|

市場調查報告書

商品編碼

1636184

亞太地區酒櫃:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Wine Coolers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

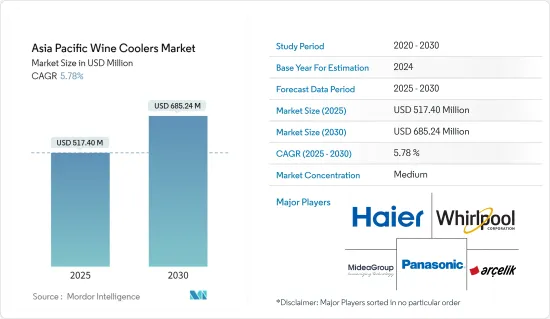

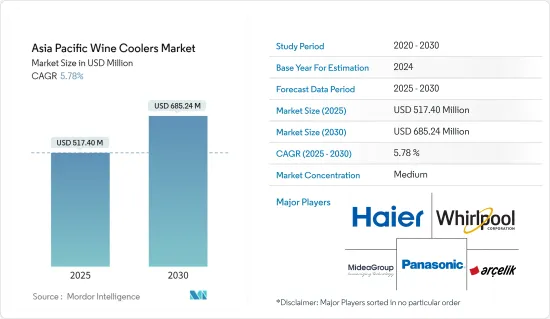

亞太地區酒櫃市場規模預計到2025年為5.174億美元,預計到2030年將達到6.8524億美元,預測期內(2025-2030年)複合年成長率為5.78%。

亞太地區酒精消費量較高,預計將推動酒櫃市場的成長。具體來說,私營部門對酒櫃的需求不斷成長。隨著消費者擴大選擇進口葡萄酒,酒櫃的需求量很大,這凸顯了保持葡萄酒涼爽和無菌的必要性。值得注意的是,特別受年輕人歡迎的葡萄酒市場將在未來幾年大幅成長。與其他烈酒相比,年輕一代更喜歡葡萄酒的甜味,進一步推動了這種快速成長,這表明酒櫃的未來充滿希望。

葡萄酒對年輕人的吸引力、先進葡萄酒保存解決方案的可用性以及葡萄酒對健康的益處(例如降低膽固醇和維護心臟健康)都進一步推動了葡萄酒的消費。亞太地區在酒櫃市場的主導地位是由於該地區可支配收入的增加以及對葡萄酒消費好處的日益認可。

亞太地區酒櫃市場趨勢

中國線上葡萄酒銷售佔市場主導地位

到目前為止,中國的電子商務市場一直以淘寶和天貓為主,但隨著網路購物的發展,更加多元化的平台生態系統正在出現。品商紅酒、酒寶王等以B2C模式經營酒類的專業企業在搶佔細分市場方面取得了顯著進展。他們的勝利可以追溯到他們的客製化產品選擇、全面的描述和互動式客戶評論功能。這種轉變不僅反映了西方在中國都市區中日益成長的影響力,也反映了中國經濟的進步和富裕中階,這推動了酒櫃的需求增加。中國在酒櫃市場的主導地位是葡萄酒消費率上升以及人們對葡萄酒消費帶來的健康益處日益重視的直接結果。

日本主導酒櫃市場

日本人均葡萄酒消費量最高,超過中國、韓國等亞洲國家。據估計,有 4500 萬日本人經常享用葡萄酒,其中紅酒位居榜首。日本的葡萄酒業正在蓬勃發展。日本的新酒莊不斷湧現,生產各種優質葡萄酒,從紅酒、白酒到玫瑰酒和氣泡酒。這種成長的主要原因是歐洲葡萄品種的採用和日本葡萄酒品質的提高。千禧世代越來越喜歡葡萄酒,認為這是一種別緻而精緻的選擇,導致酒櫃購買量激增。日本在酒櫃市場的主導地位直接反映了其高葡萄酒消費量和對葡萄酒好處的日益認知。

亞太酒櫃產業概況

亞太地區的酒櫃市場較為分散。該報告涵蓋了在亞太酒櫃市場營運的主要國際公司。從市場佔有率來看,目前該市場由少數大公司主導。然而,隨著技術進步和產品創新,中小企業在市場上的佔有率正在增加。主導市場的主要企業有海爾集團公司、惠而浦、美的、松下和Arcelik。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 葡萄酒的成長推動市場成長

- 市場限制因素

- 酒櫃高成本

- 市場機會

- 提高人們對紅酒的認知和健康益處

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

- 關於酒櫃市場技術進步的見解

第5章市場區隔

- 按類型

- 獨立式

- 檯面

- 內建

- 依技術

- 壓縮機類型

- 熱電

- 按用途

- 住宅

- 商業的

- 按分銷管道

- 線上

- 離線

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Haier Group Corporation

- Whirlpool

- Midea

- Panasonic

- Arcelik

- Samsung

- LG Corporation

- Bosch

- Philips

- Electrolux

第7章 未來市場趨勢

第8章 免責聲明

The Asia Pacific Wine Coolers Market size is estimated at USD 517.40 million in 2025, and is expected to reach USD 685.24 million by 2030, at a CAGR of 5.78% during the forecast period (2025-2030).

High alcohol consumption in the Asia-Pacific region is set to propel the growth of the wine cooler market. Specifically, there's a rising demand for wine coolers in the private sector. Consumers are increasingly opting for imported wines, emphasizing the need to keep them chilled and germ-free, thus boosting the demand for wine coolers. Notably, the wine market, especially popular with the younger demographic, is poised for significant growth in the coming years. This surge is further fueled by the younger generation's preference for wine's sweeter taste over other spirits, indicating a promising future for wine coolers.

Factors like wine's appeal to the youth, the availability of advanced wine preservation solutions, and the well-documented health benefits of wine, such as cholesterol reduction and heart health maintenance, are further propelling its consumption. The dominance of Asia Pacific in the wine cooler market can be attributed to the region's rising disposable incomes and the increasingly recognized benefits of wine consumption.

Asia Pacific Wine Coolers Market Trends

Online Wine Sales in China is Dominating the Market

While Taobao and Tmall have historically been the giants of China's e-commerce realm, the evolving online shopping landscape is witnessing the emergence of a more diversified platform ecosystem. Specialized players such as Pinshanghongjiu and Jiubaowang, with a singular focus on alcohol and a B2C operational model, are making notable strides in capturing their market segment. Their triumphs can be traced back to their tailored product selections, comprehensive descriptions, and interactive customer review features. This shift not only mirrors the growing Western influence in China's urban hubs but also highlights the nation's economic advancements and the expanding cohort of its affluent middle class, which is fueling a heightened demand for wine coolers. China's dominance in the wine cooler market is a direct consequence of its escalating wine consumption rates and the increasing appreciation for the health benefits associated with wine consumption.

Japan is Dominating the Wine Coolers Market

Japan outshines its Asian counterparts, like China and South Korea, with its higher per capita wine consumption. An estimated 45 million Japanese regularly indulge in wine, with red wine emerging as the top choice. The local wine scene in Japan is not just thriving but booming. The nation is witnessing a surge in new wineries, churning out a diverse range of high-quality wines, from reds and whites to roses and sparklings. This growth is largely attributed to the adoption of European grape varieties, elevating the quality of Japanese wines. Millennials, recognizing wine as a chic and refined option, are increasingly embracing it, leading to a surge in wine cooler purchases. Japan's dominance in the wine cooler market is a direct reflection of its high wine consumption and the growing recognition of wine's benefits.

Asia Pacific Wine Coolers Industry Overview

The Asia Pacific Wine Coolers Market is fragmented. This report covers the major international players operating in the Asia Pacific Wine Coolers Market. In terms of market share, a few large companies currently dominate the market. However, with technological advances and product innovations, small and medium-sized enterprises are increasing their market presence. The major players dominating the market are Haier Group Corporation, Whirlpool, Midea, Panasonic, and Arcelik.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Wine is Driving the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 High Cost of Wine Coolers

- 4.3 Market Opportunities

- 4.3.1 Rise in Health Benefits & Awareness about Red Wine

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the market

- 4.6 Insights on Technological Advancements in the Wine Coolers Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Free Standing

- 5.1.2 Counter-Top

- 5.1.3 Built-In

- 5.2 By Technology

- 5.2.1 Compressor based

- 5.2.2 Thermoelectric based

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 Online

- 5.4.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Haier Group Corporation

- 6.2.2 Whirlpool

- 6.2.3 Midea

- 6.2.4 Panasonic

- 6.2.5 Arcelik

- 6.2.6 Samsung

- 6.2.7 LG Corporation

- 6.2.8 Bosch

- 6.2.9 Philips

- 6.2.10 Electrolux*