|

市場調查報告書

商品編碼

1683861

中國電動車電池組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029 年)China EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

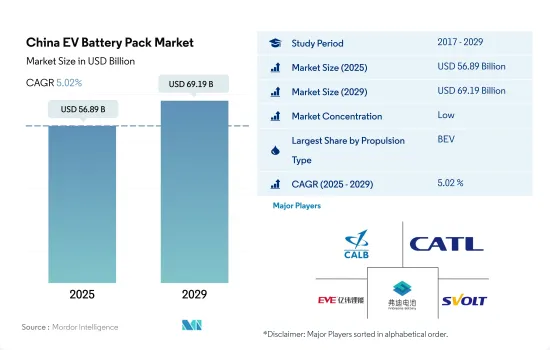

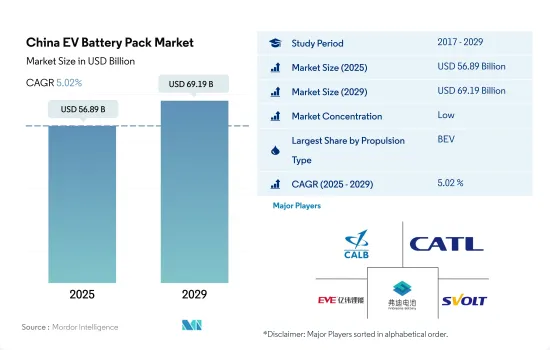

預計 2025 年中國電動車電池組市場規模將達到 568.9 億美元,預計到 2029 年將達到 691.9 億美元,預測期內(2025-2029 年)的複合年成長率為 5.02%。

由於產量增加、政府監管和消費者接受,中國對電動車和鋰離子電池的需求正在增加。電池式電動車佔據市場主導地位,但插電式混合動力車也越來越受歡迎。

- 中國是全球汽車電氣化領域的領導者之一。該國也因其電池工業而聞名。過去幾年,電動車銷量呈指數級成長。電動車產量的增加、政府規範的嚴格以及為排放碳排放而採用電動車的高採用率,使得 2021 年該國對電動車的需求高於 2017 年。

- 電池電動車的需求高於對插電式混合動力車的需求。到 2022 年,電池電動車將佔據市場最大佔有率,約佔電動車總銷量的 70%,而插電式混合動力車的銷量約為 28%。採用插電式混合動力技術的汽車在續航里程焦慮方面比全電動汽車更有優勢,因為它們可以在燃料和電池之間切換,這也在逐漸吸引客戶,因為 2022 年 PHEV 銷量較 2021 年成長了約 32%。因此,中國 2022 年電動車中使用的鋰離子電池數量與 2021 年相比有所增加。

- 除了對電池電動車的需求外,對鋰離子電池的需求也在不斷成長。此外,各公司都在推出新型電動車。 Polestar將於2023年3月推出一款全新電動SUV,電池續航里程約315英里(約563公里)。預計此類產品的推出將在預測期內提振中國對電動車電池的需求。

中國電動車電池組市場趨勢

推動電動革命的比亞迪領先中國電動車電池組市場,其次是特斯拉、五菱、豐田集團和廣汽Aion

- 中國的電動車市場規模龐大,由多家經銷商經營,但主要由五大公司推動,這五家公司在2022年佔據了50%以上的市場佔有率。這些公司包括比亞迪、特斯拉、五菱、豐田集團和廣汽Aion。比亞迪是中國最大的電動車製造商,約佔電動車銷量的25.27%。公司研發能力強大,財務實力雄厚。我們憑藉著優秀的定價策略和遍布全國的銷售和服務網路贏得了客戶。

- 特斯拉的市場佔有率約為9.72%,是中國第二大電動車銷售商。該公司專注於尖端創新,並與包括電池製造商在內的多家電動車零件製造商建立了強大的策略合作夥伴關係。我們還在中國擁有強大的銷售網路。五菱以8.47%的市場佔有率位居電動車銷量第三位。該公司是柳州五菱工業的子公司,憑藉其向不同類型的客戶提供電動車的廣泛產品系列,在中國贏得了大量追隨者。

- 中國第四大電動車銷售商是豐田集團,市場佔有率約7.06%。該公司在客戶中擁有可靠的品牌形象,並透過中國完善的供應鏈網路分銷其產品。中國電動車電池組市場第五大參與者為廣汽Aion,市場佔有率約3.71%。在中國銷售電動車的其他公司包括奇瑞、長安、納多、理想汽車和風森。

2022年,特斯拉、比亞迪、五菱將佔據中國乘用車市場50%以上的佔有率,並帶動主要電池組需求。

- 中國是全球最大的電動車市場之一,近年來電動車需求大幅成長。該國的電動車購買者範圍很廣,但掀背車和 SUV 是最暢銷的車款。經濟的駕駛、實惠的價格和方便的停車是掀背車需求不斷成長的主要因素,而充足的餘量和腿部空間、寬敞的乘客容量和較高的離地間隙可在各種道路上提供舒適的駕駛體驗,也是推動該國電動 SUV 銷售的因素之一。

- 由於人們偏愛經濟型汽車,掀背車在該國的銷售強勁。五菱宏光 MINIEV 在 2022 年銷量強勁成長,因為它是一款價格實惠的全電動汽車,具有長續航里程和最高速度限制。 MINIEV也提供敞篷版,吸引消費者。中國人民對特斯拉等各類品牌都反應正面。該公司是中國知名品牌之一,2022 年其 Model Y 和 Model 3 銷售強勁。

- 中國品牌主導電動車市場。比亞迪宋也憑藉其全電動動力傳動系統和較大的載客量成為中國消費者最暢銷的車款之一。中國電動車電池組市場還包括各品牌的電動 SUV 和掀背車。其中常見的車款是比亞迪海豚和元Plus,這兩款車在2022年銷量強勁。中國電動車電池組市場的其他品牌包括秦PLUS DM-i、漢DM和唐DM。

中國電動汽車電池組產業概況

中國電動車電池組市場較為分散,前五大企業市佔率合計0.10%。市場的主要企業是:中國航空電池(CALB)、寧德時代(CATL)、億緯鋰能、FinDreams Battery 和蜂巢能源科技(SVOLT)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動汽車銷售

- 電動車銷量(按OEM)

- 最暢銷的電動車車型

- 具有首選電池化學成分的OEM

- 電池組價格

- 電池材料成本

- 每種電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 中國

- 價值鏈與通路分析

第5章 市場區隔

- 體型

- 公車

- LCV

- M&HDT

- 搭乘用車

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 包包

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- China Aviation Battery Co. Ltd.(CALB)

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Farasis Energy(Ganzhou)Co. Ltd.

- FinDreams Battery Co. Ltd.

- Gotion High-Tech Co. Ltd.

- Ruipu Energy Co. Ltd.

- Sunwoda Electric Vehicle Battery Co. Ltd.(Sunwoda)

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- Tianjin Lishen Battery Joint-Stock Co. Ltd.(Lishen Battery)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The China EV Battery Pack Market size is estimated at 56.89 billion USD in 2025, and is expected to reach 69.19 billion USD by 2029, growing at a CAGR of 5.02% during the forecast period (2025-2029).

China's demand for electric vehicles and lithium-ion batteries is growing due to higher production, government regulations, and consumer adoption. Battery electric vehicles dominate the market while PHEVs are also gaining popularity.

- China is one of the global leaders in the electrification of vehicles. The country also has a very big name in the battery industry. The country has witnessed tremendous growth in the sales of electric vehicles over the past few years. Higher production of electric vehicles, stringent government norms, and a high adoption rate of electric vehicles to control carbon emissions enhanced the demand for electric vehicles in 2021 over 2017 in the country.

- The demand for battery electric vehicles is higher compared to the PHEV. The majority of the market, i.e., around 70% of the sales in overall electric vehicles, was acquired by battery electric vehicles compared to around 28% of the plug-in hybrid electric vehicles in 2022. Vehicles using plug-in hybrid technology may switch between using fuel or batteries, giving them an advantage over fully electric vehicles in terms of range anxiety, which is also gradually attracting customers as the sales of PHEV registered a growth of around 32% in 2022 over 2021. As a result, lithium-ion batteries used in electric vehicles grew in 2022 over 2021 in China.

- In addition to the demand for battery electric vehicles, the need for lithium-ion batteries is rising. Moreover, various companies are launching new electric vehicles. In March 2023, Polestar launched its new electric SUV, which will provide a battery range of around 315 miles (563 kms). Such new launches are expected to boost the demand for electric car batteries during the forecast period in China.

China EV Battery Pack Market Trends

DRIVING THE ELECTRIC REVOLUTION, BYD LEADS THE CHINESE EV BATTERY PACK MARKET, FOLLOWED BY TESLA, WULING, TOYOTA GROUP, AND GAC AION

- The market for electric vehicles in China is huge and is operated by many sellers, but it is largely driven by five major companies, which held more than 50% of the market in 2022. These companies include BYD, Tesla, Wuling, Toyota Group, and GAC Aion. BYD was the largest seller of electric vehicles in China, accounting for around 25.27% of the share in EV sales. The company has strong R&D capabilities with good financial positioning. It is capturing customers through a great pricing strategy and a wide sales and service network across China.

- Tesla held a market share of around 9.72%, making it the second-largest seller of electric vehicles across China. The company focuses on cutting-edge innovations and has solid strategic alliances with producers of several EV parts, including batteries. The company also has a strong sales network across China. The Wuling recorded the third-highest market share, 8.47%, for the electric vehicle sales. The company operates as a subsidiary of Liuzhou Wuling Automobile Industry Co. Ltd. It has a strong hold on the customers of China due to its wide product portfolio offering EVs for various types of customers.

- The fourth-largest player in China EV sales was Toyota Group, accounting for around 7.06% of the market share. The company has a reliable brand image among its customers and sells its products in China through a well-established supply chain network. The fifth-largest player operating in the Chinese EV battery pack market was GAC Aion, maintaining its market share at around 3.71%. Other players selling EVs in China include Chery, Changan, Neta, Li-Auto, and Fengshen.

IN 2022, TESLA, BYD, AND WULING HAD MORE THAN 50% OF CHINA'S PASSENGER CAR MARKET, DRIVING THE MAJOR BATTERY PACK DEMAND

- China is one of the largest electric vehicle markets globally, and the demand for electric vehicles has grown significantly over the past few years. The country has a variety of buyers for electric vehicles, but hatchbacks and SUVs are some of the best-selling segments. Economical drive, affordable pricing, and easy parking are the major factors for the hatchback's increasing demand, and large head and leg room, large seating capacity, and comfortable drive on various roads due to high ground clearance are some of the factors aiding the sales of the electric SUVs in the country.

- The country has witnessed good sales of the hatchback as people prefer affordability. Wuling Hongguang MINIEV registered significant sales growth in 2022, as it is one of the very affordable full electric cars with good range and limited top speed. It also offers a convertible version, which is attracting consumers. The population of China is showing a positive response to various brands, such as Tesla, owing to the good brand image and wide product offering of EVs. The company is operating as one of the prominent brands in China and registered good sales of models Y and 3 in 2022.

- Most of the electric vehicle market is captured by Chinese brands. Song has also been one of the best sellers of BYD among Chinese consumers, owing to its fully electric powertrain with a large seating capacity. The Chinese EV battery pack market also features a variety of electric SUVs and hatchbacks from various brands. One of the common cars is the BYD Dolphin and Yuan Plus, which registered good sales in 2022. Other cars in the Chinese EV battery pack market include Qin PLUS DM-I, Han DM, and Tang DM.

China EV Battery Pack Industry Overview

The China EV Battery Pack Market is fragmented, with the top five companies occupying 0.10%. The major players in this market are China Aviation Battery Co. Ltd. (CALB), Contemporary Amperex Technology Co. Ltd. (CATL), EVE Energy Co. Ltd., FinDreams Battery Co. Ltd. and SVOLT Energy Technology Co. Ltd. (SVOLT) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 China Aviation Battery Co. Ltd. (CALB)

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 EVE Energy Co. Ltd.

- 6.4.4 Farasis Energy (Ganzhou) Co. Ltd.

- 6.4.5 FinDreams Battery Co. Ltd.

- 6.4.6 Gotion High-Tech Co. Ltd.

- 6.4.7 Ruipu Energy Co. Ltd.

- 6.4.8 Sunwoda Electric Vehicle Battery Co. Ltd. (Sunwoda)

- 6.4.9 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.10 Tianjin Lishen Battery Joint-Stock Co. Ltd. (Lishen Battery)

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms