|

市場調查報告書

商品編碼

1644944

歐洲太陽能板回收 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Solar Panel Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

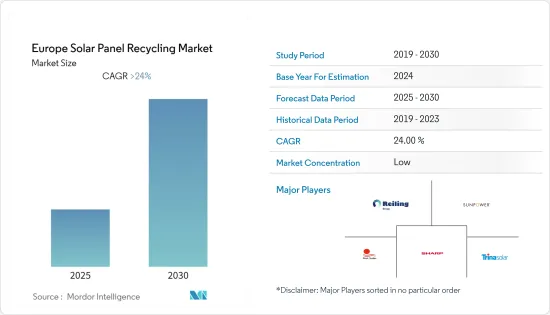

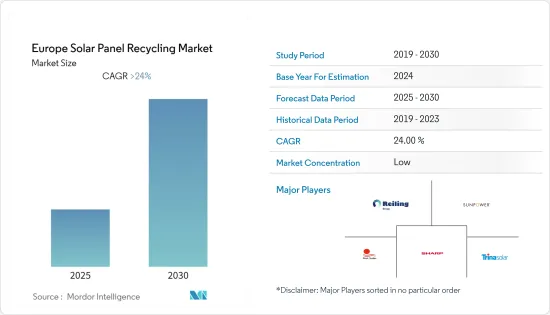

預測期內,歐洲太陽能板回收市場預計將以超過 24% 的複合年成長率成長。

市場受到了 COVID-19 的不利影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從長遠來看,預計預測期內對太陽能的不斷成長的需求以及太陽能電池對更綠色環境的貢獻將推動市場的發展。此外,降低太陽能板的成本是市場成長的重要因素。

- 然而,公眾認知度和興趣較低是市場發展的一大限制。重複使用光伏板有時在經濟上可能是一種困難的選擇,從而阻礙市場成長。

- 近年來回收過程效率的提高預計將為市場提供充足的機會。目前處於研究階段的回收方法的一個例子是由 Loser Chemie 開發的方法。

- 預計未來幾年德國將透過規劃的各種太陽能板安裝計劃佔據市場主導地位。

歐洲太陽能板回收市場的趨勢

矽晶型佔據市場主導地位

- 矽晶型太陽能板的製造使用鋁框架、玻璃、銅線、聚合物層、背板、矽太陽能電池和塑膠接線盒。聚合物層可以保護面板免受自然因素的影響,但也使其難以回收或拆卸,因為通常需要高溫才能去除黏合劑。

- 另外,實驗室矽晶型太陽能電池能量轉換效率達25%以上,實驗室多晶太陽能電池能量轉換效率達20%以上。使用矽晶型的優點包括可靠性(矽晶型電池的模組壽命超過25年,且長期性能幾乎不會劣化),以及矽的易得性,矽是地殼中第二豐富的元素。

- 到 2030 年,全球可從廢棄面板中回收材料的價值將達到約 4.5 億美元,相當於製造約 6,000 萬塊新面板所需材料的價值。將太陽能電池板從垃圾掩埋場轉移到回收利用可以節省垃圾掩埋場空間,同時實現原料的價值。

- 根據WEEE指令,歐洲國家必須制定光伏廢棄物管理政策,並要求生產商負責其銷售的太陽能板的收集和回收。該法規有兩個主要目標。首先,它將鼓勵市場創造使用更少原料、更容易回收的產品。其次,它鼓勵生產商將產品收集和報廢護理的成本納入消費者為其商品支付的價格中。

- 2021年,歐洲太陽能光電裝置容量達18.35萬千瓦。預測期內光伏容量預計會增加。太陽能板使用量的突然增加,加上政府對太陽能板回收的舉措,產生了對負責任的工業規模回收和廢物處理的需求,從而推動了太陽能電池板回收市場的發展。

- 因此,由於矽晶型部分比其他部分享有更大的利用優勢,預計預測期內將佔據市場主導地位。

德國佔據市場主導地位

- 德國佔歐洲太陽能發電能力的大部分,因此預計將主導太陽能板回收市場。此外,政府也設定了2030年將太陽能發電能力提高到200GW的目標,為實現這一目標,政府計劃將太陽能發電競標提高到20GW。

- 此外,德國的發電能力將增加約八倍,從2020年的50吉瓦多一點增加到本世紀中葉的4.15吉瓦左右。為實現2030年能源消耗中65%可再生能源的目標,太陽能和風電裝置容量每年的新增規模必須達到至少5GW。因此,太陽能發電能力的增加將導致太陽能板安裝數量的增加,這將為預測期內的太陽能板回收市場帶來機會。

- 為了回收廢棄舊光伏(PV)模組,德國威立雅公司正在計劃監督下開發一種高效而獨特的技術。與活躍於光伏組件回收供應鏈的公共和私營部門合作夥伴一起。歐盟透過 EIT RawMaterials 項目為該舉措提供了總計 480 萬歐元的資金。

- 2021年,德國太陽能發電裝置容量達58,500千瓦。預測期內,太陽能發電能力預計會增加,這將增加太陽能板的裝置容量,從而推動未來太陽能板回收市場的發展。

- 鑑於上述情況,由於光伏回收技術和計劃的新興市場發展,預計德國將在預測期內佔據市場主導地位。

歐洲太陽能板回收產業概況

歐洲太陽能板回收市場適度整合。市場的主要企業(不分先後順序)包括天合光能有限公司、夏普株式會社、First Solar Inc、SunPower Corporation 和 Reiling Group GmbH &Co.KG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按工藝

- 熱

- 機器

- 雷射

- 按類型

- 矽晶型

- 薄膜

- 按地區

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

第6章 競爭格局

- 供應商市場佔有率

- 合併和收購

- 公司簡介

- Sunpower Corporation

- Reiling Group GmbH & Co. KG

- Rosi Solar

- JA Solar Co.

- Univergy International

- Renesola

- Trina Solar Co.

- First Solar Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93272

The Europe Solar Panel Recycling Market is expected to register a CAGR of greater than 24% during the forecast period.

The market was negatively impacted by COVID-19. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand for solar energy and solar contribution to a greener environment is expected to drive the market in the forecast period. In addition, the reduction in solar panel costs is an essential factor for market growth.

- On the other hand, lack of general awareness and interest is the major restrain for the market. Sometimes, reusing PV panels becomes a challenging economic option, thus, hampering the growth of the market.

- Improvement in the efficiency of recycling processes in recent years is expected to create ample opportunities for the market. One example of a recycling method under the research phase is the method developed by Loser Chemie.

- Germany is expected to dominate the market with various upcoming solar panel installation projects.

Europe Solar Panel Recycling Market Trends

Crystalline Silicon to Dominate the Market

- An aluminum frame, glass, copper wire, polymer layers, a back sheet, silicon solar cells, and a plastic junction box are used to build crystalline-silicon solar panels. Although the polymer layers protect the panel from the elements, they also make recycling and disassembling the panel challenging because high temperatures are frequently needed to remove the glue.

- Moreover, laboratory energy conversion efficiency for single-crystal and multi-crystalline silicon photovoltaic cells is over 25% and over 20%, respectively. The benefits of using crystalline silicon include reliability as crystalline silicon cells reach module lifetimes of 25+ years and exhibit little long-term degradation and easy availability of silicon as it is the second most abundant element in earth's crust.

- By 2030, around USD 450 million will be the total global worth of recoverable raw materials from end-of-life panels, which is equal to the price of raw materials required to make around 60 million new panels. By diverting solar panels from landfills to recycling, space is saved in landfills, and the value of the raw materials is also realized.

- According to the WEEE Directive, European nations must have PV waste management policies that hold Producers accountable for collecting and recycling the panels they sell. These regulations have two main objectives. First, it pushes the market to create goods that require less raw material and are easier to recycle. Second, it encourages producers to include the cost of product collection and end-of-life care in the price customers pay for their goods.

- In 2021, Europe's total solar photovoltaic capacity accounted for 183.5 thousand MW. The PV capacity is expected to rise during the forecast period. This rapid increase in panel use and government policies for recycling panels necessitates responsible, industrial-scale recycling and disposal processes driving the solar panel recycling market.

- Therefore, the crystalline silicon segment is expected to dominate the market because its usage benefits more than the other segments during the forecast period.

Germany to Dominate the Market

- Germany is expected to dominate the solar panel recycling market as the country has the majority of solar PV capacity in Europe. Moreover, the country's government has set a target of raising its solar power capacity to 200GW by 2030, for which the government is planning to increase solar tenders to 20GW.

- Moreover, Germany's capacity will increase roughly eight times, from slightly over 50 GW in 2020 to about 415 GW by the middle of the century. The yearly capacity expansion for both solar and wind power must reach at least 5 GW to meet the 2030 target of a 65 % renewable share in energy consumption. Thus, the increase in solar capacity will lead to more solar panel installation creating an opportunity for the solar panel recycling market in the forecast period.

- For the recycling of photovoltaic (PV) modules that have reached the end of their useful lives, a highly effective and unique technology is being developed under the project supervision of Veolia Germany. Along with collaborating businesses from the public and private sectors that are active in the PV module recycling supply chain. Through EIT RawMaterials, the European Union is funding the initiative with a total of EUR 4.8 million.

- In 2021, the total solar photovoltaic capacity of Germany accounted for 58.5 thousand MW. The PV capacity is expected to rise in the forecast period, this, in turn, will increase solar panel installation capacity thus driving the solar panel recycling market in the future.

- Therefore, owing to the above points, with the development in technology and project in PV recycling, Germany is expected to dominate the market during the forecast period.

Europe Solar Panel Recycling Industry Overview

The Europe solar panel recycling market is moderately consolidated. The key players in the market ( not in particular order ) include Trina Solar Co., Sharp Corporation, First Solar Inc, SunPower Corporation, and Reiling Group GmbH & Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Thermal

- 5.1.2 Mechanical

- 5.1.3 Laser

- 5.2 By Type

- 5.2.1 Crystalline silicon

- 5.2.2 Thin film

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Sunpower Corporation

- 6.3.2 Reiling Group GmbH & Co. KG

- 6.3.3 Rosi Solar

- 6.3.4 JA Solar Co.

- 6.3.5 Univergy International

- 6.3.6 Renesola

- 6.3.7 Trina Solar Co.

- 6.3.8 First Solar Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219