|

市場調查報告書

商品編碼

1641939

幫浦 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

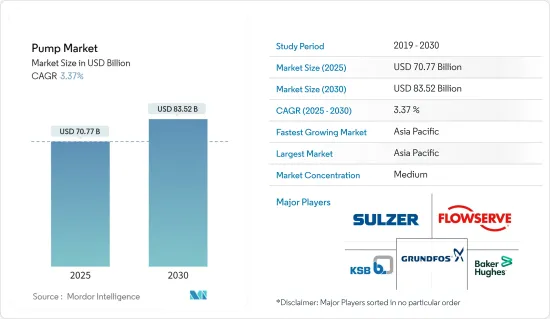

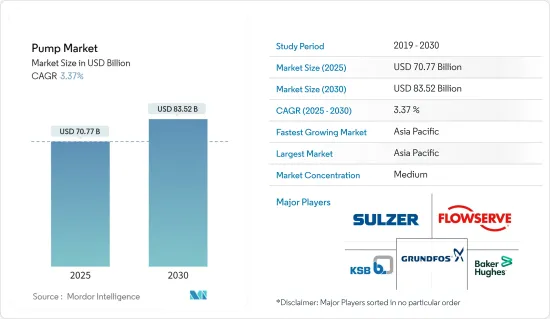

預計 2025 年泵浦市場規模為 707.7 億美元,預計到 2030 年將達到 835.2 億美元,預測期內(2025-2030 年)的複合年成長率為 3.37%。

關鍵亮點

- 從長遠來看,基礎設施建設的不斷加強以及對用水和污水管理的日益重視預計將推動泵浦市場的發展。

- 然而,預測期內鋼鐵、鐵和各種金屬等原料價格的波動預計將阻礙市場成長。

- 根據行業概況,新興經濟體的快速都市化和工業化正在為供水和工業程泵創造巨大的成長機會。

- 預計預測期內亞太地區將佔據主導市場佔有率。這一成長主要得益於印度、中國和日本等國家對終端產業投資的增加。

泵浦市場趨勢

石油和天然氣行業預計將經歷顯著的市場成長

- 產業趨勢表明,石油和天然氣產業對泵浦的需求是由提取和加工碳氫化合物的需求所驅動。隨著全球能源需求持續上升,人們的注意力轉向探勘和生產活動以滿足這一需求。泵浦在原油開採、油井刺激和精製以及石油和天然氣運輸等各種過程中都至關重要,從而推動了市場成長。

- 特別是在美國,頁岩氣革命極大地推動了對泵浦的需求。水力壓裂法涉及將大量水化學品和支撐劑以高壓泵入頁岩地層以提取天然氣。該過程高度依賴泵,從而推動了對高壓泵送設備的需求。

- 從行業角度來看,海上石油和天然氣活動(包括探勘鑽井和生產)由於其具有挑戰性的操作條件通常需要專用泵。泵浦用於海水取水、注入、冷卻系統、管道運輸和其他關鍵過程。對成熟地區和新興地區的海上蘊藏量的日益關注,為泵浦製造商創造了巨大的市場機會

- 根據世界能源統計,2021-2022年全球原油產量成長4.2%。根據關鍵產業資料詳細顯示,2022 年全球原油總產量為 9,384.8 萬桶/日,而 2021 年為 9,007.6 萬桶/日。資料顯示,全球石油需求和原油產量正在增加。

- 泵浦在石油和天然氣作業中不斷使用,因此需要維護、維修服務,有時還需要定期更換。 2023 年 6 月,Cereros Flow Technologies 與 ONGC 簽署契約,為其在印度的石油和天然氣資產網路提供泵浦維護和備件服務。

- 考慮到這些因素,由於石油和天然氣產業仍然是滿足全球能源需求的關鍵產業,泵浦市場將實現大幅成長。因此,預計該部分將在預測期內推動全球市場的發展。

亞太地區可望主導市場

- 亞太地區正在經歷強勁成長,例如中國、印度和東南亞等國家。製造業、建設業、採礦業和發電業等行業的擴張對各種應用領域的泵浦產生了巨大的需求,包括供水和廢水管理以及製程工業。

- 該地區也正在成為全球製造地,其中中國、日本、韓國和印度等國家發揮關鍵作用。製造業需要泵浦用於各種應用,包括流體處理、化學加工和工業製程。該地區在製造業的主導地位推動了對泵浦的需求,進一步鞏固了其在研究市場中的地位。

- 亞太地區正在快速發展,人口激增,都市化進程顯著加速。這種人口變化將導致對水衛生和基礎設施建設所需泵浦的需求增加。亞太地區的石油和天然氣產業正在經歷強勁成長。中國、印度和印尼等國家正在活性化探勘和生產活動,需要用泵浦進行開採、運輸和精製過程。該地區石油和天然氣行業的擴張正在加強其主導地位。

- 根據《世界能源統計評論》的市場資料,亞太地區天然氣產量預計在 2021 年至 2022 年期間成長 1% 以上,在 2012 年至 2022 年期間成長 3% 以上,從而推動該地區的石油和天然氣探勘和生產活動地區。

泵業概況

根據行業概況,泵浦市場適度細分。該市場的主要企業(不分先後順序)包括 Flowserve Corporation、Grundfos Holding AS、KSB SE &Co.KGaA、Sulzer Ltd 和 Baker Hughes Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 市場促進因素

- 加強基礎建設

- 更重視用水和污水管理

- 市場限制

- 原物料價格波動

- 市場促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 離心式幫浦

- 正排量泵

- 按最終用戶

- 石油和天然氣

- 用水和污水

- 化工和石化

- 礦業

- 發電

- 其他

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 俄羅斯

- 北歐的

- 義大利

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Flowserve Corporation

- Grundfos Holding AS

- KSB SE & Co. KGaA

- ITT Inc.

- Sulzer Ltd

- Ebara Corporation

- Weir Group PLC

- Schlumberger Ltd

- Baker Hughes Company

- Clyde Union Inc.

- Dover Corporation

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 新興經濟體快速都市化與工業化

簡介目錄

Product Code: 62632

The Pump Market size is estimated at USD 70.77 billion in 2025, and is expected to reach USD 83.52 billion by 2030, at a CAGR of 3.37% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing infrastructure development activities coupled with a rising emphasis on water and wastewater management are expected to drive the pump market.

- On the other hand, volatility in raw material prices, such as steel, iron, and various metals, is expected to hinder the market's growth during the forecast period.

- The industry overview indicates that the rapid urbanization and industrialization in emerging economies present a substantial growth opportunity for pumps for water supply and industrial processes.

- Asia-Pacific is expected to dominate the market share during the forecast period. This growth rate is attributed to increasing investments across end-use industries in countries including India, China, and Japan.

Pump Market Trends

Oil and Gas Sector Expected to Witness Significant Market Growth

- The industry trends highlight that the demand for pumps in the oil and gas industry is driven by the need to extract and process hydrocarbons. As global energy demand continues to rise, there is a growing focus on exploration and production activities to meet this demand. Pumps are crucial in various processes such as crude oil extraction, well-stimulation refining, and transportation of oil and gas, thereby driving the growth of the market.

- The shale gas revolution, particularly in the United States, has significantly boosted the demand for pumps. Hydraulic fracturing or fracking requires large volumes of water chemicals and proppants to be pumped into shale formations to extract natural gas at high pressure. This process heavily relies on pumps, driving the demand for high-pressure pumping equipment.

- The industry outlook indicates that the offshore oil and gas activities, including exploration drilling and production, often require specialized pumps due to the challenging operating conditions. Pumps are utilized for seawater intake, water injection, cooling systems, pipeline transport, and other critical processes. The increasing focus on offshore reserves both in established and emerging regions creates a substantial market opportunity for pump manufacturers.

- A statistical review of world energy shows that global oil production increased by 4.2% between 2021 and 2022. In 2022, the total crude oil production globally was 93,848 thousand barrels per day compared to 90,076 thousand barrels per day in 2021, as detailed by key industry information. This data signifies the increasing oil demand and crude oil production globally.

- As the pumps are used in a continuous way in oil and gas operations, they need maintenance, repair services, and sometimes replacements at regular intervals. In June 2023, Celeros Flow Technology made an agreement with ONGC to provide pump maintenance and spares services across a network of crude oil and natural gas assets in India.

- Considering these factors, the oil and gas sector is poised to experience significant growth in the pump market as it continues to be the crucial industry for meeting global energy needs. Therefore, this sector is expected to drive the global market studied during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is experiencing robust growth in countries such as China, India, and Southeast Asia. Expanding industries such as manufacturing, construction, mining, and power generation require a substantial demand for pumps across various applications, including water supply wastewater management and process industries.

- The region has also emerged as a global manufacturing hub, with countries like China, Japan, South Korea, and India playing a significant role. The manufacturing sector requires pumps for various applications, including fluid handling, chemical processing, and industrial processes. The region's dominance in manufacturing drives the demand for pumps, further solidifying its position in the market studied.

- Asia-Pacific has a large and rapidly growing population accompanied by a significant increase in urbanization. This demographic shift leads to increased demand for water supply sanitation systems and infrastructure development, all of which require pumps. Asia-Pacific is experiencing significant growth in the oil and gas industry. Countries like China, India, and Indonesia have been increasing their exploration and production activities, requiring pumps for extraction, transportation, and refining processes. The expansion of the oil and gas sector in the region strengthens its dominance.

- Market data from the statistical review of world energy indicates that gas production in Asia-Pacific increased by more than 1% between 2021 and 2022 and more than 3% between 2012 and 2022, signifying the increased oil and gas exploration and production activities in the region.

Pump Industry Overview

The industry profile shows that the pump market is moderately fragmented. Some of the major players in this market (in no particular order) include Flowserve Corporation, Grundfos Holding AS, KSB SE & Co. KGaA, Sulzer Ltd, and Baker Hughes Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Increasing Infrastructure Development

- 4.5.1.2 Rising Emphasis Water and Wastewater Management

- 4.5.2 Market Restraints

- 4.5.2.1 Volatility in Raw Material Prices

- 4.5.1 Market Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Centrifugal Pump

- 5.1.2 Positive Displacement Pump

- 5.2 By End User

- 5.2.1 Oil and Gas

- 5.2.2 Water and Wastewater

- 5.2.3 Chemicals and Petrochemicals

- 5.2.4 Mining Industry

- 5.2.5 Power Generation

- 5.2.6 Other End Users

- 5.3 By Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Spain

- 5.3.2.4 United Kingdom

- 5.3.2.5 Russia

- 5.3.2.6 NORDIC

- 5.3.2.7 Italy

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Flowserve Corporation

- 6.3.2 Grundfos Holding AS

- 6.3.3 KSB SE & Co. KGaA

- 6.3.4 ITT Inc.

- 6.3.5 Sulzer Ltd

- 6.3.6 Ebara Corporation

- 6.3.7 Weir Group PLC

- 6.3.8 Schlumberger Ltd

- 6.3.9 Baker Hughes Company

- 6.3.10 Clyde Union Inc.

- 6.3.11 Dover Corporation

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Urbanization and Industrialization in Emerging Economies

02-2729-4219

+886-2-2729-4219