|

市場調查報告書

商品編碼

1635472

歐洲AUV市場:佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe AUV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

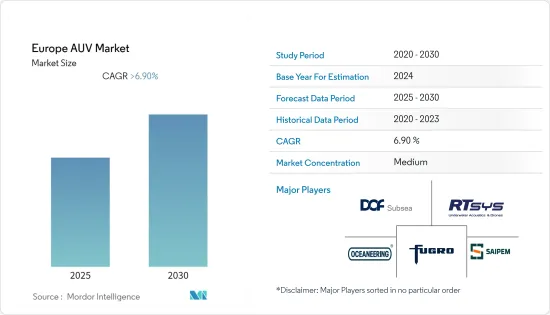

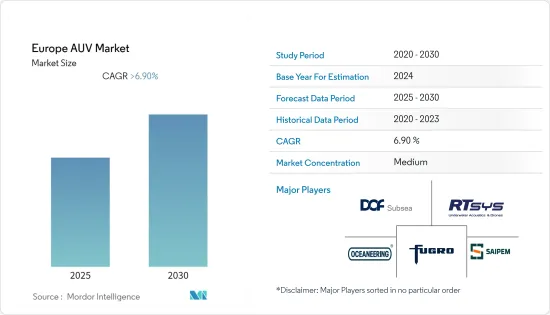

歐洲AUV市場預計在預測期內將維持6.9%以上的複合年成長率。

COVID-19大流行對2020年的市場產生了負面影響。目前市場處於大流行前的水平。

主要亮點

- 石油和天然氣生產活動的增加、離岸風力發電的增加以及石油和天然氣退役活動的增加等因素預計將在預測期內推動 AUV 市場的發展。

- 另一方面,對氣候變遷的日益擔憂以及計劃禁止海洋探勘活動的國家預計將阻礙市場成長。

- 越來越多的深海和超深海發現預計將為歐洲AUV市場創造新的商機。

- 隨著石油和天然氣投資的增加,挪威預計將呈現強勁成長並主導市場,特別是在上游領域。

歐洲AUV市場趨勢

石油和天然氣領域主導市場

- 歐洲對石油和天然氣的依賴正在上升,因為重要的區域經濟體仍然高度依賴石油產品。石油和天然氣工業對該地區的政治和經濟有重大影響。

- 歐洲石油產量將從2015年的359.6萬桶/日降至2021年的342萬桶/日。然而,該地區英國和挪威即將開展的石油和天然氣計劃大幅增加,預計將推動 AUV 市場的成長。

- 石油和天然氣鑽機可以在兩英里的水深下運作。許多深水井和管道系統都依靠無人水下航行器來幫助安裝、檢查、維修和維護。

- 海底的不利條件通常難以監測和部署,從而帶來操作、環境和技術挑戰。這些因素正在加速AUV市場新技術的發展。 AUV也為海底基礎設施建設、監測和探勘任務提供定位和引導。

- 此外,總部位於挪威的國際科技公司Kongsberg Gruppen ASA宣布將於2022年推出配備3D感測、軌跡規劃和防撞系統等創新技術的Hugin AUV升級版。

- 此外,2022 年 1 月,石油和天然氣巨頭 TotalEnergies 與 iXblue(一家為導航、光電和海上自主提供創新解決方案的全球公司)合作,提供非載人協作技能。據iXblue稱,此次檢查是在法國南部拉西奧塔海岸進行的,涉及部署兩個無人平台:iXblue DriX無人水面航行器(USV)和Teledyne Gavia自主水下航行器(AUV)。

- 因此,在預測期內,石油和天然氣領域預計將主導歐洲 AUV 市場。

挪威可望主導市場

- 挪威擁有豐富的天然氣蘊藏量。截至2021年,該國是最大的天然氣生產國。此外,隨著能源供應鏈的重組,挪威已取代俄羅斯成為歐盟最大的天然氣供應國。

- 2022年,天然氣需求預計將恢復至危機前水準。預計在預測期內,全國範圍內的需求也將略有增加。 2021年,國內天然氣產量約1,143億立方公尺(bcm)。這樣的生產水準鼓勵了擴大使用 AUV 來探測和繪製全國石油蘊藏量。

- 為了滿足需求和補償,北海業者正在減少成熟資產的產量並投資新的天然氣田。這些新計畫制裁將直接影響未來三年的鑽探活動,與這些計劃相關的開發井有 20 多口。

- 此外,2022 年 3 月,總部位於挪威的 Kongsberg Maritime 在倫敦國際海洋學活動上推出了其新推出的中型自主水下探勘HUGIN Edge。此 AUV 的設計將 HUGIN 碳單體殼方法的元素與動態建模相結合,以改善船體的低阻力配置。這種 AUV 可以從 USV(無人水面艦艇)、小型水面艦艇和岸上部署。

- 2021年10月,Floor Geophysicals(OFG)與挪威DOF Subsea(DOF)建立策略夥伴關係,為全球海工產業提供AUV服務。

- 鑑於上述情況,預計挪威將在預測期內主導歐洲 AUV 市場。

歐洲AUV產業概況

歐洲AUV市場有適度細分。市場的主要企業包括(排名不分先後)DOF Subsea AS、Fugro NV、RTSYS、Saipem SpA 和 Oceaneering International Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按車型

- 小型

- 中等尺寸

- 大的

- 按最終用戶使用情況

- 石油和天然氣

- 防禦

- 研究

- 其他

- 按活動

- 鑽探和開發

- 建造

- 檢查、維修和保養

- 退休

- 其他活動

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- DOF Subsea AS

- Fugro NV

- Oceaneering International Inc.

- Saipem SpA

- DeepOcean AS

- RTSYS

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92816

The Europe AUV Market is expected to register a CAGR of greater than 6.9% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as rising oil and gas production activities, growing offshore wind power electricity generation, and increasing oil and gas decommissioning activities are expected to drive the AUV market during the forecast period.

- On the other hand, countries planning to increase their focus on climate change and ban offshore exploration activities are expected to hinder market growth.

- Nevertheless, the rising deepwater and ultra-deepwater discoveries are expected to open up new opportunities for the European AUV market.

- With rising oil and gas investments, especially in the upstream sector, Norway is expected to witness significant growth and dominate the market.

Europe AUV Market Trends

Oil and Gas Segment to Dominate the Market

- Europe's dependence on oil and gas is on the rise as significant regional economies still rely heavily on petroleum-based products. The oil and gas industry vastly influences the region's politics and economics.

- The oil production in Europe decreased from 3,596 thousand barrels per day in 2015 to 3,420 thousand barrels per day in 2021. However, the region is witnessing a significant boom in upcoming oil and gas projects in the United Kingdom and Norway, which will uplift the AUV market's growth.

- Oil and gas drilling rigs can operate in water depths of two miles. Many of these deepwater wells and pipeline systems rely on unmanned underwater vehicles to help perform installations, inspections, repairs, and maintenance.

- Monitoring and deployment are often challenging in adverse subsea conditions, creating operational, environmental, and technical challenges. These factors are accelerating the development of new technologies in the AUV market. Also, AUVs provide positioning and guidance to sub-sea infrastructure construction, monitoring, and survey missions.

- Moreover, in March 2022, Kongsberg Gruppen ASA, a Norway-based international technology company, announced the launch of an upgraded version of the Hugin AUV with innovative technologies, including 3D sensing, trajectory planning, and collision avoidance systems, which is highly preferred in oil and gas sector for detecting and mapping oil reserves.

- Furthermore, in January 2022, oil and gas major, TotalEnergies partnered with iXblue, a global provider of innovative solutions for navigation, photonics, and maritime autonomy, to demonstrate collaborative uncrewed capabilities for subsea inspection and asset survey missions. According to iXblue, trials were conducted off the coast of La Ciotat in the south of France, deploying two uncrewed platforms: iXblue DriX Uncrewed Surface Vehicle (USV) and Teledyne Gavia Autonomous Underwater Vehicle (AUV).

- Therefore, the oil and gas sector is expected to dominate the European AUV market during the forecast period.

Norway is Expected to Dominate the Market

- Norway has rich natural gas reserves. As of 2021, the country was the topmost producer of natural gas. Norway has also displaced Russia as the top supplier of NatGas to the European Union as energy supply chains are rejiggered.

- In 2022, natural gas demand was expected to recover to its pre-crisis levels. The demand was also anticipated to increase slightly across the country during the forecast period. In 2021, natural gas production in the country was approximately 114.3 billion cubic meters (bcm). Such production levels promoted the growth in the utilization of AUVs for detecting and mapping oil reserves across the country.

- To meet the demand and offset, the operators in the North Sea are undertaking a production decline from maturing assets and investments in new gas fields. These new project sanctions would directly impact the drilling activity over the next three years, with more than 20 developing well associated with these projects.

- Additionally, in March 2022, Norway-based Kongsberg Maritime presented their newly launched medium-sized autonomous underwater vehicle, HUGIN Edge, at the Oceanology International Event in London. The design of the AUV combined elements of HUGIN's carbon monocoque approach coupled with hydrodynamic modeling to refine the hull's low-drag shape. It can be deployed from a USV (uncrewed surface vessel), small surface vessels, and from the shore.

- In October 2021, Floor Geophysics (OFG) and DOF Subsea of Norway (DOF) entered into a strategic alliance to provide AUV services to the global offshore industry.

- Owing to the above points, Norway is expected to dominate the European AUV market during the forecast period.

Europe AUV Industry Overview

The European AUV market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include DOF Subsea AS, Fugro NV, RTSYS, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Recent Trends And Developments

- 4.4 Government Policies And Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Small

- 5.1.2 Medium

- 5.1.3 Large-Size

- 5.2 By End-user Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Research

- 5.2.4 Other End-user Applications

- 5.3 By Activity

- 5.3.1 Drilling and Development

- 5.3.2 Construction

- 5.3.3 Inspection, Repair, and Maintenance

- 5.3.4 Decommissioning

- 5.3.5 Other Activity Types

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 DOF Subsea AS

- 6.3.2 Fugro NV

- 6.3.3 Oceaneering International Inc.

- 6.3.4 Saipem SpA

- 6.3.5 DeepOcean AS

- 6.3.6 RTSYS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219