|

市場調查報告書

商品編碼

1683864

亞太地區電動公車電池組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029 年)Asia-Pacific Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

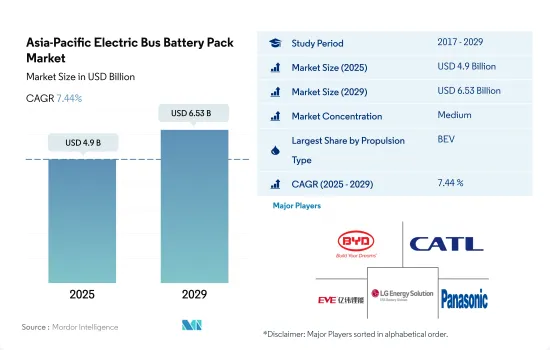

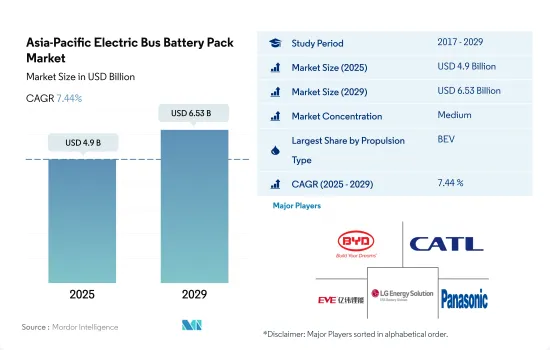

亞太地區電動公車電池組市場規模預計在 2025 年為 49 億美元,預計到 2029 年將達到 65.3 億美元,預測期內(2025-2029 年)的複合年成長率為 7.44%。

由於環境問題日益嚴重、政府規範越來越嚴格以及電動公車電池的普及,亞太地區對電動公車電池的需求預計將增加。

- 公車是亞太地區各國公共交通的主要組成部分。傳統的、過時的公車是過量二氧化碳排放的源頭。因此,近年來亞洲國家對電動公車的需求不斷增加。由於人們日益關注環境問題、政府對電動車的標準越來越嚴格以及電動車的優勢,2021 年對電動公車的需求將高於 2017 年。因此,2021 年純電動公車和插電式混合動力公車的電池組需求高於 2017 年。

- 電動公車在亞洲國家廣泛應用。中國是電動車和電池行業的領導者之一,並在 2022 年佔據了電動公車銷量的最高佔有率。中國電池產業的主要企業包括比亞迪、CATL 和深圳比亞迪鋰電池。印度、日本、韓國和泰國等國家對電動公車的需求不斷增加,也促進了電池組的成長。因此,2022 年該地區對電動公車的需求將高於 2021 年。

- 各電動車和電池製造商已宣佈在亞太國家的電池生產計畫。 2023 年 3 月,中國汽車製造商比亞迪宣布將在印尼建立一座組裝廠和一座電池製造廠,用於生產包括電池電動車和 PHEB 在內的多種類型公車。預計這些發展將在預測期內加速亞太地區對公車電池的需求。

中國成為電動車市場的主要企業,推動車載鋰電池的需求

- 由於政府支持、強勁的國內需求以及對電動車普及的關注等因素,亞太地區的電池組市場正在蓬勃發展。隨著電動車需求的不斷增加和電池組技術的進步,亞太地區預計將在塑造全球電動車產業的未來方面發揮關鍵作用。

- 中國是電池組市場的主導者,並且一直擁有較高的市場價值。中國的快速成長得益於多種因素,包括政府對電動車的支持、龐大的消費市場以及強勁的國內製造業生態系統。中國正在大力投資電動車生產,導致對電池組的需求增加。

- 日本和韓國也是亞太電池組市場的重要貢獻者。多年來,兩國的市場價值都穩定成長。這些國家擁有成熟的汽車工業、技術專長以及政府對電動車應用的大力支持,從而推動了對電池組的需求。隨著人們對電動車普及和可再生能源目標的關注,印度電池組市場正在獲得發展動力。由於政府政策和消費者意識的增強,對電池組的需求正在上升。此外,泰國努力成為電動車領域的地區領導者,為亞太電池組市場的成長提供了充足的機會。

亞太地區電動公車電池組市場趨勢

豐田、特斯拉、五菱領銜市場,多家汽車製造商進入市場

- 亞太地區電動車市場競爭激烈,但這一勢頭主要由五家主導公司推動,總合五家公司在 2022 年將佔據超過 50% 的市場佔有率。比亞迪處於領先地位,佔該地區電動車銷量的 20.93%。比亞迪擁有強大的財務基礎,加上其先進的研發基礎設施,使其成為實力雄厚的企業。有競爭力的定價和龐大的銷售及售後服務網路有效地吸引了新消費者。

- 排在比亞迪之後的第二位的是豐田集團,市佔率約12.88%。比亞迪在亞太地區享有盛譽,廣泛的銷售和服務網路贏得了消費者的信任,進一步鞏固了其地位。排名第三的是特斯拉,市佔率為8.27%。特斯拉以其前衛的技術主導產品而聞名,在包括中國和澳洲在內的國家擁有無縫的供應鏈。

- 排名第四的是五菱,市佔率約7.10%。五菱汽車由母公司柳州五菱工業經營,在中國和印尼等國家佔有一席之地,透過多樣化的電動車產品線滿足多樣化的客戶群。排名第五的是本田,市場佔有率3.85%。在亞太地區電動車市場競爭的其他品牌包括日產、奇瑞、長安和凌達。

到2022年,五菱、特斯拉和比亞迪將成為亞太地區最大的電池組需求製造商。

- 近年來,電動車(包括轎車、巴士和卡車)在亞洲國家呈現出顯著的成長勢頭。雖然不同地區和國家對電動車的興趣各不相同,但很明顯,SUV 已經在中國、印度和日本等主要市場佔據了一席之地。與傳統轎車相比,SUV 因其實用性和空間寬敞性而受到亞洲消費者越來越多的青睞。

- 緊湊型SUV近來越來越受亞洲人的歡迎。特斯拉 Model Y 憑藉全電動傳動系統、五星 NCAP 安全評級、七人座和長續航里程脫穎而出,成為亞太地區尤其是中國主要市場的熱門選擇。比亞迪宋DM憑藉其極具競爭力的價格和高效的燃油經濟性,受到了亞洲各地消費者的青睞。

- 2022 年,特斯拉 Model 3 成為亞洲地區最暢銷的車款之一,因其純電動車和一系列吸引人的功能而受到認可。充滿活力的亞太地區電動汽車產業也提供了來自知名全球製造商的眾多電動 SUV 和轎車可供選擇。 2022 年,我們預計豐田 Yaris Cross 和比亞迪 Dolphin 等汽車的銷售將強勁。其他製造商如豐田的卡羅拉和五菱的宏光 MINIEV 在亞太地區電動車生態系統中也有強大的陣容。

亞太地區電動客車電池組產業概況

亞太地區電動客車電池組市場呈現中度整合態勢,前五大廠商合計佔46.47%。該市場的主要企業為:比亞迪股份有限公司、寧德時代新能源科技股份有限公司(CATL)、億緯鋰能、LG 能源解決方案有限公司和松下控股株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動公車銷量

- 電動公車銷售(依OEM)

- 最暢銷的電動車車型

- 首選電池化學OEM

- 電池組價格

- 電池材料成本

- 不同電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 中國

- 印度

- 印尼

- 日本

- 泰國

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

- 國家

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 其他亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Ameperex Technology Limited(ATL)

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Exide Industries Ltd.

- Gotion High-Tech Co. Ltd.

- GS Yuasa International Ltd.

- LG Energy Solution Ltd.

- Olectra Greentech Ltd.

- Panasonic Holdings Corporation

- Resonac Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- Tata Autocomp Systems Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.(Lishen Battery)

- Zhengzhou Yutong Bus Co. Ltd.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Asia-Pacific Electric Bus Battery Pack Market size is estimated at 4.9 billion USD in 2025, and is expected to reach 6.53 billion USD by 2029, growing at a CAGR of 7.44% during the forecast period (2025-2029).

The demand for electric bus batteries in Asia-Pacific is expected to grow, driven by rising environmental concerns, stringent government norms, and increasing adoption

- Buses constitute one of the major parts of public transportation in various countries in Asia-Pacific. Old conventional buses are responsible for excessive carbon emissions. Hence, the demand for electric buses has been increasing in various Asian countries over the past few years. Rising environmental concerns, the implication of stringent norms for EVs by the government, and the benefits of EVs increased the demand for electric buses in 2021 over 2017. Hence, the demand for battery packs for battery electric buses and plug-in hybrid electric buses increased in 2021 over 2017.

- Electric buses are widely used in various Asian countries. China is one of the leaders in the electric vehicle and battery industry; it held the highest share of sales of electric buses in 2022. Major players operating in the battery industry in China include BYD, CATL, and Shenzhen BYD Lithium Battery Co. Ltd. India, Japan, South Korea, and Thailand also contributed to the growth of battery packs owing to the increased demand for electric buses in these countries. As a result, the region witnessed growth in the demand for electric buses in 2022 over 2021.

- Various EV and battery manufacturers are unveiling their battery production plans in APAC countries. In March 2023, the Chinese automaker BYD announced the construction of a bus assembly plant and battery manufacturing plant for various types of buses, such as battery electric and PHEB, in Indonesia. Such developments are expected to accelerate battery demand for buses during the forecast period in Asia-Pacific.

China emerging as a key player in the electric vehicle (EV) market, driving the demand for automotive lithium batteries

- The APAC region presents a thriving market for battery packs, driven by factors such as government support, strong domestic demand, and a focus on electric vehicle adoption. As the demand for EVs continues to rise and technological advancements in battery packs continue, Asia-Pacific is expected to play a pivotal role in shaping the future of the global electric vehicle industry.

- China is a dominant player in the battery pack market, with consistently high market values. China's rapid growth can be attributed to several factors, including government support for electric vehicles, a large consumer market, and a robust domestic manufacturing ecosystem. The country has made substantial investments in electric vehicle production, leading to increased demand for battery packs.

- Japan and South Korea also contribute significantly to the Asia-Pacific battery pack market. Both countries have experienced steady growth in market value over the years. These countries have well-established automotive industries, technological expertise, and strong government support for EV adoption, which is driving the demand for battery packs. India's battery pack market is gaining momentum as the country focuses on electric vehicle adoption and renewable energy targets. With supportive government policies and increasing consumer awareness, the demand for battery packs is rising. Additionally, Thailand's commitment to becoming a regional leader in electric mobility presents ample opportunities for the growth of the Asia-Pacific battery pack market.

Asia-Pacific Electric Bus Battery Pack Market Trends

A VARIETY OF AUTOMAKERS ARE PRESENT IN THE MARKET, MAJORLY DRIVEN BY TOYOTA, TESLA, AND WULING

- The APAC electric vehicle market is bustling with numerous competitors, but its momentum is chiefly steered by five dominant corporations, collectively grasping over 50% of the 2022 market share. Leading the charge is BYD, securing a remarkable 20.93% of EV sales in the region. Its potent financial standing, coupled with its advanced R&D infrastructure, has positioned BYD as a powerhouse. The company's competitive pricing, coupled with its vast sales and after-sales network, effectively appeals to new consumers.

- Following BYD, the Toyota Group clinches the second spot, with about 12.88% of the market. Its well-established reputation across the APAC region, bolstered by its extensive sales and service framework, instills trust among consumers, further cementing its footprint. Tesla claims the third position, seizing 8.27% of the market. Renowned for its avant-garde, tech-driven offerings, Tesla enjoys a seamless supply chain across nations, notably China and Australia.

- Wuling comes in fourth, holding approximately 7.10% of the market. Operating under its parent company, Liuzhou Wuling Automobile Industry Co. Ltd, Wuling has carved a niche in countries like China and Indonesia, catering to a diverse clientele with its varied EV lineup. Rounding out the top five is Honda, with a 3.85% market share. Other notable contenders in the APAC EV market encompass brands like Nissan, Chery, Changan, and Neta, among others.

IN 2022, WULING, TESLA, AND BYD WERE THE BIGGEST BATTERY PACK DEMAND GENERATORS IN APAC

- The electric vehicle landscape, encompassing cars, buses, and trucks, has witnessed a notable upswing across various Asian countries in the past few years. While the appetite for electric vehicles fluctuates across regions and nations, it is evident that SUVs have carved a niche in major markets like China, India, and Japan. As a direct reflection of Asia's growing preference for SUVs over traditional sedans, due to their enhanced utility and spaciousness, electric SUVs have seen a parallel surge across the Asia-Pacific belt.

- Recent times have spotlighted a burgeoning affinity for compact SUVs among the Asian populace. Tesla's Model Y stands out with its all-electric drivetrain, sterling 5-star NCAP safety rating, seven-seat capacity, commendable range, and other features, making it a sought-after option in pivotal APAC markets, notably China. BYD's Song DM, with its competitive pricing and efficient fuel dynamics, has resonated well with customers across several Asian territories.

- The year 2022 saw Tesla's Model 3 clinching accolades as one of the top sellers in the Asian domain, a testament to its purely electric mechanism, paired with an array of attractive functionalities. The dynamic APAC EV arena also presents a myriad of electric SUV and sedan alternatives from established global manufacturers. The year 2022 anticipated robust sales for vehicles like Toyota's Yaris Cross and BYD's Dolphin. Other players, such as the Toyota Corolla and Wuling's Hongguang MINIEV, also form a robust lineup in the APAC EV ecosystem.

Asia-Pacific Electric Bus Battery Pack Industry Overview

The Asia-Pacific Electric Bus Battery Pack Market is moderately consolidated, with the top five companies occupying 46.47%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), EVE Energy Co. Ltd., LG Energy Solution Ltd. and Panasonic Holdings Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.11.2 India

- 4.11.3 Indonesia

- 4.11.4 Japan

- 4.11.5 Thailand

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

- 5.8 Country

- 5.8.1 China

- 5.8.2 India

- 5.8.3 Japan

- 5.8.4 South Korea

- 5.8.5 Thailand

- 5.8.6 Rest-of-Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ameperex Technology Limited (ATL)

- 6.4.2 BYD Company Ltd.

- 6.4.3 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.4 EVE Energy Co. Ltd.

- 6.4.5 Exide Industries Ltd.

- 6.4.6 Gotion High-Tech Co. Ltd.

- 6.4.7 GS Yuasa International Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Olectra Greentech Ltd.

- 6.4.10 Panasonic Holdings Corporation

- 6.4.11 Resonac Holdings Corporation

- 6.4.12 Samsung SDI Co. Ltd.

- 6.4.13 SK Innovation Co. Ltd.

- 6.4.14 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.15 Tata Autocomp Systems Ltd.

- 6.4.16 Tianjin Lishen Battery Joint-Stock Co., Ltd. (Lishen Battery)

- 6.4.17 Zhengzhou Yutong Bus Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms