|

市場調查報告書

商品編碼

1635523

東南亞冷卻系統市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Southeast Asia Cooling Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

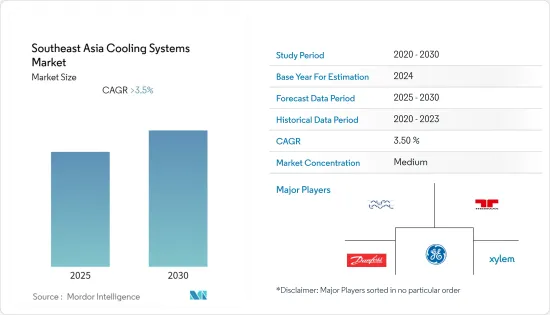

預計東南亞冷卻系統市場在預測期內將維持3.5%以上的複合年成長率。

2020 年,市場受到 COVID-19 大流行的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,該地區工業活動增加和下游領域投資增加等因素預計將在預測期內推動冷卻系統市場。

- 另一方面,在預測期內,可再生能源在電力產業中所佔佔有率的增加預計將減緩東南亞地區的市場成長。

- 冷卻系統技術的持續進步預計將在預測期內為冷卻系統市場的參與企業創造重大機會,以實現永續的工業成長。

- 預計馬來西亞在東南亞冷卻系統市場將顯著成長。

東南亞冷卻系統市場趨勢

能源領域需求龐大

- 在能源領域,無論是發電廠還是石油和天然氣計劃,溫度調節在流程效率方面發揮重要作用。例如,火力發電廠的能源效率取決於大氣溫度和發熱量,需要高效率的冷卻系統才能獲得更好的輸出。

- 蒸氣渦輪控制系統採用電液(EH)油系統。它通常是一種閃點高於渦輪機潤滑油的耐火油。這種 EH 油用於控制渦輪機的蒸氣輸入。根據負載需求產生電訊號,該訊號轉換為液壓訊號以確定渦輪機蒸氣控制閥的位置。渦輪機截止閥也由這種 EH 油操作。雖然通常被稱為 EH 油,但根據其功能和來源,它在主要渦輪機系統中可能有不同的名稱。此外,冷卻水系統中還利用來自多個蒸氣閥、經過冷卻管和殼式冷卻器的各種液壓排水管線,為火力發電廠提供高效的冷卻和效率。

- 2022年10月,Tenaga Nasional Berhad將透過其子公司TNB Power Generation Sdn Bhd,在馬來西亞雪蘭莪州Kapar開發一座2,100MW聯合火力發電廠。該發電廠計劃於 2031 年投入運作。

- 石油和天然氣供應鏈是一個複雜的過程,涉及從探勘、生產到精製的巨大投資。 2014年油價暴跌後,東南亞探勘投資大幅下降。然而,2000 年至 2021 年間,東南亞國家聯盟 (ASEAN) 10 個國家的能源需求增加了約 60%。例如,根據《BP 2022年世界能源統計回顧》,在考慮初級能源消耗時,截至2021年,印尼(8.31艾焦耳)是東南亞地區的領先國家,其次是泰國(5.11艾焦耳)和越南(4.32艾焦耳)。

- 此外,內燃機也用於各種固定發電能源應用。小型發電廠只有一台發電機組,而大型發電廠則有更多機組,總輸出功率達數百兆瓦。此外,熱交換器也用於燃燒發電引擎以維持溫度。因此,即將到來的火力發電廠計劃預計將推動該地區的冷卻系統市場。

- 因此,由於上述因素,能源產業預計在預測期內東南亞冷卻系統市場將顯著成長。

馬來西亞,預計將出現顯著成長

- 馬來西亞是東南亞最大的經濟體之一,經濟以碳氫化合物、農業和製造業為主。該國自然資源豐富,預計該國自然資源的開發和基礎設施發展將成為預測期內推動該國冷卻系統需求的主要因素。

- 根據BP《2022年世界能源統計年鑑》,馬來西亞2021年天然氣產量為742億立方公尺(bcm),較前一年(68.7bcm)成長約8.3%。馬來西亞是東南亞主要的天然氣生產國,其次是印尼和泰國。

- 馬來西亞國有能源公司馬來西亞國家石油公司 (Petronas) 正在尋求加快 2022 年至 2023 年馬來西亞上游石油和天然氣計劃的最終投資決策 (FID)。馬石油提供優質、低成本的石油和天然氣資源,以滿足該國不斷成長的能源需求。 2021 年 4 月,管理馬來西亞碳氫化合物資產的馬來西亞石油管理公司 (MPM)競標了馬來西亞投標回合,該平台已啟動,向感興趣的投資者 (MBR) 提供馬來西亞已確認碳氫化合物礦床的13 個新探勘區塊。這13個區塊包括4個深水區塊和9個淺水區塊。

- 因此,由於鑽井和完井作業的增加,預計 2021 年探勘和生產活動將出現強勁成長,預計將推動對液壓系統冷卻系統的需求。

- 此外,截至 2022 年 4 月,GE 渦輪機正在為 Edra Energy 位於馬來西亞馬六甲 Alorgh Gajah 的聯合循環發電廠提供動力。該聯合循環發電廠是該國最大的發電廠,將為馬來西亞電網提供超過220萬千瓦的電力。 Edra 是馬來西亞第二大獨立電力生產商。新工廠將包括三個發電區塊,每個發電容量超過745MW。每套設備均包括一台 GE 9HA.02燃氣渦輪機、一台 STF-D650蒸氣渦輪、一台 W88 發電機和一台熱回收蒸汽產生器(HRSG)。此類計劃可能會創造對熱交換器的正面需求,進而增加對家用冷卻系統的需求。

- 因此,由於上述因素,預計馬來西亞在預測期內東南亞冷卻系統市場將出現巨大需求。

東南亞冷卻系統產業概況

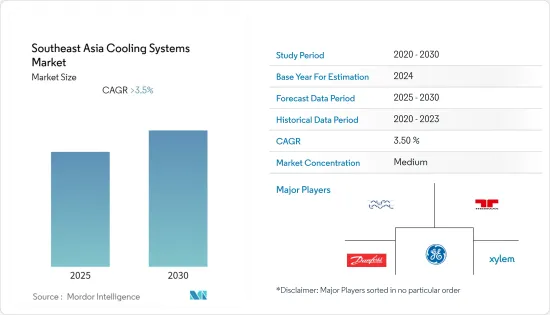

東南亞冷卻系統市場適度細分。市場上的主要企業包括(排名不分先後)Alfa Laval AB、Thermax Limited、Danfoss AS、Xylem Inc. 和 General Electric Company。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 主要國家即將進行的發電工程清單

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 透過冷卻裝置

- 熱交換器

- 風扇和鼓風機

- 其他冷卻裝置

- 按最終用戶

- 能源領域(石油/天然氣、電力等)

- 化工/石化

- 農業和建築業

- 其他

- 按地區

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他東南亞地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Alfa Laval AB

- Thermax Limited

- Danfoss AS

- Xylem Inc.

- HRS Heat Exchangers

- General Electric Company

- SPX Flow Inc.

- EJ Bowman

- Parker Hannifin Corp.

- Hydac International GmbH

第7章市場機會與未來趨勢

簡介目錄

Product Code: 93040

The Southeast Asia Cooling Systems Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing industrial activities in the region, along with rising investments in the downstream sector, are expected to drive the cooling systems market during the forecast period.

- On the flip side, an increasing share of renewables in the power sector is expected to slow down the market in the Southeast Asian region during the forecast period.

- Nevertheless, increasing advancements in cooling system technology to achieve sustainable industrial growth are expected to create immense opportunities for the cooling system market players during the forecast period.

- Malaysia is expected to witness significant growth in the Southeast Asian cooling systems market.

Southeast Asia Cooling Systems Market Trends

Energy Sector to Witness Significant Demand

- In the energy sector, temperature regulation plays a major part in the efficiency of the process, whether it be power plants or oil and gas projects. For instance, the energy efficiency of a thermal power plant depends on atmospheric temperature and heat generated, and it needs an efficient cooling system to get better output.

- The steam turbine governing system uses the electro-hydraulic (EH) oil system. Usually, these are fire-resistant oils with a high flash point compared to turbine lube oil. This EH oil is used to control the steam input to the turbine. An electric signal is produced based on the load demand, which gets converted to a hydraulic signal and decides the turbine steam control valve position. Also, the turbine stop valve is operated by this EH oil. Though it is commonly referred to as EH oil, it can be called by different names in the governing turbine system based on its function and source. Further, it utilizes various hydraulic drain lines from multiple steam valves routed through tubes and shell coolers cooled through a cooling water system to provide efficient cooling and efficiency for the thermal power plant.

- In October 2022, Tenaga Nasional Berhad, through its subsidiary TNB Power Generation Sdn Bhd, will be developing a 2,100 MW combined cycle power plant in Kapar, Selangor, Malaysia. The plant is scheduled to be operational by 2031.

- The oil and gas supply chain is a complex process involving massive investments from exploration and production to refining. Investments in exploration in Southeast Asia reduced dramatically after the oil price collapse in 2014. However, the energy demand in the ten countries which make up the Association of Southeast Asian Nations (ASEAN) increased by around 60% in the years between 2000 and 2021. For instance, according to the BP Statistical Review of World Energy 2022, Indonesia (8.31 exajoules), as of 2021, is the major country in the Southeast Asian region when primary energy consumption is considered, followed by Thailand (5.11 EJ), Vietnam (4.32 EJ), etc.

- Moreover, combustion engines are used for various stationary power energy generation applications. At the lower end of the range, the power plant consists of only one generating set, while larger plants can consist of more units and have a total output of several hundred MW. Further, heat exchangers are used in combustion power engines to maintain temperature. Hence, upcoming thermal power plant projects are expected to drive the cooling systems market in the region.

- Therefore, based on the abovementioned factors, the energy sector is expected to witness significant growth in the Southeast Asian cooling systems market during the forecast period.

Malaysia Expected to Witness Significant Growth

- Malaysia is one of Southeast Asia's largest economies, and the country's economy is dominated by its hydrocarbon, agriculture, and manufacturing sectors. The country is blessed with natural resources, and the development of natural resources and the country's infrastructure are expected to be major factors driving the demand for cooling systems in the country during the forecast period.

- According to the BP Statistical Review of World Energy 2022, Malaysia, in 2021, produced 74.2 billion cubic meters (bcm) of natural gas, i.e., an increase of about 8.3% compared to the previous year's value (68.7 bcm). Malaysia is the leading country in the Southeast Asian region when natural gas production is considered, followed by Indonesia, Thailand, etc.

- Petronas, the Malaysian national energy company, is expected to accelerate final investment decisions (FID) for upstream oil and gas projects across the country between 2022 and 2023. Petronas offers high-quality and low-cost oil and gas resources to meet the rising energy demand across the country. In April 2021, Malaysia Petroleum Management (MPM), which manages the nation's hydrocarbon assets, launched the Malaysia Bid Round (MBR), a platform to offer 13 new exploration blocks with proven hydrocarbon basins in the country to interested investors. These 13 blocks comprise four deep-water and nine shallow-water acreages.

- Therefore, exploration and production activities have shown significant growth during 2021 due to increased drilling and completion practices, which are expected to drive the demand for cooling systems for hydraulic systems.

- Furthermore, GE turbines, as of April 2022, are powering Edra Energy's combined cycle plant in Alor Gajah, Malacca, Malaysia. It is the largest combined cycle power plant in the country and adds more than 2.2 GW of electricity to Malaysia's grid, which represents the approximate amount needed to power up to 10% of the country's current demand. Edra is Malaysia's second-largest independent power producer. The new plant includes three generating blocks capable of generating over 745 MW per block. Each includes a GE 9HA.02 gas turbine, an STF-D650 steam turbine, a W88 generator, and a Heat Recovery Steam Generator (HRSG). Such projects are likely to create positive demand for heat exchangers, which, in turn, increases demand for cooling systems in the country.

- Therefore, based on the above-mentioned factors, Malaysia is expected to witness significant demand in the Southeast Asian cooling systems market during the forecast period.

Southeast Asia Cooling Systems Industry Overview

The Southeast Asian cooling systems market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Alfa Laval AB, Thermax Limited, Danfoss AS, Xylem Inc., and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 List of Upcoming Power Projects, by Major Countries

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Cooling Equipment

- 5.1.1 Heat Exchangers

- 5.1.2 Fans and Blowers

- 5.1.3 Other Cooling Equipment

- 5.2 By End User

- 5.2.1 Energy Sector (Oil & Gas, Power, etc.)

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Agriculture and Construction

- 5.2.4 Other End Users

- 5.3 By Geography

- 5.3.1 Malaysia

- 5.3.2 Thailand

- 5.3.3 Indonesia

- 5.3.4 Vietnam

- 5.3.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Thermax Limited

- 6.3.3 Danfoss AS

- 6.3.4 Xylem Inc.

- 6.3.5 HRS Heat Exchangers

- 6.3.6 General Electric Company

- 6.3.7 SPX Flow Inc.

- 6.3.8 EJ Bowman

- 6.3.9 Parker Hannifin Corp.

- 6.3.10 Hydac International GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219