|

市場調查報告書

商品編碼

1636137

中國第三方物流(3PL) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Third-Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

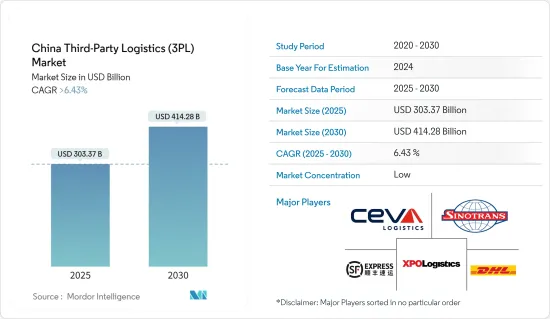

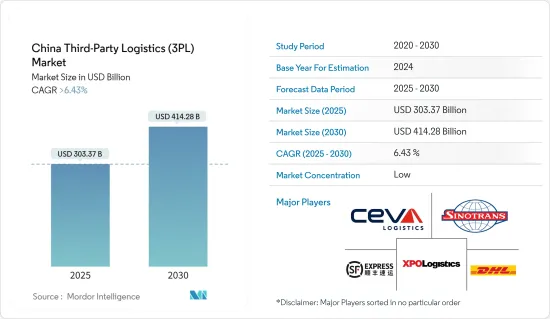

預計2025年中國第三方物流市場規模將達3,033.7億美元,預估2030年將達4,142.8億美元,預測期內(2025-2030年)複合年成長率將超過6.43%。

主要亮點

- 中國第三方物流市場主要受到電子商務活動增加和可支配收入增加的推動。

- 中國的電子商務市場正在重塑國家的經濟格局。數位經濟對於拉動中國GDP的作用日益重要。到2023年,網上購物將佔中國消費品銷售的四分之一以上,超過全球平均。此外,電子商務憑藉其豐富的勞動力,成為中國主要的就業引擎。

- 2024年上半年,中國電子商務產業實現顯著成長,增強了世界第二大經濟體消費復甦的動力。在此期間,網路零售額達到7.1兆元(約9,960億美元),年增9.8%。商務部公佈的資料顯示,全年商品零售額5.96兆元,成長8.8%。

- 中國電子商務巨頭阿里巴巴和京東在2024年「雙11」購物節期間銷售強勁,凸顯了中國消費市場的穩定復甦。

- 阿里巴巴集團旗下平台淘寶和天貓宣布「雙11」期間銷售額顯著成長。銷售額過億元的品牌總合589個,較2023年成長46.5%。該公司強調,消費者參與度將在 2024 年達到前所未有的高峰。

- 總部位於北京的京東透露,直播收入激增,較 2023 年成長 3.8 倍。超過 17,000 個品牌的銷售額成長超過 5 倍。淘寶和天貓的成長跨越各個領域,特別是在家用電子電器和裝飾用品領域。這一勢頭使得超過139個品牌的銷售額突破了億元大關,9,600個品牌的銷售額從2023年開始加倍。因此,隨著電商銷售量的激增,國內3PL物流的需求也隨之增加。

中國第三方物流(3PL)市場趨勢

高附加價值倉儲業配送業成長顯著

- 隨著中國進入工業4.0時代,製造業仍是物流成長的重要驅動力。由於高科技製造商的激增,對甲級倉庫的需求顯著增加。

- 太陽能電池產量大幅增加 54.2%,新能源汽車 (NEV) 大幅成長 30.4%,凸顯了這一趨勢。根據中國乘用車協會預測,2023年中國新能源汽車滲透率將達36.2%,不少品牌正在設立或擴大生產基地。

- 租賃趨勢因地區而異:華南地區的輕工業企業重視倉儲業務的靈活性。在引領低碳經濟轉型的華東地區,越來越多擁有LEED認證的環保倉庫如雨後春筍般出現。同時,在中國西部,新能源汽車的快速成長帶動了倉庫租賃的穩定需求。

- 2023年,31個主要城市非保稅甲級倉庫存量將超過9,000萬平方公尺。華東地區佔有壓倒性優勢,佔國內總存量的三分之一以上。近年來,隨著供應量持續增加,一些開發商採取租金的方式來緩衝不斷上升的空置率。

- 華北地區,尤其是廊坊、天津、北京等城市,2021年開始新增供應量激增。相反,中國西部地區自2020年以來成長逐漸放緩,並已能消化空置房間庫存。

- 在跨境電商強勁需求的推動下,華南地區已達到供應高峰,尤其是廣州和東莞。同時,中部地區在維持交通和消費需求穩定的同時,也因近三年的供應流入而面臨空置壓力。這證實了各行業對倉庫空間的巨大需求。

電商快速成長帶動市場

- 中國電子商務市場迎來了中國經濟的轉型時代。如今,數位經濟對中國GDP的拉動發揮著越來越重要的作用。到2023年,中國超過四分之一的消費品將在網路上購買,顯著高於全球平均。此外,由於其龐大的勞動力,電子商務是中國就業的重要動力。

- 過去十年,中國已成為電子商務的主導力量,銷售額落後美國超過4,860億美元。目前,中國擁有全球最多的數位買家。近年來,直播、加急配送等功能已融入中國電商領域,進一步豐富了客戶體驗。

- 隨著數位化快速滲透到生活的方方面面,越來越多的中國企業開始轉向線上。憑藉龐大的製造業和政府支持,中國擁有全球最大的B2B電子商務市場。然而,儘管線上零售業蓬勃發展,但 B2B 電子商務成長最近有所放緩。跨境貿易已成為中國B2B的重要組成部分,且以出口為主。

- 中國是一些全球最大的電子零售商的所在地,其電子商務銷售額持續成長。隨著網路的快速普及,網路購物的普及率已超過80%。行動裝置的使用正在迅速增加,使用智慧型手機和平板電腦購物已變得司空見慣。疫情帶來的社會限制和封城,加速了快商、線上外賣、社區團購等線上和線下業務的興起。人工智慧的進步正在再形成電子零售並最佳化營運和客戶互動。此外,擴增實境(AR)和虛擬實境(VR)技術的採用正在豐富購物體驗,從而提高客戶滿意度並增加銷售額。

中國第三方物流(3PL)產業概況

中國的第三方物流(3PL)市場高度細分,有許多本地、區域和全球參與企業。主要參與企業包括Ceva Logistics、中國外運、DHL Supply Chain、XPO Logistics 和順豐速運。

為了充分利用巨大的潛力,公司正在變得更具競爭力。因此,國際公司正在進行策略性投資,以建立區域物流網路,包括新的物流中心和智慧倉庫。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場動態

- 市場促進因素

- 服飾及配件線上銷售需求旺盛

- 快速消費品需求驅動市場

- 市場限制因素/問題

- 影響市場的監管挑戰

- 勞動短缺和成本上漲影響市場

- 市場機會

- 市場驅動的技術進步

- 市場促進因素

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 政府法規和措施

- 倉儲市場的整體趨勢

- CEP、最後一公里配送、低溫運輸物流等其他細分市場的需求

- 對電子商務業務的見解

- 物流領域的技術開發

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按服務

- 國內運輸管理

- 國際運輸管理

- 增值倉儲/配送

- 按最終用戶

- 航太

- 車

- 消費品/零售、能源

- 醫療保健

- 製造業

- 科技

- 其他

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Ceva Logistics

- Sinotrans

- DHL Supply Chain

- XPO Logistics

- SF Express

- XPO Logistics

- YTO Express

- ZTO Express

- JD Logistics

- Kerry Logistics*

- 其他公司

第7章 市場的未來

第8章附錄

- 宏觀經濟指標(GDP分佈、活動、運輸和倉儲業對經濟的貢獻)

- 對外貿易統計-出口與進口(分產品)

- 深入了解主要出口目的地和進口原產國

The China Third-Party Logistics Market size is estimated at USD 303.37 billion in 2025, and is expected to reach USD 414.28 billion by 2030, at a CAGR of greater than 6.43% during the forecast period (2025-2030).

Key Highlights

- The Chinese third-party logistics market is mainly driven by the rise in e-commerce activities and rising disposable income.

- China's e-commerce market is reshaping the nation's economic landscape. The digital economy is becoming ever more crucial in propelling China's GDP. In 2023, online purchases accounted for more than a quarter of China's consumer goods sales, outpacing the global average. Additionally, with its extensive workforce, e-commerce stands out as a major employment engine in the country.

- In the first half of 2024, China's e-commerce sector experienced significant growth, bolstering the momentum for consumption recovery in the world's second-largest economy. During this period, online retail sales jumped 9.8 percent year-on-year, totaling 7.1 trillion yuan (approximately USD 996 billion). Of this, retail sales of goods accounted for CNY 5.96 trillion, reflecting an 8.8 percent increase, as per data released by the Ministry of Commerce (MOC).

- Chinese e-commerce giants Alibaba and JD.com reported robust sales during the 2024 "Double 11" shopping festival, underscoring the steady recovery of China's consumer market.

- Alibaba Group's platforms, Taobao and Tmall, announced a notable surge in sales during the 'Double 11' event. A total of 589 brands surpassed the CNY 100 million sales mark, marking a 46.5 percent uptick from 2023. The company highlighted that consumer engagement reached an unprecedented peak in 2024.

- Beijing-based JD.com revealed that its live-streaming sales had skyrocketed, boasting a 3.8-fold increase from 2023. Over 17,000 brands celebrated sales growth exceeding five times. Taobao and Tmall's growth spanned various sectors, notably in home appliances and decoration. This momentum propelled over 139 brands past the 100-million-yuan sales milestone, with 9,600 brands experiencing a sales doubling from 2023. Hence, as e-commerce sales surge rapidly, the demand for 3PL logistics in the country is rising in tandem.

China Third-Party Logistics (3PL) Market Trends

Value-added warehousing and distribution experiencing substantial growth

- As China embraces the Industry 4.0 era, its manufacturing sector remains a key catalyst for logistics growth. The surge of high-tech manufacturers is driving a notable uptick in demand for Grade A warehouses.

- Highlighting this trend, solar cell production has seen a remarkable growth rate of 54.2%, while New Energy Vehicles (NEVs) have surged by 30.4%. According to the China Passenger Car Association (CPCA), NEV penetration in China hit 36.2% in 2023, leading many brands to either set up or expand their manufacturing bases.

- Leasing trends differ across regions: Southern China's light manufacturing firms are emphasizing flexibility in their warehouse operations. In Eastern China, a leader in the nation's shift towards a low-carbon economy, a flurry of eco-friendly warehouses boasting LEED certifications are springing up. On the other hand, Western China's rapid NEV growth is bolstering a steady demand for warehouse leases.

- In 2023, the stock of non-bonded Grade A warehouses in 31 major cities exceeded 90 million sqm. Eastern China emerged as a dominant player, representing over a third of the nation's total stock. As supply consistently flowed in recent years, some developers resorted to rental trade-offs to mitigate rising vacancy rates.

- Northern China, especially in cities like Langfang, Tianjin, and Beijing, saw a surge in new supply beginning in 2021. Conversely, Western China has been gradually slowing down since 2020, allowing it to absorb its vacant stock.

- Southern China reached a supply zenith, particularly in Guangzhou and Dongguan, spurred by strong demand from cross-border e-commerce. Meanwhile, Central China maintained steady demand for transportation and consumption, yet still grappled with vacancy pressures due to the influx of supply over the last three years. This underscores a pronounced demand for warehousing spaces across the industry.

Surge in e-commerce activities driving the market

- China's e-commerce market has ushered in a transformative era for the nation's economy. Today, the digital economy plays an increasingly pivotal role in bolstering China's GDP. In 2023, over a quarter of China's consumer goods were purchased online, significantly surpassing the global average. Moreover, e-commerce is a key driver of employment in the country, thanks to its vast workforce.

- For the past decade, China has led the e-commerce charge, outstripping the U.S. by over USD 486 billion in revenue. Currently, China boasts the world's largest population of digital buyers. Recent years have seen the integration of features like live streaming and swift delivery into China's e-commerce realm, further enriching the customer experience.

- With the rapid digitalization permeating every facet of life, a growing number of Chinese businesses are transitioning online. Bolstered by its vast manufacturing sector and governmental backing, China proudly hosts the globe's largest B2B e-commerce market. Yet, while the online retail sector flourishes, B2B e-commerce growth has recently decelerated. Cross-border transactions have emerged as a vital segment of China's B2B landscape, predominantly leaning towards exports, with the U.S. standing out as the primary destination for Chinese B2B goods.

- China, home to some of the world's largest e-retailers, has seen consistent growth in e-commerce sales. Rapid internet adoption has propelled online shopping penetration to over 80%. With the surge in mobile device usage, shopping via smartphones and tablets has become commonplace. The pandemic-induced social restrictions and lockdowns accelerated the rise of online-to-offline ventures, including quick commerce, online food delivery, and community group-buying. AI advancements are reshaping e-retail, optimizing operations and customer interactions. Furthermore, the adoption of augmented reality (AR) and virtual reality (VR) technologies is enriching shopping experiences, leading to heightened customer satisfaction and boosted sales.

China Third-Party Logistics (3PL) Industry Overview

The China third-party logistics (3PL) market is highly fragmented with a lot of local, regional, and global players. Some of the major players include Ceva Logistics, Sinotrans, DHL Supply Chain, XPO Logistics, SF Expres etc.

Companies are getting more competitive to capitalize on the enormous possibility. As a result, international firms are making strategic investments to build a regional logistics network, such as new distribution centers, smart warehouses, and so on.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Robust demand for online clothing and accessories

- 4.2.1.2 Demand for FMCG products driving the market

- 4.2.2 Market Restraints/challenges

- 4.2.2.1 Regulatory challenges affecting the market

- 4.2.2.2 Labour shortages and rising costs affecting the market

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.1 Market Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Government Policies and Regulations

- 4.6 General Trends in Warehousing Market

- 4.7 Demand From Other Segments, such as CEP, Last Mile Delivery, Cold Chain Logistics Etc.

- 4.8 Insights on Ecommerce Business

- 4.9 Technological Developments in the Logistics Sector

- 4.10 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Consumer and Retail, Energy

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Technology

- 5.2.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ceva Logistics

- 6.2.2 Sinotrans

- 6.2.3 DHL Supply Chain

- 6.2.4 XPO Logistics

- 6.2.5 SF Express

- 6.2.6 XPO Logistics

- 6.2.7 YTO Express

- 6.2.8 ZTO Express

- 6.2.9 JD Logistics

- 6.2.10 Kerry Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries