|

市場調查報告書

商品編碼

1635469

印度不斷電系統(UPS) -市場佔有率分析、產業趨勢與統計、成長預測 (2025-2030)India Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

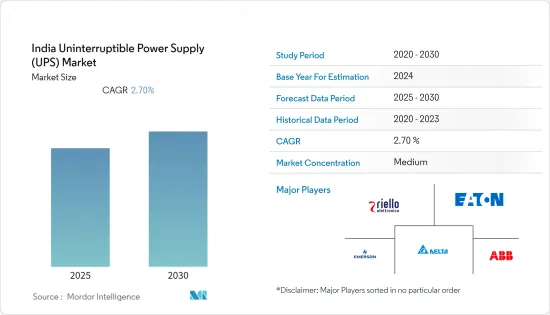

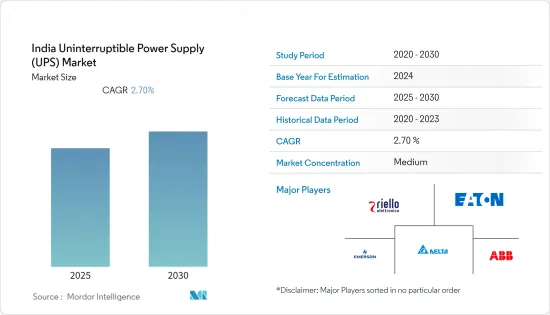

印度不斷電系統(UPS) 市場預計在預測期內複合年成長率為 2.7%。

2020 年市場受到 COVID-19 的中等程度影響。目前,市場已達到疫情前水準。

主要亮點

- 短期內,對不斷電系統(主要來自製造業和商業等終端用戶)預計將成為市場的主要驅動力。

- 另一方面,由於資本和營運成本較高,預計在預測期內市場成長將放緩。

- 人工智慧、機器學習、物聯網等 UPS 系統的技術進步預計將為受訪市場創造巨大的機會。

印度不斷電系統(UPS)市場趨勢

資料中心業務實現顯著成長

- 資料中心是儲存大量敏感資料的設施。這些設施必須每天 24 小時運作,確保資料安全並減少停機時間。資料中心配備不斷電系統。此外,資料中心連接到網際網路,在不斷電系統的幫助下,資料中心平穩運行,不會出現網際網路連接中斷的情況。不斷電系統具有冗餘配置和雙總線能力。這樣可以縮短運作並保護整個設施中的敏感電子設備。此外,不斷電系統提供電力時不會出現斷電、斷電、突波和噪音干擾的情況。

- 過去幾年,印度在數位化方面取得了顯著進展,導致全國資料中心數量穩定增加。截至 2022 年 5 月,印度約有 127 個資料中心。

- 此外,雲端基礎的網路正在興起。這可能是由於隨著世界各地的企業轉向基於雲端基礎的網路而不是維護基礎設施,整合不斷增加。此外,人工智慧、物聯網 (IoT) 和機器學習領域不斷成長的投資和應用正在改變各個領域,包括工業 4.0、金融技術、全球城市、數位基礎設施和通訊。

- 各大公司都表達了開發資料中心的興趣。例如,2022年5月,思科在印度開設了第一個資料中心。該公司旨在滿足客戶對網路防禦和資料本地化日益成長的需求。因此,思科二人組在印度建立了他們的第一個資料中心。此外,透過這項投資,思科旨在印度建立面向未來、資料相容的安全基礎設施。此外,該資料中心還列出了公共部門、醫療保健、銀行、金融服務和保險等各行業的服務。新資料中心是兩家公司全球擴大策略的一部分,其網路遍佈亞太地區、歐洲和美國。

- 2022年1月,多元化的阿達尼集團在印度北方邦的兩個資料中心計劃投資超過5,572萬美元。根據北方邦政府介紹,這兩個資料中心將分別建在諾伊達的62區和80區。此外,阿達尼集團也成立了子公司Adani-EdgeConneX India Joint Venture,在印度孟買建置資料中心。此外,該公司的目標是在未來 10 年內開發 1GW 的資料中心容量。這些計劃將在印度多個城市設立,包括清奈、新孟買、諾伊達、維扎格和海得拉巴。

- 所有這些對資料中心開發的投資將導致對不斷電系統的需求增加,並預計將在預測期內推動印度不斷電系統市場的發展。

UPS 的高資本成本和營運費用抑制市場成長

- 儘管不斷電系統(UPS)是可靠且響應迅速的系統,可保證停電期間的即時供電,但其成本是一個主要問題。 UPS 需要大量的初始投資。例如,2021年,印度新興企業的私募股權和創投交易數量從一年前的628起增加到858起。即使是家用的也要幾百美元。另一方面,如果一家公司大規模實施,光是機器成本就需要數萬美元。如此大規模的安裝還需要基礎設施設置,這顯著增加了總設置成本。因此,並非所有用戶都能負擔得起,這阻礙了市場的成長。

- 不斷電系統,如線上雙轉換系統,設計複雜,產生大量熱量,整體效率較低,導致營運成本較高。此外,UPS 電池的使用壽命並不長。與所有可充電電池一樣,UPS 的充電能力會隨著時間的推移而降低。根據型號的不同,UPS 電池的使用壽命約為 5 至 10 年。此後,必須妥善處理舊電池並購買新電池。許多 UPS 製造商和零售商將免費回收家中用過的 UPS 電池,但企業必須為其設備的安全處置付費。

- 此外,由於系統維護,使用 UPS 系統還需要考慮多種因素。維護成本要低得多,特別是對於企業辦公室和工業而言,因為它們涉及許多 UPS 連接,並且需要任命熟練的電工來管理佈線系統並確保無錯誤服務,因此成本高昂。此外,UPS 系統會定期排放氣體,並需要足夠的通風才能正常運作。這些因素預計將增加 UPS 的成本,並在預測期內抑制市場成長。

- UPS系統的功耗大於獨立設備的功耗。由於 UPS 必須始終保持電池充電,因此所需電量明顯高於設備實際所需電量。這種情況會導致不可避免的電力浪費,這與系統使用的電力有關。對於大規模應用,這種額外的電力消耗意味著很高的額外成本。在考慮公司的環保實踐時,也應考慮這種浪費的能源。

- 因此,該系統的高資本和營運成本預計將限制預測期內所研究市場的成長。

印度不斷電系統(UPS)產業概況

印度不斷電系統(UPS)市場適度細分。市場主要企業(排名不分先後)包括伊頓公司、Riello Elettronica SpA、艾默生電氣公司、台達電子公司和 ABB 有限公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 市場促進因素

- 市場限制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 按容量

- 10kVA以下

- 10~100kVA

- 100kVA以上

- 按類型

- 備用UPS系統

- 線上UPS系統

- 線上互動式UPS系統

- 按用途

- 資料中心

- 通訊

- 醫療(醫院、診所等)

- 工業的

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Riello Elettronica SpA

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- ABB Ltd

- Schneider Electric SE

- Hitachi Ltd

- Mitsubishi Electric Corporation

- General Electric Company

- Cyber Power Systems Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92812

The India Uninterruptible Power Supply Market is expected to register a CAGR of 2.7% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Now the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the major driving factor of the market is expected to be the increasing demand for uninterrupted power supply, primarily from end-users such as manufacturing and commercial.

- On the flip side, the high capital cost and operational expenditure are expected to slow down the growth of the market during the forecast period.

- The technological advancements in UPS systems, like artificial intelligence, machine learning, IoT, etc., are expected to create immense opportunities for the market studied.

India Uninterruptible Power Supply (UPS) Market Trends

Data Centers Segment to Witness Significant Growth

- Data centers are facilities that store vast amounts of sensitive data. These facilities are needed to be operational throughout the clock, maintain data safety, and reduce downtime. They are equipped with an uninterrupted power supply. Furthermore, the data centers are connected to the internet, and with the help of an uninterruptible power supply, the data centers work smoothly without any interruption in internet connectivity. An uninterruptible power supply has redundant configurations and dual bus capabilities. Thus, it requires less uptime and can provide facility-wide protection for sensitive electronics. Moreover, an uninterruptible power supply provides power without blackouts, brownouts, sags, surges, and noise interference.

- India has witnessed steady growth in the number of data centers across the country in the last couple of years, ascribing to a significant rise in digitization in the last couple of years. As of May 2022, India has around 127 data centers.

- Furthermore, there is a rise in cloud-based networks. This can be ascribed to higher integration as corporations worldwide are shifting toward cloud-based networks rather than maintaining their infrastructure. Moreover, increased investment and application of artificial intelligence, the Internet of Things (IoT), and machine learning are transforming various sectors, such as industry 4.0, financial technology, global cities, digital infrastructure, and communications.

- Major companies are showing interest in developing data centers. For instance, in May 2022, Cisco launched its first data center in India. The company aims to cater to rising customer demands for cyber-defense and data localization. Thus, Cisco's Duo has established its first data center in India. Furthermore, with this investment, Cisco aims to build future-ready, data-compliant security infrastructure in India. Moreover, this data center would serve various industries, such as the public sector, healthcare, banking, financial services, and insurance. The new data center is part of Duo's global expansion strategy to spread its network across APAC, Europe, and the United States.

- In January 2022, the diversified Adani Group invested more than USD 55.72 million in two data center projects in Uttar Pradesh, India. According to the Uttar Pradesh government, the two data centers are expected to be built in Noida sectors 62 and 80, respectively. Furthermore, Adani Group has formed a subsidiary, Adani-EdgeConneX Indian Joint Venture, to create a data center in Mumbai, India. Moreover, the company aims to develop 1 GW of data center capacity in the next ten years. These projects are expected to be located in various cities in India, including Chennai, Navi Mumbai, Noida, Vizag, and Hyderabad.

- All these investments in data center development would lead to higher demand for the uninterruptible power supply, driving India's uninterruptible power supply market during the forecast period.

High Capital Cost and Operational Expenditure of UPS Restraining Market Growth

- Despite being a reliable and highly responsive system guaranteeing an immediate power supply in the event of a power failure, the major concern about the uninterruptible power supply (UPS) system is its cost. UPS requires a significant startup investment. For instance, in 2021, the number of private equity and venture capital deals in startups in India increased from 628 in the previous year to 858. Even a single unit for home use can cost hundreds of dollars. On the other hand, corporate setups on a large-scale run into tens of thousands of dollars for the machinery alone. These major installations also require an infrastructure setup that can significantly increase the total setup cost. Therefore, not all users could afford them, hampering the market's growth.

- Uninterruptible power supplies, such as the Online Double Conversion systems, have a complicated design, generating higher heat and lower overall efficiency, increasing operating costs. Moreover, UPS batteries do not last forever. Like all rechargeable batteries, the capacity of a UPS to hold charge diminishes over time. Depending on the model, a UPS battery lasts around five to ten years. After this, the old battery requires proper disposal, and a new battery must be purchased. Though many UPS manufacturers and retail stores recycle the UPS batteries used at homes for free, corporations must pay for the safe disposal of their equipment.

- Additionally, using a UPS system involves several considerations owing to the maintenance of the system. The maintenance cost is much higher, especially for corporate offices and industries, as it involves many UPS connections and requires a skilled electrician to be appointed to manage wiring systems and ensure error-free services. Moreover, for the proper functioning of the UPS system, it must be with sufficient ventilation since it regularly emits fumes. These factors are expected to increase the cost of a UPS and, in turn, restrain the growth of the market over the forecast period.

- The UPS system draws more power than a standalone device in terms of power consumption. The amount required is significantly higher than the actual amount needed by the devices, as UPS needs to keep its batteries always charged. This situation leads to an unavoidable waste of power, correlated to the amount of electricity used in the system. In large-scale applications, this additional power consumption represents a high additional cost. This wasted energy should also be considered while considering the environmental practices of businesses.

- Therefore, the system's high capital cost and operational expenditure are expected to limit the growth of the market studied during the forecast period.

India Uninterruptible Power Supply (UPS) Industry Overview

The Indian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Riello Elettronica SpA, Emerson Electric Co., Delta Electronics, Inc., and ABB Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 Less than 10 kVA

- 5.1.2 10-100 kVA

- 5.1.3 Above 100kVA

- 5.2 By Type

- 5.2.1 Standby UPS System

- 5.2.2 Online UPS System

- 5.2.3 Line-interactive UPS System

- 5.3 By Application

- 5.3.1 Data Centers

- 5.3.2 Telecommunications

- 5.3.3 Healthcare (Hospitals, Clinics, etc.)

- 5.3.4 Industrial

- 5.3.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Riello Elettronica SpA

- 6.3.2 EATON Corporation PLC

- 6.3.3 Emerson Electric Co.

- 6.3.4 Delta Electronics Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Schneider Electric SE

- 6.3.7 Hitachi Ltd

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 General Electric Company

- 6.3.10 Cyber Power Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219