|

市場調查報告書

商品編碼

1636083

印度製造業 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

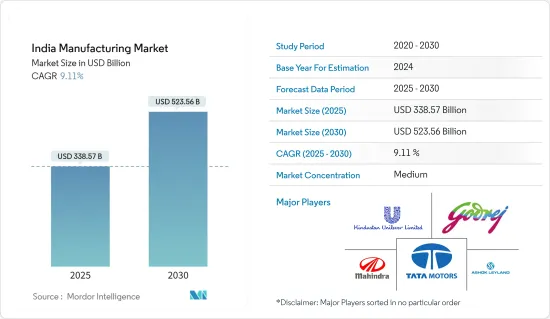

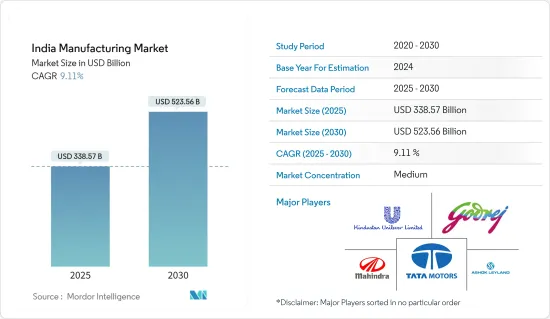

印度製造業市場規模預估至2025年為3,385.7億美元,預估至2030年將達5,235.6億美元,預測期間(2025-2030年)複合年成長率為9.11%。

主要亮點

- 印度製造業市場在疫情期間經歷了不同階段的發展,對GDP的貢獻率約為16-17%,僱用了全國近20%的勞動力。它已成為吸引外資的投資目的地,許多行動電話、奢侈品和汽車品牌在該國建立或考慮建立生產設施。商品及服務稅 (GST) 的推出使印度成為 GDP 2.5 兆美元、人口 13.2 億的單一市場,吸引了大量投資者的興趣。

- 印度行動電話電子協會 (ICEA) 表示,透過策略干預,印度有潛力在 2025 年將筆記型電腦和平板電腦的累積製造能力提高到 1,000 億美元。在政府措施中,由重工業和公共企業部主導的 SAMARTH Udyog Bharat 4.0 旨在加強製造業市場的競爭,特別是資本財方面的競爭。對發展工業走廊和智慧城市的關注凸顯了政府對促進國家整體發展的承諾。

- 印度正透過國家製造業政策和生產連結獎勵(PLI)體係等措施穩步邁向工業4.0,該政策旨在2025年將製造業佔GDP的比重提高到25%。 PLI計劃旨在使核心製造業達到世界標準。印度正逐步走向自動化、流程主導的製造,可望提高效率並增加產能。

印度製造業市場趨勢

政府支出的增加預計將推動市場成長

製造業已成為印度高成長的市場之一。政府啟動了「印度製造」計劃,旨在將印度打造成製造業中心,並讓其經濟獲得全球認可。例如,緯創資通與印度Optiemus Electronics合作生產筆記型電腦和智慧型手機等產品,大大促進了「印度製造」計畫和印度電子製造業的發展。

政府採取了多項舉措,為市場發展創造一個健康的環境。在聯邦預算中,政府撥款 240.3 億印度盧比(3.15 億美元)用於促進電子和 IT 硬體製造。半導體製造的 PLI 已定為 7,600 億印度盧比(97.1 億美元),旨在使印度成為此關鍵零件的全球領先生產國之一。

由於人口成長,印度的製造業市場正在經歷快速成長。不斷增加的投資和「印度製造」等舉措正在將該國定位為世界製造地。 2023年製造業市場年產量成長率為4.7%。

雖然附加價值毛額穩定成長,但仍落後於服務業。然而,憑藉龐大的消費群潛力,西門子、HTC 和東芝公司等大型跨國公司已經或正在該地區建立製造工廠。蘋果公司也開始在印度開展業務,並尋求將生產業務從中國轉移出去。

微型、小型和中型企業(MSME)在印度從農業經濟轉型為工業化經濟中發揮關鍵作用。近年來,中小企業對印度GDP的貢獻趨於穩定,凸顯了它們在推動經濟成長和創造就業方面的重要性。

汽車產業的成長推動市場

印度是全球第一大曳引機生產國、第二大客車生產國、第三大重型卡車生產國,在全球重型汽車市場佔有重要地位。 2022會計年度印度汽車產量將為2,293萬輛,顯示國內需求強勁,出口潛力大。

2023年11月乘用車總銷量為334,130輛,較2022年11月小幅成長3.7%。這項增幅創下了 11 月乘用車銷量的最高紀錄。 2023年印度汽車出口量為4,761,487輛,進一步證明了印度在全球汽車市場的強勢地位。

摩托車是印度生產的主要車輛類型,佔該國銷售的汽車的大部分。此類別包括摩托車、Scooter和輕型機踏車。電動Scooter和電動二輪車將推動該細分市場未來的成長軌跡,許多領先製造商紛紛涉足電動車生產。

例如,2023年1月,根據馬哈拉斯特拉邦政府公佈的電動車產業促進計劃,印度領先的汽車公司Mahindra and Mahindra Ltd核准投資1,000億印度盧比(12.2674億美元)發展電動車。

印度製造業概況

印度製造業市場是細分的,包括跨國公司和本地公司。市場上一些主要的參與者包括塔塔汽車有限公司、Mahindra & Mahindra Limited、Ashok Leyland、Hindustan Unilever Limited 和 Godrej Group。市場主要企業正在採用產品發布、聯盟、業務擴張和收購作為關鍵發展策略,為客戶提供更好的產品和服務。例如,2022年12月,塔塔汽車子公司塔塔客運電動車以72.57億印度盧比(8,901萬美元)收購了福特印度位於薩南德的汽車製造廠。此次收購預計將增加最先進的製造能力,產能可擴大至每年 30 萬台和 42 萬台。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 深入了解政府舉措

- 洞察產業近期重點投資及發展趨勢

- 洞察印度製造業叢集

- 洞察印度製造業的歷史

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 政府在「印度製造」的旗幟下推出了多項舉措

- 印度擁有豐富的技術純熟勞工,鼓勵各行各業的公司設立生產設施。

- 市場限制因素/問題

- 經濟狀況的變化

- 基礎設施限制

- 供應鏈中斷

- 市場機會

- 政府對中小微型企業的支持

- 國內需求不斷成長

- 出口可能性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 由業主

- 公部門

- 私部門

- 聯合部門

- 合作部門

- 按所用原料

- 農業產業

- 礦產工業

- 最終用戶產業

- 汽車工業

- 製造業

- 紡織品/服裝

- 家用電子電器

- 建設業

- 飲食

- 其他最終產業

第7章 競爭格局

- 公司簡介

- Tata Motors Ltd

- Mahindra & Mahindra Limited

- Ashok Leyland

- Hindustan Unilever Limited

- Godrej group

- Maruti Suzuki Limited

- Tata Steel Limited

- Larsent & Toubro Limited

- Apollo Tyres

- Moser Baer*

- 其他公司

第8章市場的未來

第9章 附錄

The India Manufacturing Market size is estimated at USD 338.57 billion in 2025, and is expected to reach USD 523.56 billion by 2030, at a CAGR of 9.11% during the forecast period (2025-2030).

Key Highlights

- India's manufacturing market underwent various phases of development during the pandemic, contributing approximately 16-17% to the GDP and employing nearly 20% of the country's workforce. It has become an attractive destination for foreign investments, with numerous mobile phone, luxury, and automobile brands establishing or considering manufacturing facilities in the country. The implementation of the Goods and Services Tax (GST) unified India into a single market with a GDP of USD 2.5 trillion and a population of 1.32 billion, attracting significant investor interest.

- According to the Indian Cellular and Electronics Association (ICEA), India has the potential to ramp up its cumulative manufacturing capacity for laptops and tablets to USD 100 billion by 2025 through strategic policy interventions. Among the government's initiatives, SAMARTH Udyog Bharat 4.0, led by the Ministry for Heavy Industries & Public Enterprises, aims to enhance the manufacturing market's competitiveness, particularly in terms of capital goods. The focus on developing industrial corridors and smart cities underscores the government's commitment to fostering holistic national development.

- India is steadily advancing toward Industry 4.0 through initiatives such as the National Manufacturing Policy, which targets a 25% share of manufacturing in GDP by 2025, and the Production Linked Incentive (PLI) scheme. The PLI scheme aims to elevate the core manufacturing sector to global standards. The gradual transition to automated and process-driven manufacturing in India is anticipated to enhance efficiency and bolster production capabilities.

India Manufacturing Market Trends

Growing Government Spending is Expected to Boost the Market's Growth

Manufacturing has emerged as one of India's high-growth markets. The government launched the 'Make in India' program to place the country on the map as a manufacturing hub and give global recognition to the economy. For instance, Wistron Corp. collaborated with India's Optiemus Electronics to manufacture products such as laptops and smartphones, significantly boosting the 'Make in India' initiative and electronics manufacturing in the country.

The government has taken several initiatives to promote a healthy environment for the growth of the market. In the Union Budget, the government allocated INR 2,403 crores (USD 315 million) to the promotion of electronics and IT hardware manufacturing. The PLI for semiconductor manufacturing was set at INR 760 billion (USD 9.71 billion) to make India one of the major global producers of this crucial component.

India's manufacturing market is experiencing rapid growth, driven by the expanding population. Increased investments and initiatives like 'Make in India' have positioned the country as a global manufacturing hub. In FY 2023, the manufacturing market saw an annual production growth rate of 4.7%.

Although the gross value added by the manufacturing sector has been steadily increasing, it still lags behind the services sector. However, with the potential of a vast consumer base, global giants like Siemens, HTC, and Toshiba have either established or are in the process of establishing manufacturing facilities in the region. Apple has also initiated operations in India, diversifying its production away from China.

Micro, small, and medium enterprises (MSMEs) play a crucial role in India's transition from an agriculture-based economy to an industrialized one. The contribution of MSMEs to India's GDP has remained stable in recent years, highlighting their importance in driving economic growth and job creation.

Growth of the Automotive Industry is Driving the Market

India holds a prominent position in the global heavy vehicles market, as it is the largest producer of tractors, the second-largest manufacturer of buses, and the third-largest producer of heavy trucks globally. In FY 2022, India's automobile production amounted to 22.93 million vehicles, indicating a robust domestic demand and significant export potential.

In November 2023, total passenger vehicle sales amounted to 334,130 units, marking a slight increase of 3.7% compared to November 2022. This surge represented the highest sales recorded for passenger vehicles in November. In FY 2023, India's automobile exports totaled 4,761,487 units, further demonstrating the country's strong presence in the global automotive market.

Two-wheelers are the dominant vehicle type manufactured in India, constituting the majority of automobiles sold domestically. This category includes motorcycles, scooters, and mopeds. The future growth trajectory of this sector is anticipated to be driven by electric scooters and motorcycles, with many major manufacturers venturing into electric vehicle production.

For instance, in January 2023, Mahindra and Mahindra Ltd, a leading automotive company in India, announced the approval of their investment of INR 10,000 crores (USD 1,226.74 million) for electric vehicles under the government of Maharashtra's industrial promotion scheme for electric vehicles.

India Manufacturing Industry Overview

The Indian manufacturing market is fragmented, with a mix of global and local players. Some of the major players present in the market include Tata Motors Ltd, Mahindra & Mahindra Limited, Ashok Leyland, Hindustan Unilever Limited, and Godrej Group. Major companies in the market adopt product launches, partnerships, business expansions, and acquisitions as key developmental strategies to offer better products and services to customers. For instance, in December 2022, Tata Passenger Electric Mobility, a subsidiary of Tata Motors, completed the acquisition of Ford India's vehicle manufacturing plant in Sanand for INR 725.7 crores (USD 89.01 million). This acquisition was expected to provide an additional state-of-the-art manufacturing capacity of 300,000 units per annum, scalable to 420,000 units per annum.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Insights into Government Initiatives

- 4.3 Insights into Recent Significant Investments and Developments the Industry

- 4.4 Insights into Manufacturing Clusters in India

- 4.5 Insights into History of Manufacturing Industry in India

- 4.6 Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The government has introduced several initiatives under the banner of "Make in India"

- 5.1.2 India boasts a sizable pool of skilled labor, facilitating the establishment of manufacturing facilities for companies in various sectors

- 5.2 Market Restraints/Challenges

- 5.2.1 Fluctuating economic conditions

- 5.2.2 Infrastructure limitation

- 5.2.3 Supply chain disruptions

- 5.3 Market Opportunities

- 5.3.1 Government Support for MSMEs

- 5.3.2 Growing Domestic Demand

- 5.3.3 Export Potential

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Ownership

- 6.1.1 Public Sector

- 6.1.2 Private Sector

- 6.1.3 Joint Sector

- 6.1.4 Cooperative Sector

- 6.2 By Raw Materials Used

- 6.2.1 Agro Based Industries

- 6.2.2 Mineral Based Industries

- 6.3 End-user Industries

- 6.3.1 Automotive

- 6.3.2 Manufacturing

- 6.3.3 Textile and Apparel

- 6.3.4 Consumer electronics

- 6.3.5 Construction

- 6.3.6 Food and Beverages

- 6.3.7 Other End-use Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Tata Motors Ltd

- 7.2.2 Mahindra & Mahindra Limited

- 7.2.3 Ashok Leyland

- 7.2.4 Hindustan Unilever Limited

- 7.2.5 Godrej group

- 7.2.6 Maruti Suzuki Limited

- 7.2.7 Tata Steel Limited

- 7.2.8 Larsent & Toubro Limited

- 7.2.9 Apollo Tyres

- 7.2.10 Moser Baer*

- 7.3 Other Companies