|

市場調查報告書

商品編碼

1635520

亞太地區小型液化天然氣 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia-Pacific Small-scale LNG - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

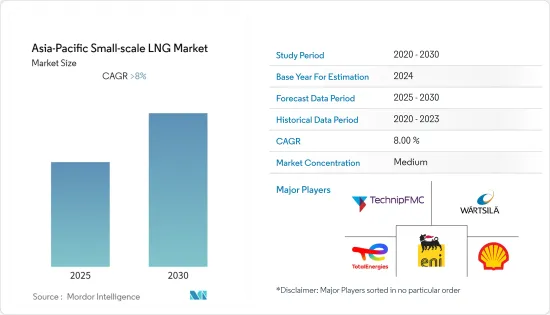

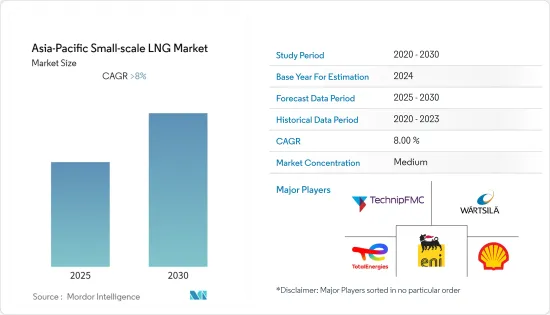

亞太小型液化天然氣市場預計在預測期內複合年成長率將超過8%。

2020 年市場受到 COVID-19 大流行的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,燃料庫、道路運輸和離網電力等方面的液化天然氣需求增加等因素預計將在預測期內推動亞太小型液化天然氣市場的發展。

- 另一方面,小型液化天然氣營業成本高、資本支出要求高以及投資回收期超過12年等因素預計將阻礙市場成長。

- 具有成本效益的小型液化天然氣基礎設施的發展預計將為小型液化天然氣技術供應商和運輸商帶來重大機會。

- 中國在市場上佔據主導地位,並可能在預測期內保持最高的複合年成長率。這一成長歸因於對液化天然氣的需求增加以及政府努力發展液化天然氣相關基礎設施。

亞太小型液化天然氣市場趨勢

液化終端佔市場主導地位

- 發展年產能50萬噸以下的小型液化接收站,服務特定市場。同時,大型液化接收站年產能達1,600萬噸。這些終端為沒有傳統基礎設施或消費者需要液體燃料的最終用戶提供服務。

- 天然氣管道為小型液化廠供氣,這些小型液化廠的成本變化很大,取決於技術和模組化。據地中海聯盟 (UfM) 稱,小型液化終端的天然氣平台投資估計在 350 美元/噸至 1,250 美元/噸之間。

- 截至2022年7月,中國正在增加液化天然氣進口能力。預計未來幾年中國將新增超過2億噸的年進口能力,其中8,530萬噸已經在建。這遠遠超過了越南和泰國等其他亞洲國家的計劃儲備。

- 然而,2021 年,隨著 COVID-19 限制的放鬆以及全球工業營運的恢復,液化天然氣價格上漲。亞洲煤炭價格上漲導致用於發電的液化天然氣進口增加,液化天然氣價格上漲。

- 此外,為了擴大分散式液化天然氣生產業務,GAIL於2022年6月訂購了兩台能夠在檢驗基礎上生產液化天然氣的小型液化撬。這些工廠將有助於在新的城市燃氣發行(CGD)網路中透過液化發行天然氣,而孤立油田中的天然氣液化將支援液化天然氣加氣站的安裝和燃料庫。該計劃預計將支持印度政府提高天然氣在初級能源籃子中的佔有率的舉措。

- 因此,各行業(主要是亞太地區)對小型液化天然氣的需求不斷增加,預計將在預測期內增加液化終端的數量。

中國主導市場

- 截至2021年,中國是世界上最富裕的國家之一,這帶動了液化天然氣需求的成長。 2020年液化天然氣進口量約1,200萬噸,2021年將增加至7,900萬噸。由於需求的快速成長,中國已超越日本成為全球最大的液化天然氣進口國。需求的增加是由於中國液化天然氣買家簽署了每年超過2000萬噸的長期合約。

- 預計澳洲將在2021年成為中國液化天然氣的主要供應國。 2021年,中國從澳洲生產商購買了約2,857萬噸液化天然氣,佔中國液化天然氣進口總量的三分之一以上。

- 在中國,小型液化廠大多位於西北和中部地區,是天然氣和煤炭的主要產區。然而,有兩個再氣化接收站,一個在海南省,一個在防城港,每個接收站的生產能力為每年60萬噸(MTPA),被認為是小型液化LNG接收站。

- 此外,中國船舶對液化天然氣的需求預計將增加。隨著IMO2020於2020年1月生效,中國政府原計劃在2020年開發近40個液化天然氣供應終端,但由於受COVID-19影響導致液化天然氣需求下降,計劃被推遲。部分機組將於 2021 年運作,部分機組將於 2022 年投入運作。

- 2021年12月,新加坡能源解決方案供應商Pavilion Energy與浙江航嘉信清潔能源簽署小規模LNG供應協議,前者計畫從2023年起每年向航嘉信供應50萬噸LNG。

- 2022年1月,Avenir LNG將一艘小型液化天然氣加註船出售給上海國際港務集團與協同效應的合資企業上海上港能源服務公司。該船是全球最大的LNG加註船,運力達2萬立方公尺。這艘液化天然氣加註船將在全球最大的貨櫃港口上海港運作。

- 因此,鑑於上述幾點,預計中國將在預測期內主導小型液化天然氣市場的成長。

亞太地區小型液化天然氣產業概況

亞太地區小型液化天然氣市場因其性質而適度分割。市場上的主要企業(排名不分先後)包括 Linde PLC、Wartsila Oyj ABP、Shell PLC、Eni SpA 和 TotalEnergies SE。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 液化終端

- 再氣化終端

- 按供貨形式

- 追蹤

- 轉運/燃料庫

- 管道/鐵路

- 按用途

- 運輸

- 工業原料

- 發電

- 其他

- 按地區

- 中國

- 印度

- 日本

- 新加坡

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- 小型液化天然氣技術供應商

- Linde PLC

- Wartsila Oyj ABP

- Baker Hughes Company

- Honeywell UOP

- Chart Industries Inc.

- Black & Veatch Corp

- 小型液化天然氣運輸業者

- Anthony Veder Group NV

- Engie SA

- Evergas AS

- 小型液化天然氣營運商

- Shell PLC

- Eni SpA

- PJSC Gazprom

- TotalEnergies SE

- Gasum Oy

- 小型液化天然氣技術供應商

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92990

The Asia-Pacific Small-scale LNG Market is expected to register a CAGR of greater than 8% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing demand for LNG in bunkering, road transportation, and off-grid power are expected to drive the Asia-Pacific small-scale LNG market during the forecast period.

- On the other hand, factors such as the high operation cost of small-scale LNG, high CAPEX requirements, and a long payback period of more than 12 years are expected to hinder the market's growth.

- Nevertheless, developing cost-efficient small-scale LNG infrastructure is expected to provide significant opportunities for small-scale LNG technology providers and transporters.

- China dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increased demand for LNG and government initiatives to develop LNG-related infrastructure.

APAC Small-scale LNG Market Trends

Liquefaction Terminals to Dominate the Market

- Small-scale liquefaction terminals are developed to serve specific markets having a production capacity of fewer than 0.5 million tons per year. In contrast, a large-scale liquefaction terminal has a production capacity of 16 million tons annually. These terminals supply the end users where traditional infrastructure is unavailable, or consumers require liquid fuel.

- Gas pipelines feed small-scale liquefaction plants, and the costs of these small liquefaction plants are very diverse and vary according to technology and modularity. According to the Union for the Mediterranean (UfM), gas platform investment in small-scale liquefaction terminals is estimated to range between 350 USD/ton and 1,250 USD/ton.

- As of July 2022, China is increasing its LNG import capacity. China is expected to add over 200 million metric tons in annual import capacity within the next few years, of which 85.3 million tons are already in construction. This is far more than the project pipeline of other Asian countries such as Vietnam and Thailand.

- However, in 2021, the LNG prices increased with the easing of COVID-19-induced restrictions that led to the global restoration of industrial operations. Higher coal prices in Asia have led to increased LNG imports for power generation and increased LNG prices.

- Furthermore, to increase the distributed LNG production business, in June 2022, GAIL placed an order for two small-scale liquefaction skids capable of producing LNG on a pilot basis. These plants will help to distribute natural gas through liquefaction in the new City Gas Distribution (CGD) network, and the liquefaction of gas at isolated fields will support setting up LNG fueling stations and bunkering. The project is forecast to provide a thrust to the Government of India's initiatives to increase the share of natural gas in the primary energy basket.

- Thus, the increasing demand for small-scale LNG from the various sectors, mainly in the Asia-Pacific region, is likely to increase the number of liquefaction terminals during the forecast period.

China to Dominate the Market

- As of 2021, China is one of the world's richest countries, which led to the growth in LNG demand. The LNG import was around 12 million tons in 2020, which will increase to 79 million tons in 2021. Due to this surge in demand, China became the world's largest LNG importer, surpassing Japan. The increased demand is due to Chinese LNG buyers signing long-term contracts for more than 20 million tons a year.

- In 2021, Australia will be the leading supplier of LNG to China. In 2021, China purchased some 28.57 million metric tons of liquefied natural gas from Australian producers, which accounted for more than one-third of the total LNG import volume in China.

- In China, most small-scale liquefaction plants are major gas and coal-producing areas located domestically in the Northwestern and Central provinces. However, two regasification terminals exist in Hainan and Fangchenggang with a capacity of 0.6 million tons per year (MTPA) each, which are considered small-scale LNG terminals.

- Further, the demand for LNG is expected to increase from marine vessels in China. With IMO 2020 coming into effect in January 2020, the Chinese government planned to develop nearly 40 terminals with LNG supply in 2020; however, due to COVID-19, the demand for LNG decreased, and thus, the projects were delayed. A few came online in 2021, and a few in 2022.

- In December 2021, Pavilion Energy, a Singapore-based energy solutions provider, and Zhejiang Hangjiaxin Clean Energy entered a deal to supply small-scale LNG under which the former company is expected to provide 0.5 million tons per year of LNG to Hangjiaxin from 2023.

- In January 2022, Avenir LNG sold one of its small-scale LNG bunker vessels to Shanghai SIPG Energy Service, a joint venture between Shanghai International Port Group and Synergy. It is the world's largest LNG bunker vessel, with a capacity of 20,000 cubic meters. The LNG bunker vessel would be operational at Shanghai port, the world's largest container port.

- Therefore, owing to the above points, China is expected to dominate the growth of the small-scale LNG market during the forecast period.

APAC Small-scale LNG Industry Overview

The Asia-Pacific small-scale LNG market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Linde PLC, Wartsila Oyj ABP, Shell PLC, Eni SpA, and TotalEnergies SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Liquefaction Terminal

- 5.1.2 Regasification Terminal

- 5.2 By Mode of Supply

- 5.2.1 Truck

- 5.2.2 Transshipment and Bunkering

- 5.2.3 Pipeline and Rail

- 5.3 By Application

- 5.3.1 Transportation

- 5.3.2 Industrial Feedstock

- 5.3.3 Power Generation

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Singapore

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Small-scale LNG Technology Providers

- 6.3.1.1 Linde PLC

- 6.3.1.2 Wartsila Oyj ABP

- 6.3.1.3 Baker Hughes Company

- 6.3.1.4 Honeywell UOP

- 6.3.1.5 Chart Industries Inc.

- 6.3.1.6 Black & Veatch Corp

- 6.3.2 Small-scale LNG Marine Transporter

- 6.3.2.1 Anthony Veder Group NV

- 6.3.2.2 Engie SA

- 6.3.2.3 Evergas AS

- 6.3.3 Small-scale LNG Operators

- 6.3.3.1 Shell PLC

- 6.3.3.2 Eni SpA

- 6.3.3.3 PJSC Gazprom

- 6.3.3.4 TotalEnergies SE

- 6.3.3.5 Gasum Oy

- 6.3.1 Small-scale LNG Technology Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219