|

市場調查報告書

商品編碼

1644960

東南亞壓縮天然氣加氣機:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Southeast Asia Compressed Natural Gas Dispenser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

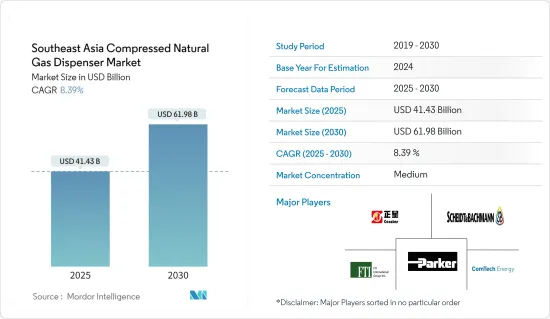

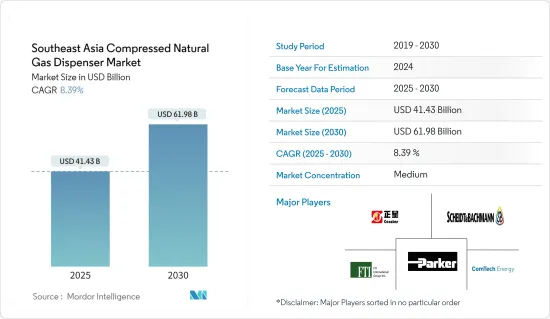

東南亞壓縮天然氣分配器市場規模預計在 2025 年為 414.3 億美元,預計到 2030 年將達到 619.8 億美元,預測期內(2025-2030 年)的複合年成長率為 8.39%。

關鍵亮點

- 從中期來看,對壓縮天然氣的需求不斷成長以及擴大 CNG 基礎設施的投資增加預計將推動市場成長。

- 另一方面,預計預測期內電池等替代燃料源的興起將阻礙東南亞壓縮天然氣分配器市場的成長。

- 為了減少對石油產品的依賴、控制能源成本、抑制日益嚴重的空氣污染,人們越來越重視壓縮天然氣等環保燃料,這可能會在預測期內為東南亞壓縮天然氣分配器市場創造豐厚的成長機會。

東南亞壓縮天然氣加氣機市場趨勢

預計天然氣消費量增加將推動市場

- 東南亞國家是發展中國家,其工業活動日益增多,並逐漸成為汽車、紡織等各領域的替代製造地,進而帶來經濟活動和人口的增加。

- 根據BP統計,截至2022年,馬來西亞天然氣產能最大,達824億立方米,與前一年同期比較增5.6%,其次是泰國、印尼、越南等東南亞國家。因此,該地區對天然氣的需求日益增加。

- 壓縮天然氣(CNG)汽車是傳統汽車的替代品。該車輛的營業成本比汽油和柴油車輛相對較低。此外,燃燒天然氣是環保的,因為它不會排放高碳顆粒。

- CNG加氣機市場與CNG汽車市場齊頭並進,隨著iCNG汽車的興起,CNG加氣站也有望成長。由於一個 CNG 站至少運作兩台加氣機,因此 CNG 站的成長預計將促進加氣機市場的發展。

- 東南亞最大的天然氣消費國是馬來西亞,2022年消費量約494億立方公尺。泰國是第二消費量,同年消費量為443億立方公尺。

- 因此,預計未來幾年,天然氣消費量和 CNG 汽車需求的增加以及政府遏制汽車排放氣體的舉措將推動東南亞壓縮天然氣分配器市場的發展。

馬來西亞正經歷快速成長

- 馬來西亞的能源產業是經濟的關鍵成長領域。政府致力於透過增加對上游產業和探勘的投資來擴大碳氫化合物產量,並將其視為經濟成長的主要動力。然而,由於新油田開發不足導致產量下降,這項策略實施起來變得越來越困難。

- 2022年,馬來西亞天然氣消費量達494億立方公尺。天然氣消費量仍高於2022年的436億立方公尺。壓縮天然氣(CNG)是一種環保的車輛替代燃料。清潔燃料在大幅減少車輛溫室氣體排放和環境污染方面發揮關鍵作用。

- 2022 年 3 月,Gas Malaysia Bhd 將與 Kulim Greenergy Sdn Bhd 合作,生產壓縮生物甲烷 (Bio-CNG),注入 Gas Malaysia 的天然氣發行網。

- 因此,由於政府採取了各種舉措,預計預測期內東南亞壓縮天然氣分配器市場將大幅成長。

東南亞壓縮天然氣加氣機產業概況

東南亞壓縮天然氣分配器市場本質上是半固體。市場的主要企業(不分先後順序)包括派克漢尼汾公司、FTI 國際集團公司、ComTech Energy、Censtar Science & Technology 和 Scheidt &Bachmann Gmbh。

2022 年 8 月,Comtec Energy 的母公司 4Refuel 進行了公司品牌重塑,以進一步表達其對永續燃料管理解決方案的奉獻精神以及對能源供應和移動現場加油服務的中立態度。隨著能源轉型的進展,4Refuel 已採取必要措施,確保其產品和服務為尋求減少碳排放的企業提供承包解決方案。 4Refuel 目前為客戶提供傳統燃料產品以及直接液體生質燃料和氣體替代燃料,讓企業能夠選擇最適合其獨特需求的能源組合。該公司提供全方位的能源選擇,包括柴油、生質柴油、HDRD(氫衍生可再生柴油)、CNG(壓縮天然氣)、RNG(可再生天然氣)和氫氣。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 壓縮天然氣需求不斷增加

- 限制因素

- 電池等替代燃料來源的興起

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 按地區分類的市場區隔

- 泰國

- 新加坡

- 印尼

- 馬來西亞

- 其他東南亞地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Parker Hannifin Corp

- FTI International Group Inc.

- ComTech Energy

- Censtar Science & Technology Co., Ltd.

- Scheidt & Bachmann Gmbh

- Gilbarco Inc.

- Greka Engineering

- Tatsuno Europe AS

- Sanki Industry Group

- TGT Fuel Technologies India Pvt. Ltd.

第7章 市場機會與未來趨勢

- 為了減少對石油產品的依賴並降低能源成本,人們越來越重視壓縮天然氣等環保燃料。

The Southeast Asia Compressed Natural Gas Dispenser Market size is estimated at USD 41.43 billion in 2025, and is expected to reach USD 61.98 billion by 2030, at a CAGR of 8.39% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing demand for compressed natural gas and increasing investments for the expansion of CNG infrastructure are expected to drive the market's growth.

- On the other hand, rising alternate fuel sources such as batteries are expected to hamper the growth of Southeast Asia's compressed natural gas dispenser market during the forecast period.

- Nevertheless, growing emphasis on greener fuels like compressed natural gas, to reduce dependency on petroleum products, to have a low energy cost, and to control the rising air pollution are likely to create lucrative growth opportunities for Southeast Asia's compressed natural gas dispenser market in the forecast period.

Southeast Asia Compressed Natural Gas Dispenser Market Trends

Increasing Natural Gas Consumption Expected to Drive the Market

- Countries in the Southeast Asia region are developing and are witnessing increased industrial activities and are emerging as alternative manufacturing hubs for various sectors such as automotive, textile industry, etc., which results in increased economic activity and population.

- According to BP Statistics, Malaysia had the largest natural gas production capacity of 82.4 billion cubic meters as of 2022, with a growth rate of 5.6% from the previous year, followed by Thailand, Indonesia, Vietnam, and other South-East Asian countries. Therefore, the region's demand for natural gas is increasing.

- Compressed natural gas (CNG) vehicles are an alternative to conventional vehicles. The operational cost of the vehicles is comparatively lower than gasoline or diesel vehicles. Moreover, the combustion of natural gas doesn't emit high carbon particles, making it more eco-friendly.

- The CNG dispenser market and the CNG vehicle market operate hand in hand, i.e., with the increase in CNG vehicles, there is much possibility for CNG station growth. A CNG station minimum operates two dispenser units; thus, growth in CNG stations is expected to boost the dispenser market.

- Southeast Asia's largest consumer of natural gas is Malaysia, which consumed nearly 49.4 billion cubic meters in 2022. Thailand is the second largest consumer of natural gas, with 44.3 billion cubic meters in the same year.

- Therefore, with the growing consumption of natural gas and demand for CNG Vehicles, the government's efforts to curb emissions from vehicles are expected to drive Southeast Asia compressed natural gas dispenser market in the coming years.

Malaysia to Witness Significant Growth

- Malaysia's energy industry is a significant growth sector for the economy. The government has focused on amplifying hydrocarbon production through soaring investment in the upstream industry and exploration as a significant driver of economic growth. But implementing this strategy has become ever more challenging because production has declined due to a lack of developed new fields.

- In 2022, natural gas consumption in Malaysia amounted to 49.4 billion cubic meters. Natural gas consumption remained increased from 43.6 billion cubic meters in 2022. Compressed natural gas (CNG) is an environment-friendly alternative to automotive fuel. Cleaner fuel plays a vital role in significantly reducing vehicular greenhouse gas emissions and environmental pollution.

- In March 2022, Gas Malaysia Bhd partnered with Kulim Greenergy Sdn Bhd to produce compressed bio-methane (Bio-CNG) to be injected into Gas Malaysia's natural gas distribution system network.

- Therefore, Southeast Asia is expected to witness significant growth in the compressed natural gas dispenser market with various government initiatives during the forecast period.

Southeast Asia Compressed Natural Gas Dispenser Industry Overview

The Southeast Asia compressed natural gas dispenser market is semi-consolidated in nature. Some of the major players in the market (in no particular order) include Parker Hannifin Corp., FTI International Group Inc., ComTech Energy, Censtar Science & Technology Co., Ltd., and Scheidt & Bachmann Gmbh., among others.

In August 2022, 4Refuel, the parent company of ComTech Energy, has undergone a company rebrand to represent further its dedication to sustainable fuel management solutions and an agnostic approach to energy delivery and mobile on-site refueling services. As the energy transition develops, 4Refuel has taken the necessary steps to ensure that its products and service offerings are turn-key solutions for companies looking to reduce their carbon footprint. The company now offers customers access to a suite of drop-in ready liquid biofuels and gaseous alternatives in addition to traditional fuel products-empowering businesses to choose the best energy mix for their unique requirements. Their full spectrum of energy choices includes Diesel, Biodiesel, HDRD (hydrogenation-derived renewable diesel), CNG (Compressed Natural Gas), RNG (Renewable Natural Gas), and Hydrogen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Compressed Natural Gas

- 4.5.2 Restraints

- 4.5.2.1 Rising Alternate Fuel Sources such as Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - BY GEOGRAPHY

- 5.1 Thailand

- 5.2 Singapore

- 5.3 Indonesia

- 5.4 Malaysia

- 5.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Parker Hannifin Corp

- 6.3.2 FTI International Group Inc.

- 6.3.3 ComTech Energy

- 6.3.4 Censtar Science & Technology Co., Ltd.

- 6.3.5 Scheidt & Bachmann Gmbh

- 6.3.6 Gilbarco Inc.

- 6.3.7 Greka Engineering

- 6.3.8 Tatsuno Europe AS

- 6.3.9 Sanki Industry Group

- 6.3.10 TGT Fuel Technologies India Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emphasis on Greener Fuels like Compressed Natural Gas, to Reduce Dependency on Petroleum Products, to have a Low Energy Cost