|

市場調查報告書

商品編碼

1640659

亞太地區能源儲存系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Energy Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

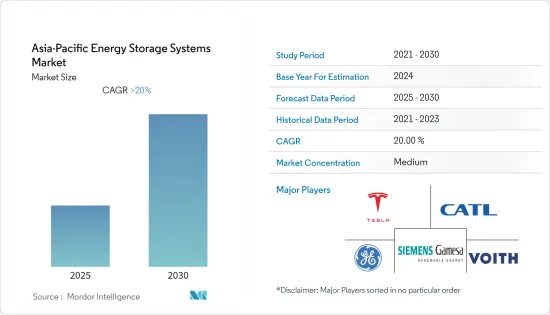

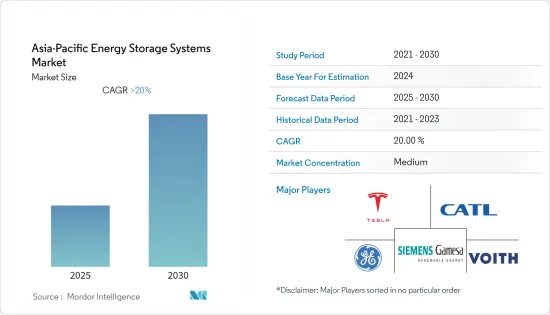

預計預測期內亞太地區能源儲存系統市場複合年成長率將超過 20%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從中期來看,可再生能源領域的擴張以及與支援和開發能源儲存技術相關的舉措預計將推動市場成長。

- 然而,預計高額的資本投入、巨大的複雜性以及額外的空間需求將在預測期內阻礙亞太地區能源儲存系統市場的成長。

- 在預測期內,太陽能光電逆變器的產品創新和最新技術的採用可能為亞太地區儲能系統市場提供有利的成長機會。

- 印度已經經歷了顯著的成長,並且很可能在預測期內實現顯著的複合年成長率。這一成長得益於對可再生能源的投資增加和政府的支持措施。

亞太地區能源儲存系統市場趨勢

抽水蓄能水力發電(PSH)將主導市場

- 能源儲存的第一個主要現代應用是抽水蓄能。此過程利用非尖峰時段的多餘能源,將水泵入水庫,在尖峰時段增加正常流量。

- 抽水蓄能是能源儲存的較有效的方法之一(約75%),但缺點是無法立即使用。抽水蓄能電站用於中長期蓄水,洩水時間從幾小時到幾天不等。

- PSH 的典型往返效率為 70% 至 84%。 PSH 的平均壽命超過 50 年,而電池的壽命僅為 8 至 15 年。

- 2021年,中國抽水蓄能容量超過36.3吉瓦,位居世界第一。日本則位居第二,裝置容量約21.9吉瓦。

- 2022年1月,中國電力建設集團公司(中國電建)宣布,計畫在2025年興建200座以上抽水蓄能電站,總合發電量達270GW。這有望為該國的能源儲存系統創造機會。

- 印度計畫在2019-20年至2029-30年期間新增79個水力發電發電工程,總合容量為30吉瓦,其中包括11個抽水發電工程,總合8.7吉瓦。全國抽水蓄能容量480萬千瓦(年終2021年底)。水力發電佔印度總發電量的 12%,達 51.4 吉瓦。因此,新的舉措和計劃有望推動能源儲存系統市場的發展。

- 西澳大利亞州 30MWh 抽水能源儲存計劃將於 2022 年 4 月開始建設,並計劃於 2023 年下半年開始商業營運。抽水能源儲存(PHES) 設施的最大輸出功率為 1.5MW,並將使用兩座水壩儲存 30MWh 的能量(持續 15 小時)。

- 因此,由於上述因素,抽水蓄能電力很可能在預測期內佔據市場主導地位。

印度經濟快速成長

- 可再生能源發電領域的擴張預計將推動對能源儲存系統的需求,以解決與可再生能源發電間歇性相關的挑戰。到2040年,印度還可能成為第三大能源儲存安裝國。預計全球能源儲存裝置將呈指數級成長,從 2018 年的 9GW/17GWh 增加到 2040 年的 1,095GW/2,850GWh。

- 南亞國家印度的太陽能發電容量在2021年達到高峰49.3吉瓦以上,與前一年同期比較去年同期成長26.4%。報告期間內,各項數據均呈現持續成長的趨勢。

- 2021 年 5 月,聯邦內閣核准了一項 24.8 億美元的電池儲存生產連結獎勵(PLI) 計畫。 PLI 計劃是“國家先進化學電池 (ACC) 計劃”,旨在印度建立 50 GWh ACC 和 5 GWh“利基”ACC 的生產能力。

- 2021年10月,電力部宣布,旨在製定全面的能源儲存政策,重點關注監管、金融、稅收、需求管理和技術方面,以加速儲能容量的部署。

- 2021年12月,印度太陽能公司(SECI)授予塔塔電力一份訂單,建造100兆瓦的EPC太陽能發電工程和一個120兆瓦時的公用事業規模電池儲能系統。塔塔電力目前正在列城實施 50 兆瓦太陽能發電工程,並配備 50 兆瓦時的 BESS 電池儲能系統。

- 2022 年 1 月,ReNew Power 宣布計劃與美國Fluence 成立合資企業 (JV),在印度提供能源儲存解決方案。該合資公司將向 ReNew 提供卡納塔克邦 300 兆瓦峰值電力計劃所需的 150 兆瓦時 BESS。

- 因此,由於上述因素,預計印度將對亞太地區能源儲存系統市場表現出顯著的需求。

亞太地區能源儲存系統產業概況

亞太地區能源儲存系統市場呈現細分化。市場的主要企業(不分先後順序)包括特斯拉公司、寧德時代科技公司、通用電氣公司、西門子歌美颯再生能源公司和福伊特有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 電池

- 抽水蓄能水電 (PSH)

- 能源儲存(TES)

- 飛輪儲能(FES)

- 其他

- 應用

- 住宅

- 商業和工業

- 地區

- 中國

- 澳洲

- 印度

- 韓國

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Tesla Inc

- Contemporary Amperex Technology Co. Ltd

- Voith GmbH & Co. KGaA

- General Electric Company

- Hydrostor Inc.

- Siemens Gamesa Renewable Energy SA

- Fitzer Incorporation

- BYD Co. Ltd

- Bharat Heavy Electricals Limited

- NGK Insulators Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 56391

The Asia-Pacific Energy Storage Systems Market is expected to register a CAGR of greater than 20% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing the renewable energy sector, and policies related to support and development of energy storage technology are expected to drive the growth of the market studied.

- On the other hand, high capital investments, along with huge complexity and additional space requirements are expected to hamper the growth of Asia-Pacific energy storage systems market during the forecast period.

- Nevertheless, product innovation and adaptation of the latest technologies in solar PV inverters are likely to create lucrative growth opportunities for the Asia-Pacific energy storage systems market in the forecast period.

- India to witness significant growth and also likely to witness the remarkable CAGR during the forecast period. This growth is attributed to the increasing investments in renewable energy, coupled with supportive government policies.

APAC Energy Storage Systems Market Trends

Pumped-Storage Hydroelectricity (PSH) to Dominate the Market

- The first primary modern application of energy storage was pumped-storage hydroelectricity. In this process, excess energy that is available during off-peak hours is used to pump water back up the hill to an upper reservoir, where it can be added to the regular flow during periods of peak demand.

- Pump storage is one of the more efficient methods of energy storage (around 75%) though it has the drawback of not being instantaneously available. Pumped hydro-storage plants are used for medium- or long-term storage, with discharge time ranging from several hours to few days.

- Typical round-trip efficiencies of PSH range between 70% and 84%. It has an average lifespan above 50 years, as compared to batteries, that lasts for 8-15 years, although significant refurbishments are required from time to time.

- In 2021, China ranked first in the world in terms of pumped storage hydropower capacity, with more than 36.3 gigawatts. The Japan followed second with roughly 21.9 gigawatts of capacity.

- In January 2022, the Power Construction Corporation of China (Power China) announced the plans to begin work on more than 200 pumped hydro plants with a combined generating capacity of 270GW by 2025. This is expected to create opportunities for energy storage systems in the country.

- India plans to add 79 hydropower projects with a total capacity of 30 GW, including 11 pumped-storage projects totaling 8.7 GW, during 2019-2020 to 2029-30. The country has a pumped storage capacity of 4.8 GW (end of 2021). Hydropower accounts for 12% of India's total capacity, with 51.4 GW. Thus, new initiatives and projects are expected to drive the energy storage systems market.

- In April 2022, Construction work commenced on a 30MWh pumped hydro storage project in Western Australia for a commercial operation start date in the second half of 2023. The pumped hydro energy storage (PHES) facility has a maximum power output of 1.5MW and uses two farm dams to store 30MWh of energy (15 hours duration).

- Therefore, based on the above-mentioned factors, pumped-storage hydroelectricity is likely to dominate the market over the forecast period.

India to Witness Significant Growth

- The growing renewable sector, the demand for the energy storage system, to address the challenges related to intermittency in renewable power generation, is expected to grow. Also, India may emerge the third-largest energy storage installation country by 2040 i.e. energy storage installations around the world will multiply exponentially, from a modest 9GW/17GWh deployed as of 2018 to 1,095GW/2,850 GWh by 2040.

- The solar photovoltaic energy capacity in the south Asian country of India peaked at over 49.3 gigawatts in 2021, up by 26.4 percent from the previous year. In the period of consideration figures presented a trend of continuous growth.

- In May 2021, the Union cabinet approved the USD 2.48 billion Production Linked Incentive (PLI) scheme for battery storage. The PLI scheme 'National Programme on Advanced Chemistry Cell (ACC) Battery Storage' for building the manufacturing capacity of 50 GWh of ACC and 5 GWh of 'Niche' ACC in India.

- In October 2021, the Power Ministry announced its aim to bring out a comprehensive policy on energy storage that would broadly focus on regulatory, financial, taxation, demand management, and technological aspects to speed up the implementation of storage capacity.

- In December 2021, the Solar Energy Corporation of India (SECI) awarded Tata Power to build a 100MW EPC solar project and a 120MWh utility-scale battery energy storage system. Tata Power is currently executing another solar project of 50MW with BESS of 50MWh battery storage in Leh.

- In January 2022, ReNew Power announced plans to set up a joint venture (JV) with US-based Fluence to provide energy storage solutions in India. The JV intends to offer the solution to ReNew, with 150 MWh BESS required for its 300 MW peak power project in Karnataka.

- Therefore, based on the above mentioned factors, India is expected to witness significant demand for energy storage systems market in Asia-Pacific region.

APAC Energy Storage Systems Industry Overview

The Asia-Pacific energy storage systems market is fragmented. Some of the major players in the market (in no particular order) include Tesla Inc., Contemporary Amperex Technology Co. Ltd, General Electric Company, Siemens Gamesa Renewable Energy SA, and Voith GmbH & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Batteries

- 5.1.2 Pumped-storage Hydroelectricity (PSH)

- 5.1.3 Thermal Energy Storage (TES)

- 5.1.4 Flywheel Energy Storage (FES)

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.3 Geography

- 5.3.1 China

- 5.3.2 Australia

- 5.3.3 India

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Tesla Inc

- 6.4.2 Contemporary Amperex Technology Co. Ltd

- 6.4.3 Voith GmbH & Co. KGaA

- 6.4.4 General Electric Company

- 6.4.5 Hydrostor Inc.

- 6.4.6 Siemens Gamesa Renewable Energy SA

- 6.4.7 Fitzer Incorporation

- 6.4.8 BYD Co. Ltd

- 6.4.9 Bharat Heavy Electricals Limited

- 6.4.10 NGK Insulators Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219