|

市場調查報告書

商品編碼

1635465

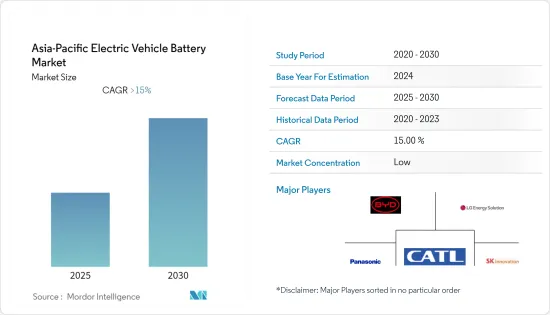

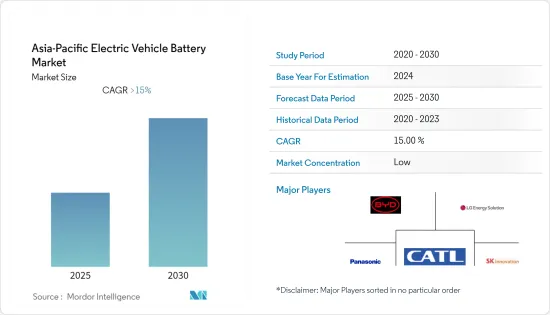

亞太地區電動汽車電池 -市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia-Pacific Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區電動汽車電池市場預計在預測期內複合年成長率將超過15%

主要亮點

- 短期內,由於亞洲國家對電動車的需求持續成長以及政府推動無碳交通,亞太地區電動車電池市場可能會出現高速成長。

- 另一方面,與電動車相關的續航里程問題和溫度問題降低了客戶的接受度,並對電動車電池市場構成重大威脅。

- 電動汽車電池產業專家的研發努力正在為市場的順利發展創造充足的機會。例如,中國工業巨頭寧德時代已宣布計劃於 2023 年推出下一代高能量密度電動車電池。

- 在政府旨在實現無排放氣體交通的舉措的支持下,由於電動車的大規模採用,中國預計將出現更高的成長率。

亞太地區電動汽車電池市場趨勢

鋰離子電池預計將顯著成長

- 由於鋰離子電池的技術特性使其成為電動車的理想選擇,因此該地區的鋰離子電池銷量預計將激增。該技術具有高能源效率、高溫性能、高功率重量比和高可回收性等優點。

- 截至2021年,中國和韓國是電動車市場的兩個主要國家。 2021年,韓國純電動車銷量約7.2萬輛,中國則為270萬輛。隨著電動車需求的飆升,該地區鋰離子電池的銷售蓬勃發展。此外,私人投資者的鋰離子電池製造計劃也正在推動市場。

- 2022年8月,比亞迪Ord Shs A宣布規劃在中國江西省興建電動車電池製造工廠。該計劃還包括一個鋰離子開採和加工計劃,為工廠提供關鍵原料。該工廠每年將生產約30GWh鋰電池。

- 此外,2022年9月,韓國電動車電池製造商SK Innovation與澳洲礦業公司Global Lithium Resources簽署協議,為鋰電池供應鋰。

- 這些發展預計將在未來幾年推動亞太地區電動車鋰電池市場的發展。

中國預計將經歷顯著成長

- 中國是該地區最大的電動車 (EV) 市場,也因生產大量用於全球各種應用的電池而聞名。由於政府努力促進無排放氣體交通,預計該國將保持其主導地位。

- 例如,中國政府計劃在2022年將電動車補貼減少30%,並於同年終取消。計劃削減補貼的目的是減少製造商對政府資金開發新技術和新車的依賴。電動車製造商預計將首先從這項變更中受益,從而增加汽車電池領域的需求。

- 2021年中國純電動車銷量達270萬輛,較2020年的93萬輛快速成長。由於即將推出的電動車工廠計劃和電動車電池製造市場的擴大,預計該國的電動車電池市場將變得更加活躍。

- 此外,2022年6月,本田旗下汽車生產和銷售合資企業廣汽本田宣布,已開始在中國廣東省廣州市建設新電動汽車工廠。新的電動車工廠預計將於 2024 年運作後每年生產約 12 萬輛汽車。本田還計劃在 2027 年推出 10 款 e:N 系列電動車型。

- 這些發展對於擴大中國電動車電池市場具有巨大潛力。

亞太地區電動汽車電池產業概況

亞太地區電動汽車電池市場細分:主要企業(排名不分先後)包括 LG Energy Solution、松下控股公司、比亞迪 Ord Shs A、寧德時代 (CATL) 和 SK Innovation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他電池類型

- 車型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 地區

- 中國

- 韓國

- 印度

- 馬來西亞

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- LG Energy Solution

- Contemporary Amperex Technology Co Ltd.

- BYD Ord Shs A

- Panasonic Holdings Corporation

- SK Innovation Co Ltd.

- Samsung SDI

- EV Energy

- Murata Electronics

- Duracell

- Enersys

第7章市場機會與未來趨勢

簡介目錄

Product Code: 92792

The Asia-Pacific Electric Vehicle Battery Market is expected to register a CAGR of greater than 15% during the forecast period.

Key Highlights

- Over the short term, the Asia-Pacific electric vehicle battery market can witness high growth due to the constantly growing demand for electric vehicles in Asian countries and the government's push toward carbon-free transportation.

- On the other hand, range anxiety and temperature issues associated with electric vehicles cause low customer acceptance, which poses a great threat to the electric vehicle battery market.

- Nevertheless, the research and development endeavors made by the electric vehicle battery industry experts create ample opportunities for the smooth progress of the market. For example, China's leading industry player CATL announced plans to introduce next-generation electric vehicle batteries with higher energy density in 2023.

- China is forecasted to grow at a faster rate due to the heavy deployment of electric vehicles backed by government policies for emission-free transportation.

APAC Electric Vehicle Battery Market Trends

Lithium-ion Battery Expected to Witness Significant Growth

- The region is predicted to witness an upsurge in lithium-ion battery sales due to its technical features that are best suited for electric vehicles. High energy efficiency, high-temperature performance, greater power-to-weight ratio, and high recyclability are some of the advantages of the technology.

- As of 2021, China and South Korea were the two leading countries in the electric vehicles market. The BEV sales recorded in South Korea were around 72000 units in 2021, whereas China stood at 2.7 million. The intensively growing demand for electric vehicles led to an escalated growth in lithium-ion battery sales in the region. Moreover, the lithium-ion battery manufacturing projects by private investors have also driven the market.

- In August 2022, BYD Ord Shs A announced that they had planned an electric vehicle battery manufacturing plant in Jiangxi, China. The plan also includes a lithium-ion mining and processing project to supply critical input to the factory. The plant is expected to produce around 30GWh of lithium batteries per year.

- Further, in September 2022, SK Innovation, the Korea-based electric vehicle battery manufacturer, entered into an agreement with Global Lithium Resources, the Australian mining company for the latter to supply lithium for lithium batteries.

- Such developments are expected to steer the lithium battery market for electric vehicle applications in the Asia-Pacific region in the coming years.

China Expected to Witness Significant Growth

- China is the largest market for electric vehicles (EVs) in the region and is also known for the mass production of batteries for various applications worldwide. The country is predicted to maintain its dominance in the future as well due to the government's efforts to promote emission-free transportation in the country.

- For example, the government of China is expected to cut subsidies on electric vehicles by 30% in 2022 and remove it by the end of the year, as the electric vehicle industry in the country is now booming. The planned subsidy cut is aimed at reducing manufacturers' reliance on government funds for developing new technologies and vehicles. Electric vehicle makers are expected to be the first to benefit from this change, thus increasing the demand in the automotive batteries segment.

- The BEV sales in China were recorded as 2.7 million in 2021, a high elevation from 930,000 units in 2020. The electric vehicle battery market is anticipated to get more impetus in the country due to the upcoming electric vehicle factory projects and expansion in the electric vehicle battery manufacturing market.

- Further, in June 2022, GAC Honda, the Honda automobile production and sales joint venture, announced that they had started the construction of a new EV plant in Guangzhou city of Guangdong state, China. The new EV plant is expected to produce around 120,000 units annually once it becomes operational in 2024. Honda also plans to introduce 10 e:N series EV models by 2027.

- Such developments have immense potential to expand China's electric vehicle battery market.

APAC Electric Vehicle Battery Industry Overview

The Asia-Pacific Electric Vehicle battery market is fragmented. Some of the key players (in no particular order) include LG Energy Solution, Panasonic Holdings Corporation, BYD Ord Shs A, Contemporary Amperex Co Ltd (CATL), and SK Innovation Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 Geography

- 5.3.1 China

- 5.3.2 South Korea

- 5.3.3 India

- 5.3.4 Malaysia

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Ord Shs A

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 SK Innovation Co Ltd.

- 6.3.6 Samsung SDI

- 6.3.7 EV Energy

- 6.3.8 Murata Electronics

- 6.3.9 Duracell

- 6.3.10 Enersys

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219