|

市場調查報告書

商品編碼

1684010

東協電動車電池組:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)ASEAN EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

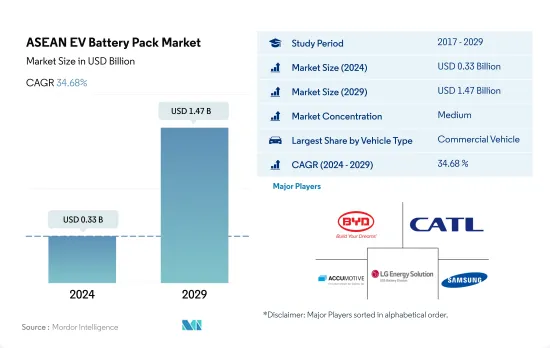

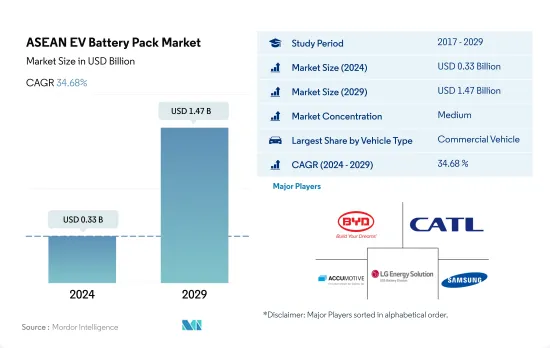

預計 2024 年東協電動車電池組市場規模為 3.3 億美元,到 2029 年將達到 14.7 億美元,預測期內(2024-2029 年)的複合年成長率為 34.68%。

東協電動車電池組市場概況

- 為亞太電池組市場的成長和發展做出貢獻的是東南亞國協。各種政府舉措、豐富的資源以及對電動車日益成長的興趣使這些國家成為電池組製造商、供應商和投資者的活躍市場。

- 在政府大力推動電動車生產和出口的推動下,泰國在電池組市場取得了長足進步。該國擁有誘人的投資激勵措施、熟練的勞動力和成熟的汽車工業。泰國位於東協地區的戰略位置,作為電池組製造地正受到日本國內外的關注。泰國致力於成為電動車領域的地區領導者,這為電池組市場的成長提供了充足的機會。

- 受電動車產業蓬勃發展和鋰離子電池關鍵成分鎳礦蘊藏量豐富的推動,印尼正逐漸成為電池組市場的重要參與者。在政府支持政策和致力於成為全球電動車和電池市場主要企業的背景下,印尼的電池組市場前景看好。馬來西亞、新加坡、越南和菲律賓等國家也對電動車和可再生能源表現出日益濃厚的興趣。這些國家實施了支持性政策、獎勵和基礎設施建設,以鼓勵電動車的普及,從而推動了對電池組的需求。東協地區消費市場的成長,加上向清潔能源解決方案的轉變,為電池組產業的擴張提供了有利的環境。

東協電動車電池組市場趨勢

東協地區有多家電動車製造商,但五菱、特斯拉和比亞迪是2022年電池組需求的主要來源。

- 過去幾年,東協多個國家對電動車的需求激增。購買電動車的興趣因地區和國家而異。然而,在東協地區,SUV是最受歡迎的電動車。作為轎車實用且寬敞的替代品,SUV 越來越受歡迎,這推動了東協地區對電動 SUV 的需求。

- 近年來,東協消費者對小型運動型多用途車(SUV)的需求急劇增加。特斯拉 Model Y 憑藉其全電動動力傳動系統、五星級 NCAP 安全認證、七人座能力和長續航里程,被多個東協主要國家列為首選。比亞迪宋DM插電式混合動力車款憑藉著低廉的價格、高燃油效率等優勢,受到了東協國家消費者的青睞。

- Model 3 是特斯拉 2022 年在東南亞國協最暢銷的車款之一。這是因為它配備了全電動引擎和一些吸引買家的功能。東協電動車市場還擁有來自各種外國品牌的電動 SUV 和轎車。 Nissan Rix Haval H6 是一款熱門車型,2022 年銷量良好。在東協電動車市場上競爭的其他車型包括Innova和現代 Ioniq。

東協電動車電池組產業概況

東協電動車電池組市場適度整合,前五大公司佔53.19%的市場。市場的主要企業有:比亞迪股份有限公司、寧德時代新能源科技有限公司(CATL)、德國ACCUmotive GmbH & Co. KG、LG Energy Solution Ltd.和三星SDI。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動汽車銷售

- 電動車銷量(按OEM)

- 最暢銷的電動車車型

- 具有優選電池化學成分的OEM

- 電池組價格

- 電池材料成本

- 每種電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 體型

- 公車

- LCV

- M&HDT

- 搭乘用車

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 包包

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

- 國家

- 泰國

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Denso Corporation

- Deutsche ACCUmotive GmbH & Co. KG

- Do-Fluoride(Jiaozuo)New Energy Technology

- Guoxuan High-tech Co. Ltd.

- LG Energy Solution Ltd.

- Ningde E-CON Power System Co. Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The ASEAN EV Battery Pack Market size is estimated at 0.33 billion USD in 2024, and is expected to reach 1.47 billion USD by 2029, growing at a CAGR of 34.68% during the forecast period (2024-2029).

An overview of the ASEAN electric vehicle battery pack market

- The ASEAN countries collectively contribute to the growth and development of the battery pack market in the Asia-Pacific region. With various government initiatives, abundant resources, and an increasing focus on electric mobility, these countries create a dynamic market for battery pack manufacturers, suppliers, and investors.

- Thailand is making significant strides in the battery pack market, driven by the government's push for electric vehicle production and export. The country offers attractive investment incentives, skilled labor, and a well-established automotive industry. With its strategic location in the ASEAN region, Thailand serves as a manufacturing hub for battery packs, attracting domestic and international players. Thailand's commitment to becoming a regional leader in electric mobility presents ample opportunities for the growth of the battery pack market.

- Indonesia is emerging as a significant player in the battery pack market, driven by its growing electric vehicle industry and ample reserves of nickel, a crucial component in lithium-ion batteries. With supportive government policies and a focus on becoming a major player in the global electric vehicle and battery market, Indonesia holds promising prospects for the battery pack market. Countries like Malaysia, Singapore, Vietnam, and the Philippines are also witnessing increasing interest in electric vehicles and renewable energy sources. These countries have implemented supportive policies, incentives, and infrastructure development to promote the adoption of electric vehicles, which drives the demand for battery packs. The ASEAN region's growing consumer market, combined with a shift toward clean energy solutions, presents a favorable landscape for the expansion of the battery pack industry.

ASEAN EV Battery Pack Market Trends

The ASEAN region has several EV manufacturers, but Wuling, Tesla, and BYD were the primary demand generators for battery packs in 2022

- In several ASEAN countries, the demand for electric cars has risen sharply during the last few years. The interest in purchasing EVs varies by location and country. However, in the ASEAN region, SUVs are the most popular EVs. The rising popularity of SUVs as a practical and spacious alternative to sedans is driving the demand for electric SUVs throughout the ASEAN region.

- The demand for compact sport utility vehicles (SUVs) among ASEAN customers has increased dramatically in recent years. Several key ASEAN countries have made the Tesla Model Y one of their top picks due to the vehicle's all-electric powertrain, 5-star NCAP safety certification, room for up to 7 people, long range, and other attributes. The BYD Song DM's plug-in hybrid engine has been well-accepted by consumers in numerous ASEAN nations as well, owing to the vehicle's low price and high fuel economy.

- The Model 3 was one of Tesla's best-selling cars in ASEAN countries in 2022. This is because it has a fully electric engine and several features that make it appealing to buyers. There are also electric SUVs and sedans from different foreign brands in the ASEAN EV market. The Haval H6, Nissan Licks, is a popular car that sold well in 2022. Other cars in the ASEAN EV market that are in competition include the Toyota Innova and Hyundai Ionic.

ASEAN EV Battery Pack Industry Overview

The ASEAN EV Battery Pack Market is moderately consolidated, with the top five companies occupying 53.19%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), Deutsche ACCUmotive GmbH & Co. KG, LG Energy Solution Ltd. and Samsung SDI Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-Selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

- 5.9 Country

- 5.9.1 Thailand

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 Denso Corporation

- 6.4.4 Deutsche ACCUmotive GmbH & Co. KG

- 6.4.5 Do-Fluoride (Jiaozuo) New Energy Technology

- 6.4.6 Guoxuan High-tech Co. Ltd.

- 6.4.7 LG Energy Solution Ltd.

- 6.4.8 Ningde E-CON Power System Co. Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 SK Innovation Co. Ltd.

- 6.4.12 SVOLT Energy Technology Co. Ltd. (SVOLT)

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms