|

市場調查報告書

商品編碼

1635517

中東和非洲的太陽能板回收:市場佔有率分析、行業趨勢和成長預測(2025-2030)Middle East and Africa Solar Panel Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

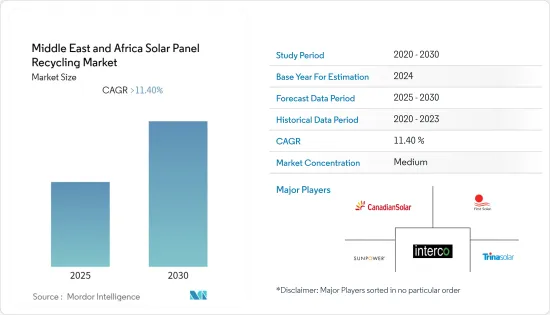

預計中東和非洲的太陽能板回收市場在預測期內複合年成長率將超過 11.4%。

2020 年,市場受到 COVID-19 大流行的負面影響。我們現在處於大流行前的水平。

主要亮點

- 從長遠來看,預計全部區域太陽能板廢棄物產生量將增加,越來越多的政府和組織透過支持措施、法規和政策關注太陽能板回收,預計將促進中國的市場研究。

- 另一方面,由於回收成本高於回收材料的經濟價值,企業不會投資回收活動,預計這將對市場成長產生負面影響。

- 提高效率、減少負面影響並降低迴收成本的新回收方法的開發預計將在未來幾年為太陽能電池板回收參與企業提供重大商機。

- 預計在預測期內,南非的中東和非洲太陽能板回收市場將強勁成長。

中東和非洲太陽能板回收市場趨勢

矽晶型(c-Si)類型實現顯著成長

- 在中東和非洲,矽晶型太陽能板佔據市場主導地位,佔據大部分市場佔有率。但由於效率低下,近年來晶矽產品已經停產,晶矽太陽能板的回收市場大幅擴大。

- c-Si 技術由太陽能級矽薄帶(也稱為晶圓)組成,組裝電池並與電池板電連接。太陽能板由 76% 玻璃、10% 塑膠、8% 鋁、5% 矽和 1% 金屬製成。回收過程產生約 96% 的材料,可重新用於製造新的太陽能板。

- 在純機械製程中,以面板品質計算,矽晶型的回收率約為 85%。然而,熱、機械和化學過程的結合會導致雜質含量較高和轉售價值較低,因此需要結合多種方法,而不僅僅是單一方法。

- 過程的第一步是拆卸鋁和玻璃組件,從中回收約 95% 的玻璃和 100% 的金屬。其餘材料,如塑膠和電池模組,在熱處理機中進行 500°C 的熱處理,以鬆開電池元件之間的結合。

- 從太陽能電池板回收的玻璃的回收成本相對較低,並且對平板玻璃回收商來說只需要很少的額外投資。此外,到2030年,太陽能板中玻璃的重量預計將增加4%,達到80%左右,從而降低新太陽能板的成本並提高舊太陽能板的回收效率。

- 因此,由於上述因素,預計在預測期內,中東和非洲太陽能板回收市場對矽晶型類型的需求將龐大。

南非預計需求量大

- 南非是該地區最大的太陽能市場之一。該國的裝置容量約為5.7GW,使其成為截至2021年運作中的最大太陽能系統市場。然而,該國的太陽能市場近年來經歷了停滯,主要原因是可再生能源競標的延遲。

- 到 2030 年,太陽能板廢棄物預計將增加約 8,500 噸,高於 2021 年估計的 450 噸。然而,截至2021年,該國還沒有太陽能設備的回收設施。

- 回收太陽能板在非洲國家在經濟上不可行,因此大部分太陽能廢棄物在 2021 年被倒入該國的垃圾掩埋場。此外,該國政府也專注於投資新的太陽能板回收技術。因此,預計預測期內市場成長率將溫和。

- 短期內,該國可回收的太陽能電池板廢棄物並不多,但隨著該國的能源目標朝著比其他地區更永續的模式發展,未來是光明的。預計該國將在不久的將來成為太陽能廢棄物回收的潛在中心。

- 因此,由於上述因素,預計南非的中東和非洲太陽能板回收市場在預測期內將顯著成長。

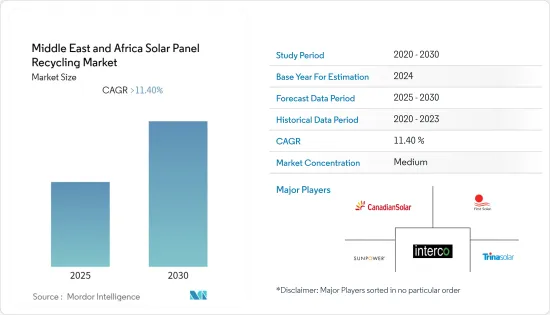

中東和非洲太陽能板回收產業概況

中東和非洲的太陽能板回收市場具有綜合性。市場主要企業包括(排名不分先後)First Solar Inc.、Interco Trading Inc.、Trina Solar Ltd.、SunPower Corporation 和 Canadian Solar Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按流程

- 熱

- 機器

- 化學

- 其他

- 按類型

- 矽晶型

- 薄膜

- 按地區

- 南非

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Canadian Solar Inc.

- First Solar Inc.

- Rinovasol GMBH

- Sharp Corporation

- SunPower Corporation

- Trina Solar Ltd

- Interco Trading Inc.

第7章 市場機會及未來趨勢

The Middle East and Africa Solar Panel Recycling Market is expected to register a CAGR of greater than 11.4% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, it has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing solar panel waste generation across the region, coupled with increasing focus of the respective governments and organizations on solar panel recycling through supportive initiatives, policies, and regulations, are expected to drive the market studied during the forecast period.

- On the flip side, with recycling costing more than the economic value of the recovered materials, companies are not expected to invest in recycling activities, thereby negatively impacting the market's growth.

- The development of new recycling methods to increase efficiency, reduce downsides, and reduce recycling costs is expected to present huge opportunities for solar panel recycling players in the coming years.

- South Africa is expected to witness significant growth in the Middle East and African solar panel recycling market during the forecast period.

MEA Solar Panel Recycling Market Trends

Crystalline Silicon (c-Si) Type to Witness Significant Growth

- Crystalline silicon solar panels dominate the market and hold a majority of the market share in the Middle East and African regions. But due to low-efficiency ratios, the c-Si products have been discontinued in recent years, which has significantly increased the c-Si solar panel recycling market.

- The c-Si technology consists of thin slices of solar-grade silicon, also known as wafers, made into cells, assembled into panels, and connected electrically. The solar panels are made of 76% glass, 10% plastic, 8% aluminum, 5% silicon, and 1% metals. The recycling process yields about 96% of the materials to be reused for producing new solar panels.

- Through the purely mechanical process, the recovery from crystalline silicon is around 85% by panel mass. However, without a combination of the thermal, mechanical, and chemical process, the level of impurities is high enough to reduce the resale value, thereby making it necessary to use a combination of methods instead of just a single method.

- The first step of the process is disassembling the aluminum and glass parts, from which around 95% of the glass and 100% of the metals can be reused. The remaining materials, like plastics and cell modules, are treated thermally at 500 °C in a thermal processing unit to ease the binding between the cell elements.

- The recycling of glass recovered from a solar panel is relatively low cost and involves minimal additional investments for flat-glass recycling companies. Also, by 2030, the weight of glass in a solar panel is expected to rise by 4%, making it around 80%, reducing the cost of new solar panels and increasing the recovery efficiency of old solar panels.

- Therefore, based on the above factors, the crystalline silicon type is expected to witness significant demand in the Middle East and African solar panel recycling market during the forecast period.

South Africa to Witness Significant Demand

- South Africa is one of the largest solar PV markets in the region. With an installed PV capacity of around 5.7 GW, the country, as of 2021, is the largest market in terms of operational solar systems. However, the country's solar market experienced stagnation in the past years, primarily due to the postponement of its renewable energy auctions.

- By 2030, the country is expected to add around 8,500 tons of solar panel waste, up from an estimated 450 metric tons in 2021. However, as of 2021, the country has no recycling facilities for solar equipment.

- In 2021, most of the solar waste was emptied into a landfill in the country as recycling solar panels is not economically viable in African countries. Moreover, the country's government is focusing on investing in new solar panel recycling technology. Therefore, the market is expected to witness a moderate growth rate during the forecast period.

- Although, in the short term, the country has not realized significant solar panel waste that can be viably recycled domestically, the future remains bright as the country's energy goals are steered toward more sustainable models than its regional counterparts. The country is expected to emerge as a potential hub for solar waste recycling in the near future.

- Therefore, based on the above factors, South Africa is expected to witness significant growth in the Middle East and African solar panel recycling market during the forecast period.

MEA Solar Panel Recycling Industry Overview

The Middle East and African solar panel recycling market is consolidated in nature. Some of the major players in the market (in no particular order) include First Solar Inc., Interco Trading Inc., Trina Solar Ltd, SunPower Corporation, and Canadian Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Thermal

- 5.1.2 Mechanical

- 5.1.3 Chemical

- 5.1.4 Other Processes

- 5.2 By Type

- 5.2.1 Crystalline Silicon

- 5.2.2 Thin Film

- 5.3 By Geography

- 5.3.1 South Africa

- 5.3.2 Egypt

- 5.3.3 United Arab Emirates

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 First Solar Inc.

- 6.3.3 Rinovasol GMBH

- 6.3.4 Sharp Corporation

- 6.3.5 SunPower Corporation

- 6.3.6 Trina Solar Ltd

- 6.3.7 Interco Trading Inc.