|

市場調查報告書

商品編碼

1635381

軸流泵和混流泵:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Axial and Mixed Flow Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

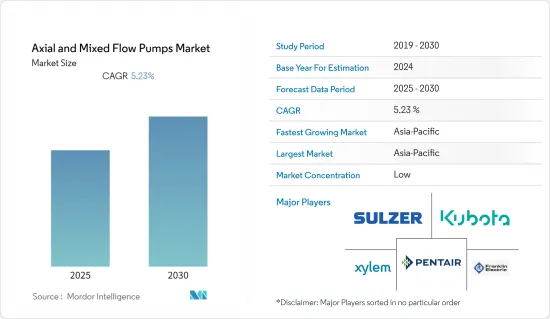

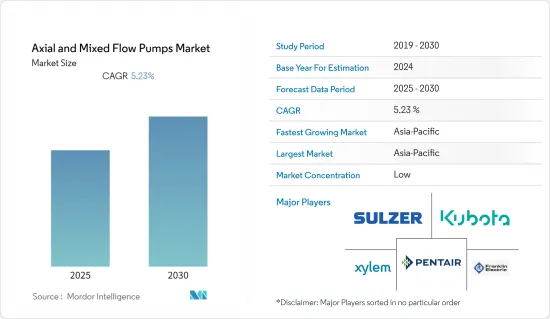

軸流泵和混流泵市場預計在預測期內複合年成長率為 5.23%。

主要亮點

- 軸流泵和混流泵用於污水處理廠、灌溉和防洪。這些泵浦在農業中用於將水從水庫抽到田地或從區域中去除不需要或多餘的水。此外,在地方政府水處理中,它們有助於將水和液體輸送到各種輸送系統和水庫。這些因素預計將推動軸流泵和混流泵市場向前發展。

- 此外,諸如具有最小壓力要求的高低速、具有相對較低揚程的增強排出速度、以及能夠以最小動態損失有效且高效地進行調節的能力等優點,使得世界上軸流泵的發展做出了貢獻。所有這些因素結合起來增加了軸流泵的需求並推動了全球市場的成長。

- 例如,2021年3月,賽萊默宣佈在水世界掀起波瀾。 Xylem Water Solutions India Pvt Ltd 是 Xylem Inc. 的完全子公司,正在印度迅速擴張。該公司提供整個水循環的創新產品和解決方案,從水提取到淨化、儲存、分配和污水管理,幫助公共工程、住宅、商業建築服務、工業和農業環境中的客戶進行運輸、處理、測試和製造。

- 此外,軸流泵在灌溉、漁業、排水等農業領域的使用是世界主要市場趨勢。此外,人口成長對作物生產的需求增加,軸流泵廣泛用於灌溉。

- 由於軸流泵和混流泵市場對化學、石化、漁業和其他行業的依賴,因此受到了 COVID-19 爆發的負面影響。中國國家統計局發布的報告顯示,2020年3月化工產業產量下降20%,但預計2021年終將進一步增加。

軸流泵和混流泵的市場趨勢

對能源燃料的需求增加

- 隨著人們環保意識的增強以及政府在水和污水處理方面的投資更加積極主動,軸流和混流泵市場預計將會成長。此外,對能源燃料的需求不斷增加也是該市場的成長趨勢。國內運輸和國際物流對原油的需求不斷增加,陸地和海上燃料探勘預計將變得更加活躍。

- 印度是世界第三大能源和石油消費國。截至2021年5月1日,印度精製能力為259.3MMT(百萬噸),是亞洲第二大精製國。到 2040 年,印度計劃將產能增加至 667 MTPA(每年百萬噸)。

- 此外,到 2040 年,印度的能源需求預計將加倍,達到 1,123 Mtoe(百萬噸油當量)。燃料需求的增加預計將推動產品在石油和天然氣、電力、水和污水處理等廣泛的最終用戶產業的採用。

- 國際能源總署 (IEA) 預計,隨著更多國家競相尋求替代燃料來源以改善因烏克蘭戰爭而降低的能源安全,煤炭投資將在 2021 年成長 10%。

- 此外,根據中國中央政府的說法,中國的目標是到2025年擁有5萬輛燃料電池汽車上路,並在同年利用可再生能源每年生產10萬至20萬噸氫氣。預計這將成為市場成長的進一步驅動力。

亞太地區預計將佔據主要市場佔有率

- 軸流和混流泵市場預計將主要受到強勁投資環境的推動,尤其是在水處理設施方面。預計亞太地區將在全球軸流泵市場中佔據重要佔有率,大規模探勘活動將在陸上和海上進行,主要是在傳統型石油和天然氣領域。這增加了軸流泵的需求斜率。

- 此外,2021 年該地區在製造業和建設業中佔據很大一部分,預計未來幾年將進一步成長。雖然該地區在市場佔有率方面對製造商有利,但它的特點還在於人事費用低和政府支持力度加大。中國和印度在內部製造轉移方面尤其成功。

- 例如,據 IBEF 稱,2021 年 9 月,政府核准了一項價值 2605.8 億盧比(35.3 億美元)的 PLI 計劃,用於汽車和無人機行業,以提高印度的製造能力。這些舉措將進一步推動該地區的研究市場。

- 此外,2021 年 11 月 19 日,莫迪總理在佔西為價值 40 億盧比(5,373 萬美元)的北方邦國防工業走廊計劃奠基。

- 該地區成長的另一個原因是技術進步和創新極大地增強了該地區的工業足跡。預計在預測期內將推動軸流泵和混流泵市場的需求。例如,根據印度品牌資產基金會的數據,2022 年 2 月印度的技術支出成長了 8.7%。這是亞太地區最快的成長率。 2021 年,印度科技領導者在硬體上的支出將比 2020 年增加 7%。

軸流泵和混流泵產業概述

由於賽萊默公司、富蘭克林電氣公司、荏原公司、蘇爾壽有限公司和濱特爾公司等大公司的存在,全球軸流泵和混流泵市場競爭非常激烈。領先公司正在開發先進技術並推出新產品,以保持市場競爭力。

- 2021 年 11 月 - 蘇爾壽宣布向 Calysseo 位於中國重慶的工廠交付用於環管反應器的高流量軸流泵,以支持亞洲水產飼料行業創新生物蛋白的生產。蘇爾壽針對就地清洗 (CIP) 客製化了泵浦設計,以抵抗腐蝕和侵蝕,因為液體中含有夾帶的氣體和固態。

- 2021 年 8 月 -工業IoT解決方案供應商 AMI World 宣布與格蘭富集團的完全子公司Peerless Pump Company 合作,專門從事 UL 和 FM 認證的消防泵浦系統的設計和製造。隨著 Peerless FireConnect 的推出,這項合作夥伴關係為世界各地的消防泵浦系統帶來了物聯網連接和狀態監控。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 創新石油和天然氣產業

- 對能源燃料的需求增加

- 市場限制因素

- 軸流泵不適合處理高黏度流體。

第 6 章 細分

- 按流量類型

- 軸流式

- 徑向

- 混合物

- 依階段數

- 單級

- 多級

- 按最終用戶產業

- 石油和天然氣

- 化學

- 飲食

- 用水和污水

- 藥品

- 發電

- 建造

- 金屬/礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東和非洲

- 北美洲

第7章 競爭狀況

- 公司簡介

- Xylem, Inc.

- Franklin Electric

- Sulzer Ltd.

- Kubota Corporation

- Pentair plc

- Torishima Pump Manufacturing Co Ltd

- Ebara Corporation

- Weir Group PLC

- Hayward Tyler

- Peerless Pump Company

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91591

The Axial and Mixed Flow Pumps Market is expected to register a CAGR of 5.23% during the forecast period.

Key Highlights

- Axial and mixed flow pumps are used in sewage treatment plants, irrigation, and flood control. These pumps are used in agriculture to pump water from reservoirs to fields and to remove unwanted or excess water from areas. Furthermore, it can be used in municipal water treatment to help drive water or fluids to different conveyor systems or reservoirs. These factors are expected to propel the axial, and mixed flow pumps market forward.

- Furthermore, advantages such as high low rate with minimal pressure requirement, enhanced discharge rate with the relatively low velocity of head, and they can be adjusted to run effectively and efficiently with minimal aerodynamic loss are contributing to the growth of global axial flow pumps. All of these factors combine to increase the demand for axial flow pumps, thereby boosting the global market growth.

- For instance, in March 2021, Xylem announced that it was making waves in the world of water. The Xylem Water Solutions India Pvt Ltd, a wholly-owned subsidiary of Xylem Inc, has expanded rapidly in India. The company offers innovative products and solutions across the entire water cycle - from extraction to purification and storage to distribution and wastewater management - allowing customers to transport, treat, test, and efficiently use water in public utility, residential and commercial building services, as well as industrial and agricultural settings.

- Moreover, the use of axial flow pumps in agricultural sectors such as irrigation, fisheries, and drainage is a key market trend in the global market. Furthermore, rising population has increased demand for crop production, where axial flow pumps are widely used for irrigation.

- The axial and mixed flow pump market has been negatively influenced due to the COVID-19 pandemic, owing to its dependence on chemical, petrochemical, fisheries, and other sectors. According to a report published by the National Bureau of Statistics of China, the chemical industry witnessed a 20% decline in production in March 2020, which is expected further increase by the end of 2021.

Axial & Mixed Flow Pumps Market Trends

Rising Demand for Energy Fuel

- The axial and mixed flow pumps market is expected to grow as people become more environmentally conscious and governments are willing to invest in water and wastewater treatment. Furthermore, the rising demand for energy fuel is a growing trend in this market. Demand for crude oil in domestic transportation and international logistics is increasing, which is expected to stimulate onshore and offshore fuel exploration.

- India is the world's third-largest consumer of both energy and oil. India's oil refining capacity was 259.3 MMT (million metric tonnes) as of May 1, 2021, making it Asia's second-largest refiner. By 2040, India plans to increase this capacity to 667 MTPA (million tonnes per annum).

- Also, by 2040, India's energy demand is expected to double to 1,123 Mtoe (million tonnes of oil equivalent). The increased demand for fuel is expected to drive product adoption across a wide range of end-user industries, including oil and gas, power, water, and wastewater treatment.

- According to the International Energy Agency, investment in coal is expected to increase by 10% by 2021 as a growing number of countries race to secure alternative fuel sources to improve energy security, which the Ukraine war has reduced.

- Further, according to China's central government, the country aims to have 50,000 fuel-cell vehicles on the road by 2025 and produce 100,000-200,000 tonnes of hydrogen annually from renewable sources by the same year. This will further drive the market growth.

Asia Pacific is Expected to Hold Significant Market Share

- The axial and mixed flow pumps market would be primarily driven by a robust investment environment, particularly in water treatment facilities. With major exploration activities underway in both onshore and offshore formats, primarily in the unconventional oil and gas sector, Asia Pacific is bound to have a significant slice of the global axial flow pump market pie. This raises the demand slope for axial flow pumps.

- Furthermore, the region accounted for a sizable portion of manufacturing and construction industries in 2021 and is expected to grow further in the coming years. While it is profitable for manufacturers in terms of market share, it is also distinguished by low labor costs and increasing government support. China and India, in particular, successfully shift the manufacturing industry to themselves.

- For instance, according to IBEF, in September 2021, the government approved the PLI scheme worth Rs. 26,058 crores (USD 3.53 billion) for the auto and drone industries to boost India's manufacturing capabilities. These initiatives further drive the studied market in the region.

- Moreover, On November 19, 2021, Prime Minister Mr. Narendra Modi laid the foundation stone for the Uttar Pradesh Defence Industrial Corridor project worth Rs. 400 crores (USD 53.73 million) in Jhansi, which further boosted the studied market.

- Other reasons for the region's growth include technological advancements and innovations that greatly empower the region's foothold for industrialization. It is expected to drive demand for the Axial and Mixed Flow Pump Market during the forecast period. For instance, According to the India Brand Equity Foundation, in February 2022, India's technology spending increased by 8.7 % in 2022. This is the fastest rate of growth in the Asia Pacific region. In 2021, India's tech leaders spent 7% more on hardware than in 2020.

Axial & Mixed Flow Pumps Industry Overview

The global axial and mixed flow pump market is competitive in nature because of the presence of major players like Xylem Inc., Franklin Electric, Ebara Corporation, Sulzer Ltd., and Pentair Plc, among others. Major companies are developing advanced technologies and launching new products to stay competitive in the market.

- November 2021- Sulzer announced a High-flow axial pump for a loop reactor to Calysseo's facility in Chongqing, China, to aid in producing an innovative bio-protein for the Asian aquafeed industry. Sulzer adjusted the pump design for clean-in-place (CIP) and to withstand corrosion and erosion, as the broth contains entrained gases and solids.

- August 2021- AMI Global, a provider of industrial IoT solutions, has announced a collaboration with Peerless Pump Company, a wholly-owned subsidiary of the Grundfos Group that specializes in the design and manufacture of UL-listed and FM-approved fire pump systems. With the launch of Peerless FireConnect, the partnership brings IoT connectivity and condition monitoring to fire pump systems worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovative Oil & Gas Industry

- 5.1.2 Rising Demand for Energy Fuel

- 5.2 Market Restraints

- 5.2.1 Axial flow pumps are not suitable for handling highly viscous fluids

6 SEGMENTATION

- 6.1 By Flow Type

- 6.1.1 Axial

- 6.1.2 Radial

- 6.1.3 Mixed

- 6.2 By Number of Stages

- 6.2.1 Single Stage

- 6.2.2 Multi Stage

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemicals

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Pharmaceuticals

- 6.3.6 Power Generation

- 6.3.7 Construction

- 6.3.8 Metal & Mining

- 6.3.9 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.2.5 Russia

- 6.4.2.6 Rest of the Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Australia & New Zealand

- 6.4.3.6 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Chile

- 6.4.4.4 Rest of the Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Turkey

- 6.4.5.4 Rest of the Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xylem, Inc.

- 7.1.2 Franklin Electric

- 7.1.3 Sulzer Ltd.

- 7.1.4 Kubota Corporation

- 7.1.5 Pentair plc

- 7.1.6 Torishima Pump Manufacturing Co Ltd

- 7.1.7 Ebara Corporation

- 7.1.8 Weir Group PLC

- 7.1.9 Hayward Tyler

- 7.1.10 Peerless Pump Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219