|

市場調查報告書

商品編碼

1683872

歐洲電動公車電池組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029 年)Europe Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

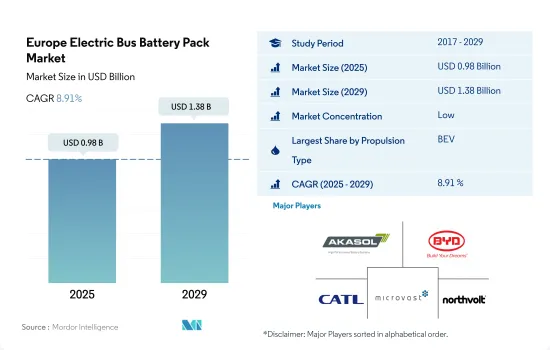

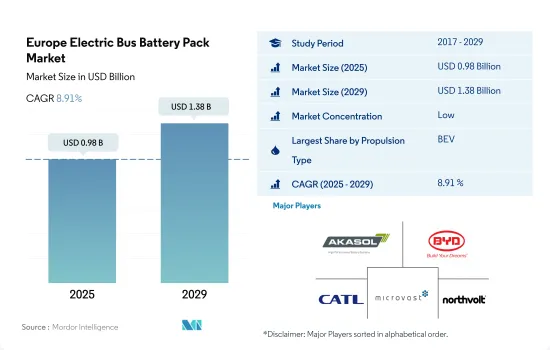

預計 2025 年歐洲電動公車電池組市場規模為 9.8 億美元,到 2029 年將達到 13.8 億美元,預測期間(2025-2029 年)的複合年成長率為 8.91%。

隨著歐洲電動車普及率的提高,政府獎勵和電池技術進步推動了電動公車市場的成長

- 2017 年至 2020 年間,歐洲的電動車普及率大幅增加,2020 年新註冊量達到 140 萬輛,比 2017 年成長 137%。歐洲電動公車市場也在成長,預計 2020 年至 2027 年的複合年成長率為 28.7%。預計這一成長將受到政府激勵措施和法規的推動,包括歐盟到 2030 年將二氧化碳排放減少 55% 的目標,以及電池技術的進步。

- 由於電池密度和續航里程的增加以及電池成本的下降,對 BEB 電池組的需求正在成長。近年來電池成本大幅下降,2010年至2020年電動車鋰離子電池平均成本下降了89%。電池成本也將持續下降,預計到2030年將達到58美元/度。此外,固態電池能量密度更高、充電速度更快、安全性更高。這些技術進步預計將進一步推動市場發展。

- 隨著技術不斷進步和新的成長機會,歐洲電動公車電池組市場未來前景光明。例如,預計到 2030 年,歐洲的電池電動公車每年將節省 9 億多公升柴油。將太陽能和風能等再生能源來源與電池儲存系統相結合是創建能夠平衡能源供需的「智慧電網」的最新趨勢。固態電池的發展和新電池化學成分的探索為歐洲電動公車市場的電池組產業提供了令人興奮的機會。

在政府支持和汽車產業的推動下,德國以強勁成長引領市場

- 歐洲電動公車電池組市場是一個充滿活力且不斷成長的市場。隨著電動車普及率的提高和電池組成本的下降,市場預計將繼續成長。除了上述因素外,預計未來幾年還有其他幾個因素將推動歐洲電動車電池組市場的成長。

- 德國是該市場的主要企業,過去幾年價格大幅上漲。這種成長歸因於多種因素,包括政府對電動車的支持、消費者對電動車的需求不斷成長以及電池技術的進步。德國強勁的汽車工業,加上主要汽車製造商對電動車生產的大量投資,是電池組需求激增的主要原因。

- 另一個歐洲主要國家法國的電池組市場也出現了顯著成長。法國致力於透過優惠政策和獎勵促進電動車的普及,這對推動電池組市場的成長發揮關鍵作用。雖然義大利的成長相對於德國和法國有所放緩,但電池組市場仍處於上升趨勢。消費者對電動車認知的不斷提高、政府激勵措施和技術進步等因素推動了義大利市場的成長。隨著對電動車的需求不斷增加,預計電池組將在支持義大利向永續交通轉型方面發揮關鍵作用。

歐洲電動公車電池組市場趨勢

豐田集團領先歐洲電動車市場,其次是雷諾、特斯拉、起亞和寶馬

- 歐洲電動車市場正在經歷強勁成長,儘管活躍的參與者很多,但主要由五家主要公司推動,到 2022 年,這五家公司將佔據 50% 以上的市場佔有率。這五家公司包括豐田集團、起亞汽車、雷諾、特斯拉、起亞汽車和大眾。豐田集團是歐洲最大的電動車經銷商,市佔率約14.84%。該公司擁有強大的供應和分銷網路,可滿足其整個歐洲客戶的需求和供應。雷諾在電動車市場提供了廣泛的產品系列。

- 雷諾的市場佔有率約為 7.47%,是歐洲第二大電動車銷售商。雷諾擁有強大的品牌形象和強勁的財務狀況。我們與日產等領先品牌建立了聯盟和策略夥伴關係。特斯拉以6.71%的銷量位居電動車第三名。特斯拉致力於尖端技術創新,與包括電池在內的電動車零件製造商建立了強大的策略合作夥伴關係。

- 起亞是歐洲第四大電動車銷售商,市場佔有率約 6.26%。該公司為不同類型的客戶提供廣泛的產品類型,並且與其他品牌相比,為每種預算提供多種選擇。在歐洲電動車市場中排名第五的是BMW,市場佔有率約為6.14%。其他在歐洲國家銷售電動車的公司包括現代、賓士、寶馬、奧迪和福特。

由於歐洲電動車的廣泛銷售,特斯拉和雷諾將成為 2022 年電池組需求的最大貢獻者。

- 過去幾年,整個歐洲對電動車的需求急劇成長。電動車如今在歐洲道路上更為普遍。消費者對購買電動車的興趣因地區和國家而異,但在德國和英國這兩個最大的電動車市場,SUV 是最受歡迎的電動車類型。由於人們對舒適交通的興趣日益濃厚,而且 SUV 比轎車擁有更大的內部空間,歐洲國家對電動 SUV 的需求超過了轎車。

- 歐洲各地消費者對小型 SUV 的購買量正在急劇增加。特斯拉 Model Y 配備全馬達、五星級 NCAP 安全認證、可容納多達七名乘客的寬敞座位以及遠距續航里程等特點。 2022年,它成為英國、德國等幾個歐洲主要市場最受歡迎的車型之一。雷諾Arkana配備全混合動力引擎,由於其燃油效率和有競爭力的價格,獲得了包括法國在內的多個歐洲國家客戶的強烈銷售反響。

- Captur 是雷諾 2022 年在歐洲國家最暢銷的汽車之一,因為它提供混合動力和插電式混合動力傳動系統,並配備了一系列吸引買家的功能。歐洲電動車市場還擁有一系列國際品牌的電動 SUV 和轎車。常見的汽車包括豐田雅力士和福特 Kuga,這兩款車在 2022 年的銷量強勁。歐洲電動車市場的其他競爭對手包括飛雅特 500 和豐田雅力士 Cross。

歐洲電動大巴電池組產業概況

歐洲電動客車電池組市場較為分散,前五大企業合計佔27.25%。市場的主要企業是:Akasol AG、比亞迪股份有限公司、寧德時代新能源科技股份有限公司 (CATL)、微宏控股有限公司和 NorthVolt AB(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動公車銷量

- 電動公車銷售(依OEM)

- 最暢銷的電動車車型

- 首選電池化學OEM

- 電池組價格

- 電池材料成本

- 不同電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 比利時

- 法國

- 德國

- 匈牙利

- 波蘭

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

- 國家名稱

- 法國

- 德國

- 匈牙利

- 義大利

- 波蘭

- 瑞典

- 英國

- 其他歐洲國家

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH

- Akasol AG

- BMZ Batterien-Montage-Zentrum GmbH

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- LG Energy Solution Ltd.

- Microvast Holdings Inc

- NorthVolt AB

- Panasonic Holdings Corporation

- SAIC Volkswagen Power Battery Co. Ltd.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- TOSHIBA Corp.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001524

The Europe Electric Bus Battery Pack Market size is estimated at 0.98 billion USD in 2025, and is expected to reach 1.38 billion USD by 2029, growing at a CAGR of 8.91% during the forecast period (2025-2029).

Europe's EV adoption driving growth in the electric bus market, fueled by government incentives and advancing battery technologies

- The adoption of EVs in Europe increased significantly from 2017 to 2020, with new registrations reaching 1.4 million in 2020, representing a 137% increase compared to 2017. The European electric bus market is also experiencing growth, with a CAGR of 28.7% predicted from 2020 to 2027. This growth is expected to be driven by government incentives and regulations, such as the European Union's target to reduce CO2 emissions by 55% by 2030, as well as advancements in battery technologies.

- The demand for battery packs in BEBs is growing, with increasing battery density and range and declining battery costs. Battery costs have decreased significantly in recent years, in line with the average cost of lithium-ion batteries for electric vehicles declining by 89% from 2010 to 2020. It is expected that battery costs will continue to decline, reaching USD 58/kWh by 2030. Additionally, solid-state batteries offer even higher energy density, faster charging, and improved safety. Such technological advancements are expected to boost the market further.

- The future of the European electric bus battery pack market is promising, with continued technological advancements and new opportunities for growth. For instance, battery electric buses are predicted to save over 900 million liters of diesel annually in Europe by 2030. The integration of battery storage systems with renewable energy sources, such as solar and wind, is a recent trend that has created "smart grids" capable of balancing energy supply and demand. The development of solid-state batteries and the exploration of new battery chemistries offer exciting opportunities for the battery pack industry in the European electric bus market.

Germany leads the market with a significant value increase, supported by government support and the automotive industry

- The European electric bus battery pack market is a dynamic and growing market. The market is expected to continue to grow in the coming years, driven by the increasing adoption of EVs and the declining cost of battery packs. In addition to the factors mentioned above, several other factors are expected to drive the growth of the European electric vehicle battery pack market in the coming years.

- Germany stands out as a leading player in the market, with a remarkable increase in value over the years. This growth can be attributed to various factors, such as government support for electric vehicles, rising consumer demand for EVs, and advancements in battery technology. Germany's robust automotive industry, combined with substantial investments by major automakers in electric vehicle production, has significantly contributed to the surge in demand for battery packs.

- France, another prominent European country, has witnessed notable growth in the battery pack market. France's commitment to promoting the adoption of electric vehicles through favorable policies and incentives has played a significant role in driving the growth of the battery pack market. Italy, exhibiting slower growth compared to Germany and France, has still experienced an upward trend in the battery pack market. Factors such as increasing consumer awareness of electric vehicles, government incentives, and technological advancements have contributed to the market's growth in Italy. As the demand for electric vehicles continues to rise, battery packs are expected to play a crucial role in supporting the transition toward sustainable mobility in Italy.

Europe Electric Bus Battery Pack Market Trends

TOYOTA GROUP LEADS THE EUROPEAN EV MARKET, FOLLOWED BY RENAULT, TESLA, KIA, AND BMW

- The market for electric vehicles in various European countries is growing significantly, with numerous players operating, but it is largely driven by five major companies, which held more than 50% of the market in 2022. These companies include Toyota Group, Kia, Renault, Tesla, Kia, and Volkswagen. Toyota Group is the largest seller of electric vehicles in Europe, accounting for around 14.84% share of the electric car market. The company has a strong supply and distribution network catering to the demand and supply of customers in various European countries. The company has a wide product portfolio offering in the EV market.

- Renault holds a market share of around 7.47%, making it the second-largest seller of electric vehicles across Europe. The company has a good brand image and a strong financial position. The company has alliances and strategic partnerships with good brands such as Nissan. The 3rd highest market share, 6.71%, for electric vehicle sales was recorded by Tesla. The business focuses on cutting-edge innovations and has solid strategic alliances with producers of several EV parts, including batteries.

- The 4th largest place in European EV sales is Kia, accounting for around 6.26% of the market share. The company has wide product offerings for various types of customers with various budget-friendly options compared to other brands. The 5th largest player operating in the European EV market is BMW, maintaining its market share at around 6.14%. Some of the other players selling EVs in various European countries include Hyundai, Mercedes-Benz, BMW, Audi, and Ford.

Tesla and Renault are the largest contributors to the demand for battery packs, as a result of the widespread sale of EVs in Europe in 2022

- The demand for electric vehicles has dramatically increased during the past several years in every part of Europe. Electric vehicles are now more prevalent on European roadways. Although consumer interest in buying electric vehicles varies by area and by country, SUVs are the most popular type of electric vehicle in Germany and the United Kingdom, the region's two biggest markets for electric vehicles. The demand for electric SUVs is outpacing that for sedans in various European countries due to the increased interest in comfortable transportation and the fact that SUVs are roomier than sedans.

- The number of compact SUVs purchased by consumers has increased dramatically across Europe. The Tesla Model Y offers a fully electric motor, a 5-star NCAP safety certification, spacious seating for up to 7 passengers, a long-range, and other features. It became one of the most popular models in several major European markets, including the United Kingdom and Germany, in 2022. The Renault Arkana provides a full hybrid engine, which has received a strong sales reaction from customers in several European nations like France due to its fuel efficiency and competitive pricing.

- Captur was one of the best sellers from Renault in the European countries in 2022, owing to its offering of a hybrid and a plug-in hybrid powertrain, and is packed with lots of features attracting buyers. The European EV market also features a variety of electric SUVs and sedans from various international brands. One of the common cars is the Toyota Yaris and Ford Kuga, which recorded good sales in 2022. Other cars in the European EV market that are in the competition include the Fiat 500 and Toyota Yaris Cross.

Europe Electric Bus Battery Pack Industry Overview

The Europe Electric Bus Battery Pack Market is fragmented, with the top five companies occupying 27.25%. The major players in this market are Akasol AG, BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), Microvast Holdings Inc and NorthVolt AB (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Belgium

- 4.11.2 France

- 4.11.3 Germany

- 4.11.4 Hungary

- 4.11.5 Poland

- 4.11.6 UK

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

- 5.8 Country

- 5.8.1 France

- 5.8.2 Germany

- 5.8.3 Hungary

- 5.8.4 Italy

- 5.8.5 Poland

- 5.8.6 Sweden

- 5.8.7 UK

- 5.8.8 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH

- 6.4.2 Akasol AG

- 6.4.3 BMZ Batterien-Montage-Zentrum GmbH

- 6.4.4 BYD Company Ltd.

- 6.4.5 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.6 LG Energy Solution Ltd.

- 6.4.7 Microvast Holdings Inc

- 6.4.8 NorthVolt AB

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 SAIC Volkswagen Power Battery Co. Ltd.

- 6.4.11 Samsung SDI Co. Ltd.

- 6.4.12 SK Innovation Co. Ltd.

- 6.4.13 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.14 TOSHIBA Corp.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219