|

市場調查報告書

商品編碼

1479767

全球和中國電動汽車電池和材料:技術、趨勢和市場預測Global and China EV Batteries and Materials: Technology, Trends, and Market Forecasts |

||||||

電動車市場正處於關鍵時刻,對清潔交通解決方案的需求不斷增長,推動了電池技術的創新。

主要研究領域包括電池化學和設計的進步,包括鋰離子電池的開發以及固態鋰和鋰硫等新化學物質的研究。 這些創新預計將帶來更高的能量密度、更短的充電時間和更高的安全性。

固態電池尤其受到關注,因為它們有潛力顯著改進傳統電池技術,例如提高能量密度和縮短充電時間。

本報告對全球及中國電動汽車電池和材料市場進行了調查,包括電動汽車電池技術現狀、新趨勢、相關主要材料、市場預測以及中國在全球電動汽車格局中的戰略定位等進行了詳細分析。

目錄

第一章簡介

第二章全球電動車與電動車電池市場展望

- 電動車市場

- 電動車電池

- 電動車電池市場預測

- 電動車電池能量密度

- 電動車電池價格

- 電動車電池市場佔有率

- 中國的崛起

- 未來電池

第三章中國電動車及電動車電池市場展望

- 中國電動車市場

- 中國電瓶電池

- 中國電動車電池市場預測

- 中國的崛起

第四章正極材料分析

- 簡介

- 正極材料成本

- 正極材質與電池型

- 鋰

- 鋰價格

- 鋰的供應和需求

- 主要鋰生產國

- 主要鋰生產公司

- 鈷

- 鈷價

- 鈷的供應和需求

- 主要鈷生產國

- 主要鈷生產公司

- 鎳/錳

第五章全球負極、電解液、隔膜材料分析

- 摘要

- 世界負極市場

- 世界分離器(膜)市場

- 全球電解液市場

第六章中國負極、電解液、隔膜材料分析

- 摘要

- 中國負極市場

- 中國隔膜(膜)市場

- 中國電解液市場

第 7 章供應商概況與策略

- Aekyung Chemical

- Aleees

- Asahi Kasei

- B&M

- BASF

- BTR New Energy Materials

- BNE

- Cangzhou Mingzhu

- Central Glass

- Do-Fluoride Chemical

- Easpring

- Ecopro

- Foshan Jinhui Hi-tech Optoelectronic Material

- Guangzhou Tinci Materials Technology

- Guotai-Huarong

- Hitachi Chemical

- Huiqiang New Energy

- Hunan Changyuan Lico

- Idemitsu Kosan

- JFE Chemical

- Johnson Matthey

- Kureha

- L&F

- Mingzhu

- Mitsubishi Chemical

- Nichia

- Ningbo Jinhe New Materials

- Posco

- Pulead Technology Industry

- Reshine

- Shenzhen Senior Technology

- ShanShan

- Shenzhen Capchem Technology

- SK Innovation

- Shinzoom

- Sinuo

- Soulbrain

- Stella Chemifa

- Sumitomo Metal Mining

- Tanaka Chemical

- Tangray

- Teijin

- Toray Battery

- Ube Industries

- Umicore

- W-Scope

- Xiamen Tungsten

- Xinxiang Zhongke Science and Technology

- XTC New Energy Materials

- Zeto

- Zhuhai Smoothway Electronic Materials

- Zichen

第八章電池企業概況及策略

- AESC

- BYD

- Beijing National Battery Technology

- CALB

- Camel Group Co

- CATL

- Cham Battery Technology Co

- Chaowei Power Holdings Limited

- CITIC Guo'An Mengguli (MGL)

- CNSG Anhui Hong Sifang Co

- Coslight

- DLG Power Battery

- Do-Fluoride (Jiaozuo) New Energy Technology

- EVE Energy Co., Ltd.

- Farasis Energy (Ganzhou) Co., Ltd.

- First New Energy Co. Ltd

- Great Power Energy Technology Co., Ltd

- Guoxuan Hi-Tech

- Harbin Coslight Power Co., Ltd.

- Henan Lithium Power Source Co

- Henan Xintaihang

- Highstar Battery

- Huanyu New Energy Technology Co., Ltd.

- Hunan Copower EV Battery Co., Ltd

- Jiangsu Tenpower

- Jiangsu Zhihang New Energy Co., Ltd.

- Kokam Co., Ltd

- LG Chem

- Lithium Energy Japan

- Mcnair New Energy Co., Ltd

- Melsen Power

- Microvast Power Systems Co., Ltd.

- Narada Power Source Co., Ltd.

- Ningbo CRRC New Energy Technology Co., Ltd.

- NorthVolt

- OptimumNano

- Panasonic

- Plylion Battery Co., Ltd.

- Primearth EV Energy Co., Ltd.

- Samsung SDI

- Shandong Forever New Energy

- Shandong Hengyu New Energy

- Shanghai CENAT New Energy Co., Ltd.

- Shenzhen BAK

- Sinopoly Battery

- Sinowatt

- SK Innovation

- Skyrich Power Co., Ltd.

- Supreme Power Systems Co., Ltd.

- Suzhou Youlion Battery Inc.

- Tianjin EV Energies Co., Ltd. (JEVE)

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power

- TerraE

- Tesla

- Tianjin EV Energies Co., Ltd. (JEVE)

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power

- Wanxiang-A123

- Wina Power

- Wuhu ETC Battery Limited

- Zhongdao Energy Co., Ltd.

- Zhuhai Yinlong New Energy Co., Ltd.

- Zhuoneng New Energy

- Zibo Guoli

- ZTT Energy Storage Technology Co., Ltd.

Introduction

The "Global and China EV Batteries and Materials: Technology, Trends, and Market Forecasts" report presents an exhaustive analysis of the electric vehicle (EV) battery sector, spotlighting the technological advancements, market dynamics, and strategic developments shaping the future of electric mobility worldwide, with a particular focus on China. As the nexus of global EV adoption and battery production, China's influence extends across the entire value chain, from raw material sourcing to end-product innovation. This comprehensive report not only dissects the current landscape but also projects future trends, offering deep insights into the evolving technologies, market shifts, and policy frameworks that are steering the industry.

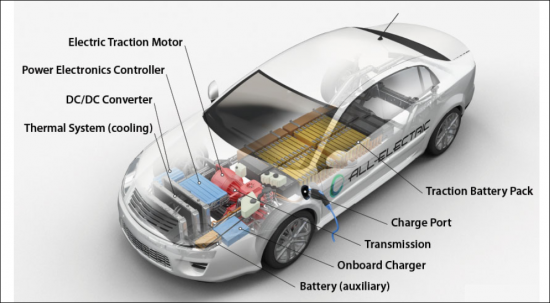

The EV market is at a critical juncture, with escalating demand for cleaner transportation solutions driving innovation in battery technologies. This report delves into the latest in battery design, including improvements in energy density, charging times, safety, and longevity, while also exploring emerging alternatives to traditional lithium-ion systems. The analysis covers advancements in solid-state batteries, lithium-sulfur technology, and other innovative materials and designs poised to redefine industry standards.

China's role as both a market leader and a technological powerhouse in the EV battery sector is examined in detail. The report evaluates China's strategic initiatives to bolster its domestic battery industry, including government policies, research and development efforts, and international partnerships. Furthermore, it assesses the competitive landscape, highlighting key players within China and globally, their market positioning, and strategies to capitalize on the burgeoning demand for EVs.

Material scarcity and supply chain sustainability are critical issues addressed in the report, with a focus on the sourcing and management of essential materials such as lithium, cobalt, nickel, and rare earth elements. It offers a thorough analysis of supply chain risks, environmental impacts, and the strategies companies are adopting to mitigate these challenges, including recycling technologies and the development of less resourceintensive battery chemistries.

Market forecasts included in the report are underpinned by a rigorous examination of trends in consumer adoption, technological breakthroughs, policy incentives, and macroeconomic factors. These forecasts provide stakeholders across the EV ecosystem - from battery manufacturers and materials suppliers to automotive OEMs and policymakers - with a strategic outlook on the market's direction, helping them to navigate the complexities of the industry and identify opportunities for growth and innovation.

By juxtaposing China's market and technological advancements with the global picture, the report offers a nuanced understanding of the interplay between domestic policies, international competition, and collaborative efforts in shaping the future of electric mobility.

"Global and China EV Batteries and Materials: Technology, Trends, and Market Forecasts" stands as an indispensable resource for anyone looking to comprehend the current state and future trajectory of the EV battery sector, providing the insights necessary to thrive in this rapidly evolving landscape.

Trends

The "Global and China EV Batteries and Materials: Technology, Trends, and Market Forecasts" report provides a comprehensive overview of the pivotal technological advancements and market dynamics shaping the electric vehicle (EV) battery sector. It delves into a range of innovations aimed at improving battery performance, safety, and sustainability. Among the key areas of exploration are advancements in battery chemistry and design, including the development of lithium-ion batteries and the exploration of new chemistries such as solid-state and lithium-sulfur. These innovations promise to deliver higher energy densities, shorter charging times, and enhanced safety features.

Solid-state batteries are particularly highlighted for their potential to offer substantial improvements over traditional battery technologies, with benefits including increased energy density and faster charging capabilities. The report also examines the growing importance of sustainability and recycling in the battery production process. This includes advancements in recycling technologies that enable the recovery of valuable materials and efforts to reduce the environmental impact of battery disposal.

Further, the report covers innovations in materials and battery components, such as anodes and cathodes, that are critical for enhancing battery performance and reducing costs. It looks into silicon-based anodes and advancements in cathode materials, alongside the exploration of alternative materials to decrease reliance on scarce resources. The role of battery management systems in optimizing battery usage and integration into vehicles is also discussed, highlighting their importance in ensuring battery longevity and safety.

Additionally, the report touches on the advancements in fast charging technologies and infrastructure that are essential for making EVs more appealing to consumers by reducing charging times. It also discusses the scale and economics of battery production, including the challenges and opportunities in achieving economies of scale, the impact on battery costs, and the strategic efforts by companies and nations to secure supply chains.

About This Report

This comprehensive report provides a detailed analysis of the current state of EV battery technology, emerging trends, key materials involved, market forecasts, and the strategic positioning of China within the global EV landscape.

China's aggressive push towards electric mobility, backed by robust government policies, substantial investments in research and development, and a well-established manufacturing ecosystem, has positioned it as a global leader in the EV battery industry. The report delves into the technological advancements driving the sector, including innovations in battery chemistry, energy density, charging speed, and longevity. It also examines the strategic moves by automobile companies to secure critical raw materials and advance battery recycling technologies, crucial for sustaining growth and reducing environmental impact.

The analysis extends to the rapidly changing market dynamics, influenced by consumer preferences, government incentives, and international trade tensions. It provides insights into how these factors are shaping demand for EVs and, by extension, the demand for advanced battery technologies. The report further explores the competitive landscape, highlighting key players in the battery manufacturing space, their market strategies, and how they are adapting to the technological and regulatory shifts within the industry.

An integral part of the report is the detailed examination of materials critical to the production of EV batteries, such as lithium, cobalt, nickel, and graphene. It assesses the supply chain dynamics, including sourcing, pricing volatility, and sustainability issues, offering a forward-looking perspective on how these factors may influence the battery sector's evolution.

Market forecasts presented in the report are grounded in a thorough analysis of current trends and projected developments in technology, policy, and consumer behavior. These forecasts offer valuable insights for stakeholders across the EV ecosystem, including battery manufacturers, material suppliers, automotive OEMs, policymakers, and investors, providing them with the information needed to make informed decisions in a rapidly changing market.

The "Global and China EV Batteries and Materials: Technology, Trends, and Market Forecasts" report stands as a crucial resource for understanding the complexities of the EV battery industry in China. It not only captures the current state but also anticipates future shifts, offering a comprehensive overview that highlights opportunities, challenges, and strategic imperatives for stakeholders looking to navigate or deepen their engagement in this pivotal sector of the global energy transition.

Table of Contents

Chapter 1. Introduction

Chapter 2. Global EV and EV Battery Market Outlook

- 2.1. EV Market

- 2.2. EV Batteries

- 2.2.1. EV Battery Market Forecast

- 2.2.2. EV Battery Energy Density

- 2.2.3. EV Battery Cell Price

- 2.2.4. EV Battery Market Share

- 2.2.5. Rise of China

- 2.2.5.1. Aggressive EV Battery Expansion

- 2.2.5.2. Chinese Battery Technology

- 2.2.6. Future Batteries

- 2.2.6.1. Lithium-air (Li-air)

- 2.2.6.2. Lithium-metal (Li-metal)

- 2.2.6.3. Solid-State Lithium

- 2.2.6.4. Lithium-sulfur (Li-S)

- 2.2.6.5. Sodium-ion (Na-ion)

Chapter 3. Chinese EV and EV Battery Market Outlook

- 3.1. China EV Market

- 3.2. China EV Batteries

- 3.2.1. China EV Battery Market Forecast

- 3.2.2. Rise of China

- 3.2.2.1. Aggressive EV Battery Expansion

- 3.2.2.2. Chinese Battery Technology

- 3.2.2.3. EV Battery Overcapacity

Chapter 4. Cathode Material Analysis

- 4.1. Introduction

- 4.1.1. Cathode Material Costs

- 4.1.2. Cathode Materials And Battery Types

- 4.1.2.1. LCO (Lithium Cobalt Oxide) Cathodes

- 4.1.2.2. NCM (Nickel Cobalt Manganese) Cathodes

- 4.1.2.3. LMO (Lithium Manganese Oxide) Cathodes

- 4.1.2.4. LFP (Lithium Iron Phosphate) Cathodes

- 4.1.2.5. NCA (Nickel Cobalt Aluminum) Cathodes

- 4.2. Lithium

- 4.2.1. Lithium Prices

- 4.2.2. Lithium Supply/Demand

- 4.2.3. Top Lithium-Producing Countries

- 4.2.4. Top Lithium-Producing Producers

- 4.3. Cobalt

- 4.3.1. Cobalt Prices

- 4.3.2. Cobalt Supply/Demand

- 4.3.3. Top Cobalt-Producing Countries

- 4.3.4. Top Cobalt-Producing Producers

- 4.4. Nickel/Manganese

Chapter 5. Global Anode, Electrolyte, And Separator Material Analysis

- 5.1. Overview

- 5.2. Global Anode Market

- 5.3. Global Separator (Membrane) Market

- 5.4. Global Electrolytes Market

Chapter 6. China Anode, Electrolyte, And Separator Material Analysis

- 6.1. Overview

- 6.2. China Anode Market

- 6.3. China Separator (Membrane) Market

- 6.4. China Electrolytes Market

Chapter 7. Supplier Profiles and Strategies

- 7.1. Aekyung Chemical

- 7.2. Aleees

- 7.3. Asahi Kasei

- 7.4. B&M

- 7.5. BASF

- 7.6. BTR New Energy Materials

- 7.7. BNE

- 7.8. Cangzhou Mingzhu

- 7.9. Central Glass

- 7.10. Do-Fluoride Chemical

- 7.11. Easpring

- 7.12. Ecopro

- 7.13. Foshan Jinhui Hi-tech Optoelectronic Material

- 7.14. Guangzhou Tinci Materials Technology

- 7.15. Guotai-Huarong

- 7.16. Hitachi Chemical

- 7.17. Huiqiang New Energy

- 7.18. Hunan Changyuan Lico

- 7.19. Idemitsu Kosan

- 7.20. JFE Chemical

- 7.21. Johnson Matthey

- 7.22. Kureha

- 7.23. L&F

- 7.24. Mingzhu

- 7.25. Mitsubishi Chemical

- 7.26. Nichia

- 7.27. Ningbo Jinhe New Materials

- 7.28. Posco

- 7.29. Pulead Technology Industry

- 7.30. Reshine

- 7.31. Shenzhen Senior Technology

- 7.32. ShanShan

- 7.33. Shenzhen Capchem Technology

- 7.34. SK Innovation

- 7.35. Shinzoom

- 7.36. Sinuo

- 7.37. Soulbrain

- 7.38. Stella Chemifa

- 7.39. Sumitomo Metal Mining

- 7.40. Tanaka Chemical

- 7.41. Tangray

- 7.42. Teijin

- 7.43. Toray Battery

- 7.44. Ube Industries

- 7.45. Umicore

- 7.46. W-Scope

- 7.47. Xiamen Tungsten

- 7.48. Xinxiang Zhongke Science and Technology

- 7.49. XTC New Energy Materials

- 7.50. Zeto

- 7.51. Zhuhai Smoothway Electronic Materials

- 7.52. Zichen

Chapter 8. Battery Company Profiles and Strategies

- 8.1. AESC

- 8.2. BYD

- 8.3. Beijing National Battery Technology

- 8.4. CALB

- 8.5. Camel Group Co

- 8.6. CATL

- 8.7. Cham Battery Technology Co

- 8.8. Chaowei Power Holdings Limited

- 8.9. CITIC Guo'An Mengguli (MGL)

- 8.10. CNSG Anhui Hong Sifang Co

- 8.11. Coslight

- 8.12. DLG Power Battery

- 8.13. Do-Fluoride (Jiaozuo) New Energy Technology

- 8.14. EVE Energy Co., Ltd.

- 8.15. Farasis Energy (Ganzhou) Co., Ltd.

- 8.16. First New Energy Co. Ltd

- 8.17. Great Power Energy Technology Co., Ltd

- 8.18. Guoxuan Hi-Tech

- 8.19. Harbin Coslight Power Co., Ltd.

- 8.20. Henan Lithium Power Source Co

- 8.21. Henan Xintaihang

- 8.22. Highstar Battery

- 8.23. Huanyu New Energy Technology Co., Ltd.

- 8.24. Hunan Copower EV Battery Co., Ltd

- 8.25. Jiangsu Tenpower

- 8.26. Jiangsu Zhihang New Energy Co., Ltd.

- 8.27. Kokam Co., Ltd

- 8.28. LG Chem

- 8.29. Lithium Energy Japan

- 8.30. Mcnair New Energy Co., Ltd

- 8.31. Melsen Power

- 8.32. Microvast Power Systems Co., Ltd.

- 8.33. Narada Power Source Co., Ltd.

- 8.34. Ningbo CRRC New Energy Technology Co., Ltd.

- 8.35. NorthVolt

- 8.36. OptimumNano

- 8.37. Panasonic

- 8.38. Plylion Battery Co., Ltd.

- 8.39. Primearth EV Energy Co., Ltd.

- 8.40. Samsung SDI

- 8.41. Shandong Forever New Energy

- 8.42. Shandong Hengyu New Energy

- 8.43. Shanghai CENAT New Energy Co., Ltd.

- 8.44. Shenzhen BAK

- 8.45. Sinopoly Battery

- 8.46. Sinowatt

- 8.47. SK Innovation

- 8.48. Skyrich Power Co., Ltd.

- 8.49. Supreme Power Systems Co., Ltd.

- 8.50. Suzhou Youlion Battery Inc.

- 8.48. Tianjin EV Energies Co., Ltd. (JEVE)

- 8.49. Tianjin Lishen Battery Joint-Stock Co., Ltd.

- 8.50. Tianneng Power

- 8.51. TerraE

- 8.52. Tesla

- 8.53. Tianjin EV Energies Co., Ltd. (JEVE)

- 8.54. Tianjin Lishen Battery Joint-Stock Co., Ltd.

- 8.55. Tianneng Power

- 8.56. Wanxiang-A123

- 8.57. Wina Power

- 8.58. Wuhu ETC Battery Limited

- 8.60. Zhongdao Energy Co., Ltd.

- 8.61. Zhuhai Yinlong New Energy Co., Ltd.

- 8.62. Zhuoneng New Energy

- 8.63. Zibo Guoli

- 8.64. ZTT Energy Storage Technology Co., Ltd.

List of Tables

- 2.1. Global EV Market Forecast

- 2.2. Global EV Battery Makers

- 2.3. Summary Table of Lithium-Based Batteries

- 2.4. EV Battery Breakdown by Company and EV Model

- 2.5. Shipment Forecast of EV Battery by Region

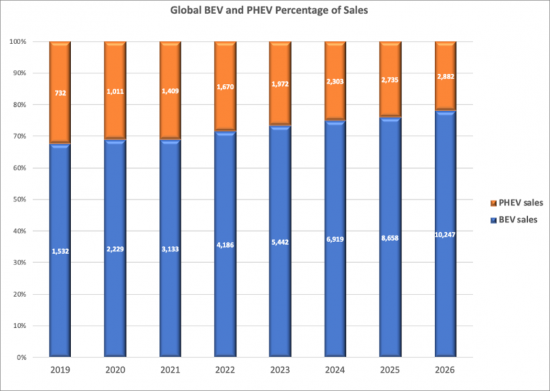

- 2.6. Outlook for EV/PHEV Sales

- 2.7. Summary Table of Future Batteries

- 3.1. Best Selling Chinese Electric Vehicles

- 3.2. China Battery Demand By Type

- 3.3. China Personal Vehicle EV Battery Output By Type

- 3.4. China EV Battery Output By Vehicle Type

- 3.5. China Personal Vehicle EV Battery Shipments By Shape

- 3.6. China Personal Vehicle EV Battery Shipments By Density

- 3.7. China Personal Vehicle EV Battery Shipments By Customer

- 4.1. Major Lithium Metal Oxides Used In Cathodes

- 4.2. Cathode Material Characteristics

- 4.3. Lithium Cobalt Oxide (LCO) Properties

- 4.4. Lithium Nickel Manganese Cobalt Oxide Properties

- 4.5. Lithium Manganese Oxide Properties

- 4.6. Lithium Nickel Cobalt Aluminum Oxide Properties

- 4.7. Lithium Production and Reserves by Country

- 4.8. Amount Of Cobalt Per Battery For Different Devices

- 4.9. Cobalt Mine Production by Country

- 5.1. Material Revenue Forecast

- 5.2. Properties and Suppliers of Anode Materials

- 5.3. Characteristics and Suppliers of Separators

- 6.1. Material Revenue Forecast

List of Figures

- 2.1. EV Battery Market Forecast by Vehicle Type

- 2.2. EV Battery Market Forecast (MWh)

- 2.3. Battery Market by Application 2000

- 2.4. Battery Market by Application 2015 And 2025

- 2.5. EV Battery Density by Type

- 2.6. EV Battery Market Share by Manufacturer

- 2.7. EV Battery Shipments 2017 and 2018

- 2.8. EV Battery Manufacturer Capacity by Region

- 2.9. China EV Battery Shares

- 2.10. China EV Battery Shares - NCM

- 2.11. China's EV Battery Output by Type

- 2.12. Comparison Between a Conventional and All-Solid-State LIB

- 2.13. Comparison Between a Conventional and Metal Polysulfide LIB

- 3.1. China EV Battery Demand

- 3.2. China EV Battery Manufacturers

- 3.3. China NEV Battery Shares (Personal/Commercial)

- 4.4. China Personal EV Battery Shares

- 3.5. China Personal Vehicle EV Battery Output By Type

- 3.6. China EV Battery Shares - LFP

- 3.7. China EV Battery Shares - NCM

- 3.8. China Personal Vehicle EV Battery Output By Shape

- 3.9. China Personal Vehicle EV Battery Output By Density

- 3.10. China Personal Vehicle EV Battery Output By Type

- 4.1. Li Battery Materials Cost Breakdown

- 4.2. Cathode Materials Market Share by Type

- 4.3. LCO Market Share by Material Supplier

- 4.4. NCM Market Share by Material Supplier

- 4.5. LMO Market Share by Material Supplier

- 4.6. LFP Market Share by Material Supplier

- 4.7. NCA Market Share by Material Supplier

- 4.8. Lithium Prices 2009-2018

- 4.9. Lithium Supply by Country - 2017

- 4.10. Lithium Supply by Country - 2025

- 4.11. Lithium Supply by Country - 2014-2025

- 4.12. Cobalt 1-Year Price Graph

- 4.13. Cobalt 5-Year Price Graph

- 4.14. Cobalt Supply/Demand

- 4.15. Cobalt Demand by Application

- 4.16. Cobalt Components by Battery Type

- 4.17. Nickel 5-Year Price Graph

- 4.18. Manganese 5-Year Price Graph

- 5.1. Anode Materials Market Share by Type

- 5.2. Market Shares of Anode Materials Suppliers

- 5.3. Market Shares of Separator Materials Suppliers

- 5.4. Wet Vs Dry Separator Forecast for EV Batteries

- 5.5. Global Demand for Separators for Automotive

- 5.6. Market Shares of Electrolyte Materials Suppliers

- 6.1. China Anode Materials Market Share by Type

- 6.2. China Market Shares Of Artificial Graphite Suppliers

- 6.2. China Market Shares Of Natural Graphite Suppliers

- 6.4. China Market Shares Of Wet Separator Materials Suppliers

- 6.5. China Market Shares Of Dry Separator Materials Suppliers

- 6.6. China Separator Shipment Breakdown By Type

- 6.7. China Market Shares Of Electrolyte Materials Suppliers