an ultra-compact satellite into space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Building and Construction

- 5.1.2 Technological Advancements in Manufacturing

- 5.2 Market Challenges

- 5.2.1 Rising Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Positive Displacement

- 6.1.1.1 Rotary Pump

- 6.1.1.2 Reciprocating

- 6.1.1.3 Peristaltic

- 6.1.2 Centrifugal

- 6.1.2.1 Single-stage

- 6.1.2.2 Multi-stage

- 6.1.2.3 Submersible

- 6.1.2.4 Others

- 6.1.1 Positive Displacement

- 6.2 By End-User Industry

- 6.2.1 Oil and Gas

- 6.2.2 Water and Wastewater

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Power Generation

- 6.2.5 Pharmaceutical/Life Sciences

- 6.2.6 Food and Beverage

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Grundfos Holding A/S

- 7.1.2 Flowserve Corporation

- 7.1.3 Sulzer Ltd.

- 7.1.4 Ebara Corporation

- 7.1.5 Kirloskar Brothers Limited

- 7.1.6 KSB SE & Co. KGaA

- 7.1.7 Schlumberger Limited

- 7.1.8 Atlas Copco

- 7.1.9 ITT Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219