|

市場調查報告書

商品編碼

1636122

中東和非洲壓縮天然氣加氣機:市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Compressed Natural Gas Dispenser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

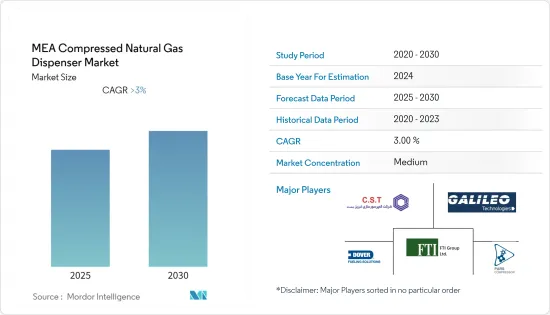

中東和非洲壓縮天然氣 (CNG) 加氣機市場預計在預測期內複合年成長率將超過 3%。

2020 年市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,由於壓縮天然氣汽車的經濟和環境效益以及從傳統引擎到壓縮天然氣汽車的轉換率不斷提高,中東和非洲的壓縮天然氣加氣機市場預計將擴大成長。

- 另一方面,該地區電動車的日益普及預計將阻礙壓縮天然氣汽車及相關基礎設施的市場成長。

- 目前,該地區對 CNG 加氣站不斷成長的需求低於 CNG 車輛所需的數量,這為 CNG 加氣機市場創造了機會。

- 由於政府舉措普及汽車,CNG汽車市場成長,預計伊朗將顯著成長。

中東和非洲壓縮天然氣加氣機市場趨勢

CNG汽車需求的成長預計將推動市場發展

- 在中東和非洲,從傳統引擎到壓縮天然氣汽車的轉換率正在穩步提高。這是由於人們越來越認知到壓縮天然氣汽車的經濟和環境效益。由於天然氣蘊藏量的高成長率,該地區天然氣的供應量很高。

- 阿拉伯聯合大公國、伊朗、土耳其、埃及等國家在CNG汽車市場大放異彩。埃及天然氣產量在過去十年呈現持續成長,2021年天然氣產量達約678億立方公尺。除了天然氣的高可用性之外,該國CNG汽車市場的另一個促進因素是政府推動市場持續成長的努力。

- 例如,埃及石油和礦產資源部於 2021 年 12 月投資約 1,130 萬歐元(1,180 萬美元),資助一項將汽車改裝為 CNG 車輛的國家計畫。作為該計劃的一部分,埃及各地的新 CNG 站將配備必要的設備。 GASTEC 將安裝 271 個分配器和 100 個壓縮機包裝,而 NGVC 將安裝 229 個分配器和 100 個壓縮機包裝。

- 此外,在其他國家,高壓縮天然氣轉換率對壓縮天然氣加氣機市場產生了積極影響。例如,在阿拉伯聯合大公國,阿拉伯聯合大公國運輸公司於 2022 年 3 月報告稱,該公司在 2021 年改裝了約 900 輛 CNG 車輛。自2010年轉型以來,全國CNG汽車保有量已達1.1萬輛。

- 預計此類發展將在未來幾年推動該地區的 CNG 加氣機市場。

伊朗實現顯著成長

- 伊朗在開發使用壓縮天然氣的運輸方式方面取得了顯著進展。根據國際天然氣汽車協會(IANGV)的數據,2022年伊朗CNG汽車保有量位居世界第三,僅次於巴基斯坦和阿根廷。這得歸功於天然氣的高可用性以及汽車公司和政府當局的努力。

- 2021年,中國天然氣產量持續成長,增加至2,567億立方公尺。 CNG汽車也有望擴大部署場景。這得歸功於伊朗政府為推動CNG汽車生產所做的努力。

- 例如,2022年12月,石油部指示伊朗國家石油產品分銷公司(NIOPDC)計劃在該國生產45,000輛CNG汽車。當局與伊朗領先的汽車製造商之一伊朗霍德羅公司簽署了一項協議。他們打算將所有汽油公共、計程車、貨車、皮卡車和客車轉換為壓縮天然氣汽車。

- 伊朗國家石油煉製和分銷公司 (NIORDC) 宣布,約 165,000 輛公共交通車輛已改裝為燃油車輛(汽油或 CNG)。所有這一切都是在迄今為止實施的壓縮天然氣項目的支持下成為可能的。

- 隨著此類新興市場的發展,伊朗預計很快就會佔據CNG加氣機市場的較大佔有率。

中東和非洲壓縮天然氣加氣機產業概況

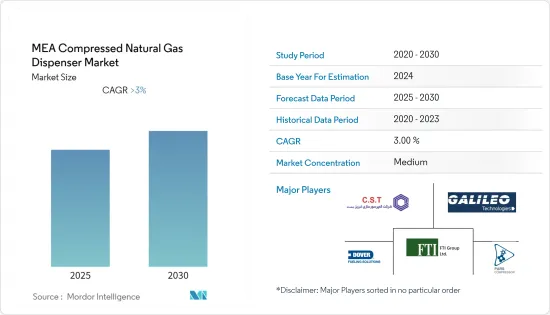

中東和非洲壓縮天然氣加氣機市場適度細分。主要參與企業(排名不分先後)包括 FTI Group Ltd.、Galileo Technologies SA、Pars 壓縮機、壓縮機 Sazi Tabriz 和 Dover Fueling Stations。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 坦尚尼亞

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- FTI Group Ltd.

- Galileo Technologies SA

- Pars Compressor Company

- Dover Fuelling Solutions

- Compressor Sazi Tabriz

- Gilbarco Inc.

- Censtar Science & Technolgy Corp. Ltd.

- Parker Hannifin Corporation

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 5000106

The MEA Compressed Natural Gas Dispenser Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market now reached the pre-pandemic levels.

Key Highlights

- Over the medium term, the Middle East and Africa compressed natural gas dispenser market is expected to include augmented growth due to CNG vehicles' economic and environmental benefits and the growing conversion rate of conventional engines to CNG vehicles.

- On the other hand, the growing occupancy of electric vehicles in the region is expected to impede the market growth for CNG vehicles and associated infrastructure.

- Nevertheless, the growing demand for CNG fuelling stations, which is currently less than the requirement for CNG vehicle units in the region, places an opportunity on the CNG dispensers market.

- Iran is expected to witness significant growth due to the growing CNG vehicles market because of the government's initiatives to promote vehicles.

MEA Compressed Natural Gas Dispenser Market Trends

Growing Demand of CNG vehicles Expected to Drive the Market

- The Middle East and Africa region is envisaging a steady growth in the conversion rate of conventional engines into CNG vehicles. It is due to the growing awareness of CNG vehicles' economic and environmental benefits. The region is blessed with high availability of natural gas due to the high growth rate in huge natural gas reserves.

- The countries like UAE, Iran, Turkey, and Egypt are glowing in the CNG vehicles market. Egypt's natural gas production witnessed consistent growth in the last decade, reaching around 67.8 billion cubic meters of natural gas production in the year 2021. Apart from high natural gas availability, the other propelling factor for the CNG vehicles market in the country is the government's initiatives to see consecutive growth in the market.

- For example, in December 2021, the Egyptian Ministry of Petroleum and Mineral Resources invested around EUR 11.3 million (USD 11.8 million) to finance the national program to convert cars to CNG vehicles. The required equipment will be installed in new CNG stations throughout Egypt as part of the program. GASTEC will install 271 dispensers and 100 compressor packages, while NGVC will install 229 dispensers and 100 compressor packages.

- Furthermore, in other countries, the high CNG conversion rate is positively influencing the CNG dispenser market. For example, in UAE, in March 2022, the Emirates Transport Company reported converting around 900 CNG vehicles in 2021. The total number of CNG vehicles in the country reached 11,000 vehicles since the conversion started in 2010.

- Such developments are expected to propel the CNG dispensers market in the region in the coming years.

Iran to Witness Significant Growth

- Iran made remarkable progress in the development of CNG-based transportation. According to the International Association of Natural Gas Vehicles (IANGV), Iran ranked third for the number of CNG vehicles in the world after Pakistan and Argentina in 2022. It is due to the high availability of natural gas and initiatives taken by automotive companies and government authorities.

- Natural gas production in the country rose to 256.7 billion cubic meters in 2021 after witnessing consistent growth. The CNG vehicles are expected to increase the unfolding scene, too. It is due to the efforts made by the Iranian government to boost CNG vehicle production.

- For example, in December 2022, the Ministry of Petroleum instructed the National Iranian Oil Products Distribution Company (NIOPDC) launched a plan to manufacture 45000 CNG vehicles in the country. The authority signed an agreement with Iran Khodro, one of the country's leading automakers. They intend to convert all gasoline-powered public vehicles, taxis, vans, pickup trucks, and passenger cars to CNG vehicles.

- The National Iranian Oil Refining and Distribution Company (NIORDC) announced that around 165,000 public transport vehicles had been converted into duel-fuel cars (gasoline or CNG). All this was made possible with the help of the CNG programs implemented so far.

- Such developments are expected to make Iran include a significant share in the CNG dispensers market shortly.

MEA Compressed Natural Gas Dispenser Industry Overview

The Middle East and Africa CNG dispenser market is moderately fragmented. Some key players (in no particular order) include FTI Group Ltd., Galileo Technologies SA, Pars Compressor, Compressor Sazi Tabriz, and Dover Fuelling Stations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United Arab Emirates

- 5.1.2 Saudi Arabia

- 5.1.3 Egypt

- 5.1.4 Tanzania

- 5.1.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FTI Group Ltd.

- 6.3.2 Galileo Technologies SA

- 6.3.3 Pars Compressor Company

- 6.3.4 Dover Fuelling Solutions

- 6.3.5 Compressor Sazi Tabriz

- 6.3.6 Gilbarco Inc.

- 6.3.7 Censtar Science & Technolgy Corp. Ltd.

- 6.3.8 Parker Hannifin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219