|

市場調查報告書

商品編碼

1636205

北美塑膠廢棄物管理:市場佔有率分析、產業趨勢和成長預測(2025-2030)North America Plastic Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

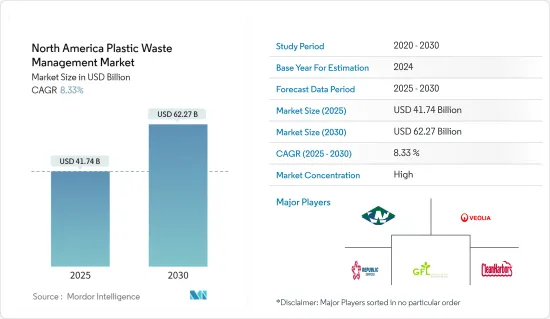

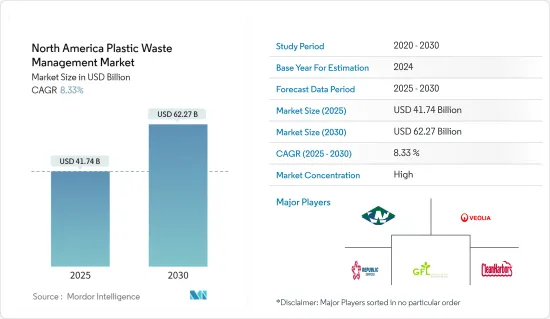

北美塑膠廢棄物管理市場規模預計到 2025 年為 417.4 億美元,預測期內(2025-2030 年)複合年成長率為 8.33%,到 2030 年預計將達到 622.7 億美元。

在強勁的塑膠消費和嚴格的法規推動下,北美塑膠廢棄物管理市場正在成長。這一勢頭得益於環保意識的增強、法規的收緊以及廢棄物管理解決方案的技術進步。

美國每年塑膠產量超過3500萬噸。從塑膠購物袋到包裝,美國人都是貪婪的消費者。但這種對塑膠的需求帶來了可怕的後果。每年約有 800 萬噸廢棄物進入海洋,其中只有 9% 被回收。這種對環境的忽視付出了高昂的補償,據估計,塑膠污染每年對美國造成 130 億美元的損失。儘管有這些成本,塑膠產業仍然是重要的雇主,為超過 100 萬美國人提供了就業機會。地方政府承擔廢棄物負擔,每年花費超過33億美元。塑膠產量約占美國國內生產總值的2.7%。

美國和加拿大已採取重大措施打擊塑膠廢棄物,包括禁止使用塑膠廢棄物和強制回收。同時,大眾對塑膠對環境影響的認知不斷增強,刺激了對更有效的廢棄物管理解決方案的需求。化學回收和先進的分類系統等顯著創新正在提高塑膠廢棄物管理的有效性。此外,隨著企業擴大轉向永續性和循環經濟原則,市場也進一步加強。

由於監管力度加大、技術創新和環保意識不斷增強,北美塑膠廢棄物管理市場預計將持續成長。該行業的公司將優先考慮創新回收技術,增強回收能力,並結成策略聯盟,以鞏固其市場地位。

北美塑膠廢棄物管理市場趨勢

塑膠產業藍圖圖為耐用消費品循環經濟鋪路

塑膠產業藍圖凸顯了重新構想耐用消費品生命週期終結階段的巨大機會。鑑於北美生產的近 60% 的塑膠用於耐用消費品,因此必須保護這些材料並轉向循環經濟,將塑膠回收製成新產品而不是丟棄。

美國工業理事會 (ACC) 塑膠特別工作小組發布了行業藍圖,以指導政策制定者、商界領袖和公眾採取更永續的做法。這張藍圖概述了加速在五個關鍵領域採用循環實踐的政策和策略:汽車、建築、電子、基礎設施和醫療保健。

藍圖中強調的主要亮點包括需要設計易於拆卸、維修和回收的產品及其零件,以及將舊零件轉化為新產品。

先進(化學)回收的一個關鍵作用是擴大可回收塑膠的範圍,特別是那些用於傳統機械回收難以實現的耐用應用的塑膠。建立標準、方法和認證計劃以確保耐用產品符合塑膠循環經濟的重要性。

需要進行更多試驗計畫,例如 ACC 與橡樹嶺國家實驗室合作的一項項目,旨在評估分類、分類和回收耐用塑膠的技術和經濟可行性。 ACC 致力於與政策制定者和耐用塑膠價值鏈合作,實現產業藍圖中概述的循環經濟目標。

在美國工業理事會的指導下,塑膠產業正在向循環經濟轉型,特別是在汽車、建築和電子產業。產業藍圖中強調的這一轉變著重於先進的回收、拆除設計和製定嚴格的標準。這是政策制定者、行業領導者和 ACC 的共同努力,旨在徹底改變耐用塑膠的管理方式。目標是確保回收和再利用的連續循環並顯著減少廢棄物。

美國在塑膠消費量領先高所得國家

包括美國在內的高所得國家的人均塑膠消費量往往高於較不富裕的國家。美國在其中表現突出,美國平均每天使用約 0.34 公斤塑膠。這個數字幾乎是加拿大和墨西哥用量的三倍,這兩個國家每人每天用量為0.09公斤。美國年消費量為3783萬噸,是全球第二大塑膠消費量,遠遠領先中國驚人的6,000萬噸。然而,僅僅因為您是最大的消費量並不意味著您就是污染者。富裕國家的人均塑膠消費量較多,但也有財力實施更有效的處置方法。

包括美國在內的富裕國家選擇在管理良好的垃圾掩埋場處理塑膠廢棄物或對其進行回收,即使經濟回報很小。相反,許多塑膠消費率較低的低收入國家面臨不受監管的垃圾掩埋場或缺乏廢棄物管理系統的困擾,增加了塑膠廢棄物進入海洋的風險。

2024 年,美國海洋暨大氣總署 (NOAA) 將實施一系列舉措,旨在清除大量海洋垃圾,並部署成熟的技術來阻止美國海岸、五大湖、領土和自由聯繫州的垃圾產生,投資額約為7000 萬美元。此外,NOAA 還向 29 個海洋撥款計劃撥款 2,700 萬美元,重點關注聯盟建設和創新研究,以長期對抗海洋垃圾。

美國是世界第二大塑膠消費國,凸顯了塑膠消費量的差異。雖然美國致力於先進的廢棄物管理和海洋垃圾清除,但 NOAA 對海洋垃圾計劃的 7,000 萬美元承諾等努力表明了美國對抗塑膠污染和保護海洋生態系統的承諾。這些努力在縮小全球消費與永續廢棄物管理實踐之間的差距方面發揮著至關重要的作用。

北美塑膠廢棄物管理產業概述

北美塑膠廢棄物管理市場高度集中,少數大公司控制著大部分市場佔有率。這些行業巨頭擁有豐富的資源、最尖端科技和強大的基礎設施,可促進區域範圍內塑膠廢棄物的有效管理。該市場的主要企業包括 Waste Connection、Veolia Environment、GFL Environmental、Republic Services 和 Clean Harbors。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 意識不斷增強,法規嚴格

- 更多採用回收技術

- 市場限制因素

- 回收設施初始投資高

- 市場機會

- 消費者對環保產品和包裝的偏好日益成長

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

- 洞察市場創新

第5章市場區隔

- 由聚合物

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚氯乙烯(PVC)

- 對苯二甲酸酯 (PET)

- 其他聚合物

- 按來源

- 住宅

- 商業的

- 工業

- 其他(建築、醫療保健等)

- 透過加工

- 回收

- 化學處理

- 垃圾掩埋場

- 其他加工

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭狀況

- Market Concetration Overview

- 公司簡介

- Waste Connection

- Veolia Environnement

- GFL Environmental

- Casella Waste Management

- Republic Services

- Clean Harbors

- Agilyx

- Brightmark LLC

- Advanced Disposal Services Inc.

- Covanta Holding Corporation

- Waste Management Inc.

第7章 未來趨勢

The North America Plastic Waste Management Market size is estimated at USD 41.74 billion in 2025, and is expected to reach USD 62.27 billion by 2030, at a CAGR of 8.33% during the forecast period (2025-2030).

The North American plastic waste management market is growing, fueled by robust plastic consumption and stringent regulations. This momentum is attributed to a rising environmental consciousness, tightening regulations, and technological strides in waste management solutions.

Plastic production in the United States surpasses 35 million tons annually. From plastic bags to packaging, Americans' consumption is voracious. However, this appetite for plastic has dire consequences. About 8 million metric tons of waste end up in the oceans yearly, with a mere 9% recycled. This environmental negligence comes at a steep price, with plastic pollution costing the United States an estimated USD 13 billion annually. Despite these costs, the plastic industry remains a significant employer, providing jobs for over 1 million Americans. Local governments bear the brunt of waste management, shelling out more than USD 3.3 billion annually. Plastic production contributes around 2.7% to the US gross domestic product.

The United States and Canada have taken significant steps to combat plastic waste, including bans and recycling mandates. Concurrently, a swelling public awareness of plastic's environmental repercussions is spurring the demand for more effective waste management solutions. Noteworthy innovations, like chemical recycling and advanced sorting systems, are elevating the efficacy of plastic waste management. Moreover, as corporations increasingly pivot toward sustainability and circular economy principles, the market is further fortified.

The North American plastic waste management market is set for sustained growth, propelled by regulatory backing, technological innovations, and a heightened environmental consciousness. Companies in this space will likely prioritize innovative recycling technologies, bolster recycling capacities, and forge strategic alliances to solidify their market standing.

North America Plastic Waste Management Market Trends

Plastics Industry's Roadmap Paves the Way for Circular Economies in Durable Goods

The plastics industry's roadmap underscores significant opportunities to reshape the end-of-life phase for durable goods. Given that nearly 60% of domestically produced North American plastics are channeled into durable goods, it is imperative to find solutions that preserve these materials, pivoting toward a circular economy where plastics are recycled into new products rather than discarded.

The American Chemistry Council's (ACC) Plastics Division has unveiled an industry roadmap to guide policymakers, business leaders, and the public toward more sustainable practices. This roadmap outlines policies and strategies to expedite the adoption of circular practices within five key sectors: automotive, building and construction, electronics, infrastructure, and medical.

Some of the key points highlighted in the roadmap include the necessity of designing products and their components for easy disassembly, repair, and recycling, emphasizing the transformation of spent components into new products.

The pivotal role of advanced (chemical) recycling broadens the scope of recyclable plastics, especially those used in durable applications that traditional mechanical recycling struggles with. The significance of establishing standards, methods, and certification programs to ensure durable products align with a circular economy for plastics.

There is a call for more pilot programs, akin to ACC's collaboration with Oak Ridge National Laboratory to assess the technical and economic feasibility of separating, sorting, and recycling durable plastics. ACC is committed to collaborating with policymakers and the durable plastics value chain to realize the circularity goals outlined in the industry roadmap.

As guided by the American Chemistry Council, the plastics industry is pivoting toward a circular economy, especially in the automotive, construction, and electronics sectors. This shift, highlighted in the industry's roadmap, focuses on advanced recycling, designing for disassembly, and setting stringent standards. It is a concerted effort involving policymakers, industry giants, and the ACC to revolutionize how durable plastics are managed. The goal is to ensure a continuous cycle of recycling and repurposing, significantly curbing waste.

United States Leads High-income Nations in Plastic Consumption

High-income countries, including the United States, exhibit a trend of higher per capita plastic consumption compared to their less affluent counterparts. The United States stands out, with the average American using approximately 0.34 kilograms of plastic daily. This figure is nearly triple the usage of Canada and Mexico, each at 0.09 kg/person per day. With an annual consumption of 37.83 million tons, the United States ranks as the world's second-largest plastic consumer, trailing significantly behind China's staggering 60-million-ton consumption. However, being a top consumer does not automatically equate to being a polluter. Wealthier nations, while consuming more plastic per person, also possess the financial resources for more effective disposal methods.

The United States and other affluent nations predominantly dispose of their plastic waste in well-managed landfills or opt for recycling, even with minimal financial returns. Conversely, many lower-income countries with lower plastic consumption rates grapple with unregulated landfills or lack waste management systems, leading to heightened risks of plastic waste entering the oceans.

In 2024, the National Oceanic and Atmospheric Administration (NOAA) allocated nearly USD 70 million for transformative, multi-year initiatives aimed at removing significant marine debris and deploying proven technologies to intercept debris along the US coasts, Great Lakes, territories, and Freely Associated States. Furthermore, NOAA earmarked USD 27 million for 29 Sea Grant projects, focusing on coalition-building and innovative research to combat marine debris over the long term.

Highlighting the disparity in plastic consumption, the United States emerges as the world's second-largest consumer, showcasing a stark contrast between affluent and less affluent nations in waste management capabilities. While the United States demonstrates a commitment to advanced waste management and marine debris removal, initiatives like NOAA's substantial funding of USD 70 million for marine debris projects underscore a dedicated approach to combatting plastic pollution and safeguarding marine ecosystems. These endeavors play a pivotal role in bridging the global gap between consumption and sustainable waste management practices.

North America Plastic Waste Management Industry Overview

The plastic waste management market in North America is highly concentrated, with a few major players holding the majority share. These industry leaders boast significant resources, cutting-edge technologies, and robust infrastructure, facilitating the effective management of plastic waste on a regional scale. Some of the key players in this market are Waste Connection, Veolia Environment, GFL Environmental, Republic Services, and Clean Harbors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness and Stringent Regulations

- 4.2.2 Rising Adoption of Recycling Technologies

- 4.3 Market Restraints

- 4.3.1 High Initial Investment for Recycling Facilities

- 4.4 Market Opportunities

- 4.4.1 Increasing Consumer Preference for Eco-friendly Products and Packaging

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technological Innovations in the Market

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Terephthalate (PET)

- 5.1.5 Other Polymers

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Other Sources (Construction, Healthcare, etc.)

- 5.3 By Treatment

- 5.3.1 Recycling

- 5.3.2 Chemical Treatment

- 5.3.3 Landfill

- 5.3.4 Other Treatments

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Waste Connection

- 6.2.2 Veolia Environnement

- 6.2.3 GFL Environmental

- 6.2.4 Casella Waste Management

- 6.2.5 Republic Services

- 6.2.6 Clean Harbors

- 6.2.7 Agilyx

- 6.2.8 Brightmark LLC

- 6.2.9 Advanced Disposal Services Inc.

- 6.2.10 Covanta Holding Corporation

- 6.2.11 Waste Management Inc.