|

市場調查報告書

商品編碼

1635405

瞬態保護元件:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Transient Protection Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

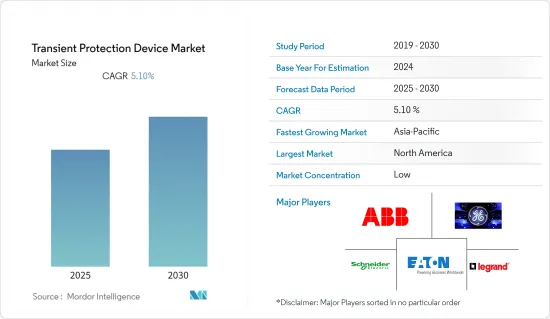

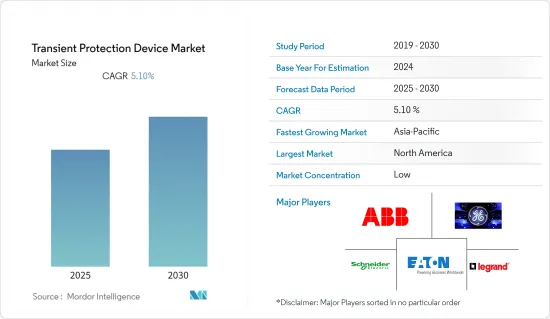

預計瞬態保護元件市場在預測期間內複合年成長率為 5.1%

主要亮點

- 美國、中國、日本和印度等主要經濟體致力於在多個產業領域開發節能電氣系統,這推動了瞬態保護裝置的需求激增。例如,印度鐵路部門的研究、開發和標準化組織 (RDSO) 建立了一個名為 CAMTECH(高級維護技術中心)的中心。 CAMTECH 旨在透過將防雷和瞬變保護裝置放置在訊號設備的整合電源中,升級維護技術和程序,並提高所有鐵路資產和員工的生產力和績效。

- 近年來,為了實現碳中和環境,對可再生能源的需求不斷增加,確保電網的可靠性變得重要。此外,還需要加強輸變電設備對大規模雷擊的容錯能力。因此,對瞬態電流保護元件的需求預計將會增加。

- 此外,對智慧電源分接頭的需求不斷成長也促進了市場的成長。客戶對支援 Wi-Fi 的電源分接頭需求量很大,因為它們可以自動建立時間表和計時器並監控能源使用情況。這就是為什麼多家公司致力於提供支援 Wi-Fi 的電源分接頭並為其客戶提供全面的解決方案。例如,APC 提供智慧瞬態保護、支援 Wi-Fi 的電源分接頭,配備三個雷克薩斯智慧插頭、一個 USB 充電器連接埠和 2,160 焦耳的智慧插頭瞬態保護。

- 此外,隨著智慧設備、智慧家庭技術和智慧城市計劃使用的增加,對智慧家庭瞬態保護設備的需求預計也會增加。例如,2021 年 10 月,美國能源局(DOE) 宣布將撥款 6,100 萬美元用於 10 個先導計畫,這些項目將利用新技術將數千個家庭和企業改造為先進的節能結構。這些互聯社區有潛力與電網進行通訊,以最佳化能源消耗並減少碳排放和能源價格。

- 然而,設計具有更高保護等級的緊湊型瞬態保護元件所面臨的挑戰可能會限制市場的成長。例如,高效能瞬態保護元件包含許多必須放置在電路中並聯陣列中的元件。由於機械設計缺陷,各個抑制組件可能必須比相鄰組件承受更多的能量,從而導致理論模型和實際設備之間的性能水平存在差異。

- 此外,COVID-19大流行也嚴重影響了裝置生產的供應,對瞬態保護元件市場的成長產生了負面影響。此外,由於缺乏現場訪問和原料短缺,包括瞬態保護裝置在內的各種電子元件製造商面臨短期營運挑戰。

瞬態保護元件市場趨勢

智慧城市對瞬態電流保護元件的需求不斷成長預計將推動市場成長

- 作為「一帶一路」數位絲路計劃的一部分,中國政府一貫鼓勵與智慧城市的合作。 《中國-東協戰略夥伴關係2030願景》加強了東協內部合作,中國致力於支持東協技術轉型舉措,例如《2020年東協資訊通訊技術總體規劃》和《東協智慧城市網路》。

- 此外,美洲地區各國政府也支持智慧城市的實施。例如,拉斯維加斯正在測試三個先導計畫,政府已撥款5億美元探索到2025年連接整個城市的方法。

- 據亞洲開發銀行稱,東南亞國家聯盟 (ASEAN) 國家約有一半人口居住在都市區,預計到 2025 年將有 7,000 萬人成為城市居民。因此,東協永續都市化策略認知到智慧城市計劃和智慧建築等技術進步是應對這些都市化挑戰的解決方案。這些舉措得到了國際投資的支持,經合組織估計,2010年至2030年間,所有城市基礎設施計劃將總共花費約1.8兆美元。數位化基礎設施的投資預計將推動需求,增加對資產安全的需求。

- 智慧建築使用各種互連的自動化系統,例如溫度控制、多媒體系統、通訊和安全系統,並且特別容易受到雷暴和照明的影響。因此,透過電源線和資料線進入結構的瞬變會對各種敏感電子設備產生負面影響,例如電腦、警報系統、轉換器、PLC 和影音設備。另一方面,網路元件通常特別容易受到雷擊和瞬態事件的影響,因為它們依賴連續的電源和資料供應來實現持續的功能和可用性。

- 此外,智慧建築中的設備故障可能會導致所有互連系統癱瘓,從而導致建築和職場環境遭到破壞並產生相關成本。所有這些都可以透過在系統中加入強大的瞬態保護裝置來消除或減少。瞬態電流保護元件也用於智慧建築中使用的智慧型設備的電源管理。

亞太地區預計將經歷顯著成長

- 由於人們生活水準的提高、可支配收入的增加以及智慧家庭的普及,亞太地區的瞬態電流保護裝置市場正在強勁成長。例如,根據統計和規劃實施部的數據,印度的可支配個人收入從2020年的199,689,740盧比增加到2021年的238,573,760盧比。此外,根據日本統計局的數據,日本的可支配收入從 2022 年 4 月的 436,850 日圓下降至 5 月的 359,510 日圓。

- 影響該地區智慧家庭市場的關鍵因素是透過智慧電子產品的應用對節能照明和安全解決方案的需求不斷增加,從而推動了瞬態保護裝置市場的發展。例如,在中國,住宅城鄉建設部和公共安全聯合發布關於加快發展數位住宅的建議,指出2022年終前訂定數位住宅政策、方法和標準.

- 此外,工業4.0計劃正在應用於汽車和電子機械,以實現遠端資料收集、遠距離診斷和遠端維護。這些努力增加了對資料中心、伺服器和通訊系統的需求。例如,在政府當局的支持下,資料中心在中國不斷發展。近日,中國政府宣布了一項三年計畫(2021-2023),目標是到2023年實現200 exaflops的資料中心運算能力。此外,政府鼓勵超大規模資料中心的行動也正在推動資料中心建置。例如,2021年4月,印度電子和資訊技術部(MeitY)計劃制定一項計劃,獎勵該國超大規模資料中心的投資,在短時間內將現有容量增加10倍以上。該地區資料中心的成長間接導致該地區瞬變保護設備的成長。

- 此外,該地區的數位轉型也正在推動市場成長。例如,2022年5月舉辦的華為亞太數位創新大會,來自亞太地區10多個國家的1,500餘人齊聚一堂,共同探討數位創新和數位經濟的未來。這項活動由華為和東協基金會共同主辦,政府相關人員、專家、研究人員、合作夥伴和分析師出席。該地區的這些舉措顯示了亞太地區瞬態電流保護設備市場的成長潛力。

- 此外,中國建築技術的崛起正在推動該地區的瞬態電流保護設備市場。例如,2021年2月,日立建築科技與中國電信廣州公司宣布推出更智慧、更有效率、更安全的產品和服務,為中國的建築和綜合體提供統一的安全、能源和設備管理服務,簽署了合作合作備忘錄。重點關注基礎設施支撐和最佳化、升級、整合。

瞬態保護設備產業概況

瞬態電流保護元件市場競爭激烈且高度細分,因為它由幾個主要參與者組成。市場上競爭公司之間的對抗關係取決於公司的侵略性策略,例如新產品開發、產能擴張、併購、策略聯盟、夥伴關係、協議以及研發活動投資。

- 2022 年 5 月 - 瞬態保護裝置製造商羅格朗在海得拉巴開設了印度第一家零售店「羅格朗工作室」。這家大型零售店將出售羅格朗印度集團公司的全系列產品,旨在加強羅格朗在印度的足跡。此外,羅格朗在印度擁有 30 多個互動產品展示室,包括 Innova、Studio 和店中店等形式。

- 2022年3月-被譽為高性能揚聲器製造商的ELAC宣布計畫憑藉Protek系列瞬態保護器進軍設備保護產品領域。 ELAC 著手創建具有更現代功能和更高性能水平的設備保護裝置產品線。應用程式控制、Wi-Fi、藍牙和 Alexa/Google Assistant 相容性使其在市場上的許多競爭對手中脫穎而出。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 各國政府對公共法規的不斷變化

- 智慧城市對瞬態保護裝置的需求不斷成長預計將推動市場成長

- 市場限制因素

- 具有增強保護等級的緊湊型瞬變保護裝置的開發問題

第6章 市場細分

- 按類型

- 交流瞬變保護系統

- 直流瞬變保護系統

- 按行業分類

- 工業的

- 商業的

- 住宅

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- General Electric Company

- Schneider Electric SE

- Eaton Corporation

- Legrand SA

- Siemens AG

- Emerson Electric Co.

- CG Power and Industrial Solutions

- Littelfuse

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91664

The Transient Protection Device Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The focus of major economies like the United States, China, Japan, India, etc., on developing energy-efficient electrical systems across multiple industrial sectors is adding to the upsurge in demand for transient protection devices. For instance, the Research Designs and Standards Organization (RDSO), a unit of the Indian Railways has developed a center called CAMTECH (Centre for Advanced Maintenance Technology). CAMTECH aims to increase the productivity and performance of all railway assets and workforce by upgrading maintenance technologies and procedures by including lightning and transient protection device arrangements in integrated power supply for signalling installations.

- In recent years, to achieve carbon neutral environment, the demand for renewable energy has increased, and ensuring the reliability of power grids has become more important. In addition, there is a requirement to enhance the resilience of transmission and substation equipment for large-scale lightning strikes. Resultantly, the demand for transient protection devices is expected to witness an uptick.

- Additionally, the rising demand for smart power strips is also contributing to boost the market's growth. Customers are in great demand for Wi-Fi-enabled power strips due to their ability to automatically create schedules, timers, and monitor energy usage. Therefore, several businesses are working towards offering Wi-Fi-enabled power strips, to serve as a comprehensive solution to their customers. For instance, APC is offering a smart transient protection WI-FI enabled Power strip with 3 Alexa Smart Plugs, USB Charger Ports, and 2160 Joules of Smart Plug transient Protection.

- Further, the need for smart home-enabled transient protection devices is predicted to rise with the rise in smart gadget use, smart home technology, and smart city projects. For instance, in October 2021, the US Department of Energy (DOE) announced the allocation of USD 61 million to ten pilot projects that would use new technologies to turn thousands of homes and businesses into advanced, energy-efficient structures. These Connected Communities may communicate with the electrical grid to optimize their energy consumption, lowering carbon emissions and energy prices.

- However, the challenges in designing compact transient protection devices with enhanced protection levels will likely restrain the market's growth. For example, high functional transient protection devices include numerous components that must be placed in parallel arrays in the circuit. Individual suppression components may have to endure greater energy than the adjacent due to poor mechanical design, and this is causing fluctuations in the performance level between the theoretical model and real devices.

- Moreover, the COVID-19 pandemic also has had a negative impact on the Transient Protection Device market's growth by severely impacting the supply for the device production. Further, due to a lack of site access and deficiencies in raw materials, manufacturers of various electronic components, including transient protection devices, faced short-term operational challenges.

Transient Protection Device Market Trends

An Increase in the Need for Transient Protection Devices in Smart Cities is Expected to Drive the Market's Growth

- The Chinese government routinely encourages smart city collaboration as part of the Belt and Road Initiative's Digital Silk Road Initiative. Cooperation within ASEAN is strengthened by the ASEAN-China Strategic Partnership Vision 2030, whereby China has vowed to support ASEAN's initiatives for technological transformation, such as the ASEAN ICT Master Plan 2020 and the ASEAN Smart City Network.

- Furthermore, various governments in the American region are also boosting the adoption of smart cities. For instance, Las Vegas is testing three pilot projects, with the government allocating USD 500 million to find ways to connect the entire city by 2025.

- According to Asian Development Bank, about half of the population in the countries making up the Association of Southeast Asian Nations (ASEAN) live in urban areas, and 70 million more people are expected to become urban dwellers by 2025. Hence, the ASEAN Sustainable Urbanization Strategy recognizes technological advancements such as smart city projects and smart buildings as a solution to tackle these urbanization challenges. These initiatives are supported by international investments, which the OECD estimates will total around USD 1.8 trillion for all urban city infrastructure projects between 2010 and 2030. The demand is anticipated to be driven by the investment in digitized infrastructure, which would increase the need for asset security.

- A broad variety of interconnected automatic systems such as temperature control, multimedia systems, telecommunications, and security systems are used in smart buildings that are particularly sensitive to the effects of thunderstorms and lighting. As a result, any transient that enters the structure, not only through the power supply lines but also through the data lines, might harm a wide range of sensitive electronic equipment, including computers, alarm systems, transducers, PLCs, and audio-visual equipment. Networked components, on the other hand, are particularly vulnerable to lightning strikes and transients in general since they rely on a continual supply of power and data for their continued functioning and availability.

- Moreover, failure of equipment in a smart building could bring all interconnected systems to a halt, resulting in the breakdown of buildings and work environments, as well as the related expenses. These all can be eliminated or can be reduced by integrating powerful transient protection devices into the systems. Transient protection devices are also used in power management for smart equipment used in smart buildings.

Asia-Pacific is Expected to Witness a Significant Growth

- The APAC region is witnessing a robust growth in the transient protection devices market owing to the enhanced living standards of the population, rising disposable income, and increasing adoption of smart homes. For instance, according to the Ministry of Statistics and Programme Implementation, Disposable Personal Income in India increased to INR 23,85,73,760 Million in 2021 from INR 19,96,89,740 INR Million in 2020. Furthermore, According to the Statistics Bureau of Japan, Disposable Personal Income in Japan decreased to JPY 359.51 Thousand in May from JPY 436.85 Thousand in April 2022

- The key element impacting the market for smart homes in the region is the increased desire for energy-efficient lighting and security solutions through the application of smart electronic products, boosting the transient protection device market. For example, in China, the Ministry of Housing and Urban-Rural Development and the Ministry of Public Security jointly released recommendations on speeding the development of digital houses, stating that policies, methods, and standards for digital homes should be in place by the end of 2022.

- Additionally, the Industry 4.0 initiative is being applied to vehicles and electrical machinery to enable remote data capture, remote diagnostics, and remote maintenance. Such initiatives have augmented the need for data centers, servers, and communication systems. For Instance, China has been growing in data centers with support from governmental authorities. Recently, the Chinese government issued a three-year plan (2021-2023) which calls for 200 exaflops of data center computing by 2023. Furthermore, The government bodies' steps to incentivize hyper-scale data centers are also driving their construction. For instance, in April 2021, the Indian Ministry of Electronics and Information Technology (MeitY) announced that it plans to develop a scheme to incentivize investments in hyper-scale data centers in the country and increase the current capacity over ten-fold in a short period. Rising of Data Centers in the region is indirectly causing the growth of Transient protection devices in the region.

- In addition, the digital transformation in the region is also driving the market growth. For instance, in May 2022 the Huawei APAC Digital Innovation Congress brought together over 1500 people from over ten nations in APAC to discuss the future of digital innovation and the digital economy. The event is co-hosted by Huawei and the ASEAN Foundation, with government officials, specialists, researchers, partners, and analysts among the attendees. These initiatives in the region show the potential for growth of the transient protection device market in the APAC region.

- Moreover, the rising of building technology in China is driving the transient protection device market in the region. For instance, in February 2021, Hitachi Building Technology and China Telecom Guangzhou signed an MOU to work cohesively to develop smart building solutions to provide smarter, more efficient, and secure products & services that will provide unified security, energy, and device management services to buildings and complexes in China. With a focus on infrastructure support and optimization, upgrading, and integration of infrastructure.

Transient Protection Device Industry Overview

The Transient Protection Device market is highly fragmented, as the market is highly competitive and consists of several major players. The competitive rivalry in the market depends on the company's aggressive strategies in new product development, capacity expansion, mergers and acquisitions, strategic collaborations, partnerships, and agreements, as well as investment in R&D activities.

- May 2022 - Legrand a manufacturer of transient protection devices opened its first retail shop in India, the Legrand Studio in Hyderabad. This mega retail store would house all of Legrand's India group company's products with the goal of strengthening Legrand's footprints in the country. In addition, Legrand has over 30 interactive product showrooms in India, including Innova, Studio, and Shop-in-Shop formats.

- March 2022 - ELAC, a well-known high-performance speaker manufacturer announced its plans to enter the equipment protection product area with the Protek line of transient protectors. ELAC set out to create a line of equipment protection devices with more modern features and greater performance levels. App control, Wi-Fi, Bluetooth, and Alexa / Google Assistant compatibility set it apart from much of the competition in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Ongoing Changes That Various Governments Are Making to Their Public Safety Regulations

- 5.1.2 An Increase in the Need for Transient Protection Devices in Smart Cities is Expected to Drive the Market's Growth

- 5.2 Market Restraints

- 5.2.1 Design Challenge to Develop Smaller Size Transient Protection Devices With Enhanced Protection Level

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Transient Protection System

- 6.1.2 DC Transient Protection System

- 6.2 By End-user Verticals

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Residential

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 General Electric Company

- 7.1.3 Schneider Electric SE

- 7.1.4 Eaton Corporation

- 7.1.5 Legrand S.A.

- 7.1.6 Siemens AG

- 7.1.7 Emerson Electric Co.

- 7.1.8 CG Power and Industrial Solutions

- 7.1.9 Littelfuse

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219