|

市場調查報告書

商品編碼

1645053

歐洲葡萄酒冷卻器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Wine Coolers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

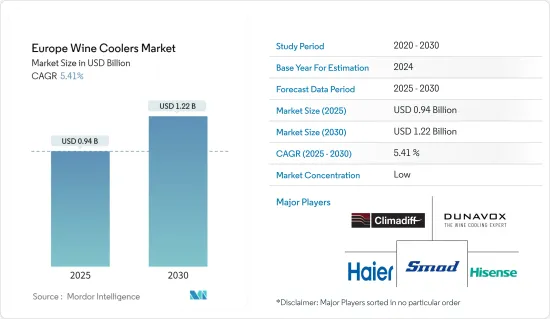

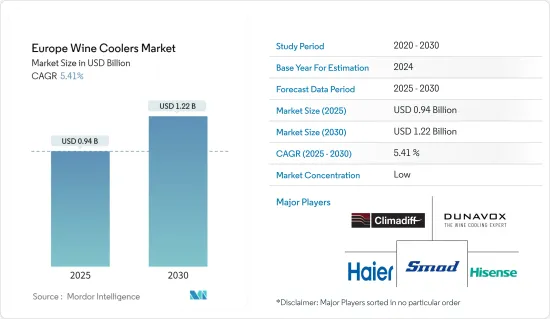

預計 2025 年歐洲葡萄酒冷卻器市場規模為 9.4 億美元,到 2030 年將達到 12.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.41%。

儘管自新冠疫情以來,歐洲的人均葡萄酒消費量一直在下降,但仍在持續成長,而且這種消費量的增加對葡萄酒櫃的銷售產生了正外部影響。自新冠疫情爆發以來,隨著歐洲酒店入住率的提高,遊客的葡萄酒消費量也在增加,為商業性領域的葡萄酒櫃銷售創造了機會。

隨著新冠疫情后歐洲人均葡萄酒銷量和總銷量持續成長,以及其在戶外消費中的佔有率不斷上升,與住宅領域相比,商業領域已成為未來一段時間內葡萄酒冷卻器的主要需求領域。

技術創新將智慧冷卻器推向市場,徹底改變了葡萄酒冷卻器產業。由於其具有 Wi-Fi 連接的智慧功能,您可以透過智慧型手機存取葡萄酒冷卻器,以設定溫度、檢查庫存並在冷卻器內儲存葡萄酒。越來越多的網路零售商和電子商務營運商將葡萄酒櫃作為銷售商品,豐富了銷售管道並增加了製造商的市場收益。此外,歐洲都市化進程加快,人均收入增加,從而導致葡萄酒消費量增加,推動了住宅和商業場所對葡萄酒冷卻器的需求。

歐洲葡萄酒冷卻器市場趨勢

商業部門銷售額成長

葡萄酒銷售佔有率不斷增加,而住宅銷售佔有率卻不斷減少。出於這個原因,商業領域正在推動葡萄酒冷卻器的市場需求。在歐洲酒精飲料總銷量中,葡萄酒佔了約 40% 的佔有率,因此葡萄酒冷卻器成為市場的關鍵組成部分。博洛尼亞、布拉格、瓦倫西亞和利茲是歐洲地區每百萬居民酒吧數量最多的老牌城市,在商業領域對葡萄酒冷卻器的需求方面也處於領先地位。南歐的葡萄酒櫃市場規模比北歐更大,由於新冠疫情之後酒店和旅遊業務的擴張,該地區的需求預計將進一步增加。

法國領先葡萄酒冷卻器銷售

法國是歐洲最大的葡萄酒消費國,也是該地區葡萄酒櫃銷售成長最快的國家。在法國的飲料領域,酒精飲料約佔銷售額的50%,該國的酒精消費人口正穩定增加。葡萄酒約佔法國酒精飲料的55%,使法國成為該地區葡萄酒冷卻器銷量最大的銷售國。由於這些趨勢,越來越多的葡萄酒冷卻器製造商正在擴大在該地區的銷售和業務。法國都市化很高,超過80%,這導致商業和住宅環境中的葡萄酒消費量增加,為法國的葡萄酒櫃銷售創造了積極的外部因素。

歐洲葡萄酒冷卻器產業概況

歐洲葡萄酒冷卻器市場部分分散,越來越多的參與者進入市場,希望利用現有的市場空白。 Wi-Fi 技術的智慧特性和多種尺寸的可用性使其在商業和住宅領域得到應用。歐洲葡萄酒櫃市場現有的參與者包括Climadiff、Dunavox、Smad、海爾和海信。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 歐洲葡萄酒消費量不斷成長

- 城市人口在葡萄酒冷卻器上的支出增加

- 市場限制

- 歐洲家電價格上漲

- 大部分市佔率集中在都市區

- 市場機會

- 客製化和 Wi-Fi 葡萄酒櫃的需求不斷成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 歐洲葡萄酒冷卻器市場的技術創新

- COVID-19 市場影響

第5章 市場區隔

- 按類型

- 獨立式

- 檯面

- 內建

- 依技術分類

- 壓縮機類型

- 熱電

- 按銷售管道

- 線上

- 離線

- 按國家

- 德國

- 法國

- 英國

- 其他歐洲國家

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Climadiff

- Dunavox

- Smad

- Haier

- Hisense

- Arte Vino

- Avintage

- Dometic

- Swisscave

- EXPO*

第7章 未來市場趨勢

第8章 免責聲明及發布者

The Europe Wine Coolers Market size is estimated at USD 0.94 billion in 2025, and is expected to reach USD 1.22 billion by 2030, at a CAGR of 5.41% during the forecast period (2025-2030).

Per capita, wine consumption in Europe observed a continuous increase after a declining trend post-COVID-19; this rise in consumption of wine generated a positive externality for the sales of wine coolers. Rising users of hotels in Europe post covid are leading to an increasing consumption of wine by tourists and an opportunistic market for Wine cooler sales in the commercial segments.

The post-COVID-19 average revenue per capita and total revenue of wine in Europe observed a continuous increase, with the rising share in out-of-home consumption leading to the commercial segment emerging as a major demand segment for wine coolers over the coming period in comparison to residential space.

With technological innovations launch of smart coolers in the market is revolutionizing the wine cooler industry. Through smart features of wi-fi connectivity, the wine coolers can be accessed through smartphones and can be used for setting the temperature or checking the stock and storage of wine in the cooler. The rising number of online retailers and e-commerce players are offering wine coolers as their sales product, resulting in the diversification of sales channels and an increasing market revenue for manufacturers. In addition, the rising share of urbanization in Europe, existing with increasing per capita income and wine consumption, is resulting in residential and commercial segments increasing their demand for wine coolers.

Europe Wine Coolers Market Trends

Rising Sales in Commercial segment

The revenue share of wine had observed a continuous increase with a declining revenue share from the residential segment. This is leading to the commercial segments raising the market demand for wine coolers. In the total revenue of Europe, alcoholic drinks wine exists with a major share of around 40%, making wine coolers an important component of the market. Bologna, Prague, Valencia, and Leeds are among some of the existing cities in the European region with the largest number of bars per million population, making them the leading cities in the region for the demand for wine coolers by commercial segment. Southern Europe exists as a significantly larger market for wine coolers in comparison to Northern Europe, and with expanding hotels and tourism business post-COVID-19, the demand is expected to increase further in the region.

France Leading in Sales of Wine Cooler

France exists as the European country with the largest consumption of wine making it the fastest-growing country for sales of wine coolers in the region. In the beverage segment of France, alcoholic drinks have a share of around 50% in sales, with a continuous rise in the population consuming alcohol in the country. Among the alcoholic drinks in France, wine exists with a share of around 55% with a sales revenue making it a leading country for sales of wine coolers in the region. These trends are leading to an increasing number of wine cooler manufacturer expanding their sales and business in the region. Rising urbanization in France, existing at more than 80%, is leading to an increase in wine consumption in the commercial as well as residential segments and creating a positive externality for sales of wine coolers in France.

Europe Wine Coolers Industry Overview

Europe's wine coolers market is partially fragmented, with a rising number of players entering the market to reap the existing market gap. Smart features of wi-fi technology and the availability of different sizes are leading to their adoption in the commercial as well as residential segments. Some of the existing players europe wine cooler market are Climadiff, Dunavox, Smad, Haier, and Hisense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumption of Wine in Europe

- 4.2.2 Increasing Spending on Wine Coolers by Urban Population

- 4.3 Market Restraints

- 4.3.1 Rising Price of Home Appliances in Europe

- 4.3.2 Major Market Share of Market Restricted to Urban Cities

- 4.4 Market Opportunities

- 4.4.1 Increasing demand for Customized and Wi-Fi Enabled Wine Coolers

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Europe Wine Coolers Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Free Standing

- 5.1.2 Counter-top

- 5.1.3 Built-in

- 5.2 By Technology

- 5.2.1 Compressor Based

- 5.2.2 Thermoelectric Based

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Climadiff

- 6.2.2 Dunavox

- 6.2.3 Smad

- 6.2.4 Haier

- 6.2.5 Hisense

- 6.2.6 Arte Vino

- 6.2.7 Avintage

- 6.2.8 Dometic

- 6.2.9 Swisscave

- 6.2.10 EXPO*