|

市場調查報告書

商品編碼

1632102

全球行動ID:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Mobile Identification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

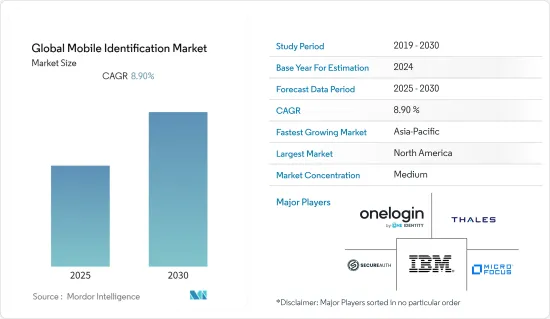

全球行動ID市場預計在預測期間內複合年成長率為8.9%

主要亮點

- 移動 ID 功能在很大程度上依賴生物辨識技術。借助將相機和麥克風轉換為生物識別感測器的生物識別軟體,智慧型手機和平板電腦可以用作多因素身份驗證設備。行動身分驗證越來越受到強大的身份驗證因素的支持,指紋感應器和臉部認證幾乎成為現代智慧型手機的常見組件。

- 消費者市場和垂直市場都在採用行動 ID 技術。行動ID可以用來取代使用者的個人密碼,保護病患在醫院的醫療記錄,讓金融交易更加便捷安全,並幫助執法部門識別現場通緝人員。

- 按需經濟 (ODE) 公司正在轉向行動 ID 掃描和檢驗,以解決與員工和客戶的資金籌措、授權、合規性和人身安全相關的問題。這種即時身份驗證正在推動市場供應商提供行動、快速且易於使用的平台。它還具有智慧/連接資料庫,可以更快地獲得身份檢驗結果。

- 對於大型企業來說,購買行動身分檢驗解決方案更容易。然而,對於中小企業來說,缺乏預算資源是一個問題。身份檢驗的高昂初始成本和維護成本使得資金有限的公司起步困難。由於預算緊張,中小型企業獲得銀行級技術和安全解決方案的機會通常有限,這使得它們很容易成為網路犯罪分子的目標。

行動認證市場趨勢

多因素身份驗證有望獲得顯著的市場佔有率

- 遠端和混合工作的擴展增加了多因素身份驗證在職場和消費者環境中的使用,導致公司要求對特定用戶和帳戶進行多因素身份驗證。

- MFA 是一種身份驗證機制,要求使用者提供兩個或多個身份驗證因素才能存取應用程式、線上帳戶和 VPN 等資源。強大的身份和存取管理 (IAM) 策略必須包括多重身份驗證 (MFA)。除了使用者名稱和密碼之外,MFA 還需要一項或多項額外的檢驗標準,從而降低網路攻擊成功的可能性。

- 此外,MFA 透過收集進一步的資訊(元素)進行檢驗來運作。動態密碼是消費者遇到的最典型的 MFA 因素 (OTP) 之一。 OTP 是透過電子郵件、簡訊或行動應用程式發送的 4-8 位元代碼。使用 OTP 時,會定期或每次發出身份驗證請求時建立新代碼。程式碼是使用使用者首次註冊時提供的種子值和遞增計數器或時間值等元件建立的。

- 儘管安全性有所提高,但消費者和員工仍然認為獲取包含動態密碼(OTP) 的文字訊息或電子郵件的額外步驟是我在登入過程中的繁瑣且多餘的步驟。但隨著員工接受遠距工作,一些觀點在整個大流行期間發生了變化。

亞太地區預計將佔據主要市場佔有率

- 亞太地區包括中國和印度等人口密度高的國家。該地區以其高網際網路普及率和最早採用技術的地區之一而聞名。此外,隨著這些新興國家擁抱數位化,客戶資料和資料通道受到損害的風險不斷增加,從而增加了該地區對行動ID的需求。

- 思科預計,到 2023 年,網路用戶滲透率將達到 72%,而 2018 年為 52%。此外,廣泛的平均通訊速度達到157.1Mbps,刺激了市場的成長。報告還稱,到 2023 年,亞太地區網路用戶總數將從 2018 年的 27 億增加到 31 億。

- 此外,亞太地區是GDP成長最快的地區之一,吸引了現有公司的擴張和新興企業的進入。預計這將增加對行動身份驗證解決方案以防止資料外洩的需求。

- 此外,隨著疫情日益迫使人們和企業數位化成為新常態,該地區的數位交易數量呈指數級成長。然而,這些為用戶提供更大便利的趨勢已經在這些平台上打開了多個安全閘道器,以避免資料外洩。

行動ID產業概況

全球行動 ID 市場競爭適中,有大量區域和全球參與企業。主要參與企業包括 OneLogin、Thales Group、SecureAuth Corporation、Micro Focus 和 IBM Corporation。

- 2022 年 6 月 - 存取管理和身份驗證公司 SecureAuth 宣布發布 Arculix,這是一個結合了編配、高級無密碼技術和持續身份驗證的平台。此新一代平台可用作完整的端到端解決方案,或透過提供與業界標準身分提供者的整合來補充現有的 IAM 投資。

- 2022 年 2 月 - HUMBL, Inc. 收購了行動身分和區塊鏈代幣化平台 BizSecure。該公司收購了 BizSecure 的員工和諮詢資源。 HUMBL, Inc. 將透過建立一個名為 HUMBL 區塊鏈服務的新商業部門,利用這些資源來實施區塊鏈企業和政府解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 由於嚴格的法規和合規性需求而採用解決方案

- 在企業採用 BYOD 趨勢

- 市場問題

- 實施行動身分驗證解決方案時的預算限制

第6章 市場細分

- 通過認證

- 單因素身份驗證

- 多重身份驗證

- 按成分

- 生物識別

- 非生物特徵識別

- 按服務

- 按發展

- 雲

- 本地

- 按用途

- 資訊科技/通訊

- 零售

- 醫療保健

- 政府/國防

- 銀行

- 旅遊/酒店

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- OneLogin(One Identity LLC.)

- Thales Group

- IDEMIA

- Okta

- SecureAuth Corporation

- Trend Micro Incorporated

- F-Secure

- Sophos Ltd.

- Telesign

- Regula

- IBM Corporation

- 42Gears Mobility Systems Pvt Ltd.

- Micro Focus

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91316

The Global Mobile Identification Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- Mobile ID largely relies on biometric technology to function. Any smartphone or tablet can be used as a multi-factor authentication device with the help of biometric software that converts cameras and microphones into biometric sensors. Mobile identity is increasingly supported by strong authentication factors, with fingerprint sensors and facial recognition becoming almost common components of modern smartphones.

- Consumer and vertical markets both employ mobile identification technologies. It can be used to replace a user's personal passwords or to protect a patient's medical records in a hospital; it can make financial transactions more convenient and secure, or allow law enforcement agents to identify wanted persons in the field; it can open a door, or notify a doctor if a patient requires medical attention.

- The On-Demand Economy (ODE) companies are shifting towards mobile ID scanning and verification to solve problems related to financing, licensing, compliance, and the personal safety security of both employees and customers. This instant identity verification has triggered the market vendors to offer a mobile, fast, and easy-to-use platform. They also feature smart/connected databases for quicker identity verification results.

- For large enterprises, it is easier to purchase mobile identity verification solutions. However, for SMEs, it becomes an issue due to insufficient resources in terms of budget. The high initial costs and maintenance of identity verification make it difficult for companies bootstrapped with limited capital. Due to budget restraints, SMBs typically have limited access to bank-grade technology and security solutions, making them an easy target for cybercriminals.

Mobile Identification Market Trends

Multi-Factor Authentication Expected to Witness Significant Market Share

- The expansion of remote and hybrid work has increased the usage of multifactor authentication in the workplace and consumer contexts, prompting organizations to make it mandatory for certain users and accounts.

- MFA is an authentication mechanism that requires a user to give two or more verification factors to access a resource such as an application, an online account, or a VPN. A strong identity and access management (IAM) policy must include multifactor authentication (MFA). MFA needs one or more extra verification criteria in addition to a username and password, which reduces the chances of a successful cyber attack.

- Further, MFA operates by collecting further information for verification (factors). One-time passwords are one of the most typical MFA factors that consumers encounter (OTP). OTPs are four to eight-digit codes sent via email, SMS, or a mobile app. When using OTPs, a fresh code is created on a regular basis or whenever an authentication request is made. The code is created using a seed value supplied to the user when they first register and another component, such as an incremented counter or a time value.

- Despite the added security, consumers and employees have seen the extra step of obtaining a text message or email with a one-time password (OTP) as a burdensome and redundant step in the login process. However, as employees have embraced remote work, some perspectives have evolved throughout the pandemic.

Asia Pacific Expected to Witness Significant Market Share

- The Asia-Pacific region is home to densely populated countries, such as China and India. The region is well known for being the fastest adopter of technology with increasing internet penetration. Also, as these emerging economies adopt digitalization, the risk of breach of customer data and data channels is increasing, due to which the demand for mobile identification is increasing in the region.

- According to Cisco estimates, the internet user penetration is expected to reach 72% in 2023 compared with 52% in 2018. Also, broad average speeds can reach 157.1 Mbps, fueling the market's growth. Also, the report states that Asia-Pacific will have 3.1 billion total internet users by 2023, which is an increase from 2.7 billion internet users in 2018.

- Further, Asia-Pacific is one of the fastest-growing regions in terms of GDP, which induced expansion of the existing corporates and the addition of new startups. It created the demand for fast, secure, and paperless digital transactions across these growing corporates, which is expected to increase the need for mobile identity verification solutions to prevent data breaches.

- Moreover, due to the pandemic, people and businesses have increasingly resorted to digitalization as the new normal, which has tremendously increased the number of digital transactions in the region. However, these trends offering greater convenience to the users have opened several gateways for security across these platforms to avoid data breaches.

Mobile Identification Industry Overview

The Global Mobile Identification Market is moderately competitive, with a considerable number of regional and global players. Key players include OneLogin, Thales Group, SecureAuth Corporation., Micro Focus, and IBM Corporation.

- June 2022 - SecureAuth, access management, and authentication announced the release of Arculix, a platform that combines orchestration, advanced passwordless technology, and continuous authentication. The next-generation platform can be used as a complete end-to-end solution or to supplement existing IAM investments by providing integration with any industry-standard identity provider.

- February 2022 - HUMBL, Inc. acquired BizSecure, a mobile identification and blockchain tokenization platform provider. The company acquired BizSecure employees and consulting resources. HUMBL, Inc. will utilize these resources to introduce blockchain corporate and governmental solutions by forming a new commercial division called HUMBL Blockchain Services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Solution Through Stringent Regulations and Need For Compliance

- 5.1.2 Adoption of BYOD Trends in Enterprises

- 5.2 Market Challenges

- 5.2.1 Budgetary Constraints During the Adoption of Mobile Identity Verification Solutions

6 MARKET SEGMENTATION

- 6.1 By Authentication

- 6.1.1 Single-factor Authentication

- 6.1.2 Multi-Factor Authentication

- 6.2 By Component

- 6.2.1 Biometric

- 6.2.2 Non-biometric

- 6.2.3 Services

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By Application

- 6.4.1 IT & Telecom

- 6.4.2 Retail

- 6.4.3 Healthcare

- 6.4.4 Government and Defense

- 6.4.5 Banking

- 6.4.6 Travel and Hospitality

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Middle East and Africa

- 6.5.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OneLogin (One Identity LLC. )

- 7.1.2 Thales Group

- 7.1.3 IDEMIA

- 7.1.4 Okta

- 7.1.5 SecureAuth Corporation.

- 7.1.6 Trend Micro Incorporated

- 7.1.7 F-Secure

- 7.1.8 Sophos Ltd.

- 7.1.9 Telesign

- 7.1.10 Regula

- 7.1.11 IBM Corporation

- 7.1.12 42Gears Mobility Systems Pvt Ltd.

- 7.1.13 Micro Focus

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219