|

市場調查報告書

商品編碼

1635422

美國建築自動化控制:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)United States Building Automation Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

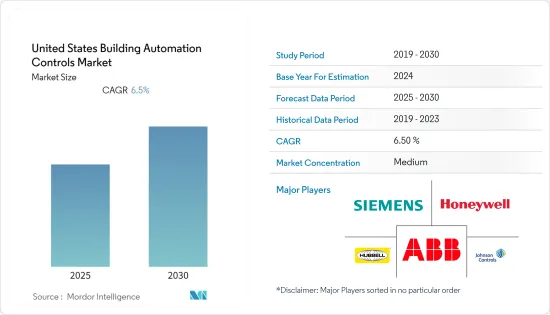

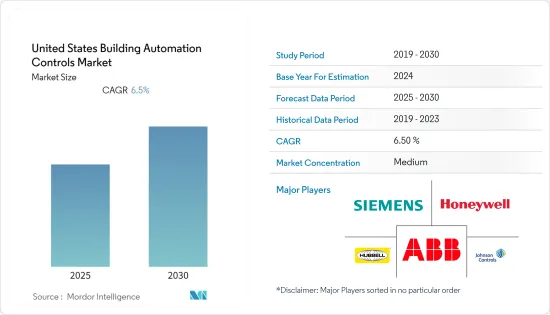

美國建築自動化控制市場預計在預測期內複合年成長率為 6.5%。

主要亮點

- 據紐約州能源研究與發展局 (NYSERDA) 稱,啟用即時能源管理系統和智慧技術可平均降低 15% 的成本,並創造一個提高收益。

- 隨著建築與 IT 和網路技術的整合程度越來越高,建築經理和安全專業人員越來越意識到智慧建築的安全風險。金融服務業和其他行業的機構應優先考慮智慧建築安全,因為它們是駭客潛在的有利可圖的目標。這些變化可能會增加對智慧安全系統解決方案的需求。

- 此外,智慧建築物連網在商業領域越來越受歡迎,因為它提供了使用者友好的自動化和智慧任務應用,例如透過自動控制 HVAC 系統來控制整個建築物的定時器來控制加熱。物聯網設施管理服務透過使用攝影機、運動探測器和生物識別系統等數位識別元件,為智慧建築提供高效的實體安全。

- 據美國設施經理稱,人們對升級和創新建築環境的興趣也很高。然而,受訪者的意見表明,目前在建築物中實施的技術存在重大差距。超過一半的受訪者表示,他們管理的建築物 (57%) 擁有合適的空氣品質解決方案,整合照明可提高居住者的工作效率(66%),而受訪者(73%) 的非接觸式建築入口(67%) 則表示他們不喜歡沒有一個應用程式可以提供有關建築物健康狀況的即時資訊。這些因素預計將推動疫情後自動化解決方案的採用。

- 儘管智慧建築具有許多優勢,但由於製造商部署和安裝系統的方式,建築自動化系統產業始終面臨重大挑戰。關鍵的建築自動化系統是封閉式通訊協定,不允許將第三方系統安裝到生態系統中。由於安裝的系統缺乏靈活性,商業建築業主在選擇唯一製造商時面臨挑戰,這可能導致定期維護成本增加和服務延遲。

美國建築自動化控制市場趨勢

消防系統是推動市場的因素之一

- 將消防和安全系統整合到自動化建築中對於預防火災威脅和最大程度地減少損失至關重要。消防安全系統在發生火災時提供主動消防系統、建築物範圍內的通訊系統和雙向煙霧控制系統之間所需的複雜協調。這種方法可以減少火災可能造成的損失。

- 根據美國國家消防協會 2021 年報告,2020 年美國地方消防部門估計應對了 140 萬起火災。這些火災導致 3,500 名平民死亡,15,200 人受傷。財產損失估計為 219 億美元。 2020 年,美國消防部門平均每 23 秒就會回應一次火災。每 89 秒就有一起住宅火災報告,每 3 小時 24 分鐘就有住宅火災死亡報告,每 46 分鐘就有一起住宅火災受傷報告。

- 隨著感測器性能和通訊通道技術的改進,工業和住宅空間中存在的物聯網設備使得新技術解決方案的採用成為可能。因此,市場需要能夠與新系統和舊系統整合的消防安全系統。

- 由於適用於該行業的安全法規和政策,儘管市場已經成熟,但該行業仍在不斷推出新產品,從而增加了產品周轉率並吸引了新的需求。在許多城市,法律要求所有住宅和商業空間每年至少進行兩次消防疏散演習。此外,石油和天然氣、發電、用水和污水處理、食品製造、金屬和採礦、造紙和紙漿以及紡織品製造和加工等製程工業越來越意識到安裝符合安全標準、法規和消防安全系統的設備馬蘇。

- 2021 年 12 月,綜合消防供應商 Texas Fire Alarm (TFA) 被 Highview Capital 旗下端到端消防與生命安全解決方案平台 National Fire &Safety 收購。 TFA 專門從事倉庫/配送、工業、商業和多用戶住宅火警警報器、噴灌、滅火器和廚房抽油煙機系統服務。 TFA 的員工包括 NICET 認證的工程師和高素質的技術人員。 TFA的全方位消防服務還包括TFA中央監控站的24小時緊急監控。此類收購將使公司能夠根據客戶要求開發產品,並擴大市場佔有率。

商業的

- 根據美國能源局的數據,建築業消耗了約 76% 的電力,並產生大量溫室氣體 (GHG)排放。到 2030 年,利用目前具有成本效益的技術,建築物的能源使用量可減少 20% 以上,如果實現研究目標,則可減少 35% 以上。從技術上講,更高的減排量是可能的。

- 美國能源政策法案允許企業為提高商業建築能源效率的成本獲得稅額扣抵。對於符合 ASHRAE 標準 90.1-2001 或 90.1-2007 的系統或節省至少 50% 供暖和製冷能源的建築物,可享受每平方英尺高達 1.80 美元的稅額扣抵。這些稅收激勵措施預計將增加能源管理系統的使用。

- 美國對商業建築進行了大量投資。根據Construct Connect和牛津經濟研究院的數據,到2022年,零售業將建造196.4億美元的商業設施、149.6億美元的飯店、120.5億美元的政府建築和96.6億美元的體育場館。

- 最近,2021 年 7 月,專門從事商業空間 IAQ 和能源效率最佳化的基於物聯網的建築自動化技術的著名供應商之一 75F 宣布獲得西門子股份公司的投資。 75F A 系列資金籌措流入使這家總部位於明尼阿波利斯的公司的總資金籌措達到 2800 萬美元。

- 2021 年 8 月,總部位於伊利諾州的 Intermatic Incorporated 宣布推出全新 ARISTA 高級照明控制系統,這是一種可自訂的智慧照明解決方案,支援面積達 10,000 平方英尺的商業和市政建築。該系統允許所有技術背景的安裝人員在各種照明控制應用中整合令人印象深刻且法規的功能。

美國建築自動化控制產業概況

美國建築自動化市場由多家大型企業適度整合。公司不斷投資於策略聯盟和產品開發,以增加市場佔有率。以下是近期的一些市場趨勢:

- 2022 年 1 月 - Stay-Lite Lighting 是一家全國性照明和電氣維護服務供應商,是一家節能 LED 照明、控制和物聯網系統提供商,包括承包計劃交付、項目管理和系統維護,被Orion Energy Systems, Inc 收購。此次收購將使為客戶提供照明和電氣服務的 Orion Maintenance Services 獲得更快的發展。

- 2021 年 11 月 - AI Fire 收購 BCI Technologies。 BCI Technologies 為企業和商業設施安裝、維修專業安全系統並提供服務。透過此次收購,AI Fire 的 Academy Fireteam 將在德州德克薩斯州開設第一個區域辦公室。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 有利的當地法規鼓勵採用安全和消防系統

- 該地區對節能建築的需求不斷成長

- 物聯網和無線基礎設施領域的技術進步

- 市場挑戰

- 缺乏技術一致性以及高昂的取得和實施成本

第 6 章 技術概覽

- 主要通訊協定分析(KNX、NON-KNX)

- 建築自動化和控制系統領域的關鍵進展

- 新裝置和維修裝置的分析

第7章 市場區隔

- 按類型

- 照明控制

- 暖通空調系統

- 安全和存取控制

- 消防系統

- 軟體(建築能耗管理系統)

- 服務(專業)

- 按最終用戶

- 住宅

- 商業的

- 產業

第8章 競爭格局

- 公司簡介

- Honeywell International, Inc

- Siemens AG

- ABB Limited

- Johnson Controls International

- Hubell

- Delta Controls

- Robert Bosch

- Schneider Electric

- United Technologies Corporation

- Lutron Electronics

第9章投資分析

第10章市場的未來

簡介目錄

Product Code: 91745

The United States Building Automation Controls Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- According to the New York State Energy Research and Development Authority, enabling real-time energy management systems and smart technologies could reduce costs by an average of 15% and increase the bottom line by creating an environment that encourages employee productivity and reduces energy waste, according to the New York State Energy Research and Development Authority (NYSERDA).

- Building managers and security experts are becoming more aware of the risk of smart building security as buildings become more integrated with IT and networking technology. Institutions in the financial services sector and other sectors should place a priority on smart building security since they are potentially lucrative targets for hackers. Because of these changes, the need for intelligent security system solutions will increase.

- Moreover, smart building IoT is gaining popularity in the commercial spaces as it provides user-friendly automation and application of intelligence for tasks, such as timer-controlled heating to an entire building by automatically regulating HVAC systems. IoT facility management service provides efficient physical security for a smart building by using cameras, movement detectors, and digital identification factors, such as biometrics identification systems.

- According to US facility managers, there is also a strong interest in upgrades and innovative building environments. Yet respondent input shows a major gap in the technologies currently deployed in the buildings. More than half of those surveyed says that the buildings they manage do not have proper air quality solutions (57%), integrated lighting that improves occupant productivity (66%), contactless building entry (67%), or an app that provides real-time information on building health (73%). Such a factor is expected to encourage the adoption of automation solutions post-pandemic.

- Despite the benefits that smart buildings offer, the building automation systems industry has always faced a tremendous challenge due to the way manufacturers deploy and install their systems. Significant building control systems are closed protocols that do not allow third-party systems to be installed in the ecosystems. Commercial building owners are challenged when it comes to choosing a sole manufacturer to be tied down to, as this lack of flexibility in installed systems could lead to high routine maintenance costs and delayed service.

US Building Automation Controls Market Trends

Fire Protection Systems are one of the Factor Driving the Market

- Integrating fire and safety systems with automated buildings is essential for preventing or minimizing loss during a fire threat. A fire safety system provides a high level of coordination, which is required between the active fire system, building-wide communications, and interactive smoke control systems in case of a fire. This method reduces the quantity of damage that a fire might inflict.

- According to the national fire protection association 2021 report, in 2020, local fire departments responded to an estimated 1.4 million fires in the united states. These fires resulted in the deaths of 3,500 civilians and the injury of 15,200 civilians. Property damage was projected to be worth USD 21.9 billion. In 2020, a fire department in the united states responded to a fire every 23 seconds on average. Every 89 seconds, a home structure fire was reported, every three hours and 24 minutes, a home fire death was reported, and every 46 minutes, a home fire injury was reported.

- With the improvements in the sensors' capabilities and communication channel technology, IoT devices present in industries and residential spaces have made the adoption of new-tech solutions possible. Therefore, the market is experiencing the demand for fire safety systems that can integrate with the new as well as legacy systems.

- Owing to safety policies and regulations applicable to the industry, despite market maturity, the industry continues to introduce new product offerings that have contributed to product turnover and attracted new demand. In many cities, it is a statutory requirement to carry out fire evacuation drills at least twice a year in all residential and commercial spaces. Further, the awareness toward the adoption of equipment to meet the safety standards, regulations, and fire safety systems is demanded in several process industries, such as oil and gas, power generation, water and wastewater, food manufacturing, metal and mining, paper and pulp, and textile manufacturing and processing.

- In December 2021, Texas Fire Alarm(TFA), a full-service fire protection provider, was acquired by the National Fire & Safety, end-to-end fire protection and life safety solutions platform and a portfolio business of Highview Capital. TFA specializes in warehouse/distribution, industrial, commercial, and multi-family fire alarm, fire sprinkler, extinguisher, and kitchen hood system service. TFA's staff includes NICET-certified engineers and highly qualified technicians. TFA's full-service fire protection services include TFA's central monitoring station's 24-hour emergency monitoring. Such acquisitions will enable the company to develop the products according to the requirements of customers and increase the market share in the studies region.

Commercial

- According to the US Department of Energy, the buildings sector accounted for about 76% of the electricity used, resulting in a considerable amount of associated greenhouse gas (GHG) emissions, thereby making it necessary to reduce the energy consumption in buildings to comply with national energy and environmental challenges and decrease costs to building owners and tenants. By 2030, building energy use could be cut more than 20% using technologies known to be cost-effective today and by more than 35% if the research goals are met. Much higher savings are technically possible.

- The Energy Policy Act of the United States offers businesses tax deductions for the costs of improving the energy efficiency of commercial buildings. A tax deduction of up to USD 1.80 per square foot is available for buildings that save at least 50% of the heating and cooling energy of a system or building that meets ASHRAE Standard 90.1-2001 or 90.1-2007. Such tax benefits are expected to increase the use of energy management systems.

- The investments in commercial buildings are massive in the United States. According to Construct Connect and Oxford Economics, in 2022, the value of commercial construction by retail will account for USD 19.64 billion, USD 14.96 billion for hotels, USD 12.05 billion for government, and USD 9.66 billion for sports stadiums.

- Recently, in July 2021, 75F, one of the prominent providers of IoT-based building automation technologies, specialized in optimizing IAQ and energy efficiency in commercial spaces, announced an investment from Siemens AG. The latest influx in 75F's Series A funding round brings the Minneapolis-based company's total funding to USD 28 million.

- In August 2021, Illinois-based Intermatic Incorporated announced the launch of its new ARISTA Advanced Lighting Control System, a customizable smart lighting solution that supports commercial and municipal buildings up to 10,000 square feet. The system allows installers of all technology backgrounds to integrate impressive, code-compliant functionality in a wide range of lighting control applications.

US Building Automation Controls Industry Overview

The United States Building Automation market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- January 2022- Stay-Lite Lighting, nationwide lighting and electrical maintenance service provider was acquired by Orion Energy Systems, Inc., a provider of energy-efficient LED lighting, control, and IoT systems, including turnkey project implementation, program management, and system maintenance. The acquisition enables Orion Maintenance Services to develop faster, which provides lighting and electrical services to customers.

- November 2021 - AI Fire has acquired BCI Technologies. BCI Technologies installs, repairs, and services specialized security systems for businesses and commercial facilities. The Academy Fireteam of AI Fire will open its first district office in Dallas, Texas, due to the acquisition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment Of The Impact Of Covid-19 On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable local regulations driving adoption of security & fire protection systems

- 5.1.2 Rising demand for energy efficient buildings in the region

- 5.1.3 Technological advancements in the field of IoT & wireless infrastructure

- 5.2 Market Challenges

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6 TECHNOLOGY SNAPSHOT

- 6.1 Analysis of major communication protocols (KNX, NON-KNX)

- 6.2 Major advancements in the field of Building Automation and Control Systems

- 6.3 Analysis of new & retrofit installations

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Lighting Controls

- 7.1.2 HVAC Systems

- 7.1.3 Security and Access Control

- 7.1.4 Fire Protection Systems

- 7.1.5 Software(BEMS)

- 7.1.6 Services(Professional)

- 7.2 By End User

- 7.2.1 Residential

- 7.2.2 Commercial

- 7.2.3 Industrial

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Honeywell International, Inc

- 8.1.2 Siemens AG

- 8.1.3 ABB Limited

- 8.1.4 Johnson Controls International

- 8.1.5 Hubell

- 8.1.6 Delta Controls

- 8.1.7 Robert Bosch

- 8.1.8 Schneider Electric

- 8.1.9 United Technologies Corporation

- 8.1.10 Lutron Electronics

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219