|

市場調查報告書

商品編碼

1635461

美國能源儲存:市場佔有率分析、產業趨勢與成長預測(2025-2030)United States Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

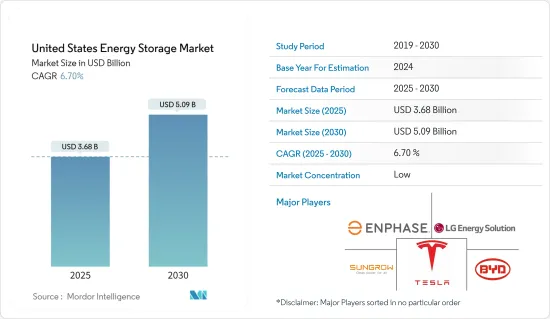

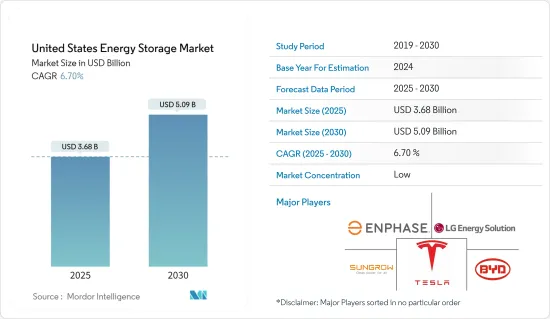

預計2025年美國能源儲存市場規模為36.8億美元,2030年將達50.9億美元,預測期間(2025-2030年)複合年成長率為6.7%。

主要亮點

- 從長遠來看,可再生能源的採用增加和鋰離子電池價格下降等因素預計將在預測期內推動市場發展。

- 電池製造所用原料的短缺預計將阻礙預測期內的市場成長。

- 美國研發人員處於替代電池化學物質研究和開發的前沿,這些化學物質比目前的電池化學物質更安全、更有效率,這為未來的市場帶來了一些機會。

美國能源儲存市場趨勢

住宅領域預計將主導市場

- 最近,美國的能源儲存系統(ESS)顯著成長,特別是在住宅領域,同時全部區域對可再生能源基礎設施的投資也有所增加。由於年度可支配所得的增加以及美國各地在家工作趨勢的成長,預計住宅電力消耗在預測期內將會增加。能源儲存系統在尖峰時段停電期間為您的家庭提供持續的電力供應。

- 美國各地推出了各種獎勵計劃來支持住宅能源儲存市場。加州的家庭發電獎勵計畫(SGIP)支持住宅儲能領域,並為新的和現有的分散式能源提供誘因。此外,隨著能源儲存技術的不斷進步,住宅能源儲存領域可能會受到歡迎,導致電池價格下降和可再生能源的採用增加。

- 由於新澤西州政府推出的太陽能可再生能源積分(SREC)等有利的獎勵計劃以及太陽能電池板成本的降低,新澤西州的住宅太陽能裝置正在蓬勃發展,可能會顯著成長。太陽能的趨勢使住宅可以節省電費。因此,住宅能源儲存系統的採用可能會增加。

- 此外,2023年2月,加州淨計量政策(又稱NEM3.0)將生效,允許住宅消費者出售屋頂發電廠產生的多餘電力,並在電網電價飆升時給予儲存和使用獎勵。同樣,商業消費者也有望從 NEM 3.0 中受益。

- 此外,2023年5月,LG能源解決方案公司(LGES)在美國推出了住宅電池儲能系統,以滿足儲能需求。該公司的備用解決方案「Prime」由電池、逆變器和自動備用裝置組成,可儲存、使用和輸出電力,容量約為19.2kWh至32kWh。

- 因此,有鑑於此,住宅領域預計將在預測期內主導美國能源儲存市場。

可再生能源發電的增加預計將推動市場

- 過去十年,美國可再生能源發電發電裝置容量和發電量穩步成長。太陽能和風能等可再生資源會間歇性地產生不同程度的電力,因此儲存這些能源並在需求高時使用它至關重要。

- 因此,現代能源儲存系統(ESS)對於可再生能源計劃變得至關重要。可再生能源領域的快速成長預計將成為美國ESS 市場成長的強勁驅動力之一。

- 截至2023年,美國可再生已從2012年的160GW增加到約387.54GW。可再生能源的使用不斷增加,使得能源儲存概念更容易以如此快的速度滲透市場。

- 傳統上,美國最廣泛使用的能源儲存技術是抽水蓄能系統。截至 2023 年,美國抽水蓄能發電容量將超過 24 吉瓦,住宅、商業和公共產業領域的電池儲存容量將達到 150 吉瓦。然而,由於地理限制、土地面積大和電池成本下降,預計該技術的需求成長在預測期內將受到限制。

- 此外,美國能源儲存系統的未來前景廣闊,特別是考慮到隨著可再生能源部署的增加,對電網穩定性和能源安全的需求不斷成長。此外,新型經濟型鋰離子電池的開發顯著增加了可與 ESS 結合的住宅、商業和工業太陽能系統的數量。

- 綜上所述,可再生能源發電的增加預計將在不久的將來推動市場。

美國能源儲存產業概況

美國能源儲存市場適度細分。該市場的主要企業包括特斯拉公司、比亞迪、LG Energy Solution Ltd、Enphase Energy 和陽光電源。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年能源儲存系統裝置容量及預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 增加可再生能源的部署

- 鋰離子電池成本更低

- 抑制因素

- 其他能源儲存系統的存在

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 技術部分

- 電池

- 其他能源儲存系統技術

- 階段

- 單相

- 三相

- 最終用戶

- 住宅

- 商業/工業

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Tesla Inc.

- Sungrow Power Supply Co. Ltd

- BYD Co. Ltd

- Sonnen GmbH

- LG Energy Solution Ltd

- Enphase Energy

- Voith GmbH & Co. KGaA

- Andritz AG

- Siemens Energy AG

- Fluence Energy

- 市場排名分析

第7章 市場機會及未來趨勢

- 鋰離子電池的技術進步

簡介目錄

Product Code: 92093

The United States Energy Storage Market size is estimated at USD 3.68 billion in 2025, and is expected to reach USD 5.09 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

Key Highlights

- In the long term, factors such as increasing installations of renewable energy and declining prices for lithium-ion batteries are expected to drive the market during the forecast period.

- The scarcity of raw materials used for battery manufacturing is likely to hinder the market's growth during the forecast period.

- Researchers in the United States have been at the forefront of researching and developing alternate battery chemistries, which are safer and more efficient than current battery chemistries, thus creating several opportunities for the market in the future.

United States Energy Storage Market Trends

The Residential Segment is Expected to Dominate the Market

- In the recent past, the energy storage system (ESS) in the United States experienced significant growth, especially in the residential sector, along with the rising investments in renewable energy infrastructure across the region. Electricity consumption in residential buildings is estimated to increase during the forecast period due to increasing annual disposable incomes and the rising work-from-home trend across the United States. Energy storage systems provide continuous power supply at homes during power outages at peak hours.

- Various incentive programs across the United States are in place to support the residential energy storage market. California's Self-Generation Incentive Program (SGIP) supports the residential storage sector and offers incentives for new and existing distributed energy resources. Moreover, the residential energy storage segment is likely to proliferate because of increasing technological advancements in energy storage technology, which is leading to a decline in battery prices and widespread deployment of renewable power sources.

- Residential solar installations in New Jersey are likely to witness significant growth due to favorable incentive programs like Solar Renewable Energy Credits (SREC) and the declining cost of solar panels, which was introduced by the government of New Jersey. The shifting trend toward solar enables homeowners to save money on electricity bills. This, in turn, is likely to increase the deployment of residential energy storage systems.

- Moreover, in February 2023, California's net metering policy, also called NEM 3.0, incentivized residential consumers to sell the excess generated electricity from their rooftop power plants and store the electricity to use it at a time when prices of grid electricity become high. Similarly, commercial consumers are also expected to gain benefits from NEM 3.0.

- Furthermore, in May 2023, LG Energy Solution (LGES) launched a residential battery energy storage system in the United States to cater to the demand for electricity storage. The company's backup solution, Prime, contains a battery, inverter, and an auto-backup device with a capacity of about 19.2 kWh to 32 kWh to store, use, and export electricity.

- Therefore, owing to such points, the residential segment is expected to dominate the US energy storage market during the forecast period.

Rising Renewable Energy Generation is Expected to Drive the Market

- In the last decade, the installed renewable energy capacity and generation have been rising steadily in the United States. Renewable resources, such as solar and wind, generate power intermittently and at various levels, and storing this energy to be used during high demand is of vital importance.

- Due to this, modern energy-storing systems (ESS) are becoming an indispensable part of renewable energy projects. The rapid growth in the renewable energy sector is expected to be one of the strongest drivers for the growth of the ESS market in the United States.

- As of 2023, the United States had approximately 387.54 GW of renewable installed capacity from 160 GW in 2012. The increasing usage of renewable energy has made it easy for the energy storage concept to penetrate the market at such a fast rate.

- Traditionally, the most widely-used energy storage technology utilized in the United States has been pumped storage systems. As of 2023, the United States had more than 24 GW of storage from pumped hydropower and another 1.5 GW in batteries in the residential, commercial, and utility sectors. However, due to their geographical limitations, large land footprint, and falling battery costs, this technology is expected to see limited growth in demand during the forecast period.

- Moreover, the future outlook for energy storage systems in the United States is promising, driven by the growing need for grid stability and energy security, particularly in the context of increasing renewable energy deployment. Also, with the development of new and affordable lithium-ion batteries, the number of residential, commercial, and industrial solar rooftop PV systems coupled with ESS has increased significantly.

- Owing to the above points, rising renewable energy generation is expected to drive the market in the near future.

United States Energy Storage Industry Overview

The US energy storage market is moderately fragmented. Some of the key players in the market are Tesla Inc., BYD Co. Ltd, LG Energy Solution Ltd, Enphase Energy, and Sungrow Power Supply Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Energy Storage Systems Installed Capacity and Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy

- 4.5.1.2 Declining Cost of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Presence of Other Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Batteries

- 5.1.2 Other Energy Storage System Technologies

- 5.2 Phase

- 5.2.1 Single Phase

- 5.2.2 Three Phase

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tesla Inc.

- 6.3.2 Sungrow Power Supply Co. Ltd

- 6.3.3 BYD Co. Ltd

- 6.3.4 Sonnen GmbH

- 6.3.5 LG Energy Solution Ltd

- 6.3.6 Enphase Energy

- 6.3.7 Voith GmbH & Co. KGaA

- 6.3.8 Andritz AG

- 6.3.9 Siemens Energy AG

- 6.3.10 Fluence Energy

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Lithium-ion Batteries

02-2729-4219

+886-2-2729-4219