|

市場調查報告書

商品編碼

1635425

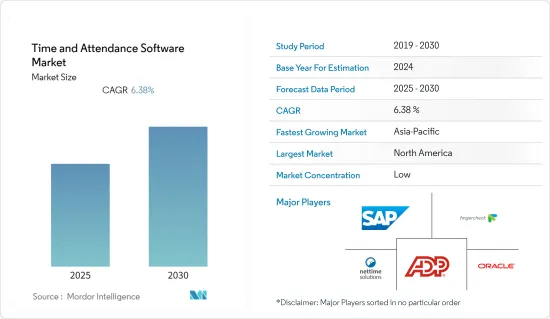

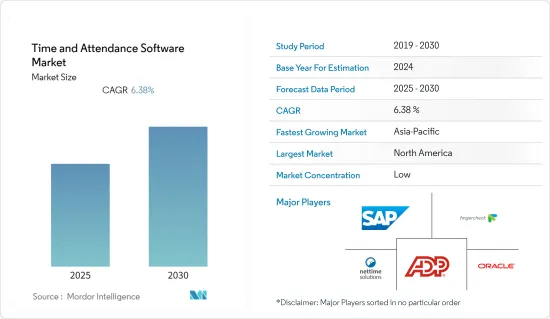

考勤管理軟體 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Time and Attendance Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內考勤管理軟體市場複合年成長率預估為 6.38%

主要亮點

- 創新的考勤系統使管理人員能夠監控員工的時間,同時大幅減少人力。時間管理系統可確保員工能夠完成必須準時完成的特定任務,進而協助管理者提高業務效率。計劃經理可以利用技術將管理人員從常規任務和手動調度中解放出來,從而專注於他們的公司。時間管理系統也可用於確定如何完成特定任務或計劃以滿足任務要求。例如,有效的時間和勞動力軟體分析銷售數據和商店客流量訊息,以預測零售企業對適當數量員工的需求。然後,管理人員根據勞動力預測制定時間表,以提高生產力並保持在分配的預算範圍內。

- 整合的考勤系統提高了資料視覺性,並使薪資核算、休假請求和績效評估的管理變得更加容易。自動警報和通知使管理人員能夠快速核准加班或提前解僱的請求,而無需進行額外的討論。出勤管理工具讓您只需點擊幾下即可組織您的日程安排並追蹤輪班變更。每個出勤輪班都可以有獨立的設置,可以選擇定義出勤週期、假期扣除、標記入/出指南和可選假期。例如,海康威視推出了HikCentral門禁軟體。只需 i3 CPU 和 4GB RAM,使用者就可以使用標準 Web 瀏覽器存取所有功能,而無需安裝桌面用戶端。用戶能夠透過在 iOS 和 Android 作業系統上運行的易於使用的行動應用程式進行遠端管理,從而提高了靈活性

- 透過利用雲端基礎的考勤系統,您可以有效地消除對勞動密集型手動考勤系統的需求(這會增加人為錯誤的可能性)以及對代理計時的需求(這會降低企業的生產力水平)。例如,雲端基礎的HCM Ceridian Dayforce 描述了核心 HR 管理、員工自助服務、人才招募、人才管理、勞動力管理和社會福利管理。

- 由於低品質的免費和開放原始碼考勤軟體隨時可用,小型企業正在採用免費軟體,而不是犧牲品質並尋求成熟的解決方案,這對參與企業有限制。例如,「偉大的現場工作需要偉大的團隊合作」是 Fieldsence 開發的應用程式,它將強大的追蹤、監控和彙報系統與實用的工具和工作流程相結合,以加快現場工作的速度。位置追蹤、存取管理、費用工作流程、儀表板和見解以及時間和出勤都是該應用程式的組成部分。最多 25 位用戶免費。

- COVID-19疫情不會影響考勤管理軟體市場的擴大,因為面對前所未有的情況,越來越多的人正在採用考勤管理軟體解決方案。由於向自動化考勤軟體的重大轉變,以提高薪資核算準確性並減少人為容易出錯的資料輸入,COVID-19 的爆發顯著加快了市場成長率。此外,透過確保關鍵時刻有合適的人員在場,這些產品可以幫助企業提高生產力。

考勤管理軟體市場趨勢

雲端基礎的考勤管理系統的普及正在推動考勤管理軟體市場

- 目前將雲端服務與考勤管理軟體整合的趨勢正在以非常有效的方式解決所有人力資源和相關危機。在當今競爭激烈的環境中,軟體是一套工具,可幫助公司招募、培訓、薪酬、管理和留住熟練的高績效人才。許多公司提供雲端基礎的考勤軟體產品。例如,Oracle 考勤軟體是 Oracle 融合雲端應用套件的一個元件,可協助公司使用單一共用資料來源規劃、監控和改進其全球人力資源流程,確保資訊準確且最新我保證是的。它具有工作與生活平衡、學習、薪資核算、時間追蹤、人才管理、勞動力管理和全球人力資源等模組。

- 此外,Paycheck Flex 還與人才管理分析和總分類帳整合。該平台提供有關招聘、社會福利、人事費用、時間和出勤管理以及人員成長的易於理解的資訊,並允許人力資源經理設計儀表板。 Paycheck Flex 與其他人力資源、財務、時間和社會福利管理系統有介面。您也可以透過 Paychex Flex 行動應用程式存取該軟體。

- 全球越來越多的小型企業採用薪資核算自動化,正在推動雲端基礎的考勤軟體市場的發展。許多公司開發適合中小企業的軟體。例如,Paycor HCM是一款雲端基礎考勤管理軟體,可協助中小型企業有效率地管理人力資源。核心人力資源、入職和發展、時間追蹤、薪資核算、招募、培訓、員工自助服務、人力資源報告、勞動力洞察、人才發展、績效和目標設定只是它提供的一些功能。 Paycor 的行動應用程式可讓您存取時間和出勤、薪資核算和人力資源工具。

- 各大銀行和企業集團正在大力投資新興的雲端基礎的考勤軟體供應商。例如,根據向美國證券交易委員會提交的最新文件,總部位於辛辛那提的 Fifth Third Bancorp 在第一季(SEC) 將持有的 Paylocity Holding Co 股份增加了 162.5%。 Paylocity Holding Corporation 為美國的中型企業提供雲端基礎的薪資核算和人力資本管理軟體解決方案。該公司提供薪資和稅務服務,可簡化程序、滿足合規性要求並實現薪資核算自動化。

- 此外,據報道,卡達最大的私人多元化企業集團之一 Al Faisal Holding 已選擇 Ramco Systems 來改善其人力資源和薪資系統。 Al Faisal 透過其子公司和附屬公司經營專注於多個行業的業務,包括教育、文化、體育、房地產、酒店、貿易、建築和計劃管理。

亞太地區成長率最高

- 亞太地區的衛生服務正在快速成長。政府和非政府組織管理者正在專注於整個部門的出勤監控。例如,衛生和醫學教育部長 K. Sudhakar 博士在多次申訴衛生工作者缺席後,呼籲生物醫學教育給衛生部門帶來質的變化,並改善員工紀律、課責和效率。制度並將薪資與出勤掛鉤。

- 亞太地區由中國、印度等主要新興經濟體組成,無組織的部門正逐漸轉變為商業的主流。這為該地區的考勤軟體供應商提供了機會。例如,在聖雄甘地國家農村就業保障計畫(MGNREGS)涵蓋的員工人數達到或超過20人的職場,印度聯邦政府強制要求員工透過國家行動監控系統應用程式記錄考勤。儘管面臨許多挑戰,包括網路存取不可靠以及農村地區技術支援有限或不存在,但這些變化仍在發生。

- 亞太地區對非接觸式生物辨識考勤系統的需求不斷成長,推動了亞太地區考勤管理軟體市場的成長。例如,日本建築工地使用的新型生物識別門禁系統採用 RealNetworks臉部認證技術 SAFR 進行即時視訊。在 SAFR 生物辨識技術的幫助下,Nextware 和 Kidsway 共同開發的新解決方案的硬體可以自動追蹤員工的考勤和出勤情況,並檢查他們的體溫是否有發燒症狀。

- 學校的數位化、新的線上監控和教育品管系統正在推動該地區的市場。例如,斯里蘭卡國家商業管理學院 (NIBM) 宣布正在部署 NtechLab 和當地科技Start-UpsGreen Orgro 的臉部認證設備,以在校園內實施生物識別考勤追蹤和存取控制。據NIBM稱,它是斯里蘭卡第一個使用臉部辨識軟體的高等教育機構。 NIBM 聲稱生物識別技術為學生提供了簡單、快速、方便的存取。

- 此外,阿里雲也決定提高釘釘協作工作空間平台對國內外企業客戶的吸引力。釘釘與線上個人生產力套件連接,該套件結合了通訊、會議和任務管理。此外,釘釘應用也有一些不好的方面。其監控功能包括可選的考勤系統,可讓您即時追蹤員工位置。

考勤管理軟體產業概況

由於大型跨國公司的存在,考勤管理軟體市場競爭非常激烈。市場上的公司專注於整合,以在保護員工資料、績效監督、培訓和市場開發、員工自助服務、薪酬處理以及獲得最大市場佔有率獲得競爭優勢。

- 2022 年 3 月:XTM, Inc. 是一家總部位於邁阿密和多倫多的新銀行領域金融科技公司,在全球範圍內提供行動銀行和付款解決方案,該公司最近宣布已在墨西哥安裝了20 個餐廳專用POS (銷售點)地點。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 2020年至2027年市場規模及預測

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 提高工作流程管理的彈性

- 更多採用雲端基礎的考勤管理系統

- 遠距工作文化的趨勢

- 市場問題

- 市場上免費開放原始碼的時間追蹤軟體

- 市場機會

- 擴大使用考勤軟體來追蹤員工執行的計劃和任務,從而創造了市場機會

第6章 市場細分

- 按發展

- 本地

- 雲

- 按用途

- 核心人員/人才引進

- 人力資源管理

- 其他

- 按最終用戶產業

- BFSI

- 零售/電子商務

- 資訊科技/通訊

- 政府機構

- 醫療保健

- 製造業

- 教育

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- SAP SE

- FingerCheck

- NETtime Solutions

- ADP, Inc.

- Oracle Corporation

- Reflexis Systems Inc.

- Replicon

- Ultimate Kronos Group(UKG)

- Paycor

- Paycom Software, Inc.

- Rippling

- Civica

- Ramco Systems

- Workday, Inc.

- Ceridian HCM

- ATOSS

- 供應商排名分析

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91748

The Time and Attendance Software Market is expected to register a CAGR of 6.38% during the forecast period.

Key Highlights

- Innovative time & attendance systems enable managers to monitor employee time while saving significant amounts of human effort. Time and attendance systems assist managers in streamlining work by verifying employee availability for specific tasks that must be completed on time. Project managers can concentrate on the company by using the technology to relieve managers of regular tasks and manual scheduling. Time & attendance systems can also be used to determine how certain tasks and projects can be completed to fulfill a task. For example, Effective time and labor software analyses sales or shop traffic information to forecast the need for the right number of employees in the retail sector. Following that, managers create schedules based on the workforce projection to enhance productivity and keep within the allocated budget.

- An integrated time & attendance system can provide good data visibility and make it easier to manage payrolls, leave requests, and performance reviews. Automated alerts and notifications allow the manager to promptly approve requests for overtime and early departure without the need for additional discussion. A time & attendance management tool can assist in organizing schedules and keeping track of shift swaps with only a few clicks. Each attendance shift can have a separate configuration, with options for defining attendance cycles, leave deductions, mark in/out guidelines, and optional holidays. For example, Hikvision has made the HikCentral Access Control software available, which may fit applications and scenarios of any scale and improve daily operations. Users can access all features using standard web browsers without installing a desktop client because it just has an i3 CPU and 4 GB of RAM. The flexibility is increased by the ability for users to administer remotely through an easy-to-use mobile app that works with both iOS and Android operating systems.

- Utilizing a cloud-based time & attendance system effectively aids in removing the need for labor-intensive manual attendance systems, which increase the likelihood of human mistakes, and proxy punching practices, which lower productivity levels in a business. For Example, the cloud-based HCM Ceridian Dayforce provides management of core HR, employee self-service, talent acquisition, talent management, workforce management, and benefits administration.

- The ready availability of low-quality free & open-source Time and Attendance Softwires are creating a constraint for the market players because small-scale companies are adopting the free software instead of going for an authentic solution by compromising the quality. For example, Great Field Work Takes Great Teamwork is an app created by Fieldsence that combines a powerful tracking, monitoring, and reporting system with practical tools and workflows to speed up field operations. Location Tracking, Visit Management, Expense Reimbursement Workflow, Dashboard & Insights, and Attendance Management are all components of the app. Up to 25 users can use this for free.

- The COVID-19 epidemic has no effect on the expansion of the time and attendance software market since, in the face of unprecedented circumstances, more people are adopting time and attendance software solutions. Due to the greater transition to an automated time and attendance software for boosting payroll accuracy and reducing human and error-prone data entry, the COVID-19 epidemic has greatly accelerated the market's growth rate. Additionally, by ensuring the proper individuals are there when it counts, these products help firms enhance productivity.

Time and Attendance Software Market Trends

The rise in the Adoption of Cloud-based Time & Attendance Systems is driving the Time and Attendance Software Market

- The current trend of cloud services and their integration with Time and Attendance Software is solving all the Human resource and allied criticality in a very effective manner. In today's fiercely competitive business environment, the software is a set of tools that aids firms in the hiring, training, compensation, management, and retention of skilled, high-performing people. Many companies are providing cloud-based Time and Attendance Software products. For example, a component of the Oracle Fusion Cloud Applications Suite, Oracle Time and Attendance software helps businesses to plan, monitor, and improve global personnel processes using a single, shared data source, guaranteeing that the information is correct and up to date. It has modules for work-life balance, learning, payroll, time tracking, talent management, workforce management, and global HR.

- In addition, Paycheck Flex connects with talent management analytics and the general ledger. The platform offers simple-to-understand information about hiring, benefits, labor expenses, time and attendance, and changes in headcount and enables HR administrators to design dashboards. For the administration of HR, finance, time and attendance, and benefits, Paycheck Flex interfaces with other systems. The Paychex Flex Mobile App also provides access to the software.

- The rise of small-scale companies across the globe and their adoption of payroll automation is driving the cloud-based Time and Attendance software market. Many companies are developing software that will be suited for small and medium enterprises. For example, A cloud-based unified time and attendance software called Paycor HCM aids small and midsize businesses in effectively managing HR. Core HR, onboarding and development, time tracking, payroll, hiring, training, employee self-service, HR reporting, workforce insights, talent development, and performance and goal setting are just a few of the features it provides. The Paycor mobile app gives users access to time and attendance, payroll, and HR tools.

- Large Banks and conglomerates are investing huge amounts in emerging cloud-based Time and Attendance software providers, which is creating an opportunity for the companies to go for high-tech and more robust services. For example, according to its most recent filing with the Securities and Exchange Commission, Cincinnati-based Fifth Third Bancorp increased its holdings in Paylocity Holding Co. shares by 162.5 percent during the first quarter (SEC). For American medium-sized businesses, Paylocity Holding Corporation offers cloud-based payroll and human capital management software solutions. The business provides payroll and tax services to streamline procedures, handle compliance demands, and automate payroll.

- In addition, Al Faisal Holding, one of Qatar's largest privately held diversified conglomerates, reportedly selected Ramco Systems to improve its HR and payroll systems. Through its subsidiaries and affiliated businesses, Al Faisal engages in business in a few industries, with a significant emphasis on education, culture, and sports, as well as in real estate, hotel, trading, construction, and project management.

Asia-Pacific Region is experiencing the Highest Growth Rate

- The region is witnessing a high growth rate of health care services. Administrators of both government and non-government organizations are focusing on attendance monitoring across the sector. For example, Health and Medical Education Minister Dr. K. Sudhakar made the decision to implement a biometric attendance system and tie salaries to attendance in response to repeated complaints about the absence of health officials to bring about a qualitative change in the department and more discipline, accountability, and efficiency among the staffs.

- The Asia-Pacific region consists of major emerging economies like China and India, where unorganized sectors are gradually transforming their business into the mainstream. This is creating an opportunity for Time and Attendance Software providers in the region. For example, at workplaces where 20 or more employees are covered by the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), the Union government of India has made recording attendance via its app, National Mobile Monitoring System, mandatory. This change is being made despite numerous issues, such as inconsistent Internet access in rural areas and scant or nonexistent technical support.

- The increasing demand for a touchless biometric attendance system in the region is driving the growth of the Time and Attendance software market in Asia-Pacific. For example, A new biometric access control system being used at Japanese construction sites uses SAFR from RealNetworks' facial recognition technology for live video. With the help of SAFR biometrics, the new solution's hardware, which will be jointly developed by Nextware and Kids-Way, will automatically track employee arrival and departure as well as check their body temperatures for fever symptoms.

- The digitalization in schools, new online monitoring, and quality management system in education in the region is driving the market. For example, to implement biometric attendance tracking and access management on the campus, Sri Lanka's National Institute of Business Management (NIBM) announced the combined installation of facial recognition equipment from NtechLab and local technology startup Green Orgro. According to NIBM, it was the first higher education institution in Sri Lanka to use facial recognition software. It claims that biometric technology will give pupils easy, rapid, and convenient access.

- In addition, Alibaba Cloud has made the decision to increase the appeal of its DingTalk collaborative workspace platform to business clients in China and beyond. DingTalk connects with online personal productivity suites and combines messaging, conferencing, and task management. Additionally, the Ding app includes certain undesirable aspects. Its monitoring features include an optional attendance system that can track employees' locations in real-time.

Time and Attendance Software Industry Overview

Due to the presence of serval big multinational companies, the Time and Attendance Software Market is extremely competitive. Companies in the market are focused on safeguarding employee data, performance supervision, training and development, staff self-service, handling of compensation, and integrations to gain a competitive advantage in terms of acquiring maximum market share.

- March 2022: A recent technical integration that grants access to 20 restaurant-specific Point-of-Sale (POS) and time-and-attendance software systems across the United States has been completed by XTM, Inc., a Miami and Toronto-based FinTech company in the neo-banking space that offers mobile banking and payment solutions globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates for 2020-2027

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Attractiveness-Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Flexibility in Workflow Management

- 5.1.2 Rise in Adoption of Cloud-based Time & Attendance Systems

- 5.1.3 Trend of Remote Working Culture

- 5.2 Market Challenges

- 5.2.1 Availability of Free and Open Source Time Tracking Software in the Market

- 5.3 Market Opportunities

- 5.3.1 Increase in Usage of Time & Attendance Software to Track Projects and Tasks Performed by Employees is creating an opportunity for the market

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Application

- 6.2.1 Core HR and Talent Acquisition

- 6.2.2 Workforce Management

- 6.2.3 Others

- 6.3 By End-User Industry

- 6.3.1 BFSI

- 6.3.2 Retail and E-commerce

- 6.3.3 IT and Telecommunication

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Education

- 6.3.8 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 FingerCheck

- 7.1.3 NETtime Solutions

- 7.1.4 ADP, Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Reflexis Systems Inc.

- 7.1.7 Replicon

- 7.1.8 Ultimate Kronos Group (UKG)

- 7.1.9 Paycor

- 7.1.10 Paycom Software, Inc.

- 7.1.11 Rippling

- 7.1.12 Civica

- 7.1.13 Ramco Systems

- 7.1.14 Workday, Inc.

- 7.1.15 Ceridian HCM

- 7.1.16 ATOSS

- 7.2 Vendor Ranking Analysis

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219