|

市場調查報告書

商品編碼

1636085

整車物流 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Finished Vehicles Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

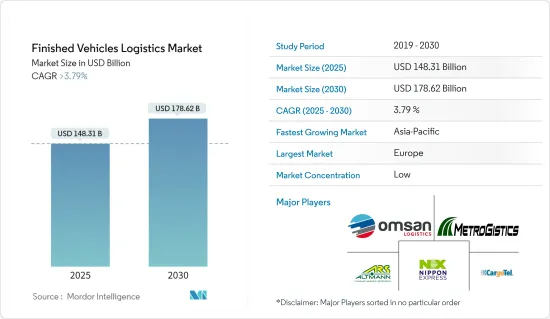

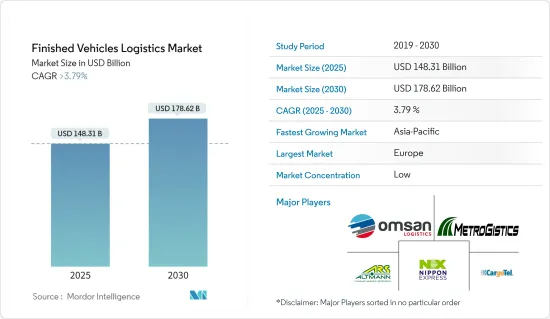

預計2025年整車物流市場規模為1,483.1億美元,2030年將達1,786.2億美元,預測期間(2025-2030年)複合年成長率將超過3.79%。

整車物流市場是全球汽車供應鏈的重要組成部分,負責車輛從製造地到最終消費者的無縫運輸。 2024年,由於技術進步、環境法規收緊以及客戶期望的變化,市場將發生重大演變,為相關人員創造機會和挑戰。

塑造市場的顯著趨勢之一是擴大採用電動和替代燃料卡車。例如,CEVA Logistics於2024年9月宣布與比亞迪建立合作關係,並決定在2025年1月之前將四輛比亞迪ETH8電動卡車納入其歐洲業務。這些車輛採用先進技術設計,續航里程達 250 公里,並具有快速充電功能,滿足 CEVA 到 2050 年實現淨零排放的更廣泛目標。諸如此類的舉措強調物流業務的脫碳,同時保持效率。

此外,人們越來越重視多式聯運,以最佳化物流效率和永續性。作為其綠色運輸和物流計劃的一部分,寶馬正在其萊比錫工廠部署電動卡車,以展示公路和鐵路系統的整合以減少排放。這些卡車每天行駛約 100 公里,凸顯了該公司如何採用多式聯運策略來滿足監管要求並最大限度地減少對環境的影響。此外,物流公司正在利用數位雙胞胎和遠端資訊處理等技術來追蹤車輛並提高業務效率。在 2024 年 IAA 運輸活動上,此類創新被宣佈為駕馭當今複雜物流網路的重要工具。

整車物流市場趨勢

北美整車銷售熱潮刺激物流投資

2024年,汽車銷售的快速成長將帶動北美整車物流市場。這種繁榮正在推動對交通基礎設施和物流解決方案的重大投資,特別是在美國、墨西哥和加拿大。為了滿足這一需求,製造商和服務供應商正在微調其網路,以確保在整個全部區域及時交付。

United Road 於 2024 年 5 月進行擴張,利用其龐大的北美網路來提高服務速度和效率。此舉凸顯了對強大交通系統日益成長的需求。同時,主要企業Jack Cooper 擴大了在墨西哥的業務範圍,推出了5 個新地點,並於 2024 年迎來 12 個新客戶。這項擴張凸顯了墨西哥快速成長的汽車產業在更廣泛的區域物流框架中的至關重要性。

例如,通用汽車於 2024 年與北美物流供應商合作,簡化供應鏈路線,以降低成本並縮短交貨時間。這些努力由人工智慧驅動的路線最佳化和數位雙胞胎等最尖端科技提供支持,這些技術正在成為現代物流的主要內容。這些趨勢凸顯了北美物流格局,強調可擴展性和技術整合。

全球倉儲和製造物流的成長

在全球範圍內,整車物流市場正在發生重大變化。製造商和物流提供者正在大力投資先進的倉儲和製造支援系統。這項變更主要是由於對高效車輛儲存、加強庫存管理以及最大限度地減少環境影響的共同努力的需求增加所推動的。

BMW透過制定 2024 年計畫來強調這一趨勢,該計畫旨在將自動化和永續性發展納入全球物流框架。透過在多個設施中實施自動化儲存和搜尋系統,BMW不僅提高了效率,而且在實現碳中和目標方面取得了進展。這些升級後的倉庫在BMW全球物流業務轉型的綜合策略中發揮著至關重要的作用。

此外,物流公司也擴大轉向綠色解決方案來增強其倉庫管理業務。 Vascor 就是一個例子,該公司於 2024 年中期推出了用於陸路物流的電動接駁車系統。除了抑制排放之外,此舉還加強了製造地的永續性努力,並呼應了該行業對環保倉儲業務的更廣泛承諾。

CEVA Logistics 等全球領先公司正在倡導無縫整合公路、鐵路和海運樞紐的多模態倉儲策略,進一步凸顯了這一趨勢。 CEVA 的策略重點是將人工智慧和物聯網技術納入其倉庫管理系統,幫助縮短儲存週期並實現密切庫存追蹤。這些努力鞏固了倉儲和製造物流作為整車供應鏈業務效率的關鍵促進因素日益成長的重要性。

整車物流行業概況

由於市場競爭極為激烈且分散,參與企業並沒有佔據很大的市場佔有率。一些公司進行併購以擴大其地理足跡和專有資訊。例如,2022年10月,DFDS與土耳其領先的物流公司Ekol Logistics開始討論收購Ekol Logistics的國際道路運輸業務。地中海網路中渡輪和物流服務的結合將效仿北歐 DFDS 的成功經濟模式。

主要參與企業包括 MetroGistics LLC、Nippon Express Holdings Inc.、Omsan Logistics、ARS Altmann 和 CargoTel Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場動態

- 市場促進因素

- 新興市場汽車銷售成長

- 物流業務的技術進步

- 市場限制因素

- 促進要素短缺,勞動成本高

- 燃料成本上升和監管挑戰

- 市場機會

- 拓展綜合物流解決方案

- 市場促進因素

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 政府法規和舉措

- 供應鏈/價值鏈分析

- 洞察活動和物流領域的技術創新

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按活動

- 運輸(鐵路、公路、航空、海運)

- 倉庫

- 附加價值服務

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 孟加拉

- 土耳其

- 韓國

- 澳洲

- 印尼

- 其他亞太地區

- 中東/非洲

- 埃及

- 南非

- 沙烏地阿拉伯

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- Market Concentration Analysis

- 公司簡介

- MetroGistics LLC

- Nippon Express Holdings Inc

- Omsan Logistics

- CargoTel Inc.

- ARS Altmann

- CMA CGM SA

- Pound Gates Vehicle Management Services Ltd.

- CEVA Logistics

- Penske Corporation

- XPO Logistics*

- 其他公司

第7章 市場未來展望

第8章附錄

- 宏觀經濟指標(GDP 分佈,依活動分類)

- 經濟統計-交通運輸和倉儲業對經濟的貢獻

- 對外貿易統計-進出口(分項)

The Finished Vehicles Logistics Market size is estimated at USD 148.31 billion in 2025, and is expected to reach USD 178.62 billion by 2030, at a CAGR of greater than 3.79% during the forecast period (2025-2030).

The finished vehicles logistics market is a critical component of the global automotive supply chain, responsible for the seamless transportation of vehicles from manufacturing hubs to end consumers. In 2024, the market is witnessing significant evolution driven by advancements in technology, stricter environmental regulations, and changing customer expectations, creating opportunities and challenges for stakeholders.

One prominent trend shaping the market is the increasing adoption of electric and alternative fuel-powered trucks. For instance, CEVA Logistics announced a partnership with BYD in September 2024 to incorporate four BYD ETH8 electric trucks into its European operations by January 2025. These vehicles, designed with advanced technology, support a range of 250 km and feature fast-charging capabilities, aligning with CEVA's broader goal to achieve net zero emissions by 2050. Such initiatives underscore the push toward decarbonizing logistics operations while maintaining efficiency.

Additionally, there is a growing emphasis on multimodal transportation to optimize logistics efficiency and sustainability. BMW has adopted electric trucks for its Leipzig facility as part of its "Green Transport Logistics Project," demonstrating the integration of road and rail systems to reduce emissions. These trucks cover approximately 100 km daily, highlighting how companies are embracing multimodal strategies to meet regulatory demands and minimize environmental impact. Furthermore, logistics companies are leveraging technology like digital twins and telematics to enhance vehicle tracking and operational efficiency. At the 2024 IAA Transportation event, such innovations were showcased as vital tools to navigate the complexities of modern logistics networks.

Finished Vehicles Logistics Market Trends

North America Finished Vehicle Sales Boom Driving Logistics Investments

In 2024, a surge in vehicle sales is propelling the North American finished vehicle logistics market. This upswing is prompting substantial investments in transport infrastructure and logistics solutions, especially in the U.S., Mexico, and Canada. In response to this demand, manufacturers and service providers are fine-tuning their networks to guarantee timely deliveries throughout the region.

Highlighting this trend, United Road expanded its operations in May 2024, capitalizing on its vast North American network to boost service speed and efficiency. This move underscores the growing demand for robust transport systems. In a parallel development, Jack Cooper, a key player in logistics, broadened its footprint in Mexico by launching five new locations and welcoming 12 new customers in 2024. This expansion underscores the pivotal significance of Mexico's burgeoning automotive sector in the broader regional logistics framework.

Furthermore, regional OEMs are gravitating towards collaborative logistics models.For instance, General Motors teamed up with North American logistics providers in 2024, streamlining its supply chain routes, which led to cost reductions and enhanced delivery timelines. Such initiatives are bolstered by cutting-edge technologies like AI-driven route optimization and digital twins, which are swiftly becoming staples in contemporary logistics. These trends highlight North America's evolving logistics landscape, marked by a keen emphasis on both scalability and technological integration.

Growth in Warehousing and Manufacturing Logistics Across the Globe

Across the globe, the logistics market for finished vehicles is witnessing a significant transformation. Manufacturers and logistics providers are channeling substantial investments into advanced warehousing and manufacturing support systems. This shift is primarily driven by a rising demand for efficient vehicle storage, enhanced inventory management, and a concerted effort to minimize environmental impact.

Highlighting this trend, BMW has rolled out a 2024 initiative aimed at weaving automation and sustainability into its global logistics framework. By deploying automated storage and retrieval systems across multiple facilities, BMW has not only boosted efficiency but also made strides towards its carbon neutrality objectives. These upgraded warehouses play a pivotal role in BMW's overarching strategy to revamp its global logistics operations.

Moreover, logistics companies are increasingly turning to green solutions to bolster their warehousing activities. A case in point is Vascor, which, in mid-2024, unveiled electric shuttle systems for landside logistics. This move not only curtails emissions but also bolsters sustainability efforts at manufacturing hubs, echoing the industry's broader commitment to eco-friendly warehouse practices.

Further underscoring this trend, global giants like CEVA Logistics are championing multimodal warehousing strategies, seamlessly integrating road, rail, and maritime transport hubs. CEVA's strategic emphasis on embedding AI and IoT technologies into its warehouse management systems has been instrumental in slashing storage durations and achieving meticulous inventory tracking. Such initiatives underscore the growing significance of warehousing and manufacturing logistics as pivotal drivers of operational efficiency in the finished vehicle supply chain.

Finished Vehicles Logistics Industry Overview

Because the market is extremely competitive and fragmented, players in the Finished Vehicles Logistics Market do not have a significant market share. Several firms are merging and acquiring to extend their geographical footprint and proprietary information. For instance, in October 2022, DFDS and Ekol Logistics, a major Turkish logistics firm, began discussions about acquiring Ekol Logistics' international road haulage operations. A combination of ferry and logistics services in the Mediterranean network would mimic DFDS' successful economic model in Northern Europe.

Some of the major players are MetroGistics LLC, Nippon Express Holdings Inc., Omsan Logistics, ARS Altmann, and CargoTel Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Vehicle Sales in Emerging Markets

- 4.2.1.2 Technological Advancements in Logistics Operations

- 4.2.2 Market Restraints

- 4.2.2.1 Driver Shortages and High Labour Costs

- 4.2.2.2 Rising Fuel Costs and Regulatory Challenges

- 4.2.3 Market Opportunities

- 4.2.3.1 Expansion of Multimodal Logistics Solutions

- 4.2.1 Market Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Government Regulations and Initiatives

- 4.6 Supply Chain/Value Chain Analysis

- 4.7 Insights into Technological Innovation in the Events Logistics Sector

- 4.8 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Activity

- 5.1.1 Transport (Rail, Road, Air, Sea)

- 5.1.2 Warehouse

- 5.1.3 Value-added Services

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Bangladesh

- 5.2.3.5 Turkey

- 5.2.3.6 South Korea

- 5.2.3.7 Australia

- 5.2.3.8 Indonesia

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East & Africa

- 5.2.4.1 Egypt

- 5.2.4.2 South Africa

- 5.2.4.3 Saudi Arabia

- 5.2.4.4 Rest of Middle East & Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Company Profiles

- 6.2.1 MetroGistics LLC

- 6.2.2 Nippon Express Holdings Inc

- 6.2.3 Omsan Logistics

- 6.2.4 CargoTel Inc.

- 6.2.5 ARS Altmann

- 6.2.6 CMA CGM S.A

- 6.2.7 Pound Gates Vehicle Management Services Ltd.

- 6.2.8 CEVA Logistics

- 6.2.9 Penske Corporation

- 6.2.10 XPO Logistics*

- 6.3 Other Companies

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to the Economy

- 8.3 External Trade Statistics - Export and Import, by Product