|

市場調查報告書

商品編碼

1635521

中東和非洲的冷卻系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Middle East and Africa Cooling Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

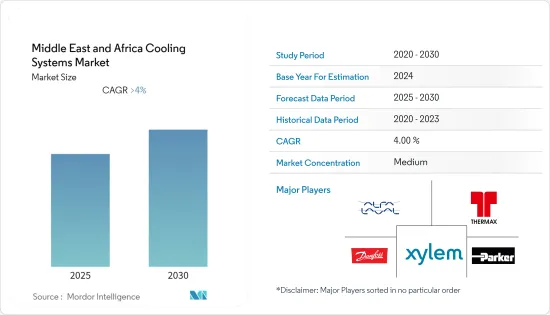

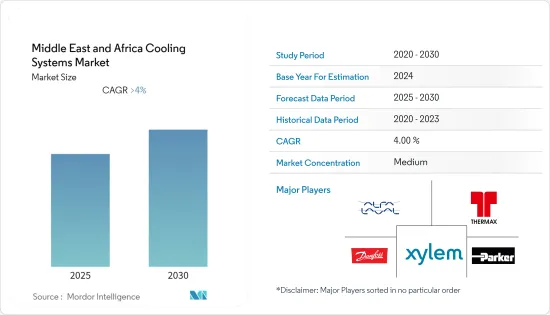

中東和非洲冷卻系統市場預計在預測期內將維持4%以上的複合年成長率。

2020 年市場受到 COVID-19 的負面影響。目前已達到疫情前水準。

主要亮點

- 從中期來看,下游領域投資增加以及能源領域對冷卻系統的需求等因素預計將推動研究市場的成長。

- 另一方面,可再生能源發電發電廠對風機和鼓風機的需求明顯低於傳統火力發電廠和核能發電廠,導致可再生能源在電力部門的佔有率增加,並且-非洲的冷卻系統市場正在成長。壓制。

- 冷卻系統技術的進步可實現行業的永續成長,這可能為市場創造機會。

- 沙烏地阿拉伯在市場上佔據主導地位,預計在預測期內複合年成長率最高。這種成長得益於石化工業的存在。該國還擁有大型基礎設施和建設計劃。

中東和非洲冷卻系統市場趨勢

能源領域主導市場

- 在能源領域,無論是發電廠還是石油和天然氣計劃,溫度調節在流程效率方面發揮重要作用。例如,火力發電廠的能源效率取決於大氣溫度和產生的熱量,因此需要一個高效的冷卻系統才能從火力發電廠獲得更好的輸出。

- 蒸氣渦輪控制系統採用電液(EH)油系統。這些油通常是閃點高於渦輪機潤滑油的難熔油。這種 EH 油用於控制渦輪機的蒸氣輸入。根據負載需求產生電訊號,該訊號轉換為液壓訊號以確定渦輪機蒸氣控制閥的位置。渦輪機截止閥由這種 EH 油操作。儘管通常被稱為 EH 油,但根據其功能和來源,它在主流渦輪機系統中可能有不同的名稱。此外,透過冷卻水系統中的冷卻管和殼式冷卻器,利用來自多個蒸氣閥的各種液壓排水管線,為火力發電廠提供高效的冷卻和效率。

- 中東和非洲是最大的上游油氣市場之一。截至2022年10月,中東及非洲地區運作鑽機數量約410座,約佔全球運作鑽機數量的22%。此外,在上游作業中,鑽井液壓被認為是影響鑽井性能最重要的因素之一。透過更好的水力最佳化技術可以顯著提高穿透率,其中之一就是更好的冷卻過程。液壓油冷卻器,也稱為帶有風扇的油熱交換器,主要用於鑽孔機上。這是因為使用空氣冷卻油的機器可能會達到無法使用的溫度。

- 2021年12月,阿布達比國家石油公司(ADNOC)宣布,隨著阿拉伯聯合大公國油氣蘊藏量的成長,其2022-2026年的資本投資計畫將達到1,270億美元。該國營公司表示,石油蘊藏量增加了40億桶,天然氣儲量增加了16兆立方英尺,分別達到1,110億標準桶和289兆標準立方英尺。

- 此外,內燃機也用於各種固定發電能源應用。在低階,發電廠由一台發電機組組成,但在較大規模時,它可能由更多機組組成,總合輸出為數百兆瓦。此外,熱交換器也用於燃燒發電引擎以維持溫度。

- 總體而言,中東和非洲油氣天然氣田的開發,加上即將到來的火力發電廠計劃,預計將推動該地區的冷卻系統市場。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯是中東和非洲最大的冷卻系統市場之一。預計該國在預測期內將保持其優勢。沙烏地阿拉伯擁有龐大的能源部門,包括傳統石化燃料和可再生能源。沙烏地阿拉伯還擁有世界上最大的石化工業之一,並且在基礎設施和建設計劃方面處於世界領先地位。

- 在頁岩氣繁榮的推動下,沙烏地阿拉伯的上游碳氫化合物產業在過去十年中顯著成長,國內頁岩油氣產量快速成長,該國已成為碳氫化合物淨出口國。

- 2021年11月,沙烏地阿美公司簽署了一項價值100億美元的巨型Jafra計劃,據稱該項目是美國以外世界上最大的頁岩天然氣田。據估計,沙烏地阿拉伯擁有世界第五大頁岩氣蘊藏量。據沙烏地阿拉伯能源部長稱,到2030年,賈夫拉氣田將成為世界第三大天然氣生產地。

- 根據貝克休斯鑽機統計,2022 年 8 月,沙烏地阿拉伯有 68 座鑽機在運作。鑽機是高度精密的設備,具有獨特的冷卻需求。鑽機上的主要冷卻系統之一是絞車煞車冷卻系統和稱為絞車的相關組件,用於控制電纜放線以及升高和降低鑽柱。

- 根據IRENA統計,截至2021年,沙烏地阿拉伯太陽能發電容量為439MW,與前一年同期比較成長303%。在沙烏地阿拉伯2030年願景架構內,該國修訂了可再生能源目標,到2023年可再生能源裝置容量達到2,730萬千瓦,到2030年達到5,870萬千瓦。

- 隨著可變電源可再生能源發電的增加,能源儲存已成為提供電網穩定和穩定能力的關鍵要求。這就是電池儲存 (BESS) 系統擴大部署在住宅和公共產業中的原因。然而,當電池充電時,尤其是較大的電池,它們會發熱並需要冷卻系統。

- 從上述案例可以看出,沙烏地阿拉伯是最大的冷卻系統市場之一,其需求來自各個最終用戶產業,預計在預測期內將主導中東和非洲冷卻系統市場。

中東和非洲冷卻系統產業概況

中東和非洲的冷卻系統市場較為分散。市場主要企業包括(排名不分先後)Alfa Laval AB、Thermax Limited、Danfoss AS、Xylem Inc. 和 Parker Hannifin Corp.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 市場促進因素

- 市場限制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 透過冷卻裝置

- 熱交換器

- 風扇和鼓風機

- 其他冷卻裝置

- 按最終用戶

- 能源部門

- 化工/石化

- 建造

- 其他

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 奈及利亞

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Alfa Laval AB

- Thermax Limited

- Danfoss AS

- Xylem Inc.

- Parker Hannifin Corp

- Reitz Middle East FZE

- Gmark Middle East FZC

- Infinair Arabia Co Ltd

- AKG Group

- Hydac International GmbH

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92991

The Middle East and Africa Cooling Systems Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing investments in the downstream sector and demand for cooling systems from the energy sector are expected to drive the growth of the market studied.

- On the other hand, as the requirement of renewable power plants for fans and blowers is significantly less than that of conventional fossil-fired and nuclear power plants, the increasing share of renewables in the power sector is expected to restrain the cooling systems market in the Middle East and Africa region during the forecast period.

- Nevertheless, increasing advancements in cooling system technology to achieve sustainable industrial growth are likely to create opportunities for the market.

- Saudi Arabia is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the presence of petrochemical industries. The country also has an extensive infrastructure and construction projects.

MEA Cooling Systems Market Trends

Energy Sector Segment to Dominate the Market

- In the energy sector, temperature regulation plays a major part in the efficiency of the process, whether it be power plants or oil and gas projects. For instance, the energy efficiency of a thermal power plant depends on atmospheric temperature and heat generated, which needs an efficient cooling system to get better output from a thermal plant.

- The steam turbine governing system uses the electro-hydraulic (EH) oil system. Usually, these are fire-resistant oil with a high flash point compared to turbine lube oil. This EH oil is used to control the steam input to the turbine. An electric signal is produced based on the load demand, which gets converted to a hydraulic signal and decides the turbine steam control valve position. The turbine stop valve is operated by this EH oil. Though it is commonly referred to as EH oil, it can be called by different names in the governing turbine system based on its function and source. Further, it utilizes various hydraulic drain lines from multiple steam valves routed through tubes and shell coolers cooled through a cooling water system to provide efficient cooling and efficiency for the thermal power plant.

- The Middle East and Africa are one of the largest markets for upstream oil and gas. As of October 2022, the active rig count in the Middle East and Africa was about 410, which is about 22% of the global active rig count. In addition, in upstream operations, drilling hydraulics is considered one of the most critical factors for drilling performance. The rate of penetration can be increased significantly using better hydraulic optimization techniques, one of which is a better cooling process. In drilling rigs, hydraulic oil coolers, also known as oil heat exchangers with fans, are used primarily. This is because the machines that use air to cool the oil may reach unusable temperatures.

- In December 2021, the Abu Dhabi National Oil Company (ADNOC) announced that its capital spending plan for 2022-2026 is going to amount to USD 127 billion as oil and natural gas reserves in the United Arab Emirates (UAE) increased. According to the state-owned company, national reserves had risen by 4 billion barrels of oil and 16 trillion cubic feet of natural gas, bringing their totals to 111 billion STB and 289 trillion SCF, respectively.

- Moreover, combustion engines are used for various stationary power energy generation applications. At the lower end of the range, the power plant consists of only one generating set, while larger plants can consist of more units and have a total output of several hundred MW. Furthermore, heat exchangers are used in combustion power engines to maintain temperature.

- Overall, the development of oil and gas fields in the Middle East and Africa region, coupled with upcoming thermal power plant projects, is expected to drive the cooling systems market in the region.

Saudi Arabia to Dominate the Market

- Saudi Arabia is one of the largest markets for cooling systems in the Middle East and Africa region. The country is expected to continue its dominance during the forecast period as well. Saudi Arabia is home to a massive energy sector that includes both conventional fossil fuel and renewable energy. The country also houses one of the world's largest petrochemical industries, and it also leads the world in infrastructure and construction projects, all sectors which have extensive use of cooling systems.

- The country's upstream hydrocarbon sector has grown significantly over the past decade, fuelled by the shale boom, which has resulted in rapid growth in domestic shale oil and gas production, transforming the country into a net exporter of hydrocarbons.

- In November 2021, Saudi Aramco awarded USD 10 billion in contracts for the development of its giant Jafurah project, which is believed to be the world's largest shale gas field outside of the United States. In terms of shale gas reserves, the country is estimated to have the world's fifth-largest deposit. According to Saudi Arabia's Energy Minister, the Jafurah gas field will place Saudi Arabia third in the world in terms of natural gas production by 2030.

- According to Baker Hughes Rig Count, in August 2022, Saudi Arabia had 68 active drilling rigs. Drilling rigs are highly sophisticated equipment with specific cooling requirements. One of the primary cooling systems on a drilling rig is the brake cooling system in the winch and associated components called drawworks, which are used to control cable payout and to raise or lower the drill string.

- According to IRENA, as of 2021, total solar energy capacity in Saudi Arabia stood at 439 MW, witnessing a 303% growth from the previous year. In the framework of Saudi Arabia Vision 2030, the country revised its renewable energy target to reach 27.3 GW of renewable energy capacity by 2023 and 58.7 GW by 2030.

- With the growth in renewable energy generation from variable sources, energy storage has become a major requirement to provide grid stability and firming capacity. This has facilitated a rise in the deployment of Battery Energy Storage (BESS) systems, both in the residential and utility segment. However, as batteries are charged, especially larger batteries, they are heated up and require cooling systems.

- From the above instances, it is evident that Saudi Arabia is one of the largest markets for cooling systems, with demand originating from various end-user industries, and it is expected to dominate the cooling systems market in the Middle East and Africa during the forecast period.

MEA Cooling Systems Industry Overview

The cooling systems market in the Middle East and Africa is fragmented in nature. Some of the major players in the market (in no particular order) include Alfa Laval AB, Thermax Limited, Danfoss AS, Xylem Inc., and Parker Hannifin Corp., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Cooling Equipment

- 5.1.1 Heat Exchangers

- 5.1.2 Fans & Blowers

- 5.1.3 Other Cooling Equipment

- 5.2 By End User

- 5.2.1 Energy Sector

- 5.2.2 Chemical & Petrochemicals

- 5.2.3 Construction

- 5.2.4 Other End Users

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Qatar

- 5.3.4 Nigeria

- 5.3.5 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Thermax Limited

- 6.3.3 Danfoss AS

- 6.3.4 Xylem Inc.

- 6.3.5 Parker Hannifin Corp

- 6.3.6 Reitz Middle East FZE

- 6.3.7 Gmark Middle East FZC

- 6.3.8 Infinair Arabia Co Ltd

- 6.3.9 AKG Group

- 6.3.10 Hydac International GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219