|

市場調查報告書

商品編碼

1635397

拉丁美洲的正排量幫浦:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)Latin America Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

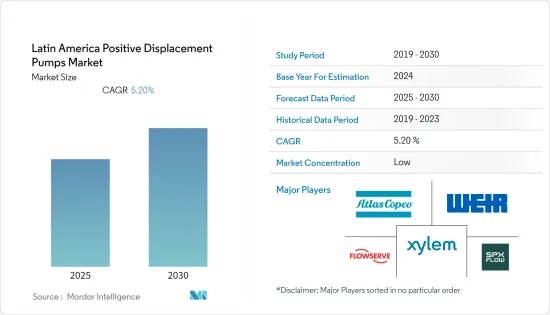

拉丁美洲正排量幫浦市場預計在預測期內複合年成長率為 5.2%。

主要亮點

- 拉丁美洲自然資源豐富。因此,採礦業對各國經濟極為重要。石油和天然氣行業是主要的最終用戶,但發電、水和用水和污水、建築、化學加工、食品和飲料、製藥、金屬和採礦等其他行業也推動了銷售。

- COVID-19 疫情對拉丁美洲的石油、天然氣和電力生產產生了重大影響。由於供應鏈中斷和計劃建設活動的延誤,整個全部區域正排量幫浦的需求正在減少。預計正排量幫浦市場的幫浦銷售可能會在 COVID-19 大流行結束後恢復。該地區工業化的進一步發展、建設計劃數量的增加和採礦活動的活性化是推動拉丁美洲容積泵需求的主要因素。

- 工業部門產生的污水處理需求的增加和地下水位下降可能會推動未來對正排量幫浦的市場需求。正排量泵浦具有高黏度、固態吞吐量、效率和精確的重複性,所有這些都有助於市場成長。

- 此外,拉丁美洲等新興地區的民用供水基礎設施正在迅速發展,對正排量泵的需求正在增加。公共部門和工業部門對污水處理的需求都在顯著增加,安裝的泵浦組數量也在增加。海水淡化和零液體排放(ZLD)等技術預計將推動民用和工業領域的正排量泵市場。

拉丁美洲正排量幫浦市場趨勢

石油和天然氣產業推動正排量幫浦市場

- 作為最大的最終用戶之一,石油和天然氣行業正在推動正排量泵的銷售。在 COVID-19 爆發導致該地區經濟嚴重衰退後,國家法律體制和法規的改革對於泵浦銷售的恢復至關重要。由於該地區重點開發油氣資源和基礎化學品的普遍需求,正排量幫浦製造商具有誘人的市場前景。

- 此外,容積泵廣泛應用於委內瑞拉、巴西和墨西哥等國家的石油和天然氣產業。這些泵浦用於探勘和精製目的。此外,頁岩氣探勘和液化天然氣等石油和天然氣行業的投資可能會推動拉丁美洲地區對正排量泵的需求。

- 此外,秘魯和智利等拉丁美洲國家的採礦活動不斷增加,增加了對正排量泵浦的需求,特別是對現有泵浦的維修和維護。智利和秘魯似乎也有資本投資的機會。因此,這些因素預計將在整個預測期內推動市場成長。

- 儘管材料價格的供需趨勢正在放緩,但石油和天然氣行業預計在預測期內對正排量泵的需求龐大。這是由於世界各地對頁岩氣的持續投資。人們越來越重視安裝小容量液化天然氣終端,導致石油生產商投資減少,對正排量幫浦的需求增加。

巴西是拉丁美洲容積泵市場最具優勢的國家

- 巴西是拉丁美洲正排量幫浦市場的主要收益國。這是因為企業數量增加導致飲用水量減少,地下水污染加劇。此外,由於一次性水量減少和地下水污染,正排量泵浦的使用不斷增加,預計將進一步加速市場擴張。

- 根據世界綜合貿易解決方案統計,在拉丁美洲,巴西的容積泵主要出口到玻利維亞、智利和巴拉圭。緊隨其後的是美國、阿根廷和德國。主要目的國中,美國和德國的出貨量成長最為顯著,而其他主要國家的成長速度則較慢。

- 2020 年 6 月,Netch Pump & Systems(巴西)從 Exton美國子公司交付了第 100 萬台泵浦。泵浦在我們位於德國 Waldkreiburg 的總部製造,是一款用於高密度固態的 Nemo 蛇形泵浦。這些零件在巴西內奇工廠設計和製造,然後對泵浦進行組裝、測試並運往美國。

- 此外,根據 Indexbox 的數據,2020 年巴西容積泵和手動泵的國外進口量增加。期間進口急劇增加。成長最快的是2009年,當時進口量增加。預計2020年進口將達到峰值,短期內可望穩定成長。

拉丁美洲正排量泵產業概況

拉丁美洲正排量幫浦市場是一個高度分散的市場。該市場的主要企業包括福斯公司、阿特拉斯·科普柯和賽萊默公司。

- 2021 年 3 月 - Abel Pumps 被 IDEX Corporation 收購,該公司為採礦、船舶、電力、水和用水和污水以及其他一般行業等各種終端行業製造高度工程化的往復式正排量泵。

- 2021 年 1 月 - 阿特拉斯·科普柯可攜式能源公司擴大了脫水泵產品線,推出了 30 多款新型重型、大容量泵。我們推出了一款新型活塞正排量泵,可以乾運轉而不會損壞內部零件。非常適合中等水量和深度的井點應用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 石油和天然氣產業的持續需求

- 一次性水位嚴重短缺和地下水污染推動市場

- 市場挑戰

- 傳統最終用戶產業市場飽和

第6章 市場細分

- 按類型

- 往復泵

- 隔膜

- 活塞

- 柱塞

- 旋轉泵

- 齒輪

- 長袍

- 擰緊

- 葉片

- 蠕動幫浦

- 漸進空洞

- 往復泵

- 按最終用戶

- 石油和天然氣

- 化學

- 飲食

- 用水和污水

- 製藥

- 電力

- 其他

- 按地區

- 巴西

- 哥倫比亞

- 墨西哥

第7章 競爭格局

- 公司簡介

- Atlas Copco

- The Weir Group PLC

- Flowserve Corporation

- Xylem Inc.

- SPX FLOW, Inc

- Colfax

- IDEX

- Abel Pumps

- Dover Corporation

- Tsurumi Pump

- Pentair Plc

- Alfa Laval AB

第8章投資分析

第9章 未來市場展望

簡介目錄

Product Code: 91648

The Latin America Positive Displacement Pumps Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Latin America has an abundance of natural resources. As a result, the extractive industry is critical to the economies of the countries. Although the oil and gas industry is the major end-user, sales are also driven by other industries including as power generation, water and wastewater, construction, chemical processes, food and beverage, pharmaceuticals, and metals and mining.

- The COVID-19 pandemic has had a significant effect on the production of oil, gas, and electricity in Latin America. Positive displacement pumps are in less demand throughout the region as a result of supply chain interruptions and delays in project construction activity. Also, It was expected that positive displacement pump market pump sales will likely resume after the end of COVID-19 pandemic. Further rising industrialization, increased construction projects, and increased mining activity in the region are the primary drivers boosting demand for positive displacement pumps in Latin America.

- The rising need to treat wastewater created by the industrial sector, along with declining groundwater levels, will drive market demand for positive displacement pumps in the future. Positive displacement pumps have high viscosity, solids handling capability, efficiency, and accurate repeatable measurement, all of which contribute to market growth.

- Additionally, The rapid development of civic water utility infrastructure in emerging regions such as Latin America has led to increased demand for positive displacement pumps. The demand for sewage treatment has increased massively in both public and industrial sectors with increased number of pumping units installed base. Technologies such as desalination and ZLD (zero-liquid discharge) is expected to boost the market for positive displacement pumps market in civic and industrial sectors.

Latin America Positive Displacement Pumps Market Trends

Oil and Gas Industry drives Positive Displacement Pumps Market

- As one of the largest end-user, the oil and gas industry drives positive displacement pump sales. Following a devastating drop in the region's economy as a result of the COVID-19 outbreak, reforms in each country's legal frameworks and regulations are critical to reviving pump sales. Positive displacement pump manufacturers have an appealing market outlook due to regional attention to the development of oil and gas resources as well as the general requirement for basic chemicals.

- Moreover, positive displacement pumps are widely used in the oil and gas industries of nations such as Venezuela, Brazil, and Mexico. These pumps are utilized for both exploratory and refining purposes. Furthermore, investments in the oil and gas sector, such as shale gas exploration and liquefied natural gas, are likely to drive demand for positive displacement pumps in Latin American regions.

- Further, mining activity in Latin American countries such as Peru and Chile has increased the demand for positive displacement pumps, particularly for the repair and maintenance of existing pumps. Chile and Peru are likely to present a combined opportunity for capital expenditure. As a result, these factors are likely to promote market growth throughout the forecast period.

- Despite the slowing trend in material price supply and demand, the oil and gas industry is likely to have enormous demand for positive displacement pumps over the projection period. This is due to ongoing investments in shale gas around the world. The increasing emphasis on establishing micro-liquefied natural gas terminals, which has resulted in reduced investment value for oil producers, has resulted in rising demand for positive displacement pumps.

Brazil is the Most Lucrative Country in the Latin America Positive Displacement Pump Market

- Brazil is the leading revenue-producing nation in the Latin American positive displacement pump market because of an increase in businesses that has decreased the amount of potable water and increased groundwater contamination. Additionally, the use of positive displacement pumps has expanded as a result of low disposable water levels and groundwater adulteration, which would accelerate market expansion even more.

- According to World Integrated Trade Solution, in Latin America, positive displacement pump exports from Brazil were primarily destined for Bolivia, Chile, and Paraguay. Following these countries are the United States, Argentina, and Germany. The US and Germany recorded the most noticeable rates of growth in terms of shipments among the major destination nations, while the other leaders experienced more modest rates of growth.

- Netzsch Pumps & Systems, Brazil, delivered its millionth pump from its subsidiary in Exton, USA, in June 2020. The pump was created at the company's headquarters in Waldkraiburg, Germany, and is a Nemo progressive cavity pump for high-density solids. The components were designed and constructed in the Netzsch facility in Brazil, and the pump was then assembled, tested, and transported to the United States.

- Additionally, according to Indexbox, Brazil saw a rise in foreign imports of positive displacement pumps and hand pumps in 2020. Imports increased dramatically during this time period. The rate of growth was fastest in 2009, when imports rose. Imports peaked in 2020 and are expected to grow steadily in the short term.

Latin America Positive Displacement Pumps Industry Overview

Latin America positive displacement pumps market is fairly fragmented market. Some of the key players in the market include Flowserve Corp., Atlas Copco, Xylem Inc., etc.

- March 2021 - Abel Pumps, a producer of highly engineered reciprocating positive displacement pumps for a range of end sectors, including mining, marine, power, water, wastewater, and other general industries, was acquired by IDEX Corporation.

- January 2021 - Atlas Copco Portable Energy has expanded its dewatering range with the introduction of over thirty new heavy-duty, high-capacity pumps. A novel piston positive displacement pump that may run dry without destroying internal components has been introduced. It is best suited for wellpoint applications with modest water volume and depth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Demand from the Oil & Gas Industry

- 5.1.2 Huge Scarcity in the Disposable Water Level and Groundwater Adulteration will Drive the Market

- 5.2 Market Challenges

- 5.2.1 Market Saturation in Conventional End-user Industries

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Reciprocating Pumps

- 6.1.1.1 Diaphragm

- 6.1.1.2 Piston

- 6.1.1.3 Plunger

- 6.1.2 Rotary Pumps

- 6.1.2.1 Gear

- 6.1.2.2 Lobe

- 6.1.2.3 Screw

- 6.1.2.4 Vane

- 6.1.2.5 Peristaltic

- 6.1.2.6 Progressive Cavity

- 6.1.1 Reciprocating Pumps

- 6.2 End-User

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverages

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceuticals

- 6.2.6 Power

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 Brazil

- 6.3.2 Colombia

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco

- 7.1.2 The Weir Group PLC

- 7.1.3 Flowserve Corporation

- 7.1.4 Xylem Inc.

- 7.1.5 SPX FLOW, Inc

- 7.1.6 Colfax

- 7.1.7 IDEX

- 7.1.8 Abel Pumps

- 7.1.9 Dover Corporation

- 7.1.10 Tsurumi Pump

- 7.1.11 Pentair Plc

- 7.1.12 Alfa Laval AB

8 INVESTMENT ANALYSIS

9 FUTURE MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219