|

市場調查報告書

商品編碼

1644909

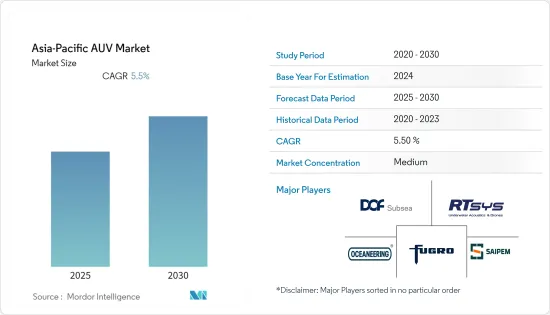

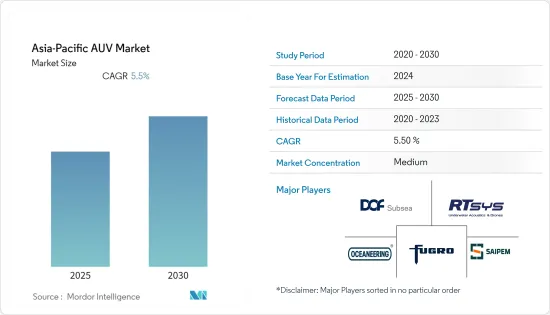

亞太地區 AUV -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific AUV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內亞太地區 AUV 市場複合年成長率將達到 5.5%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,預計預測期內石油和天然氣生產活動活性化以及離岸風力發電行業成長等因素將推動 AUV 市場的發展。

- 另一方面,越南、菲律賓等多個國家越來越關注氣候變化,並計劃在未來禁止海上探勘活動,預計將抑制市場成長。

- 預計預測期內,深海和超深海發現的增加將為亞太地區 AUV 市場創造新的商機。

- 預計中國將實現顯著成長。隨著石油和天然氣投資的增加,特別是上游領域的投資,預計它將佔據市場主導地位。

亞太地區 AUV 市場趨勢

石油和天然氣領域佔市場主導地位

- 亞太地區石油、天然氣蘊藏量十分豐富。世界主要經濟體仍然嚴重依賴石油產品,對石油和天然氣的依賴日益增加。石油和天然氣工業對國際政治和經濟有巨大影響。

- 亞太地區石油產量將從2015年的837.2萬桶/日下降到2021年的733.5萬桶/日。然而,疫情過後的需求正在增加,尤其是在運輸和工業領域。

- 世界上大部分的潛在碳氫化合物蘊藏量都位於海底之下。碳氫化合物產業已經開發出適合海上條件的尋找和生產石油和天然氣的技術。

- 2022 年 8 月,印度石油探勘和生產公司石油天然氣公司與全球石油巨頭埃克森美孚簽署了意向書 (HoA),將在該國東、西海岸進行深水探勘。兩家石油探勘公司將專注於東部近海的克里希納戈達瓦里盆地和卡弗里盆地以及西部近海的卡奇-孟買地區的探勘。這可能導致使用自主水下航行器(AUV)進行探勘。

- 此外,2022 年 3 月,馬來西亞國家石油化學Group Limited宣布已在馬來西亞五個海上區塊簽署了四份產品分成合約。預計這一發展將在預測期內促進海洋探勘活動並推動該地區對 AUV 市場的需求。

- 考慮到上述因素,預計石油和天然氣產業將在預測期內佔據市場主導地位。

中國可望主導市場

- 中國是世界第二大油氣消費國、第六大油氣生產國。該國的石油和上游天然氣市場由開展國內石油和天然氣探勘和生產活動的國有石油和天然氣公司主導。

- 由於各行各業的需求不斷成長,中國的天然氣產量大幅增加。天然氣產量將從2019年的1,761億立方公尺增加到2021年的2,075.8億立方公尺。預計這將吸引大量投資來滿足需求。

- 此外,2022年1月,中國海洋石油Group Limited(中海油)宣布,2022年石油產量目標將比去年高出10%。報告也預測,到 2030 年,國內原油產量將達到穩定水平,到 2035 年,國內天然氣產量也將達到穩定水平,與中國燃料需求達到峰值相一致。這將鼓勵擴大使用 AUV 在全國範圍內探測和繪製石油和天然氣蘊藏量。

- 此外,2022年9月,我們計劃向沙烏地阿拉伯王國供應由中國船舶動力過程研究院有限公司製造的高度先進的隱形自主水下航行器(AUV)。這顯示中國在AUV市場已經處於領先。

- 鑑於上述情況,預計中國將在預測期內主導亞太 AUV 市場。

亞太地區AUV產業概況

亞太地區 AUV 市場區隔程度適中。市場的主要企業(不分先後順序)包括 DOF Subsea AS、Fugro NV、RTSYS、Saipem SpA 和 Oceaneering International Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 最新趨勢和發展

- 市場動態

- 驅動程式

- 限制因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 汽車模型

- 袖珍的

- 中等的

- 大的

- 最終用戶應用程式

- 石油和天然氣

- 防禦

- 研究

- 其他最終用戶應用程式

- 地區

- 中國

- 日本

- 印度

- 印尼

- 越南

- 泰國

- 菲律賓

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- DOF Subsea AS

- Fugro NV

- Oceaneering International Inc.

- Saipem SpA

- DeepOcean AS

- RTSYS

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92852

The Asia-Pacific AUV Market is expected to register a CAGR of 5.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as the rising offshore oil and gas production activities and the growing offshore wind power industry are expected to drive the AUV market during the forecast period.

- On the other hand, various countries such as Vietnam and the Philippines are planning to increase their focus on climate change and ban offshore exploration activities in the future, which is expected to restrain the market growth.

- Nevertheless, the rising deepwater and ultra-deepwater discoveries are expected to open up new opportunities for the Asia-Pacific AUV market during the forecast period.

- China is expected to witness significant growth. With rising oil and gas investments, especially in the upstream sector, it is expected to dominate the market.

APAC AUV Market Trends

Oil and Gas Segment to Dominate the Market

- The Asia-Pacific region is rich in oil and gas reserves. The dependence on oil and gas increases as major economies across the world still rely heavily on petroleum-based products. The oil and gas industry displays immense influence in international politics and economics.

- The oil production in Asia-Pacific decreased from 8,372 thousand barrels per day in 2015 to 7,335 thousand barrels per day in 2021. However, the demand has increased post-pandemic, particularly in the transportation and industrial sectors.

- Many of the potential global reserves of hydrocarbons lie beneath the sea. The hydrocarbon industry has developed techniques suited to conditions found in offshore sites to find oil and gas and produce it successfully.

- In August 2022, Indian oil explorer and producer Oil and Natural Gas Corp. signed a Heads of Agreement (HoA) with global petroleum giant ExxonMobil Corp for deepwater exploration on the country's East and West coasts. The two oil explorers would focus on the Krishna Godavari and Cauvery basins in the eastern offshore and the Kutch-Mumbai region in the western offshore. This may, in turn, culminate in using autonomous underwater vehicles (AUVs) for explorations.

- Furthermore, in March 2022, Petronas Chemicals Group Berhad announced that it had signed four production-sharing contracts for five offshore blocks in Malaysia. The development is expected to bolster offshore exploration activities and is expected to drive the demand for the AUV market in the region during the forecast period.

- Owing to the above points, the oil and gas segment is expected to dominate the market during the forecast period.

China is Expected to Dominate the Market

- China is the world's second-largest consumer of oil and gas and the sixth-largest producer of oil and gas across the world. The country's oil and upstream gas market is dominated by state-owned oil and gas companies by developing the country's domestic oil and gas exploration and production activities.

- China's natural gas production has witnessed significant growth with rising demand from numerous industries. Natural gas production increased to 207.58 billion cubic meters in 2021 from 176.1 billion cubic meters in 2019. This is expected to attract major investments to meet the demand.

- Moreover, in January 2022, China National Offshore Oil Corporation (CNOOC) announced its oil production target for the year 2022 at 10% above last year's goal. Also, the country expects its domestic crude oil output to hit a plateau by 2030 and domestic natural gas by 2035, in line with China's peak fuel demand. This, in turn, promotes the growth in the utilization of AUVs for detecting and mapping oil and gas reserves across the country.

- Furthermore, in September 2022, the country has planned to supply highly advanced stealth autonomous underwater vehicles (AUVs) manufactured by China Shipbuilding Power Engineering Institute Co. to the Saudi Arabian Kingdom. This showcases that the country is ahead in the AUV market.

- Owing to the above points, China is expected to dominate the Asia-Pacific AUV market during the forecast period.

APAC AUV Industry Overview

The Asia-Pacific AUV market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include DOF Subsea AS, Fugro NV, RTSYS, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Small-Size

- 5.1.2 Medium-Size

- 5.1.3 Large-Size

- 5.2 End-User Applications

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Research

- 5.2.4 Other End-User Applications

- 5.3 Geography

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Vietnam

- 5.3.6 Thailand

- 5.3.7 Philippines

- 5.3.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DOF Subsea AS

- 6.3.2 Fugro NV

- 6.3.3 Oceaneering International Inc.

- 6.3.4 Saipem SpA

- 6.3.5 DeepOcean AS

- 6.3.6 RTSYS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219