|

市場調查報告書

商品編碼

1635347

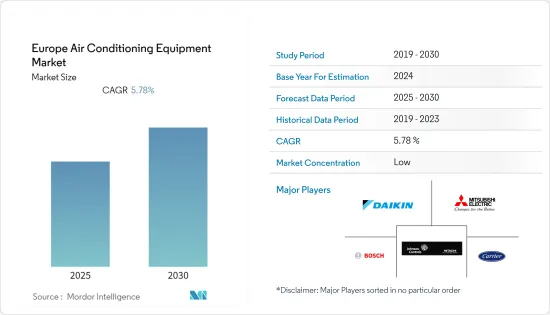

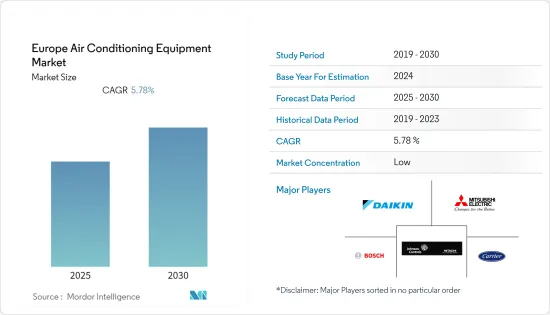

歐洲空調設備:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

歐洲空調設備市場預計在預測期內複合年成長率為5.78%。

主要亮點

- 根據歐洲提高能源效率的承諾,英國和法國在過去十年中為工業、交通和建築業制定了廣泛的法規結構和具有約束力的目標。

- 例如,法國組織智慧建築聯盟(SBA)旨在推動智慧城市的智慧建築產業。該聯盟匯集了來自建設產業各個領域的 170 個組織:工業公司、服務公司、建築商、開發商、設計公司、建築師、開發商和創新新興企業。

- 產品創新的進步進一步提高了設備的採用率。例如,2021 年 2 月,Carrier Global Corporation 宣佈在歐洲推出針對 Carrier 和 CIAT 暖氣、通風和空調 (HVAC) 設備的新 BluEdge 服務平台。 Carrier World Corporation 是全球知名的健康、安全和永續建築及低溫運輸解決方案供應商。多層 BluEdge 服務平台旨在滿足特定客戶需求並在整個產品生命週期中保持設備效能。

- 第二波新冠肺炎 (COVID-19) 疫情也正在影響空調設備供應鏈。 2021年,由於製造空調設備的鋼材、塑膠和鋁等原料成本增加,供應限制增加了空調成本。由於智慧型手機和電動車製造商等其他行業的高需求,市場也出現了半導體供不應求。

歐洲空調設備市場趨勢

工業用途預計將大幅成長

- 它正在成為世界關鍵產業平穩運作的驅動力之一,工業現場擴大採用製程冷凍。工業冷凍行業由各種工藝組成,包括冷凍和低溫冷凍機。由於其多功能性,它已成為一個大規模的產業。

- 例如,德國製造商Efficient Energy推出了一款新型冷卻器,其製冷量為120kW(34.1TR),僅使用水(R718)作為冷媒,適用於工業冷卻。據該公司稱,新型 eChiller120 的能源效率比傳統冷卻器系統高出 82%。 eChiller120 適用於冷卻製程和機器,如雷射頭、滾筒和冷卻底座。它還可用於資料中心和伺服器機房的技術空調。 eChiller 是產生 16°C 至 22°C 之間冷凍水溫度的完美設備。

- 為了實現安全健康的室內環境,商業和工業設施提供新鮮空氣的需求日益增加。 2022年2月,大金發布了與大金改進型分散式通風裝置「VAM-J8」相容的新型直膨盤管模組(型號:EKVDX-A),可降低新風對舒適空調系統的熱負荷影響。這種創新的大金直接膨脹盤管模組為商業和工業設施提供新鮮、衛生的空氣。

- 此外,2021年10月,大金宣布了其戰略管理計劃“Fusion 25”,該計劃考慮了全球暖化、能源短缺和清潔室內空氣需求等緊迫的社會問題。大金歐洲的目標是在未來五年內成為覆蓋歐洲、中東和非洲(EMEA)的暖氣、通風、空調和冷凍(HVAC-R)解決方案供應商。成長步伐強勁,預計 2025 年銷售額將達到 57 億歐元。目前正在投資加強歐洲研發中心,提高生產、銷售和服務能力,並為經營模式的數位化資金籌措。

英國分析將創下顯著成長率

- 近年來,英國通風和空調市場受益於更強力的健康、安全和能源效率立法、建築法規和環境立法的修訂。英國政府也積極參與減輕氣候變遷的影響。預計這將影響暖通空調設備的部署。

- 政府承諾在2050年將英國溫室氣體排放減少至零。面臨的挑戰是,由於氣候變遷的暖化效應以及創造健康的室內環境以提高工作效率的願望,預計夏季對建築物降溫的需求將會增加。為了經濟有效地滿足這種不斷成長的需求並實現淨零排放,考慮被動和主動冷卻的最佳組合非常重要。必須考慮更廣泛的視角和影響。例如,使用可逆熱泵進行冷卻可以增加低碳空間加熱對現有建築的滲透。

- 除此之外,國內合作的不斷增加也進一步促進了市場的成長。例如,2021 年 11 月,Balfour Beatty Kilpatrick 和 EJ Parker Technical Services 同意在整個交付中完成價值 1.5 億英鎊至 2.5 億英鎊的暖氣、通風和空調 (HVAC) 框架安排。 HVAC 方案是合作夥伴公司將在未來幾個月發布的眾多合約中的第一份,作為將持續 18 年的強大框架的一部分。

- 2022 年 6 月,Smith Brothers Store, Inc. 宣布與國際著名暖通空調產品製造商美的進行全國分銷合作。該協議於 2022 年 6 月開始,補充了 SBS 目前的空調設備陣容和成功的市場策略,同時考慮了消費者的回饋,以最終為客戶提供更多選擇。

歐洲空調設備產業概況

歐洲空調設備市場競爭非常激烈,因為每個細分市場都有領先的供應商,擁有主要的市場佔有率並擁有成熟的分銷網路。隨著智慧解決方案的出現,市場競爭有望成為另一個策略點。商業和工業領域智慧建築技術的引入預計將推動歐洲的互聯暖通空調系統,並增加市場內供應商之間的競爭。

- 2022 年 4 月 - 江森自控日立空調推出了具有多種智慧直覺功能的 airHome Smart,可協助消費者保持舒適的室內環境,同時提高 IAQ 並節省空調。 airHome 系列的首批型號將於 4 月在法國開始銷售,隨後將在歐洲銷售,隨後在亞洲銷售。

- 2021 年 6 月 - CIAT 推出新的空氣調節機(AHU) 系列 Clima Ciat。 CLIMACIAT 系列包括創新、節能、易於安裝的裝置,適用於各種商業應用。共有三種型號:Airtech、Airclean 和 Air access。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 該地區智慧城市的發展

- 更換現有設備並提高性能

- 市場限制因素

- 設備高成本

第6章 市場細分

- 按類型

- 單分體/多分體

- VRF

- 空氣調節機

- 冷卻器

- 扇子

- 其他類型

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按國家/地區

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Daikin Industries Limited

- Mitsubishi Electric Corporation

- Carrier Global Corporation

- Danfoss A/S

- Johnson Controls-Hitachi Air Conditioning

- Whirlpool Corp.

- Luvata Oy

- ROBERT Bosch GmbH

- Emerson Electric Co.

- Lennox International Inc

第8章投資分析

第9章 未來趨勢

The Europe Air Conditioning Equipment Market is expected to register a CAGR of 5.78% during the forecast period.

Key Highlights

- In line with European commitments toward an increase in energy efficiency, the United Kingdom and France developed a massive regulatory framework and binding targets for the industrial, transport, and building sectors over the past decade.

- For instance, Smart Buildings Alliance (SBA), an association in France, aims to promote the smart building industry in smart cities. The alliance has combined 170 organizations from different trades related to the construction industry (industrial companies, service companies, builders, developers, design offices, architects, developers, and innovative start-ups).

- The growing product innovations are further bolstering the adoption rate of the equipment. For instance, In February 2021, Carrier Global Corporation announced the launch of its new BluEdge service platform for Carrier and CIAT heating, ventilating, and air conditioning (HVAC) equipment in Europe. Carrier Global Corporation is a prominent global provider of healthy, safe, and sustainable building and cold chain solutions. The multi-tiered BluEdge service platform was created to accommodate specific customer needs and maintain equipment performance over the course of a product's lifecycle.

- The COVID-19 second wave has also impacted the supply chain for air conditioning equipment. The cost of air conditioning grew in 2021 due to supply limitations since the cost of raw materials to make HVAC equipment, such as steel, plastic, and aluminum, increased. Due to the high demand from other industries, such as smartphone and Electron Vehicle producers, the market also experienced a shortage of semiconductor supplies.

Europe Air Conditioning Equipment Market Trends

Industrial is Expected to Grow at a Signficant Rate

- Refrigeration is increasingly becoming one of the driving forces behind the smooth operations of essential industries worldwide and the adoption of process chillers in industrial settings. The industrial refrigeration sector comprises various processes, including chilling and low-temperature freezers. Its widespread applications have made it a large-scale industry.

- For instance, German manufacturer, Efficient Energy, introduced a new chiller with a 120kW (34.1TR) cooling capacity, suitable for industrial cooling and using only water (R718) as a refrigerant. As per the company, the new eChiller120 is up to 82% more energy-efficient than conventional chiller systems. The eChiller120 model is suitable for process and machine cooling applications, like laser heads, rollers, and cooling basins. It can also be used for technical air conditioning of data centers and server rooms. The eChiller is best equipped to produce chilled-water temperatures between 16°C (61°F) and 22°C (72°F).

- To create safe and healthy indoor settings, there is an increasing need for fresh air supply in commercial and industrial facilities. In February 2022, Daikin launched a new direct expansion coil module, model number EKVDX-A, compatible with Daikin's upgraded VAM-J8 decentralized ventilation unit and enabled the supply of fresh air while minimizing the heat load impact of fresh air on comfort air-conditioning systems. This innovative Daikin direct expansion coil module provides fresh and hygienic air in commercial and industrial settings.

- Further, in October 2021, Daikin announced Fusion25, the strategic management plan based on the social backdrop where pressing concerns such as global warming, energy scarcity, and the need for clean indoor air are prevalent. Regarding heating, ventilation, air conditioning, and refrigeration (HVAC-R), Daikin Europe wants to be a complete solutions provider throughout Europe, the Middle East, and Africa in the next five years (EMEA). The growth speed is aggressive, with a forecasted turnover of 5.7 billion Euros by the fiscal year 2025. Investments are being made to enhance its R&D Centers in Europe, increase production, sales, and service capabilities, and finance the growth of its business model's digitization.

United Kingdom is Analyzed to Register Significant Growth Rate

- In recent years, the UK ventilation and air conditioning market has benefited from growing health, safety, and energy efficiency legislation, revised building regulations, and environmental legislation. The UK government has also been actively participating in reducing the effects of climate change. This is expected to impact the adoption of HVAC equipment.

- By 2050, the government promises to have cut the UK's greenhouse gas emissions to zero. As a result of climate change's warming effects and the requirement to create a healthy indoor environment that fosters productivity at work, there is a difficulty that the demand for cooling in buildings during the summer is anticipated to increase. It is important to consider the best possible mix of passive and active cooling strategies to fulfill this rising demand cost-effectively and at net zero. The wider prospects and ramifications must be taken into account. For instance, using reversible heat pumps for cooling could increase the penetration of low-carbon space heating into the existing building stock.

- Adding to this, the growing collaborations in the country further contribute to the market growth rate. For instance, In November 2021, Balfour Beatty Kilpatrick and EJ Parker Technical Services have been contracted to deliver the Heating, Ventilation, and Air Conditioning (HVAC), a framework arrangement worth GBP150 to GBP250 million throughout the program. The HVAC package is the first of many contracts the partners will issue over the ensuing months as a part of a powerful framework lasting the following 18 years.

- In June 2022, Smith Brothers Stores announced a collaboration with Midea, a prominent international producer of HVAC products, for nationwide distribution. This agreement, which began in June 2022, has been carefully planned with consideration for consumer feedback to ensure that it compliments SBS's current air conditioning lineup and successful approach to market while eventually giving the customers additional options.

Europe Air Conditioning Equipment Industry Overview

The Europe Air Conditioning Equipment Market is competitive as it is home to prominent vendors with a major market share in different segments and access to well-established distribution networks. With the advent of smart solutions, it is expected to become another strategic competitive point in the market. The smart building technology incorporation across commercial and industrial sectors is expected to drive connected HVAC systems in Europe and increase the competitive rivalry among the vendors in the market.

- April 2022 - Johnson Controls-Hitachi Air Conditioning introduced the airHome smart household air conditioner series, equipped with several smart and intuitive capabilities that assist consumers in maintaining a comfortable indoor environment while enhancing IAQ and saving energy. Beginning in April in France, the first model in the airtime series is offered throughout Europe before being made available in Asia.

- June 2021- CIAT introduced CLIMACIAT, a new line of air handling units (AHUs). The CLIMACIAT line includes innovative, energy-efficient, and simple-to-install units for various commercial applications. It is offered in three models: Airtech, Airclean, and Air access.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Cities in the Region

- 5.1.2 Replacement of Existing Equipment with Better Performing Ones

- 5.2 Market Restraints

- 5.2.1 High Costs of Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Splits/Multi-Splits

- 6.1.2 VRF

- 6.1.3 Air Handling Units

- 6.1.4 Chillers

- 6.1.5 Fans

- 6.1.6 Other Types

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Limited

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Carrier Global Corporation

- 7.1.4 Danfoss A/S

- 7.1.5 Johnson Controls-Hitachi Air Conditioning

- 7.1.6 Whirlpool Corp.

- 7.1.7 Luvata Oy

- 7.1.8 ROBERT Bosch GmbH

- 7.1.9 Emerson Electric Co.

- 7.1.10 Lennox International Inc