|

市場調查報告書

商品編碼

1635362

亞太地區藥品包裝器材:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia-Pacific Pharmaceutical Packaging Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

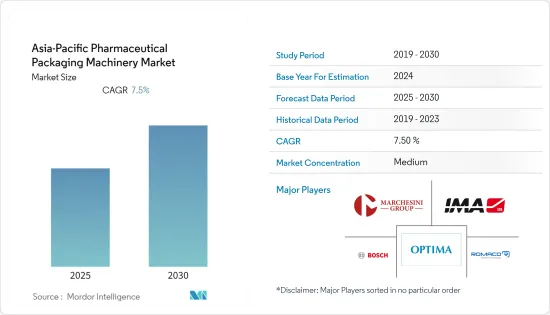

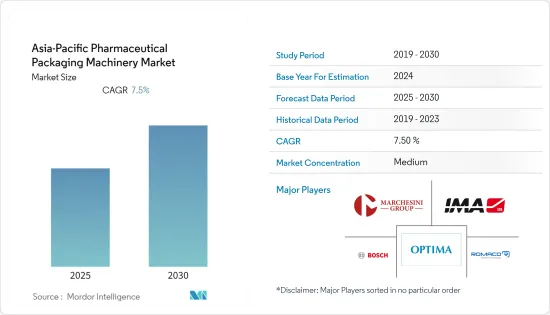

預計亞太地區藥品包裝器材市場在預測期內的複合年成長率為 7.5%。

主要亮點

- 藥品和藥物輸送系統的包裝在製藥業中至關重要。藥品包裝器材為藥品包裝提供安全和品質。

- 藥品包裝是指由相容材料製成的用於儲存和運輸藥品的包裝製品。根據藥物的性質,包裝產品選自多種產品和材料類型,以提供識別和保護並確保封裝藥物的完整性。因此,藥品包裝器材為藥品提供初級包裝、二級包裝、標籤和序列化解決方案。

- 由於工廠長期關閉和生產延誤導致供應鏈中斷,COVID-19 大流行的出現對市場產生了重大影響。

- 未來2-3年藥品包裝器材的需求將會增加。在 COVID-19 疫情期間,疫苗供應商擴大了產能以滿足不斷成長的需求。這種情況預計將為藥品包裝器材市場創造新的成長機會。

- 藥品包裝器材市場與藥品市場有著直接的相關性。因為新藥的需求不斷增加,增加了對包裝的需求,從而影響了所研究市場的成長。

亞太藥品包裝器材市場趨勢

製藥業安全標準和法規的存在預計將推動市場發展

- 製藥業使用的藥品包裝器材受到嚴格監管,並專注於安全性和永續性。在醫療保健領域,已經頒布了可追溯法來打擊假藥和醫療設備。

- 藥品包裝器材在藥品供應鏈中發揮著至關重要的作用。包裝器材有助於確保所有藥品的安全分發、追蹤和識別。

- 中國對藥品包裝器材的需求不斷增加。藥品包裝產品採用適合藥品運送儲存的材料製造。根據藥品的性質,包裝器材從不同的材料類型和產品類型中進行選擇,以提供保護和識別並確保封裝藥品的完整性。

- 國家監督管理局(NMPA)數據顯示,2021年我國新藥認證數量再創新高。 NMPA核准新藥61個,較2020年的46個增加。 「新藥」是指在中國首次核准的化學藥品或生物製藥,不包括適應症、劑型或組合。這為藥品包裝器材市場創造了更多的需求。

- 該行業依賴藥品包裝市場遵循嚴格的指導方針並提供專業和先進的技術。這種情況正在推動藥品包裝器材供應商進行技術創新,以提供複雜的解決方案來滿足最終用戶的需求。

- 多家公司正在實施先進的泡殼生產線以加快生產和產量。這些自動化整合生產線預計將泡殼包裝到所需的紙箱中並快速捆綁。

- 此外,一些領先的供應商已經實施了全面的解決方案,包括品質檢測、生產和包裝器材。這些平台包括各種設備,從序列化設備到泡殼/紙盒包裝機、壓平機錠劑以及追蹤應用程式。這些自動化解決方案減少了人機交互,並提供對精密、無污染設備的完美控制。

預計印度在預測期內將出現顯著成長

- 印度是全球非專利處方藥學名藥供應的領導者。印度製藥業滿足全球各種疫苗需求的 50% 以上、美國非專利藥需求的 40% 和英國所有藥品需求的 25%。

- 印度製藥業的顯著發展得益於多種因素,包括更嚴格的監管標準以及對人們健康管理和發明的重視。此外,對非處方藥的需求不斷增加以及精明的客戶群不斷成長也支持了印度市場的成長。

- 根據 2020 年 CPhI 製藥指數,印度是活性藥物原料藥(API) 製造和委外研發機構(CRO) 化學品服務外包的主要受益者,並被視為正在經歷中國的再平衡。印度已成為世界學名藥和疫苗的製藥製造地。例如,印度血清研究所是印度最大的疫苗生產商之一,向世界各地出口疫苗。

- 憑藉大量勞動力和WHO-GMP(品管生產規範)核准的生產原則等資源,印度在醫療藥品和產品的基礎製造方面比許多國家具有優勢。

- 此外,印度製藥公司正在吸引全球私募股權公司的大力投資,棕地製藥企業的外國直接學名藥%。例如,2021年8月,印度製藥商Cipla Limited和印度領先的合約藥品受託製造廠商(CDMO)Kemwell Biopharma宣布,他們將為全球市場開發、製造和銷售生物學名藥。

- 此外,該國的製藥公司正在積極提高生產能力,以應對不斷成長的市場需求。例如,燦盛製藥 (Centrient Pharmaceuticals) 於 2021 年 6 月宣布,已開始在其新的他汀類藥物製造廠進行生產,並在印度圖安薩 (Tuansa) 工廠建造了第二個專用工廠。該公司的目標是將他汀類藥物的產能提高一倍,以滿足對Atorvastatin和rosuvastatin原料藥日益成長的需求。

- 此外,隨著COVID-19疫苗的開發,合併後的公司已與一家包裝公司簽署了生產管瓶和注射器的協議。這種包裝趨勢是包裝器材市場的主要成長動力之一。

- 此外,隨著疫苗產能的擴大,相關包裝工程公司和OEM對無菌填充線的需求也隨之增加。由於這些趨勢,製藥包裝器材製造商正在推出具有模組化概念的完全整合系統和即插即用解決方案。

亞太地區藥品包裝器材產業概況

亞太地區藥品包裝器材市場競爭適中,由幾家主要公司組成,例如: Robert Bosch GmbH、Romaco Pharmatechnik GmbH、Optima Packaging Group GmbH、Marchesini、MULTIVAC Group、PAC Machinery Group 等。 。

- 2021年10月,Marchesini集團收購了Dott Bonapace,進入小規模工業生產業務。由此,Marchesini 集團收購了 Dott.Bonapace 70% 的股份,並利用管理膠囊和栓劑等專業產品的新技術擴大了其龐大的機器園區。

- 2021 年 2 月,Promach 收購了 Serpa Packaging Solutions,該公司是一家為製藥、醫療設備、營養品、食品、化妝品和個人護理市場提供裝盒系統和終端包裝系統的製造商。 Serpa 的加入為 Promac 的產品組合增添了自動化裝盒系統,擴大了其專業的二次包裝器材和生產線整合能力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- COVID-19對包裝器材產業的影響

- 市場促進因素

- 主要最終用戶市場的高需求

- 持續的技術發展

- 製藥業安全標準與法規的影響

- 市場限制因素

- 高成本和進口關稅對新客戶來說是一項挑戰

- 資本密集型製造流程

第5章技術概況

第6章 市場細分

- 按機器類型(概述、趨勢、主要趨勢、市場概述)

- 初級包裝

- 無菌灌裝封口設備

- 灌裝旋蓋設備

- 泡殼包裝設備

- 其他

- 二次包裝

- 裝盒設備

- 裝箱包裝設備

- 包裝設備

- 托盤包裝設備

- 其他

- 標籤和序列化

- 瓶子和安瓿的貼標和序列化設備

- 紙箱貼標系列設備

- 其他

- 初級包裝

- 按地區(概述、趨勢、主要趨勢、市場前景)

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他國家

第7章 競爭格局

- 公司簡介

- Robert Bosch GmbH

- Romaco Pharmatechnik GmbH

- Optima Packaging Group GmbH

- Marchesini

- Mesoblast

- IMA Industria Macchine Automatiche SpA

- MULTIVAC Group

- Ishida Co. Limited

- PAC Machinery Group

- Uhlmann Group

第8章投資分析

第9章 市場未來展望

The Asia-Pacific Pharmaceutical Packaging Machinery Market is expected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- Packaging pharmaceutical products and drug delivery systems are essential in the pharmaceutical industry. Pharmaceutical packaging machinery provides safety and quality in packaging pharmaceutical products.

- Pharmaceutical packaging refers to packaging products made by utilizing compatible materials that are used for the storage and transfer of drugs. Depending on the nature of the drug, packaging products are selected from a range of product types and material types to provide identification and protection and ensure the enclosed drug product's integrity. Thus, pharmaceutical packaging machinery offers primary packaging, secondary packaging, and labeling and serialization solutions for pharmaceuticals.

- The emergence of the COVID-19 pandemic has significantly impacted the market due to disruptions in the supply chain owing to extended factory closures and delayed production.

- The demand for pharmaceutical packaging machinery will increase over the next two to three years. During COVID-19, the vaccine suppliers have expanded their capacity to meet the rising demand. This scenario is expected to create new growth opportunities in the pharmaceutical packaging machinery market.

- The pharmaceutical packaging machinery market has a direct correlation with the pharmaceutical market. Any changes in demand for pharmaceutical drugs will positively impact the packaging machinery markets, as higher demand for new drugs leads to a greater need for packaging, thereby impacting the growth of the studied market.

APAC Pharmaceutical Packaging Machinery Market Trends

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- The Pharmaceutical packaging machinery used in the pharmaceutical sector is heavily regulated and emphasizes safety and sustainability. Traceability legislations across the healthcare sector have been established to counter counterfeit drugs and medical devices.

- Pharmaceutical packaging machinery plays an integral role in the wider pharmaceutical supply chain. Packaging machinery helps to ensure all pharmaceutical products are safely distributed, tracked, and identified.

- The demand for Pharmaceutical packaging machinery is growing in China. Pharmaceutical packaging products are made using compatible materials to transfer and store drugs. Depending upon the nature of the drug, packaging machinery is chosen from a range of material types and product types, providing, protection and identification and ensuring the enclosed drug product's integrity.

- According to National Medical Products Administration (NMPA), the number of new drug approvals in China hit a high record in 2021. 61 new drugs were approved by NMPA, up from 46 in 2020. "New drug" is defined in this article as new chemical drugs or new biological products approved for the first time in China, excluding any new indications, new dosage forms, or a new combination of approved drugs. This will create more demand for the pharmaceutical Packaging Machinery Market.

- The industry depends on the pharmaceutical packaging market, which follows strict guidelines and offers specialized, advanced technologies. The scenario is propelling providers of pharmaceutical packaging machinery to work on innovations to deliver sophisticated solutions to cater to end-users' needs.

- Several companies have introduced advanced blister lines to accelerate production and output. These automated, integrated lines are expected to package blisters into desirable cartons and bundle them quickly.

- Furthermore, some leading vendors have introduced holistic solutions involving quality inspection, production, and packaging machinery. These platforms involve various equipment, from serialization units to blister/carton packaging machinery and tablet presses to trace and track applications. These automated solutions reduce human-machine interactions and impeccably control high-precision, contamination-free equipment.

India is Expected to Register a Significant Growth During the Forecast Period

- India is leading in providing generic pharmaceuticals (generic drugs) globally. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the U.S., and 25% of all medicine in the U.K. Globally.

- In India, The pharmaceutical industry has evolved considerably, owing to various factors that include the growth in regulatory norms and focus on population health management and invention. In addition, the increase in the demand for over-the-counter medicines and a more informed customer base are also driving the market growth in India.

- According to the CPhI Pharma Index 2020, India is viewed as the primary beneficiary of active pharmaceutical ingredient (API) manufacturing and contract research organization (CRO) chemistry services outsourcing, rebalancing away from China. India has become a global pharmaceutical manufacturing hub for generic drugs and vaccines. For Instance, the Serum Institute of India is one of the largest vaccine manufacturers in India, exporting vaccines worldwide.

- India has a superior advantage, over many countries, in the basic manufacturing of medical drugs and products due to resources, such as a large workforce and WHO-GMP (Good manufacturing practices)-approved production principles.

- Further, India's pharmaceutical manufacturing organization has been strongly attracting investment from global private equity firms, which is driven by relaxations offered by the government, such as increasing the foreign direct investment (FDI) limit from 49% to 74% in brownfield pharma ventures and a thriving generic drugs market. For Instance, in August 2021, Cipla Limited, an Indian drugmaker, and Kemwell Biopharma, a large pharmaceutical contract manufacturing organization (CDMO) located in India, announced the signing of a joint venture agreement to develop, manufacture, and distribute biosimilars for the worldwide market.

- Furthermore, pharma companies in the country are actively increasing their manufacturing capacities due to increased demand in the market. For Instance, in June 2021, Centrient Pharmaceuticals announced that it had started manufacturing at its new statins manufacturing facility by building its second dedicated unit in the Toansa site in India. The company aims to double its statins production capacity to meet the growing demand for Atorvastatin and Rosuvastatin Active Pharmaceutical Ingredients.

- Moreover, it is observed that the development of COVID-19 vaccines has led the combined companies to set up agreements with packaging companies for manufacturing vials and syringes. Such packaging trends act is one of the major growth drivers in the packaging machinery market.

- Also, expanding vaccine capacities have led the allied packaging engineering companies and OEMs to witness increasing demand for aseptic filling lines. As a result of such trends, pharmaceutical packaging machinery players are launching completely integrated systems and plug-and-play solutions with modular concepts.

APAC Pharmaceutical Packaging Machinery Industry Overview

The Asia-Pacific Pharmaceutical Packaging Machinery Market is moderately competitive and consists of several major players such as Robert Bosch GmbH, Romaco Pharmatechnik GmbH, Optima Packaging Group GmbH, Marchesini, MULTIVAC Group, PAC Machinery Group, etc. In terms of market share, few major players currently dominate the market. Mergers and acquisitions among pharmaceutical packaging machinery industries drive the market's growth.

- In October 2021, Marchesini Group acquired Dott. Bonapace and entered the small industrial production business. With this move, Marchesini Group acquired 70% of the shares in Dott. Bonapace expanded its vast machine park with novel technologies that manage special products such as capsules and suppositories.

- In February 2021, ProMach acquired Serpa Packaging Solutions, a manufacturer of cartoning and end-of-line packaging systems for the pharmaceutical, medical device, nutraceutical, food, cosmetics, and personal care markets. The addition of Serpa brings automated cartoning systems into ProMach's portfolio and expands its specialized secondary packaging machinery and line integration capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of Substitute Products

- 4.3.4 Threat of New Entrants

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Packaging Machinery Industry

- 4.5 Market Drivers

- 4.5.1 High demand in key end-user markets

- 4.5.2 Ongoing technological developments

- 4.5.3 Impact of Safety Standards and Regulations in the pharmaceutical industry

- 4.6 Market Restraints

- 4.6.1 High costs and import duties pose a challenge for new customers

- 4.6.2 Capital Intensive manufacturing process

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Machinery Type (Overview, Forecasts, Key Trends and Market Outlook)

- 6.1.1 Primary Packaging

- 6.1.1.1 Aseptic Filling and Sealing Equipment

- 6.1.1.2 Bottle Filling and Capping Equipment

- 6.1.1.3 Blister Packaging Equipment

- 6.1.1.4 Others

- 6.1.2 Secondary Packaging

- 6.1.2.1 Cartoning Equipment

- 6.1.2.2 Case packaging Equipment

- 6.1.2.3 Wrapping Equipment

- 6.1.2.4 Tray Packing Equipment

- 6.1.2.5 Others

- 6.1.3 Labelling and Serialization

- 6.1.3.1 Bottle and Ampule Labelling and Serialization Equipment

- 6.1.3.2 Carton Labelling and Serialization Equipment

- 6.1.3.3 Others

- 6.1.1 Primary Packaging

- 6.2 By Region (Overview, Forecasts, key Trends and Market Outlook)

- 6.2.1 China

- 6.2.2 India

- 6.2.3 Japan

- 6.2.4 South Korea

- 6.2.5 Rest of APAC

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GmbH

- 7.1.2 Romaco Pharmatechnik GmbH

- 7.1.3 Optima Packaging Group GmbH

- 7.1.4 Marchesini

- 7.1.5 Mesoblast

- 7.1.6 I.M.A Industria Macchine Automatiche S.p.A

- 7.1.7 MULTIVAC Group

- 7.1.8 Ishida Co. Limited

- 7.1.9 PAC Machinery Group

- 7.1.10 Uhlmann Group