|

市場調查報告書

商品編碼

1635402

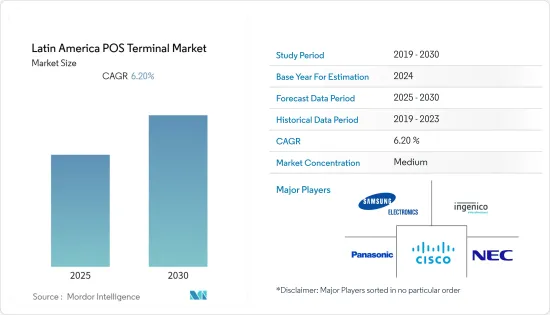

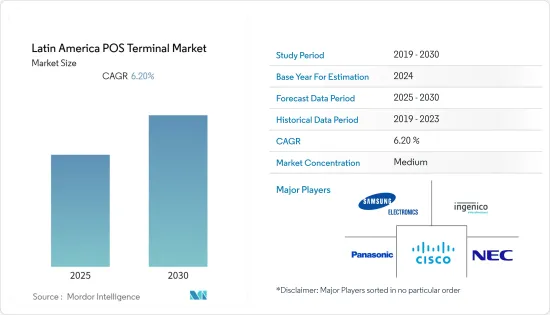

拉丁美洲 POS 終端:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Latin America POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

拉丁美洲 POS 終端市場預計在預測期內複合年成長率為 6.2%。

主要亮點

- 由於投資收益率的提高和可訪問的便利性,POS 終端市場在過去幾年中顯著成長。 POS 系統促進零售、餐旅服務業、運輸和銀行等各行業企業核心要素的交易,多年來對於各種規模的企業都變得越來越重要。

- 在該市場營運的公司也致力於透過推出新產品來支持墨西哥的數位付款。 2020年10月,著名付款技術公司Epos Now宣佈在墨西哥推出雲端POS系統。該 POS 解決方案為墨西哥中小企業 (SMB) 開闢了新的數位收益來源,使他們能夠連接全球客戶群並應對當前環境下快速變化的消費者習慣。

- POS 終端系統正在從以交易為中心的終端/設備發展為可以與公司的 CRM 和其他金融解決方案整合的系統。這種演變為最終用戶提供了商業情報,以更好地管理收益流和庫存。降低維護成本、準確交易和即時庫存管理是 POS 系統的主要優點。先進的 POS 系統提供的功能優勢正在使企業以 POS 系統取代傳統的收費軟體,從而確保 POS 系統市場的成長。

- 與其他付款管道相比,該市場的主要驅動力之一是擁有成本較低。與傳統系統相比,增強型 POS 系統具有更高的耐用性和可靠性,從而降低了擁有成本,從而增加了中小型企業對 POS 解決方案的需求。

- 市場成長面臨的挑戰之一是由於使用敏感資訊而導致的安全問題。由於 POS 終端連接到網路和網際網路,因此它們很容易受到試圖存取或操縱它們的攻擊,就像任何其他不安全的機器一樣。終端與網路其餘部分的通訊方式意味著攻擊者可能能夠存取竊取或克隆支付卡所需的未加密的卡片資料,包括 Track2 和 PIN 資訊。

拉丁美洲POS終端市場趨勢

行動/可攜式POS 終端預計將獲得顯著的市場佔有率

- mPOS 是傳統 POS 的智慧型 POS 替代品,透過藍牙連接到您的智慧型手機。行動 POS 系統允許用戶透過平板電腦、智慧型手機和其他手持裝置接受付款,而無需綁定到單一 POS 收銀機。交易包括信用卡磁條閱讀器支付和無線交易。我們利用行動電話的資料連線來處理交易。

- 行動 POS 系統越來越受歡迎,因為它們允許銷售和服務企業在客戶所在的地方進行交易,從而增加了整個流程的靈活性並改善了客戶體驗。

- 電子商務的成長以及實體零售和網路零售業的交織預計也將影響終端的未來成長。事實上,由於主要電子商務平台提供貨到付款選項,行動 POS 終端機的採用率激增。

- mPOS 終端可能沒有像 POS 終端那樣強大的安全通訊協定,特別是如果您使用 Apple 或 Android 智慧型手機和平板電腦等商用現成 (COTS) 終端,因此資料保護至關重要。

- 在預測期結束時,隨著商家增加相關服務,以滿足對非接觸式和易於使用的支付方式不斷成長的需求,該細分市場預計將增加其在市場上的影響力。由於 mPOS 解決方案是專門為平板電腦而不是桌上型電腦設計的,因此更小、更便攜的設備的趨勢預計將促進市場成長。

巴西可望獲得顯著的市場佔有率

- 數位付款的擴張正在推動巴西市場的成長。各種金融服務機構正在與當地企業合作,加速使用 POS 終端機的數位付款。

- 此外,2021 年 8 月,全球知名金融服務技術解決方案提供商 Fiserv 宣布與 Caixa Economia Federal 子公司 Caixa Cartoes 簽署獨家協議,幫助巴西各地的公司透過 Caixa 獲得收購服務。

- 此次合作的目的是促進拉丁美洲地區的數位付款。 Caixa 品牌的 POS 終端可以接受簽帳金融卡、信用卡、代金券付款以及透過卡片或2D碼進行的近距離付款(例如使用 Caixa Tem 應用程式進行的付款)。 2021 年 7 月使用 Caixa 終端機完成第一筆交易後,該終端已在巴西 174 個 Caixa分店進行試用。

- 此外,根據 Fiserv 2021 年的一項研究,巴西人首選的支付方式是信用卡和簽帳金融卡卡(28%),其次是PIX (22%)、數位錢包(11%)、條碼支付(9%) 和現金。巴西對信用卡和簽帳金融卡付款的高度依賴正在為市場創造新的機會。

- 然而,POS 終端的更換工作也在進行中,預計這將影響該地區基於硬體的 POS 終端的成長。 2021 年 3 月,軟體定義信任 (SDT) 領域的知名參與者 Magiccube 宣布推出 i-Accept,這是巴西驗收終端的完全基於軟體的替代品。

拉丁美洲POS終端產業概況

拉丁美洲 POS 終端市場競爭溫和,擁有大量區域和全球參與者。主要企業包括三星電子、Ingenico 集團和思科系統公司。

- 2021 年 10 月 - Hash 是一家專門從事付款基礎設施的金融科技公司,在由 QED Investors 和 Kaszek 共同管理的 C 輪資金籌措中籌集了 4000 萬美元。 Hash 為希望提供銀行服務的非金融 B2B 公司提供端到端付款基礎設施,從銷售點 (POS) 軟體和行動應用程式到儀表板和付款。

- 2021 年 8 月 - 根據 Caixa Economia Federal 子公司 Caixa Cartes 與付款和金融服務技術提供商 Fiserv, Inc. 之間達成的獨家協議,巴西各地的企業將透過 Caixa 品牌的 POS 終端獲得採購服務。所有 4,300 個 Caixa分店均配備 Caixa 品牌終端。企業可以使用該終端透過卡片和2D碼進行感應支付,包括簽帳金融卡、信用卡、禮品卡支付以及使用 Caixa Tem 應用程式進行支付。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 價值鏈分析

- COVID-19 市場評估

第5章市場動態

- 市場促進因素

- 與其他付款管道相比,整體擁有成本較低

- 非接觸式和行動 POS 終端需求大幅成長

- 市場限制

- 由於使用敏感資訊而引起的安全性問題

- 市場機會

- 無現金交易增加

- POS終端主要法規及申訴標準

- 關於非接觸式付款的日益使用及其對行業影響的說明

- 重大案例分析

第6章 市場細分

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按國家/地區

- 墨西哥

- 巴西

- 阿根廷

第7章 競爭格局

- 公司簡介

- PAX Technology

- BBPOS

- VeriFone System Inc.

- DSpread

- Castles

- YourTransactor

- Ingenico SA

- SZZT

- Spectra

- WizarPOS

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91659

The Latin America POS Terminal Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- The POS terminal market has grown significantly over the past few years, owing to its ability to offer an increased return on investment and ease of access. POS systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in companies of small and big sizes, over the years.

- Companies operating in the market are also focusing on supporting the digital payments in Mexico with the launch of new products. In October 2020, Epos Now, a prominent payment technology company, announced the launch of its cloud POS system in Mexico. The POS solution offers Mexican small and medium-sized businesses (SMBs) the ability to open new digital revenue streams, connect to a global customer base, and cater to rapidly shifting consumer habits in the current climate.

- POS terminal systems have evolved from being transaction-oriented terminals/devices to systems that can integrate with the company's CRM and other financial solutions. This evolution has empowered the end-users with business intelligence to better manage their revenue streams and inventory. Lower maintenance costs, accurate transactions, and real-time inventory are key advantages of the POS systems. With the functional benefits that the advanced POS systems offer, companies have replaced their traditional billing software with POS systems, thus, securing the growth of the POS system market.

- One of the major drivers of the market is the low cost of ownership compared to other payments channels. The enhanced POS systems provide higher durability and reliability, which leads to a lower cost of ownership, thus raising the demand for POS solutions in both medium and small-sized businesses compared to the traditional system.

- One of the challenge to the market's growth is the security concerns due to the usage of critical information. POS terminals are connected to the network and the internet, making them vulnerable to attacks to gain access to and manipulate it like any other insecure machine. The way the terminal communicates with the rest of the network means attackers could access unencrypted card data, including Track2 and PIN information, providing all the necessary information required to steal and clone payment cards.

Latin America POS Terminal Market Trends

Mobile/Portable Point-of-Sale Terminals Expected to Witness Significant Market Share

- An mPOS is a smarter alternative to the traditional POS which connects to smartphones via Bluetooth. A mobile point of sale system allows users to accept payments via tablets, smartphones, and other handheld devices without being tied to a POS register in a single location. The transactions can include credit card magstripe reader payments and wireless transactions. It utilizes a mobile phone's data connection to process transactions.

- Mobile POS systems are gaining traction as they allow sales and service industries to conduct the transaction at the customer's location, adding flexibility to the whole process and improving customer experience.

- The growth in e-commerce and the entangling of the brick-and-mortar and online retail practices are also expected to affect the future growth of the terminals. In fact, with the option of cash on delivery, provided by major e-commerce platforms, a sudden surge in the adoption of mobile POS terminal has been recognized.

- Data protection is paramount as mPOS devices may not have security protocols as robust as their POS counterparts, especially if you're using commercial-off-the-shelf (COTS) devices such as Apple or Android smartphones and tablets.

- Towards the end of the forecast period, the segment is expected to multiply in market presence as vends increase their relevant offerings in response to the increased demand for contactless ease-of-use payment methods. As mPOS solutions are specially designed for tablets instead of desktop computers, the trend of smaller and more portable devices will augment the growth of the market.

Brazil Expected to Witness Significant Market Share

- The growth of digital payments is fueling the growth of the market in Brazil. Various financial services organizations are partnering with regional companies to accelerate digital payments using POS terminals.

- Further, in August 2021, Fiserv, a prominent global provider of financial services technology solutions, announced that it has entered into an exclusive agreement with Caixa Cartoes a subsidiary of Caixa Economia Federal, which enables businesses throughout Brazil to have access to acquiring services through Caixa-branded point-of-sale (POS) terminals.

- The aim of the partnership is to push digital payments in the Latin America region. The Caixa-branded terminals allow businesses to accept payments via debit or credit card or voucher and proximity payments via card or QR code, such as those made using the Caixa Tem app. Following the first transaction completed using a Caixa terminal in July 2021, the terminals were made available through a pilot at 174 Caixa branches throughout Brazil.

- Furthermore, according to a 2021 study by Fiserv, Credit cards and Debit cards are preferred payment methods by the Brazilians (28%), followed by PIX (22%), digital wallets (11%), payments by barcode (9%), and cash (6%). The strong dependence on credit and debit cards for payments creates new opportunities for the market in Brazil.

- However, there have been efforts to replace the POS terminals which is expected to affect the growth of the hardware-based POS terminals in the region. In March 2021, Magiccube, a prominent player in Software Defined Trust (SDT) announced the availability of i-Accept, a complete software-based replacement for acceptance terminals in Brazil.

Latin America POS Terminal Industry Overview

The Latin America POS Terminal Market is moderately competitive, with a considerable number of regional and global players. Key players include Samsung Electronics Co. Ltd, Ingenico Group, Cisco Systems Inc. among others

- October 2021 - Hash, a fintech company focused on payment infrastructure raised USD 40 million in a Series C fundraising round that was jointly managed by QED Investors and Kaszek. Hash provides end-to-end payment infrastructure, ranging from point-of-sale (POS) software and mobile applications to dashboards and payments, for non-financial B2B enterprises wishing to offer banking services.

- August 2021 - As a result of an exclusive agreement between Caixa Cartes, a division of Caixa Economia Federal, and Fiserv, Inc, a provider in payments and financial services technology, businesses across Brazil now have access to purchasing services through Caixa-branded point-of-sale (POS) terminals. All 4,300 Caixa branches have Caixa-branded terminals. Businesses can use the terminals to take payments made with debit, credit, or gift cards and proximity payments made with a card or QR code, such as those made with the Caixa Tem app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assesment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Total Cost of Ownership Compared to Other Channels of Payments

- 5.1.2 Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 5.2 Market Restrains

- 5.2.1 Security Concerns due to the Usage of Critical Information

- 5.3 Market Opportunities

- 5.3.1 Increase in Number of Cashlesss Transactions

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the rising use of contactless payment and its impact on the industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By Country

- 6.2.1 Mexico

- 6.2.2 Brazil

- 6.2.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAX Technology

- 7.1.2 BBPOS

- 7.1.3 VeriFone System Inc.

- 7.1.4 DSpread

- 7.1.5 Castles

- 7.1.6 YourTransactor

- 7.1.7 Ingenico SA

- 7.1.8 SZZT

- 7.1.9 Spectra

- 7.1.10 WizarPOS

8 INVESTMNET ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219