|

市場調查報告書

商品編碼

1635529

英國建築幕牆:市場佔有率分析、產業趨勢與成長預測(2025-2030)UK Facade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

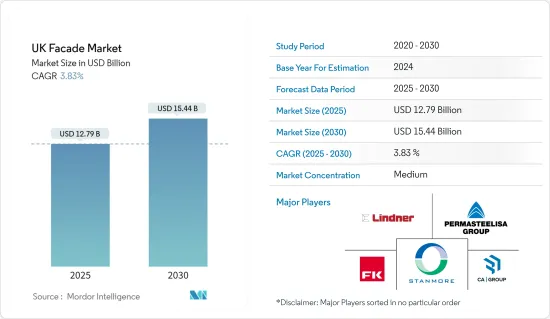

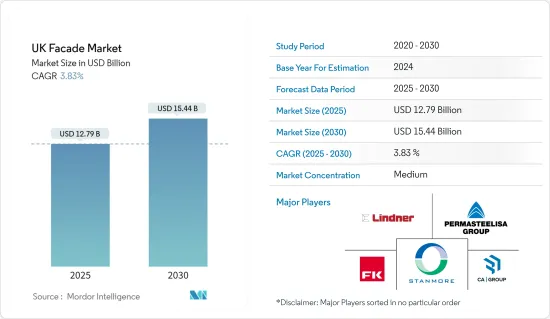

英國建築幕牆市場規模預計到 2025 年為 127.9 億美元,預計到 2030 年將達到 154.4 億美元,預測期內(2025-2030 年)複合年成長率為 3.83%。

主要亮點

- 在都市化、現代化和對永續性的關注的推動下,英國建築幕牆市場正在經歷強勁成長。這種快速成長反映了政府加強基礎設施發展的舉措。特別是,英國政府累計10 億英鎊(12.7 億美元),以促進住宅建築中不安全包層的修復。此舉突顯了我們對提高建築安全標準的堅定承諾,特別是在格倫菲爾大廈火災悲劇發生後。此類資金對於繼續努力確保住宅遵守安全法規至關重要,同時增加全國範圍內對更安全的建築幕牆材料的需求。此措施解決了緊迫的安全問題,同時引導建築幕牆市場在建築設計中採用高性能、相容的材料。

- 市場成長的另一個關鍵驅動力是英國政府對永續性和能源效率堅定不移的承諾。例如,截至2024年10月,英國政府推出了新的建築法規,要求新建商業建築將二氧化碳排放減少27%。此舉突顯了政府對建築幕牆市場永續性的堅定承諾。此類法規支援採用先進的建築幕牆材料,以提高熱性能並減少對環境的影響。因此,對環保建築幕牆的需求不斷增加,例如由回收材料製成的建築幕牆或帶有整合式太陽能電池板的建築幕牆。透過這些永續舉措,政府旨在減少建築業的碳排放,並實現 2050 年實現淨零排放的宏偉目標。

- 商業領域正在蓬勃發展,充滿了引人注目的計劃,所有這些都需要最先進的建築幕牆解決方案。例如,該行業機構報告稱,2024年第三季度,英國商業房地產投資12個月累計值連續第二季成長。這些商業項目,包括建造新車站和設施,為建築幕牆製造商提供了利潤豐厚的機會。這些發展不僅擴大了對建築幕牆的需求,也鼓勵建築師和建築幕牆專家之間的合作,並推動創造獨特設計的願望。

- 創新正在英國建築幕牆市場掀起波瀾。將智慧技術融入建築幕牆設計中,為更大的客製化和功能打開了大門,將美學吸引力與性能相結合。自清潔表面和發電建築幕牆等尖端功能的興起標誌著支持永續性的建築外牆的轉向。此外,數位工具允許建築師創建複雜的設計,無縫地融合功能和視覺吸引力。

英國建築幕牆市場趨勢

英國建築幕牆市場在商業繁榮中蓬勃發展

英國的智慧城市運動正在迅速加速,人們對複雜的建築幕牆解決方案的需求日益成長。城市中心優先考慮提高生活品質的環境,同時限制其生態足跡。根據《建築新聞》報道,Permasteelisa 最近收購了位於倫敦艦隊街的索爾茲伯里廣場開發項目的建築幕牆套件,這就是這一趨勢的證明。這些舉措凸顯了商業企業對建築幕牆永續性的集體承諾,開發商的目標是打造將功能性和環境管理無縫融合的建築。

一項由政府主導的支持永續建築的舉措正在重塑建築幕牆景觀。英國政府正式報告稱,嚴格的建築法規要求新建商業建築大幅減少二氧化碳排放。這項監管措施刺激了對節能帷幕建築幕牆系統的投資,符合英國政府的永續性議程。因此,開發商被能夠提高熱性能和降低能源消耗的創新材料和技術所吸引,從而加強了國家的整體永續性目標。

總之,在大型基礎設施計劃、智慧城市計畫和嚴格的永續性法規的推動下,英國建築幕牆市場正在經歷一段變革時期期。這些因素正在推動建築幕牆開發的創新和成長,將市場定位為國家建築和環境策略的關鍵要素。

英國政府措施推動建築幕牆市場成長

英國政府透過一系列資助計畫積極支持先進建築幕牆解決方案的開發。特別是,2024 年 9 月更新的公共部門脫碳計畫為旨在提高能源效率和減少碳排放的公共機構提供財政支持。此舉不僅激勵市政當局和公共機構採用可提供更好的熱性能和永續性的現代建築幕牆系統,而且還創造了一個接受創新建築幕牆設計的環境。

同時,英國政府正在透過綠色家園津貼住房升級津貼(HUG) 等舉措支持建築幕牆開發,作為永續城市成長的一部分,這些計畫將於 2024 年 6 月實施。這些計劃鼓勵住宅維修建築幕牆,以改善隔熱效果並減少能源使用。這些措施直接促進了建築幕牆技術的進步,符合國家永續性目標並振興建築幕牆市場。節能建築幕牆維修需求的快速成長將刺激建築幕牆製造商之間的創新並加劇競爭。

總而言之,英國政府的針對性舉措正在為建築幕牆市場的發展提供重大推動力。透過鼓勵對節能和永續建築幕牆解決方案的投資,這些計劃不僅可以實現環境目標,還可以為市場創新和成長創造機會。

英國建築幕牆產業概況

由於市場上存在多個參與者,英國建築幕牆市場本質上是分散的,沒有主要參與者佔據重要的市場佔有率。 Permasteelisa、Lindner Exteriors、FK Group、Stanmore、CA Group 是市場上的主要企業。商業建築中建築幕牆的日益普及可能會為新進入者創造機會。然而,這些小企業必須面對現有大企業的激烈競爭。

市場上的主要參與者提供多樣化的產品以超越競爭對手。同時,新興企業也帶著尖端產品和技術整合進入市場。此外,一些公司正在投資研發,開發建築幕牆建築新材料,增加市場佔有率。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 目前的市場狀況

- 市場促進因素

- 建設活動增加

- 技術進步

- 市場限制因素

- 經濟波動

- 供應鏈中斷

- 市場機會

- 模組化和預製建築幕牆

- 智慧建築幕牆

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 洞察市場中不斷變化的消費行為

- 市場中政府監管的見解

- 市場技術進步的見解

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按類型

- 通風的

- 不通風

- 其他

- 按材質

- 玻璃

- 金屬

- 塑膠纖維

- 石材

- 其他

- 按用途

- 商業的

- 住宅

- 其他

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Permasteelisa

- Lindner Exteriors

- FK Group

- Stanmore

- CA Group

- McMullen Facades

- Yuanda

- Lee Marley

- Swift Brickwork

- Alucraft Systems

- EAG*

第7章英國建築幕牆市場的未來

第8章附錄

The UK Facade Market size is estimated at USD 12.79 billion in 2025, and is expected to reach USD 15.44 billion by 2030, at a CAGR of 3.83% during the forecast period (2025-2030).

Key Highlights

- The UK facade market is witnessing robust growth, fueled by urbanization, modernization, and an intensified emphasis on sustainability. This surge mirrors government initiatives designed to bolster infrastructure development. Notably, the UK government has earmarked Pound 1 billion (USD 1.27 billion) in 2024 to expedite the remediation of unsafe cladding on residential buildings. This move underscores a deep-seated commitment to elevating building safety standards, especially in the wake of the Grenfell Tower fire tragedy. Such funding is integral to ongoing endeavors ensuring residential buildings adhere to safety regulations, simultaneously amplifying the demand for safer facade materials nationwide. While addressing pressing safety concerns, this initiative also steers the facade market towards the adoption of high-performance, compliant materials in architectural designs.

- Another pivotal driver of the market's growth is the UK government's unwavering dedication to sustainability and energy efficiency. For instance, as of October 2024, the UK government has rolled out new building regulations mandating a 27% reduction in CO2 emissions for new commercial structures. This move underscores the government's robust commitment to sustainability within the facade market. Such regulations champion the adoption of advanced facade materials, bolstering thermal performance and curtailing environmental impact. Consequently, there's an uptick in demand for eco-friendly facades, including those crafted from recycled materials or equipped with integrated solar panels. Through these sustainable initiatives, the government aspires to slash the construction sector's carbon footprint, aligning with its ambitious target of achieving net-zero emissions by 2050.

- The commercial sector is bustling, with a slew of high-profile projects in the pipeline, all necessitating cutting-edge facade solutions. For instance, as reported by Industry Associations, in Q3 2024, the rolling 12-month value of commercial real estate investments in the UK saw a rise for the second straight quarter. These commercial undertakings, including the construction of new stations and facilities, present lucrative opportunities for facade manufacturers. Such developments not only amplify the demand for facades but also foster collaboration between architects and facade specialists, driving unique design aspirations.

- Technological innovations are making waves in the UK facade market. The infusion of smart technologies into facade designs paves the way for heightened customization and functionality, marrying aesthetic allure with performance. Cutting-edge features like self-cleaning surfaces and energy-generating facades are on the rise, signaling a pivot towards building envelopes that champion sustainability. Furthermore, digital tools empower architects to craft intricate designs that seamlessly blend functionality with visual appeal.

UK Facade Market Trends

UK's Facade Market Thrives Amidst Commercial Boom

The UK's burgeoning smart city movement further amplifies the appetite for sophisticated facade solutions. Urban centers are prioritizing environments that uplift quality of life while curbing ecological footprints. A testament to this trend is Permasteelisa's recent acquisition of the facade package for the GBP 300 million (USD 382.77 million) Salisbury Square development on Fleet Street, London as reported by Construction News. Such moves underscore a collective commitment to facade sustainability in commercial ventures, with developers aiming for buildings that seamlessly blend functionality with environmental stewardship.

Government-led initiatives championing sustainable construction are reshaping the facade landscape. Stringent building regulations now mandate significant CO2 emission reductions for new commercial edifices as reported officially by the UK Government. This regulatory push has catalyzed heightened investments in energy-efficient facade systems, aligning with the UK Government's sustainability agenda. Consequently, developers are gravitating towards innovative materials and technologies that bolster thermal performance and curtail energy consumption, reinforcing the nation's overarching sustainability objectives.

In conclusion, the UK's facade market is undergoing a transformative phase, driven by large-scale infrastructure projects, smart city initiatives, and stringent sustainability regulations. These factors collectively foster innovation and growth in facade development, positioning the market as a critical component of the nation's construction and environmental strategies.

UK Government Initiatives Propel Facade Market Growth

The UK government is actively backing the development of advanced facade solutions through a series of funding programs. Notably, the Public Sector Decarbonisation Scheme, updated in September 2024, offers financial aid to public entities aiming to boost energy efficiency and cut carbon emissions. This move not only motivates local authorities and public institutions to adopt modern facade systems for better thermal performance and sustainability but also cultivates an environment ripe for innovative facade designs.

In a parallel effort, the UK government, through initiatives like the Green Homes Grant and Home Upgrade Grant (HUG) schemes rolled out in June 2024, is championing facade development as part of sustainable urban growth. These programs incentivize homeowners to undertake facade upgrades that enhance insulation and curtail energy use. Such efforts directly contribute to the advancement of facade technologies, aligning with the nation's sustainability objectives while invigorating the facade market. As the demand for energy-efficient facade renovations surges, it spurs heightened innovation and competition among facade manufacturers.

In conclusion, the UK government's targeted initiatives are significantly driving the development of the facade market. By fostering investments in energy-efficient and sustainable facade solutions, these programs are not only addressing environmental goals but also creating opportunities for innovation and growth within the market.

UK Facade Industry Overview

The UK facade market is fragmented in nature considering the presence of several players in the market, with the major players not holding significant market share. Permasteelisa, Lindner Exteriors, FK Group, Stanmore, and CA Group are some of the major players in the market. The increasing popularity of facades in commercial construction will create opportunities for new players to enter the market. Still, these small players have to face fierce competition from established major players.

Major players in the market offer diverse products to outpace competitors. Meanwhile, start-ups are entering the fray with cutting-edge products and tech integration. Additionally, some players are channeling investments into R&D, aiming to develop novel materials for facade construction, seeking to bolster their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Increasing Construction Activities

- 4.2.2 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Economic Fluctuations

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Modular and Prefabricated Facades

- 4.4.2 Smart Facades

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Changes in Consumer Behavior in the Market

- 4.8 Insights on Government Regulations in the Market

- 4.9 Insights on Technological Advancements in the Market

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ventilated

- 5.1.2 Non-ventilated

- 5.1.3 Others

- 5.2 By Material

- 5.2.1 Glass

- 5.2.2 Metal

- 5.2.3 Plastics and Fibres

- 5.2.4 Stone

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Permasteelisa

- 6.2.2 Lindner Exteriors

- 6.2.3 FK Group

- 6.2.4 Stanmore

- 6.2.5 CA Group

- 6.2.6 McMullen Facades

- 6.2.7 Yuanda

- 6.2.8 Lee Marley

- 6.2.9 Swift Brickwork

- 6.2.10 Alucraft Systems

- 6.2.11 EAG*